24M Technologies

Founded Year

2010Stage

Series H | AliveTotal Raised

$253.83MValuation

$0000Last Raised

$87M | 7 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+11 points in the past 30 days

About 24M Technologies

24M Technologies focuses on the technology sector, specifically in the area of energy storage. The company's main offering is a revolutionary lithium-ion battery cell manufacturing process that aims to provide a simpler, more reliable, and safer production method. Its technology is primarily targeted at sectors such as electric mobility, aerospace, stationary power, and lead-acid replacement. It was founded in 2010 and is based in Cambridge, Massachusetts.

Loading...

ESPs containing 24M Technologies

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

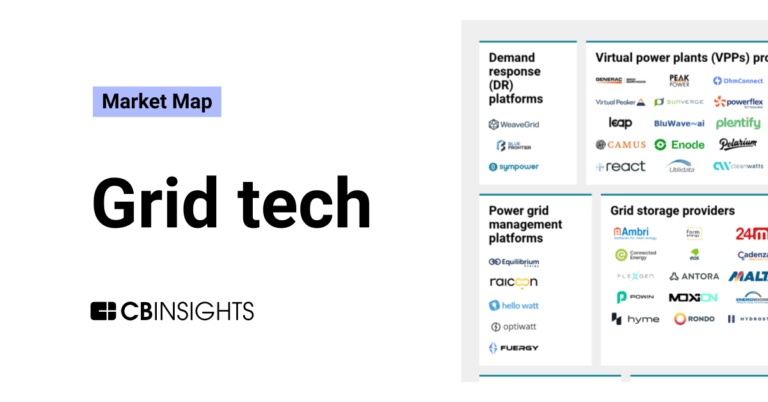

The grid storage providers market offers energy storage solutions that promote grid stability, renewable source integration, and demand response strategies. These providers focus on low-cost, long-duration storage technologies with high energy density and efficiency. Their offerings include modular storage systems and advanced vanadium redox battery solutions with renewable energy and microgrid ap…

24M Technologies named as Challenger among 15 other companies, including Fluence, Eos Energy Storage, and Powin.

Loading...

Research containing 24M Technologies

Get data-driven expert analysis from the CB Insights Intelligence Unit.

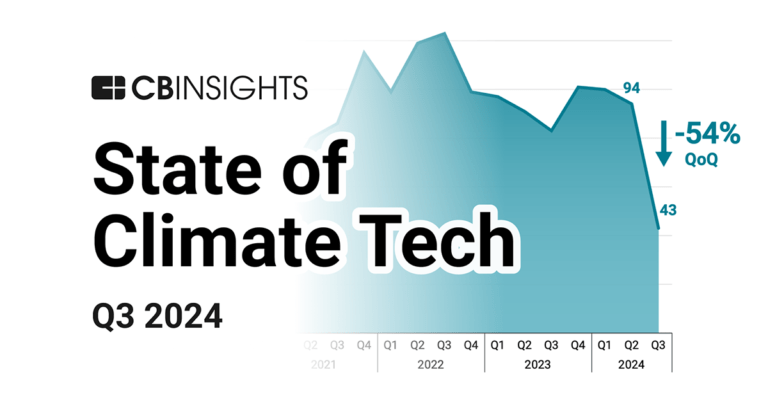

CB Insights Intelligence Analysts have mentioned 24M Technologies in 3 CB Insights research briefs, most recently on Nov 7, 2024.

Nov 7, 2024 report

State of Climate Tech Q3’24 Report

Expert Collections containing 24M Technologies

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

24M Technologies is included in 4 Expert Collections, including Auto Tech.

Auto Tech

3,978 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,270 items

Grid and Utility

2,754 items

Companies that are developing and implementing new technologies to optimize the grid and utility sector. This includes, but is not limited to, distributed energy resources, infrastructure security, utility asset management, grid inspection, energy efficiency, grid storage, etc.

Energy Storage

5,350 items

Companies in the Energy Storage space, including those developing and manufacturing energy storage solutions such as lithium-ion batteries, solid-state batteries, and related software for battery management.

24M Technologies Patents

24M Technologies has filed 161 patents.

The 3 most popular patent topics include:

- electrochemistry

- fuel cells

- rechargeable batteries

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/25/2023 | 4/8/2025 | Electrochemistry, Lithium-ion batteries, Rechargeable batteries, Capacitors, Battery types | Grant |

Application Date | 9/25/2023 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Electrochemistry, Lithium-ion batteries, Rechargeable batteries, Capacitors, Battery types |

Status | Grant |

Latest 24M Technologies News

Apr 8, 2025

The Lithium-Ion Battery Anode Market grew from USD 10.70 billion in 2024 to USD 12.34 billion in 2025. It is expected to continue growing at a CAGR of 16.17%, reaching USD 26.33 billion by 2030. The lithium-ion battery anode market is at the cusp of a dramatic transformation, marked by significant technological advancements and shifting market fundamentals. Emerging trends indicate a clear move towards more sustainable processes and materials that promise enhanced energy densities and prolonged lifecycles. Companies across the market are increasing their focus on research and development initiatives to explore alternative materials and refined production methodologies, thus fostering an era of innovation. One of the most profound shifts is the transition from traditional material choices to a more diversified approach. Innovations in nanoscale engineering and precision manufacturing have led to a re-imagination of anode materials, where advanced formulations are not only improving performance metrics but also aligning with environmental sustainability goals. The integration of breakthrough processes in material synthesis and battery design is enabling the production of electrodes that resist degradation, operate at lower temperatures, and provide higher charge retention over numerous cycles. Moreover, competitive pressures and regulatory changes are catalyzing a propulsion towards efficiency and greener production strategies. This has led stakeholders to invest more heavily in novel chemical processes such as optimized deposition techniques and surface modification treatments. These advancements are crucial in effectively meeting the dual challenge of performance improvement while minimizing the environmental footprint. Overall, the convergence of technology and sustainability is redefining competitive benchmarks in the lithium-ion battery anode market, offering new avenues for growth and innovation. Regional Market Dynamics: Americas, Europe, Middle East & Africa, and Asia-Pacific Analysis The market exhibits distinct regional variations that are instrumental in understanding demand patterns, regulatory environments, and innovation capacities. In the Americas, there is a robust interplay between technological advancement and supportive government policies, creating a conducive environment for industrial scaling and investments in next-generation battery technologies. This region benefits from strong industrial bases that drive both production and consumption, alongside well-developed infrastructure which supports the rapid adoption of advanced anode materials. Across Europe, the Middle East & Africa, stakeholders are witnessing concerted efforts aimed at sustainability and energy security. Growth in this region is propelled by stringent environmental regulations and a commitment to reducing carbon footprints. The adoption of advanced lithium-ion battery anodes is being accelerated by initiatives aimed at integrating renewable energy methods with efficient storage systems, a focus that is equally evident in the commercial and industrial sectors. Regulatory frameworks here are geared towards providing long-term stability that encourages innovation while balancing the need for environmental stewardship. The Asia-Pacific region is emerging as a powerhouse in the lithium-ion battery sector, combining extensive manufacturing expertise with rapid technological adoption. Investments in research and development, coupled with economies of scale, have positioned this region as a leader in both production and application. The dynamic consumer market, supported by government-backed incentives and robust supply chain infrastructures, ensures that the latest advancements in anode technology are rapidly deployed. In summary, these regional perspectives demonstrate a varied yet interconnected global market, where innovation and regulation collaboratively define growth parameters. Competitive Landscape: Insights on Leading Players in the Lithium-Ion Battery Anode Sector The competitive environment within the lithium-ion battery anode market is characterized by the presence of several leading companies that are pioneering market innovations and technological evolution. Prominent industry players such as Ascend Elements, Inc. and BASF SE are leveraging their robust research capabilities to develop next-generation anode materials that meet the dual demands of performance and sustainability. Contemporary Amperex Technology Co., Limited and EcoGraf Limited are driving innovation by integrating state-of-the-art materials and customized production processes, while Epsilon Advanced Materials Pvt Ltd and Group14 Technologies are strategically expanding their portfolios to address diverse market segments. The report delves into recent significant developments in the Lithium-Ion Battery Anode Market, highlighting leading vendors and their innovative profiles. These include: Ascend Elements, Inc. EcoGraf Limited Group14 Technologies Jiangxi Zhengtuo New Energy Technology Co., Ltd. Kureha Corporation Resonac Group Companies Sila Nanotechnologies, Inc. Strategic Recommendations for Industry Leaders Industry leaders must navigate this evolving market landscape with proactive strategies that prioritize innovation, efficiency, and resilience. Leaders are advised to invest significantly in research and development to further enhance material properties and optimize production techniques. Aligning product development with emerging performance benchmarks and regulatory requirements will be critical in staying ahead of the competitive curve. A detailed analysis of market segmentation indicates that a diversified approach across material type, production technology, and application sectors is essential. Leaders should focus on harnessing the unique properties of both natural and synthetic graphite as well as alternative materials such as silicon to drive performance improvements. Integrating advanced production technologies, including Chemical Vapor Deposition and the Sintering Process, will yield improved process efficiencies that can be scaled across different applications. This multi-dimensional strategy ensures that companies are well-equipped to meet the diverse demands of consumer electronics, electric vehicles, and energy storage systems. Collaboration across the supply chain and strategic partnerships with technology innovators are highly recommended. Enhancing synergies with material suppliers, research institutions, and production experts can lead to improved product quality and optimized operational costs. Furthermore, maintaining a robust digital infrastructure to monitor and analyze real-time market trends is vital for making informed strategic decisions. Leaders should also consider regional diversification as part of their broader market strategy. Tapping into emerging markets in the Asia-Pacific region while consolidating gains in the Americas and Europe, Middle East & Africa can provide a balanced portfolio of growth opportunities. Proactive measures in diversifying market channels and exploring untapped regional prospects will help in mitigating risks associated with market volatility and regulatory changes. In conclusion, a blend of technological innovation, strategic operational adjustments, and targeted regional expansion will position industry leaders to capture value effectively in a rapidly transforming market. Key Attributes 5.1.1.2. Expansion of grid modernization efforts in distributed renewable energy resources globally 5.1.1.3. Government incentives and subsidies encouraging investments in sustainable energy infrastructure worldwide 5.1.2. Restraints 5.1.2.1. High capital expenditure and technological risks in research and development of innovative lithium ion battery anode formulations 5.1.3. Opportunities 5.1.3.2. Expanding adoption in modern electric vehicles 5.1.4. Challenges 5.2. Market Segmentation Analysis 5.2.1. Materials: Innovations to improve the functionality and efficiency of active anode materials 5.2.2. Application: Emerging usage of lithium-ion battery anode in the automotive sector to cater the growth of EVs 5.3. Porter's Five Forces Analysis 5.3.1. Threat of New Entrants 5.3.2. Threat of Substitutes 5.3.4. Bargaining Power of Suppliers 5.3.5. Industry Rivalry 12.2. FPNV Positioning Matrix, 2024 12.3. Competitive Scenario Analysis 12.3.2. Stellantis and Zeta Energy partner to develop next-generation lithium-sulfur batteries 12.3.3. BTR launches major battery anode plant in Indonesia 12.3.4. Enhancing EV and Mobile Electronics through the Emergence of TNO-Based Lithium-Ion Batteries 12.3.5. 24M Technologies Advances Lithium-Ion Battery Recycling with Liforever Process 12.3.6. Sicona's Strategic Advancement in Li-ion Battery Sector with New Funding Phase 12.4. Strategy Analysis & Recommendations About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. Tags Related Links

24M Technologies Frequently Asked Questions (FAQ)

When was 24M Technologies founded?

24M Technologies was founded in 2010.

Where is 24M Technologies's headquarters?

24M Technologies's headquarters is located at 130 Brookine Street, Cambridge.

What is 24M Technologies's latest funding round?

24M Technologies's latest funding round is Series H.

How much did 24M Technologies raise?

24M Technologies raised a total of $253.83M.

Who are the investors of 24M Technologies?

Investors of 24M Technologies include KYOCERA, Lucas TVS, Nuovo+, Dai Nippon Printing, Asahi Kasei and 12 more.

Loading...

Loading...