AgentSync

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$161.1MLast Raised

$50M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-21 points in the past 30 days

About AgentSync

AgentSync provides insurance compliance software within the financial services sector. The company has tools for producer management, compliance, and onboarding processes for distribution networks for insurers. AgentSync serves the insurance industry, including carriers, agencies, and MGAs. It was founded in 2018 and is based in Denver, Colorado.

Loading...

ESPs containing AgentSync

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance lead management market refers to the software solutions that help insurance companies manage their leads and sales processes. These solutions typically include lead tracking, customer relationship management (CRM), marketing automation, and analytics tools. The market is driven by the need for insurers to streamline their sales processes, improve customer engagement, and increase rev…

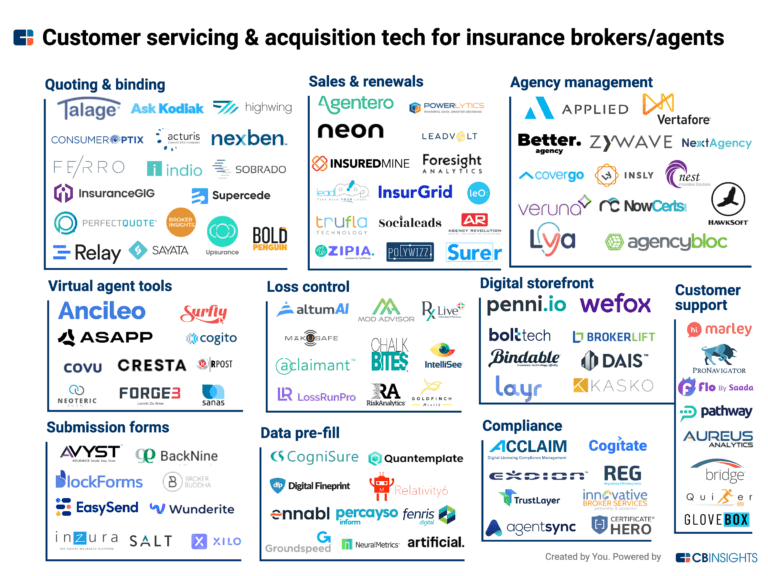

AgentSync named as Leader among 9 other companies, including Better Agency, Applied, and Bridge.

AgentSync's Products & Differentiators

AgentSync Manage

Our core solution, AgentSync Manage, is a powerful platform that effortlessly enforces state producer licensing and appointment regulatory requirements through an integration with the National Insurance Producer Registry (NIPR). Manage minimizes compliance costs and prevents regulatory violations before they occur by automating the administrative paper chase required to verify that agents have the necessary appointments and state licenses to sell. By simplifying the complexity of selling insurance, you can drastically reduce costs and compliance risks associated with manually managing these tasks via spreadsheets and disparate legacy systems.

Loading...

Research containing AgentSync

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AgentSync in 1 CB Insights research brief, most recently on Sep 30, 2022.

Expert Collections containing AgentSync

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AgentSync is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Insurtech

3,304 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest AgentSync News

Apr 8, 2025

When your team has come to the conclusion that your current vendor, process, or (let’s be honest) spreadsheet isn’t working, you need to get buy-in across your larger organization. Easy, right? If you’re the one responsible for any variation on the themes of streamlining your producers’ onboarding, licensing, carrier appointments, or sales territory assignments, then articulating the value of AgentSync and its distribution channel management (DCM) solutions to other organizational stakeholders is the next hurdle to your future state. Who does DCM benefit? You. Better distribution channel management benefits you. But coming out and saying so right up front is likely not enough to get the broader organization on board, especially if you’ve historically managed your distributors and downstream producers on spreadsheets. Your organization may see your distribution channel management as a zero-cost solution. You know that it’s not . You know that every day that you bootstrap your producer licensing could be the day that a license lapses and costs you $20,000 in state fines and even more in reputational cache. It could be the day that slow onboarding funnels a $5 million policy to your competitor. While the daily change to your workflow will be most visible to you and your team, the drudgeries of change management and upgrading critical aspects of your fundamental business architecture will be beyond your control. Implementation is no wave of a magic wand (we wish). You have to make the case that AgentSync and its transformative distribution channel management solutions will deliver to your business well beyond the convenience of freeing up your team from hours of typing (and retyping and retyping) to fact-check NPNs by hand. Defining and scoping the problem If you’ve recognized your business’s need to handle producer data better and to implement AgentSync as your DCM solution, you know you need to get other stakeholders on board (the kind of stakeholders that have the authority to cut checks and affect change management). Part of that is going to be getting everyone to agree on the problem. It can be easy for agencies and carriers to become complacent with regulatory risk as the cost of doing business, although we’d argue the penalty isn’t the real pain . But slow onboarding processes can cost you millions of dollars as producers funnel business to agencies or carriers they already have contracts with. After all, just because you can’t pay a producer yet doesn’t mean they don’t want to get paid – they aren’t waiting for you to process their paperwork before placing business for their customers. Especially with an industry driven by independent agents, slow onboarding is a risk to your competitive edge, and poses the risk of churning an agent altogether. Your ability to visualize who your producers and distributors are and where they are licensed or appointed is critical to your compliance, sure. But it’s also a critical part of evaluating your overall distribution, and the effectiveness of your various regional investments. Knowing who you’re in competition with for your producers and lines of authority is data that can make or break a distribution strategy for new products in a given year. How to solve your pain points with AgentSync Your stakeholders will have real concerns about any new tech they evaluate, and it’s not just about getting a favorable ROI – it’s also about the total cost of ownership for a given technology. It’s one thing to make a significant initial investment; it’s another to realize the most of its potential with integrations, automations, reporting, and actual adoption across the business. Making the case means being able to answer questions about these pain points and more. Empower yourself to make the case for AgentSync at your business and transform your total distribution channel management today. Download the guide. About AgentSync AgentSync provides Distribution Channel Management (DCM) solutions that connect the insurance ecosystem. By automating producer onboarding workflows and integrating real-time data across systems, AgentSync enables insurers to scale and optimize their distribution networks while remaining compliant. Our configurable, intuitive platform simplifies the producer ready-to-sell process, supported by API connectivity for seamless data exchange across systems. AgentSync recognizes compliance as the ultimate enabler for optimized distribution, unlocking new revenue opportunity and agility to adapt in a rapidly evolving industry. Founded in 2018 by Niji Sabharwal and Jenn Knight, and headquartered in Denver, CO, AgentSync has been recognized as one of Denver’s Best Places to Work, a Forbes Magazine Cloud 100 Rising Star, an Insurtech Insights Future 50 winner, and was ranked 65th in Forbes’ America’s Best Startup Employers 2023. To learn more, visit www.agentsync.io .

AgentSync Frequently Asked Questions (FAQ)

When was AgentSync founded?

AgentSync was founded in 2018.

Where is AgentSync's headquarters?

AgentSync's headquarters is located at 3601 Walnut Street, Denver.

What is AgentSync's latest funding round?

AgentSync's latest funding round is Series B - II.

How much did AgentSync raise?

AgentSync raised a total of $161.1M.

Who are the investors of AgentSync?

Investors of AgentSync include Craft Ventures, Valor Equity Partners, Tiger Global Management, Anthemis, Atreides Management and 9 more.

Who are AgentSync's competitors?

Competitors of AgentSync include RegEd and 5 more.

What products does AgentSync offer?

AgentSync's products include AgentSync Manage and 1 more.

Who are AgentSync's customers?

Customers of AgentSync include Senior Life and Online Medicare Distributor.

Loading...

Compare AgentSync to Competitors

RegEd operates as a market-leading provider of Regulatory Technology solutions within the financial services industry. The company offers a suite of enterprise solutions that include workflow-directed processes, regulatory intelligence, automated validations, and compliance dashboards to facilitate operational efficiency and regulatory compliance. RegEd primarily serves the financial services sector, with a focus on compliance and risk management for enterprise clients. It was founded in 2000 and is based in Morrisville, North Carolina.

Spyder specializes in data management, cyber compliance, and secure document storage for the financial services and insurance domains. The company offers a platform that helps in data management and compliance with cyber regulations and document storage needs, tailored specifically for insurance agents and financial service providers. Its solutions are designed to support licensed individuals and home office firms in managing licensing renewals, continuing education, and cyber security certifications. The company was founded in 2021 and is based in Fort Scott, Kansas.

Egnyte provides services in content collaboration and governance within the cloud content management sector. The company offers a platform that enables collaboration, intelligence for content insights, and governance to address cyber threats and ensure data compliance. Egnyte provides solutions for industries including architecture, engineering, construction, operations, life sciences, and financial services. It was founded in 2007 and is based in Mountain View, California.

Advocate provides a software platform to replace manual insurance review processes with automated solutions for lenders in the financial services industry. The platform aims to improve pre-closing and servicing functions. Advocate serves commercial real estate lenders and other financial institutions involved in loan programs. It was founded in 2020 and is based in New York, New York.

CaseWare specializes in cloud-enabled audit, financial reporting, and data analytics solutions for various sectors within the accounting industry. The company provides tools that automate and streamline financial reporting, tax engagements, practice management, and audit processes to enhance efficiency and insights. It was founded in 1988 and is based in Toronto, Canada.

EverCheck is a company that focuses on healthcare compliance, operating within the healthcare and software industries. The company offers automated compliance software that provides services such as license verification, sanction and exclusion management, and continuing education tracking for healthcare professionals. The primary sectors EverCheck caters to are the healthcare and human resources industries. It was founded in 2012 and is based in Jacksonville, Florida.

Loading...