Addepar

Founded Year

2009Stage

Secondary Market | AliveTotal Raised

$513.93MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-18 points in the past 30 days

About Addepar

Addepar focuses on investment portfolio management within the financial services industry. The company provides a system that consolidates and evaluates data related to the market and clients, aiding investment professionals in decision-making. Addepar's services are relevant to wealth managers, family offices, private banks, and institutions, offering functionalities for trading, rebalancing, scenario modeling, and billing. It was founded in 2009 and is based in Mountain View, California.

Loading...

Addepar's Product Videos

Addepar's Products & Differentiators

Addepar (core platform)

Addepar is a software and data platform purpose-built for professional wealth, investment and asset management firms to deliver outstanding results for their clients. Addepar provides a complete set of portfolio data aggregation, analysis, trading and reporting capabilities built on top of a unique data aggregation model. The platform’s highly scalable and robust APIs integrate with hundreds of Addepar-native and industry-leading products, data providers and service partners to deliver a complete solution for a wide range of firms and use cases.

Loading...

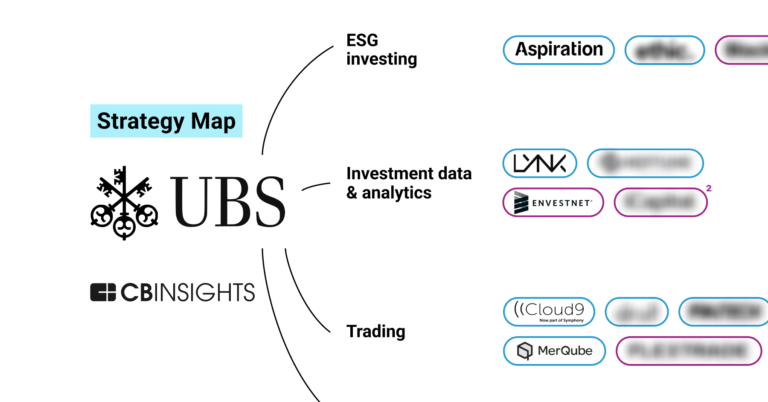

Research containing Addepar

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Addepar in 1 CB Insights research brief, most recently on Jul 6, 2023.

Expert Collections containing Addepar

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Addepar is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,617 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

825 items

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Addepar Patents

Addepar has filed 27 patents.

The 3 most popular patent topics include:

- data management

- banking technology

- computer memory

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/19/2022 | 11/26/2024 | Grant |

Application Date | 7/19/2022 |

|---|---|

Grant Date | 11/26/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Addepar News

Mar 17, 2025

Business Insider Share Impact Link Shreya Murthy, Gary Lin , Alex Katz Shreya Murthy, Gary Lin, Alex Katz This story is available exclusively to Business Insider subscribers. Become an Insider and start reading now.Have an account? Log in BI identified 30 founders building in the AI, legaltech, consumer, and healthcare spaces. The Palantir Mafia includes Partiful, Ironclad, Joe Lonsdale, Anduril, Garry Tan, and more. Move over, PayPal : there's a new tech mafia in town. Meet the Palantir Mafia: from Y Combinator 's Garry Tan, to Joe Lonsdale, to the founders of ElevenLabs, IronClad, and Partiful, the big data software company has produced a slew of former employees who now run startups and investment funds of their own. More than a decade ago, PayPal set the standard for producing a formidable group of alumni who now run their own companies, including Elon Musk , David Sacks, Reid Hoffman, Max Levchin, and Peter Thiel — who later co-founder Palantir. Now, Facebook and Oracle each have their own mafias and more recent tech companies like Square , OpenAI , and Instacart have mafias, too. Palantir 's original clients were federal agencies, and one of its core product offerings, "Gotham," assists in locating targets on battlefields. While some former Palantir employees are leveraging their experience to found defense tech startups, others are building companies in healthcare, consumer, AI, and enterprise. Palantir mafia companies have been backed by top VC firms including a16z, Sequoia, Redpoint, and Accel, as well as the prestigious startup accelerator Y Combinator. In total, the startups identified by BI have collectively raised more than $6 billion in VC funding, according to PitchBook data as well as founders themselves. More than half of that funding — $3.8 billion — went to one place: Anduril , the defense-tech startup founded by three Palantir alums. Take a look at BI's list of 30 Palantir Mafia members who are now startup founders. We put Y Combinator's Garry Tan at the top of the list and then listed everyone else in descending order based on how much VC funding their startup has raised. Garry Tan Role at Palantir: Lead engineer, designer Garry Tan needs no introduction: a longtime fixture of the tech community, he founded the early-stage VC firm Initialized Capital in 2012 and was its managing partner through the end of 2022 (he's still a board member and advisor). His investments, which include Coinbase, Instacart, Patreon, Flexport, Rippling, and more have created more than $200 billion in market value in nine years, according to his LinkedIn profile. Tan worked at Palantir for two years: in 2005, he joined the company as employee number 10 and co-founded the first version of Palantir's financial analysis product. He also designed the company's current logo. Trae Stephens, Matt Grimm, and Brian Schimpf, Anduril Trae Stephens, Matt Grimm, and Brian Schimpf, Anduril Anduril Total funding: $3.8 billion, according to the company Notable investors: Founders Fund, Sands Capital, General Catalyst, Andreessen Horowitz, 8VC, Lux Capital, Valor Equity Partners, Elad Gil, Human Capital Total employees: 4,000+, according to the company Role at Palantir: Trae Stephens, Forward Deployed Engineer (5.5 years); Matt Grimm, Forward Deployed Engineer (6 years 8 months); Brian Schimpf, Director of Engineering (9 years 7 months) (all according to their LinkedIn profiles) Former Palantir employees Trae Stephens, Matt Grimm, and Brian Schimpf cofounded Anduril in 2017 alongside Palmer Luckey and Joe Chen to bring advanced autonomous systems to the military. Like Palantir, Anduril has attracted some of Silicon Valley's most prolific defense investors. Peter Thiel's Founders Fund (where Stephens is now a partner), an early investor in Palantir, seeded Anduril. Anduril last raised $1.5 billion at a $14 billion valuation in August 2024. "Anduril's founding was motivated by a belief that the U.S. technology community should play a central role in both the development of weapons and supporting capabilities for US and allied militaries," Stephens wrote in a Medium post in 2022, underscoring the company's mission. Joe Lonsdale, Addepar and 8VC Joe Lonsdale Brian Ach/Getty Images Total funding: $495 million, according to PitchBook Notable investors: 8VC, Valor Equity Partners, Peter Thiel, Thrive Capital Total employees: 1,118, according to PitchBook Role at Palantir: Founder Joe Lonsdale cofounded Palantir, a data and defense tech company, in 2004 with current CEO Alex Karp, Silicon Valley magnate Peter Thiel, current president Stephen Cohen, and Nathan Gettings. "Our success relied on boldness and talent and a unique approach to mapping customers' data and processes and encoding it in our solutions," Lonsdale wrote about Palantir in a blog post from October 2024. Lonsdale left Palantir in 2009 and founded Addepar, a software platform for investment portfolios. Addepar has raised nearly half a billion dollars from the likes of Valor Equity Partners, Thrive Capital, Peter Thiel, and Lonsdale's venture capital firm, 8VC. Cai Wangwilt, Ironclad Notable investors: Sequoia, Accel, YC Continuity, Franklin Templeton Total employees: 516, according to the company Role at Palantir: Software engineer Cai Wangwilt is the co-founder and chief architect of Ironclad, the hot contract management software company that automates the contracting process for legal teams. Wangwilt founded the company in 2014 after spending three years as a software engineer at Palantir, where, among other projects, he built the successor to the company's original desktop client. Given his background in developing tech at Palantir, Wangwilt recommends that aspiring founders reconsider what's possible in terms of delivering products to customers. "AI is allowing us all to move exponentially faster with more precision," he said. "If there's something you're targeting, say, five years from now, ask yourself: 'is this something we might be able to do today?' You'll be surprised with your answer." Mati Staniszewski, ElevenLabs Total funding: $281 million, according to the company Notable investors: a16z, ICONIQ Capital Total employees: 150, according to the company Role at Palantir: Deployment strategist Mati Staniszewski spent nearly four years at Palantir, working as a deployment strategist from 2018 to 2022. Now, he's the co-founder of buzzy AI startup ElevenLabs, which is building audio models that generate realistic speech and sound effects in multiple languages. He said that when he worked at Palantir, he was given a high level of autonomy and ownership from day one, which made him effective at quickly solving problems. "That shaped how we built ElevenLabs — lean, empowered teams that move quickly to make things happen," he said. The startup, which has raised $281 million in total funding from investors like a16z and ICONIQ Capital, closed an $180 million Series C in January. Nick Noone, Peregrine Total funding: $252.7 million, according to PitchBook Notable investors: Founders Fund, XYZ Venture Capital, Village Global, Sequoia Capital, Craft Ventures, according to Pitchbook Total employees: 190, according to PitchBook Role at Palantir: Head of U.S. Special Operations Business Unit Nick Noone spent five years at Palantir, where he led the U.S. Special Operations (SOCOM) Business Unit and was the Business Operations and Strategy team's first hire in 2012. He now leads Peregrine, which makes a decision-support platform for government organizations, like public safety and law enforcement agencies, as well as commercial companies. Peregrine is growing fast—the company has tripled its annual revenues over the past three years, according to a press release . The startup, which has raised money from prominent defense tech investors, including Founders Fund and XYZ Venture Capital, raised $190 million in Series C funding in March led by Sequoia Capital. The financing valued the company at $2.5 billion and will enable it to recruit more software engineers, the press release said. Quinn Slack and Beyang Liu, Sourcegraph Quinn Slack and Beyang Liu, Sourcegraph Sourcegraph Total funding: $235 million with a $2.6 billion valuation, according to the company Notable investors: Andreessen Horowitz, Sequoia, Craft, Redpoint, Felicis, Goldcrest Total employees: 200, according to the company Role at Palantir: Slack was a forward-deployed engineer, and Liu was a software engineer Quinn Slack and Beyang Liu have spent the last 12 years building Sourcegraph, an AI code search and intelligence tool for software developers. The company, which is valued at more than $2.6 billion, most recently raised a $125 million Series D in 2021 from investors including a16z and Insight Partners. Slack Sourcegraph's CEO, while Liu is CTO. The pair also overlapped at Palantir: Slack spent 10 months in 2011 and 2012 as a forward-deployed engineer advising banks in the home lending space, while Liu spent two years as a software engineer building software to analyze mortgage datasets and other financial data. "As a Forward Deployed Engineer at Palantir, I worked directly with top executives at major banks, getting feedback by day and building solutions overnight, Slack said. "That incredibly tight feedback loop taught me how to build products the right way: close to the problem and the customer." Cobi Blumenfeld-Gantz, Chapter Total funding: $111 million, according to the company Notable investors: Addition, XYZ Venture Capital, Maverick Ventures, Peter Thiel, Narya, Susa Ventures Total employees: 125, according to the company Role at Palantir: Deployment Strategist on the US Government team Cobi Blumenfeld-Gantz started as an intern at Palantir and returned full-time as a Deployment Strategist on the US Government team, where he spent nearly six years. The fast-paced environment helped shape his approach to problem-solving: "When I was at Palantir, it was a chaotic environment," Blumenfeld-Gantz told BI. "There was little structure and everything was open to be defined by the teams closest to the problems. It's not quite the same as being in a green field environment, but I learned how to just figure stuff out and get stuff done — because I had to." After leaving the company in early 2020, Blumenfeld-Gantz cofounded Chapter, a medicare advisory provider that helps seniors choose the right health coverage. Chapter closed a $50 million Series C led by XYZ Venture Capital in May 2024. Tarek Mansour, Kalshi Notable investors: Sequoia, Charles Schwab, Kravis, Y Combinator, SV Angel Total employees: Unknown Role at Palantir: Forward-deployed engineer After spending a year as a forward-deployed engineer at Palantir, Tarek Mansour completed stints as an AI researcher at MIT's Computer Science and Artificial Intelligence Laboratory and as a macro trader at Citadel before turning to startups. In 2021, he co-founded Kalshi, a fintech platform that lets users trade on the outcome of any event, like whether or not a bill will pass through Congress. Alex Katz, Two Chairs Total funding: $103 million, according to the company Notable investors: Amplo, Goldcrest Capital, Fifth Down Capital, Maveron Total employees: 750 million, according to the company Role at Palantir: Deployment lead and enterprise lead Alex Katz is currently the founder and CEO of mental healthcare startup Two Chairs, which matches clients to therapists. Since launching in 2016, the startup has raised $103 million, most recently in a $72 million debt and equity Series C in April 2024 led by Amplo and Fifth Down Capital. Prior to building a healthtech startup, Katz spent two years at Palantir, where he was first a deployment lead, and then an enterprise lead — and he said that the entrepreneurial talent at the company during that time was "off the charts." "It's no surprise to me that Palantir has turned out to be such an incredible generator of founder talent," he said. "It was an environment that gave enormous opportunity to people often quite early in their career — certainly much earlier than any more traditional environment I'd worked in." Ashwin Sreenivas, Decagon Total funding: $100 million, according to the company Notable investors: A16z, Accel, Bain Capital Ventures, Elad Gil, A*, Bond Capital, Acme Capital Total employees: 60 Role at Palantir: Deployment Strategist Ashwin Sreenivas worked as a Deployment Strategist at Palantir for a year before pivoting to startups. In 2019, he cofounded Helia, a computer vision platform acquired by data labeling company Scale AI for an undisclosed amount in 2020. Sreenivas' latest startup, Decagon , makes AI support agents that autonomously handle customer inquiries across chat, email, and voice calls. The startup has raised $100 million to date, and Bain Capital Ventures led its $65 million Series B in October 2024, which quadrupled Decagon's valuation, according to the company's blog . Elad Gil, A*, Accel, Bond Capital, and Acme Capital also participated in the fundraise. Barry McCardel, Caitlin Colgrove, and Glen Takahashi, Hex Barry McCardel, Glen Takahashi, and Caitlin Colgrove Hex Hex Total funding: $100 million, according to the company Notable investors: A16z, Sequoia, Redpoint, Amplify, Snowflake Total employees: 120, according to the company Role at Palantir: McCardel was a forward deployed engineer; Colgrove was a software engineer, software engineering team lead, and software engineering group lead; and Takahashi was an intern and forward deployed engineer. As a forward deployed engineer at Palantir, Barry McCardel spent more than four and a half years at the company, from 2014 to 2018, before eventually becoming a startup founder in 2019. His company, Hex, provides collaborative data analytics for enterprises, and it last raised $28 million in Series B funding in 2023 from a16z, Amplify, and Snowflake. McCardel, who is Hex's CEO, co-founded the startup alongside two other Palantir alums: CTO Caitlin Colgrove built one of Palantir's first modern web applications at Palantir, and chief architect Glen Takahashi was an intern before becoming a full-time forward deployed engineer from 2014-2018. For McCardel, building a successful startup requires a deep understanding of users and the ability to rapidly iterate on a great product for them. "I can't imagine a better training ground for this than being a forward-deployed role at Palantir — even if we didn't realize it at the time," he said. John Doyle, Cape Notable investors: A*, ex/ante, Point72 Ventures, Andreessen Horowitz, XYZ Venture Capital Total employees: 55, according to the company Role at Palantir: Head of National Security John Doyle spent nearly nine years leading national security at Palantir, where he experienced the company's "flat and high-ownership culture" and saw "tons of room for creative people with big ideas to build," he told BI. His work with national security customers shaped his vision for Cape, the private and secure mobile carrier he founded in 2022. "That work crystallized for me that many of those same threats also apply to everyday citizens, which is what made me want to build a mobile solution for the average consumer that doesn't come at the expense of being productized or compromised," he said of his time at Palantir. Cape last raised $61 million in funding rounds led by A* and Andreessen Horowitz in August 2024, according to a press release . Eliot Hodges, Anduin Notable investors: 8VC, GC1 Ventures, Asymmetric Capital Total employees: 130, according to the company Role at Palantir: Forward Deployed Engineer Eliot Hodges worked as a Forward Deployed Engineer at Palantir for over two years. At the company, he focused on "fraud workflows" for "big box retailers" and monitoring and compliance within the federal government, according to his LinkedIn. Hodges' time at Palantir was pivotal to launching his career: two of his last three jobs since leaving the defense tech company were all a result of Palantir connections, he said. "Palantir taught me how a small group of mission-driven people can solve some of the world's hardest challenges for government and commercial organizations alike," Hodges said. Anduin, founded in 2014, makes tools for private market investors. Its platform simplifies the subscription process for limited partners, reducing administrative work. The startup has raised money from prominent investors, including 8VC, the venture firm started by Palantir cofounder Joe Lonsdale. Hodges joined Anduin as its CEO in 2020. Hodges has carried over a key lesson from Palantir while building Anduin—and advises aspiring founders to do the same: "Build deeply technical teams and find promisingly unsexy problems to solve." Rebecca Egger, Little Otter Total funding: $35 million, according to the company Notable investors: Charles River Ventures, Pivotal Ventures, BoxGroup, Torch Capital, 8VC, Palantir Alumni Group Total employees: 175 Role at Palantir: Forward Deployed Product Lead Rebecca Egger spent over two years as a Forward Deployed Product Lead at Palantir before transitioning to a role as a product and program lead at the Chan Zuckerberg Initiative. In 2020, she cofounded Little Otter, an online counseling and therapy service focused on serving families and children, alongside her mother, Dr. Helen Egger. In February, Little Otter secured $9.5 million in strategic funding in February from investors, including Charles River Ventures and Pivotal Ventures. The funding will help the startup scale its operations using AI and expand its services to families covered by Medicaid and commercial insurance plans, according to a company blog post . Shreya Murthy and Joy Tao, Partiful Partiful co-founders Shreya Murthy and Joy Tao Shreya Murthy, Joy Tao Total funding: $27 million, according to PitchBook Notable investors: a16z, according to PitchBook Total employees: 27, according to PitchBook Role at Palantir: Tao was a product engineer, and Murthy was an enterprise lead and business operations and strategy lead Joy Tao and Shreya Murthy are currently running Partiful, an app for inviting friends and connections to IRL events. The pair founded the startup in 2020. Since then, it has become a go-to organizing tool for group gatherings, and at the end of 2022, Partiful raised a Series A funding round from a16z. Tao and Murthy both worked at Palantir from 2014 to 2018. Tao was a product engineer, while Murthy held multiple positions: enterprise lead, deployment lead, and business operations and strategy team lead. Alex Ince-Cushman, Branch Energy Total funding: $20 million, according to the company Notable investors: Prelude Ventures, Zero Infinity Partners Total employees: 20, according to PitchBook Role at Palantir: Head of Product Operations Alex Ince-Cushman worked as Palantir's Head of Product Operations for nearly four years after over six years at the consulting firm McKinsey & Company. After Palantir, Ince-Cushman spent almost two years as chief technology officer at Just Energy, a retail energy provider in the US and Canada. He founded Branch Energy in late 2020. This vertically integrated power provider helps customers lower their energy bills and carbon footprints by providing access to clean energy. In August 2024, the startup raised just under $11 million in a round led by climate tech venture firm Prelude Ventures. Gary Lin, Explo Notable investors: Craft, Felicis, and Y Combinator Total employees: 25, according to the company Role at Palantir: Forward deployed engineer, enterprise tech lead In 2019, Gary Lin co-founded Explo, which allows companies to quickly build customer-facing dashboards and reporting. The company was a member of YC's Winter 2020 batch and has since raised $14 million in VC funding, most recently through its $12 million Series A in August 2022, which was led by Craft Ventures. Prior to starting Explo, Lin spent more than two years at Palantir, first as a forward-deployed engineer working with the Department of Defense and later commercial clients and then as an enterprise tech lead for the Department of Defense. "Being an engineer on the frontlines via forward deployed engineering gave me a glimpse into what it was like to embed closely with customers, make difficult, multi-dimensional tradeoffs, and close pilots," he said. Angela McNeal and Mayada Gonimah, Thread AI Angela McNeal and Mayada Gonimah, Thread AI Angela McNeal, Mayada Gonimah Total funding: $6 million, according to the company Notable investors: Greycroft, Index Ventures Total employees: 14, according to the company Role at Palantir: Angela McNeal: Head of AI/ML Product, Foundry Modeling; Mayada Gonimah: Head of AI/ML Engineering, Foundry At Palantir, McNeal and Gonimah led the Foundry Modeling team, where they worked on AI and machine learning projects. Drawing on that experience, they left the company in 2023 and cofounded ThreadAI, a composable infrastructure platform that allows companies to make, implement, and manage AI-powered workflows. For aspiring founders looking to break out of their current company and start something new, Gonimah emphasizes the importance of building a resilient team: "There are a lot of tourists, so make sure you have a deep bench to build a durable company that isn't at risk of being eliminated by the next shiny thing," she told BI. Thread AI raised a seed round led by Index Ventures, with participation from Greycroft and a handful of angel investors, in 2024. Sinclair Toffa, Mural Pay

Addepar Frequently Asked Questions (FAQ)

When was Addepar founded?

Addepar was founded in 2009.

Where is Addepar's headquarters?

Addepar's headquarters is located at 335 Madison Avenue, Mountain View.

What is Addepar's latest funding round?

Addepar's latest funding round is Secondary Market.

How much did Addepar raise?

Addepar raised a total of $513.93M.

Who are the investors of Addepar?

Investors of Addepar include Fabrica Ventures, Manhattan Venture Partners, D1 Capital Partners, 8VC, Sway Ventures and 19 more.

Who are Addepar's competitors?

Competitors of Addepar include Flanks, Qplix, PureFacts, Canoe Intelligence, BridgeFT and 7 more.

What products does Addepar offer?

Addepar's products include Addepar (core platform) and 4 more.

Who are Addepar's customers?

Customers of Addepar include RBC Wealth Management – U.S..

Loading...

Compare Addepar to Competitors

InvestCloud focuses on transforming the financial industry's approach to digital and operates within the financial technology sector. The company offers a no-code software platform for digital and commerce enablement, providing cloud-native, multi-tenanted solutions that help banks, wealth managers, and asset managers overcome technology debt and meet the needs of their clients. The company primarily serves the financial industry. It was founded in 2010 and is based in West Hollywood, California.

d1g1t provides an enterprise wealth management platform in the financial technology sector. The company offers a comprehensive suite of analytics and risk management tools designed to enhance the quality of financial advice and streamline wealth management operations. Its services cater to financial advisory firms, multi-family offices, registered investment advisors (RIAs), broker-dealers, and bank advisor networks, aiming to integrate various aspects of wealth management into a cohesive system. It was founded in 2017 and is based in Toronto, Canada.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

Masttro operates as a WealthData company within the financial technology sector. The company offers a platform that aggregates, analyzes, and reports on individuals' and families' total net worth, encompassing both liquid and illiquid investments, liabilities, and passion assets across various currencies and regions. The company primarily serves wealth owners, their beneficiaries, and financial advisors with a focus on providing control, transparency, and peace of mind for informed financial decision-making. It was founded in 2010 and is based in New York, New York.

Canopy is a WealthTech firm that provides portfolio management software for the financial services industry. The company offers tools for account aggregation, portfolio analytics, and client reporting. Canopy serves financial institutions, wealth management professionals, and high net-worth individuals. It was founded in 2013 and is based in Singapore.

BridgeFT focuses on wealth technology (WealthTech) infrastructure. It provides services within the financial technology sector. The company offers a WealthTech-as-a-Service platform that includes financial data aggregation, advanced analytics, and applications essential for wealth management. BridgeFT primarily serves FinTech companies, registered investment advisors (RIAs), turnkey asset management platforms (TAMPs), and other financial institutions. It was founded in 2015 and is based in Chicago, Illinois.

Loading...