AlphaSense

Founded Year

2011Stage

Biz Plan Competition | AliveTotal Raised

$1.397BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+55 points in the past 30 days

About AlphaSense

AlphaSense is a market intelligence and search platform that uses AI (artificial intelligence) and NLP (natural language processing) technology to provide insights across various sectors. The company offers tools for financial research, including access to equity research, expert call transcripts, and the ability to integrate and analyze internal content alongside public data. AlphaSense serves the financial services, asset management, consulting, and corporate sectors with its market intelligence solutions. It was founded in 2011 and is based in New York, New York.

Loading...

ESPs containing AlphaSense

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI investing copilots market uses algorithms and machine learning to assist investors in making more informed investment decisions. These solutions analyze vast amounts of financial data, market trends, and individual preferences to provide personalized investment strategies. By automating processes and providing real-time insights, AI investing copilots enhance portfolio management efficiency…

AlphaSense named as Leader among 11 other companies, including Public, Boosted.ai, and Reflexivity.

AlphaSense's Products & Differentiators

AlphaSense Core Search (newest release: AlphaSense X)

AlphaSense is the leading market intelligence platform leveraging cutting-edge technology to continuously filter and analyze billions of fragmented pieces of information. We apply the power of AI to an extensive library of high value unstructured and structured data-sets, enabling business professionals to make critical decisions with confidence.

Loading...

Research containing AlphaSense

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AlphaSense in 6 CB Insights research briefs, most recently on Oct 15, 2024.

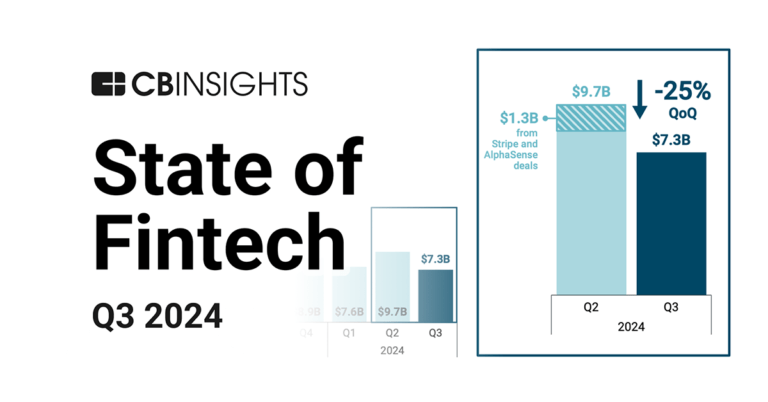

Oct 15, 2024 report

State of Fintech Q3’24 Report

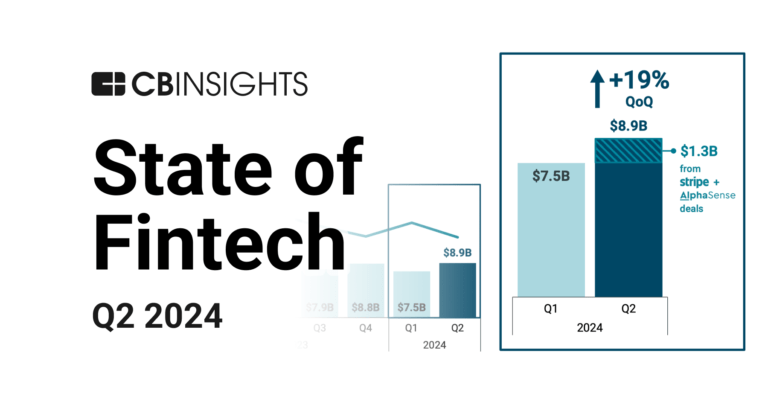

Jul 16, 2024 report

State of Fintech Q2’24 Report

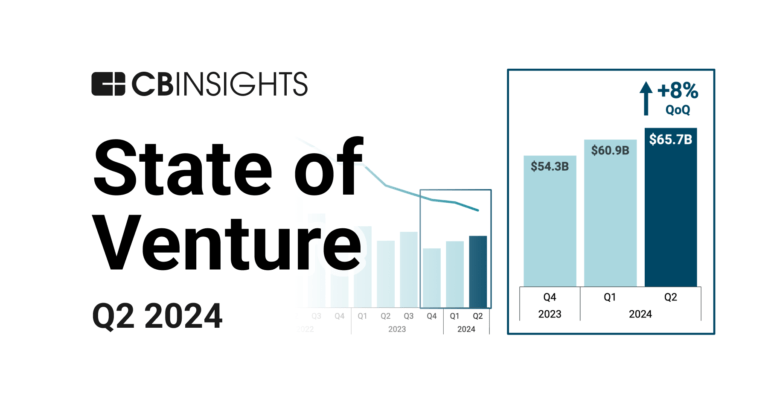

Jul 3, 2024 report

State of Venture Q2’24 Report

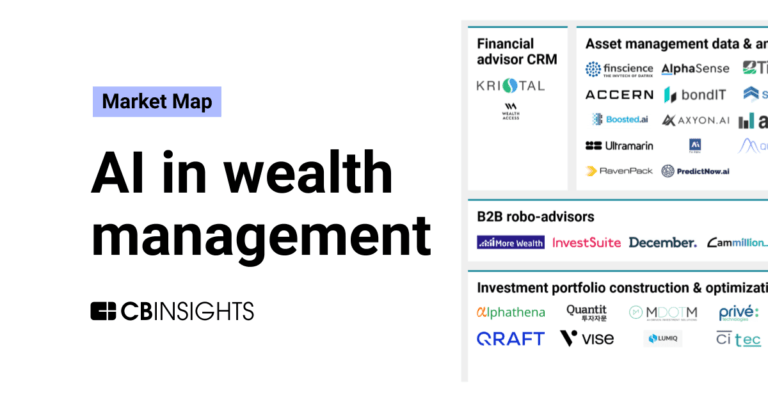

Oct 6, 2023

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing AlphaSense

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AlphaSense is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,042 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

7,221 items

AlphaSense Patents

AlphaSense has filed 37 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/20/2024 | 3/11/2025 | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres | Grant |

Application Date | 9/20/2024 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres |

Status | Grant |

Latest AlphaSense News

Apr 1, 2025

News provided by Share this article Share toX NEW YORK, April 1, 2025 /PRNewswire/ -- With M&A activity poised for a resurgence in 2025, investment banks are under mounting pressure to accelerate dealmaking while maintaining the highest standards of due diligence. Analysts are under pressure to deliver more, faster—automating manual workflows to stay ahead—while senior bankers rely on AI-powered market intelligence to craft smarter, more compelling pitches and win mandates. AlphaSense , the leading AI-powered market intelligence and search platform, is transforming how investment banking teams operate. Trusted by 80% of top global banks, AlphaSense accelerates deal sourcing, qualification, and execution —delivering deeper insights, faster decisions, and greater efficiency. With the world's largest library of business and financial content, AlphaSense gives firms a competitive edge to win more mandates and drive superior outcomes. "In a world where efficiency is everything, AlphaSense's AI boosts banker productivity up to 3x, cuts costs, and delivers deeper insights to win deals," said Frank Nash, SVP, Strategic Financial Services Sales at AlphaSense. "By streamlining workflows and reducing blind spots, we help firms move faster and smarter in today's M&A landscape." AI's Transformative Impact on Investment Banking The financial industry's reliance on AI is growing rapidly. According to Deloitte's 2025 M&A Trends Survey , 55% of CFOs are planning to pursue acquisitions or mergers, and 97% of executives report that their organizations have already started incorporating generative AI or advanced data analytics into their dealmaking processes. AlphaSense's AI-driven platform delivers game-changing efficiencies across key stages of investment banking: Due Diligence Optimization – Generative Search instantly scans 10,000+ public, private, premium, and proprietary sources—including deal data rooms—to automate and accelerate document review, insight extraction, and due diligence. Deal Sourcing – AI-driven analysis helps senior bankers pinpoint high-potential opportunities faster while reducing non-strategic pursuits. Next-Level Research & Analysis with AI-Powered Insights AlphaSense acts as a virtual analyst at the fingertips of every user, augmenting research teams with tools that provide rapid, reliable intelligence: Generative Search enables analysts to ask business and financial questions and get answers based on the best high value financial content in the world. Expert Insights offers an on-demand library of 150,000+ expert call transcripts covering 35,000+ public and private companies, equipping bankers with unique insights to strengthen pitches and win mandates. Enterprise Intelligence allows teams to interrogate data rooms and other internal datasets, surfacing proprietary insights that enhance dealmaking. Accelerating Research & Due Diligence with Generative Grid Investment banking teams juggle multiple high-stakes deals at once, making fast, comprehensive market and financial insights essential. AlphaSense's Generative Grid simplifies this process by organizing intelligence into dynamic, side-by-side comparison tables, enabling quicker, more informed decision-making. Whether tapping into internal sources like data room content or AlphaSense's extensive content library, users can automate repetitive diligence tasks by asking multiple questions, summarizing findings, and comparing documents with unprecedented ease. It also offers: Expert Interview Summaries that extract key insights from thousands of expert transcripts providing deeper insights on a company or industry. CIM Analyzers to cross-analyze financial disclosures, ensuring faster and more informed decision-making in M&A and other investment banking workflows. The Future of Investment Banking Starts Here As the dealmaking landscape rebounds, investment banks need technology that keeps pace with demand while maintaining the highest standards of quality. AlphaSense empowers your teams to navigate the evolving M&A environment with confidence, speed, and accuracy—giving you the edge to uncover insights faster and make smarter decisions. Start your free trial today to experience the power of AlphaSense firsthand. Read more about how evolving technology is shaping the future of investment banking. About AlphaSense The world's most sophisticated companies rely on AlphaSense to remove uncertainty from decision-making. With market intelligence and search built on proven AI, AlphaSense delivers insights that matter from content you can trust. Our universe of public and private content includes equity research, company filings, event transcripts, expert calls, news, trade journals, and clients' own research content. Founded in 2011, AlphaSense is headquartered in New York City with over 2,000 people across the globe and offices in the U.S., U.K., Finland, India, Singapore, Canada, and Ireland. For more information, please visit www.alpha-sense.com . Media Contact

AlphaSense Frequently Asked Questions (FAQ)

When was AlphaSense founded?

AlphaSense was founded in 2011.

Where is AlphaSense's headquarters?

AlphaSense's headquarters is located at 24 Union Square East, New York.

What is AlphaSense's latest funding round?

AlphaSense's latest funding round is Biz Plan Competition.

How much did AlphaSense raise?

AlphaSense raised a total of $1.397B.

Who are the investors of AlphaSense?

Investors of AlphaSense include Fast Company’s Next Big Things in Tech, Viking Global Investors, CapitalG, Goldman Sachs, J.P. Morgan Asset Management and 34 more.

Who are AlphaSense's competitors?

Competitors of AlphaSense include Rogo, Street Context, Auquan, Hebbia, Preqin and 7 more.

What products does AlphaSense offer?

AlphaSense's products include AlphaSense Core Search (newest release: AlphaSense X) and 3 more.

Loading...

Compare AlphaSense to Competitors

YCharts operates as a financial research and proposal platform within the financial services industry. The company provides inclusive data, visualization tools, and analytics for equity, mutual fund, and exchange-traded fund (ETF) data and analysis, enabling investment professionals to improve client engagements and simplify complex financial topics. YCharts primarily serves the financial advisory and asset management sectors. It was founded in 2009 and is based in Chicago, Illinois.

Prosights specializes in providing a research platform tailored for private equity investors within the financial services domain. The company offers tools for private investment analysis, including financial data aggregation and insights into market trends. It primarily serves professionals in the private equity and investment sectors. The company was founded in 2024 and is based in San Francisco, California.

280First is a financial services platform that analyzes unstructured data to provide insights for investment professionals. The company offers a platform that helps investment professionals identify opportunities and manage risks in financial documents. This platform supports investment professionals in managing a broader portfolio of companies. It is based in Redwood City, California.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

Canoe Intelligence provides alternative investment data management within the financial technology sector. The company offers cloud-based solutions that facilitate document collection, data extraction, and data science initiatives, allowing financial institutions to process complex investment documents. Canoe's technology is utilized by institutional investors, asset servicers, capital allocators, and wealth managers to manage their data workflows. It was founded in 2017 and is based in New York, New York.

Calcbench provides an interactive financial data platform for the financial services industry. The company offers access to as-filed SEC filings, earnings press releases, and tools for financial analysis, including an Excel add-in and an API. Calcbench serves buy-side and sell-side analysts, quants, auditors, academics, and corporate finance professionals. It was founded in 2011 and is based in New York, New York.

Loading...