Acko

Founded Year

2016Stage

Growth Equity | AliveTotal Raised

$428MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-35 points in the past 30 days

About Acko

Acko is a tech-driven company that specializes in insurance products across various sectors, such as auto, health, and life insurance. The company offers a range of insurance policies designed to provide financial protection and peace of mind, including vehicle coverage, health plans, life insurance, and travel protection. Acko's approach includes features like zero commission, instant policy renewal, and same-day claim settlements, catering to the digitally savvy consumer. It was founded in 2016 and is based in Bengaluru, India.

Loading...

ESPs containing Acko

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — home market comprises insurtech carriers that underwrite homeowners and renters insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for…

Acko named as Leader among 13 other companies, including Lemonade, Branch, and Digit Insurance.

Acko's Products & Differentiators

Auto insurance

ACKO offers customized motor insurance products that can be easily accessed online and with quotes and all the relevant information pertaining to motor insurance available on the website. ACKO uses data and analytics to underwrite the customer, which in turn helps improve premium pricing accuracy. After the purchase is made, the policy is directly sent into the buyer’s inbox in less than two minutes. Claim assessment time is drastically reduced and a settlement is provided within 48 - 72 business hours.

Loading...

Research containing Acko

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Acko in 2 CB Insights research briefs, most recently on Aug 16, 2022.

Expert Collections containing Acko

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Acko is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,699 items

Excludes US-based companies

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Acko News

Apr 8, 2025

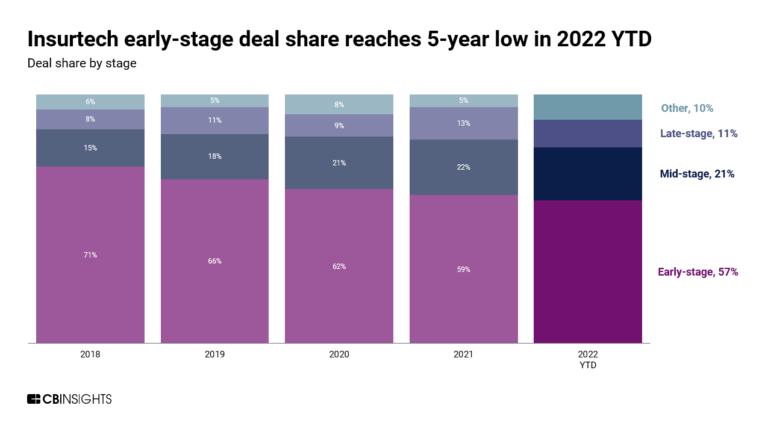

By Shahzaib Jamali 6 minute read You are living in a time where most things are now connected to the internet. You order food, book tickets, attend classes, and even consult a doctor online. In the same way, the insurance world is also going through a big change. The old method of meeting an insurance agent, filling long forms, and waiting for claims is slowly vanishing. Today, many insurance companies are using online platforms, mobile apps, and digital tools to give you quicker and better service. These changes are not just saving your time but also giving you more control over your insurance. In this article, you will see how the internet is creating a digital shift in the insurance world. This major change started in India after people got access to low-cost and free internet services . Digital Transformation in Insurance Insurance is no longer limited to paperwork or branch visits. You can now sit at home and buy health, life, or car insurance using your phone. Many companies like LIC, Vitality, Scottish Widows, ICICI Lombard, etc are now giving options to check policies, compare prices, and make payments online. You do not need to stand in queues or depend fully on agents. You can even upload your documents directly on the app or website. Some apps even allow you to do video KYC, which means your identity is confirmed through a video call. This full process has become fast, safe, and easy to handle from your side. Personalized Customer Experience With internet and data collection tools, insurance companies can now give you better options that match your needs. Suppose you are a safe driver and use your car only a few times a week. The company can check your driving pattern using GPS or app data and then offer a policy with lower premiums. In the same way, if you track your health using fitness apps, some health insurance plans can reward you with discounts or extra benefits. These features give you a feeling that the insurance is made just for you, not for everyone in the same way. Artificial Intelligence and Automation You must have noticed how chatbots now talk to you when you visit any bank or insurance site. These chatbots are trained using artificial intelligence. They can solve many of your queries like policy status, premium due date, or coverage details. You do not need to call customer care and wait for your turn. Automation has also changed the way claims are handled. For example, if your car meets with an accident, you can upload the pictures in the app. Some companies use AI to check the damage and approve the claim instantly. You do not need to wait for a human surveyor to visit the spot. Rise of InsurTech Companies A new group of companies known as InsurTech is coming forward. These companies mix technology with insurance. They do not work like traditional companies but give you smarter and faster tools. Companies like Acko, Digit, and Policybazaar are changing how you look at insurance. You can get bike or car insurance from Acko in just 2 minutes using their app. Digit gives you paperless claim processing. Policybazaar allows you to compare many policies in one place. These companies are forcing old companies to also improve their online services. Cyber Insurance: A New Need Earlier, most insurance was about life, health, or vehicles. But now many companies and even normal people are using digital platforms daily. Because of this, the risk of hacking and online fraud is also growing. That is why a new type of insurance called cyber insurance is becoming popular. If your personal data is stolen or your company website is attacked, cyber insurance can help you recover losses. Big IT firms and digital businesses are now using this policy to stay protected. Even small shops using online payment apps are now thinking about it. Challenges and Things You Must Know This new digital trend is also bringing some problems. First is data privacy. Your Aadhaar card, PAN number, phone number, and bank details are now stored online. If the insurance company does not have strong security, this data can be stolen. Second is the issue of trust. Many people still feel unsafe in buying policies online. They fear fake websites or getting scammed. Also, people in villages or those who are not used to using apps face problems in this shift. So you must always check if the website is official. You should read the terms properly before making payment. You can also ask your family or a trusted person to help if you are not sure. Scams to Stay Away From Online scams are increasing day by day. Here are some common tricks you must avoid: Do not click on links that come in unknown emails or messages. Never call back on numbers shown in spam emails saying “Your policy has expired” or “You have got a refund”. Avoid downloading apps from any random website. Always use Google Play Store or Apple App Store. Do not share your insurance policy number or OTP with unknown people. Change your login password every few months. If you face any issue with your policy, go directly to the official website of that company. Stay away from people or groups offering insurance at huge discounts on WhatsApp or Telegram. Conclusion You are now part of a world where internet has changed how insurance works. From buying a policy to getting claims, everything has become fast and more in your control. You do not need to depend only on agents. You can explore, decide, and even manage your policies by yourself. With more control in your hands, you can now explore plans, check policy features, and use the different tools like London Insurance calculator or LIC calculator to make smart choices. Still, like every good thing, this also has a side where you need to stay careful. Use only trusted platforms. Keep your data safe. Ask when in doubt. The insurance world is changing every year with better tools, smarter apps, and more options for people like you. You just need to stay aware and take full benefit of this digital change.

Acko Frequently Asked Questions (FAQ)

When was Acko founded?

Acko was founded in 2016.

Where is Acko's headquarters?

Acko's headquarters is located at Somasandrapalya, 27th Main Rd, Sector 2, HSR Layout, Bengaluru.

What is Acko's latest funding round?

Acko's latest funding round is Growth Equity.

How much did Acko raise?

Acko raised a total of $428M.

Who are the investors of Acko?

Investors of Acko include General Atlantic, Multiples Alternate Asset Management, Cpp Investment Board Private Holdings, Intact Ventures, Munich Re Ventures and 20 more.

Who are Acko's competitors?

Competitors of Acko include Bajaj Allianz General Insurance and 7 more.

What products does Acko offer?

Acko's products include Auto insurance and 2 more.

Loading...

Compare Acko to Competitors

Tata AIG General Insurance Company Limited specializes in general insurance services across various sectors. The company offers various insurance products including health, motor vehicle, travel, and business insurance. Tata AIG serves individuals and businesses with its insurance solutions. It was founded in 2001 and is based in Mumbai, India.

OneAssure is a health insurance brokerage that operates in the insurance sector. The company offers a platform for comparing, buying, and renewing health and term insurance policies, providing advice and facilitating claims settlements without unnecessary add-ons. OneAssure serves individuals and families seeking insurance coverage and financial security. It was founded in 2020 and is based in Bangalore, India.

Probus Insurance is a prominent insurance broker that operates in the insurance industry. The company offers a wide range of insurance plans including life, health, motor, travel, property, and commercial insurance. It primarily serves retail clients across various sectors. It was founded in 2003 and is based in mumbai, Delaware.

Coverfox is an insurtech platform focused on providing online insurance products in various sectors such as motor, health, and life insurance. The company offers a comparison tool for customers to evaluate and purchase insurance policies from over 50 providers, ensuring a diverse range of options. Coverfox also provides claims assistance and prioritizes data security for its users. It was founded in 2013 and is based in Mumbai, India.

Yingda Taihe Life Insurance provides individual and group insurance policies, investment products, and retirement savings products. The company operates within the insurance and financial services sector. It was founded in 2007 and is based in Beijing, China.

Sunshine Property and Casualty Insurance offers property damage insurance, liability insurance, credit insurance and guarantee insurance, short-term health insurance and accidental injury insurance. The company also offers reinsurance regarding property and casualty. Sunshine Property and Casualty was founded in 2005 and is based in Beijing, China.

Loading...