Amount

Founded Year

2014Stage

Series E | AliveTotal Raised

$253.2MLast Raised

$30M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+113 points in the past 30 days

About Amount

Amount specializes in digital origination and decisioning within the financial technology sector. The company offers a platform that facilitates account origination for lenders, integrating decisioning for credit, fraud, and compliance, as well as customer journeys to support the lending process. Amount primarily serves regional and community banks, large commercial banks, and credit unions, providing them with tools for their operations. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing Amount

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

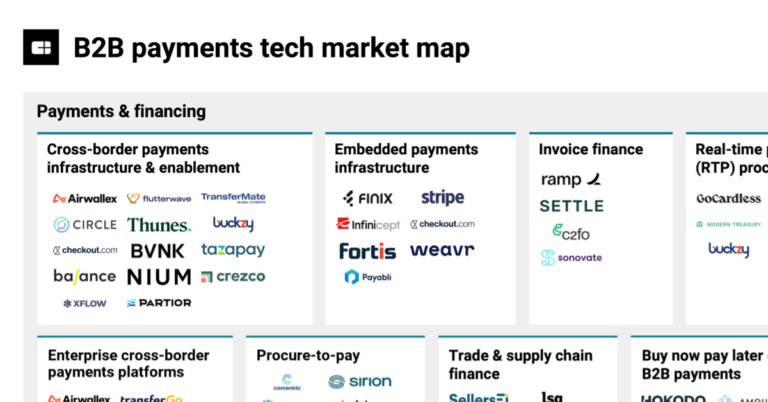

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Amount named as Highflier among 15 other companies, including Affirm, PayPal, and Hokodo.

Amount's Products & Differentiators

Retail Banking

Amount empowers financial institutions to rapidly and securely create high-value digital solutions so customers can bank when, where and how they want. Amount’s fully integrated and flexible platform is underpinned by enterprise bank-grade infrastructure and compliance, ensuring safe and reliable banking experiences across e-commerce and brick-and-mortar channels. Amount technology delivers: Ø White-label application to tailor and optimize cross-channel consumer experiences. Ø API toolkit that enables seamless integrations to originate and manage loans. Ø Proprietary decisioning engine and fraud prevention framework that delivers instant customer approvals and greater conversions without increasing overall risk. Ø Flexible reporting and analytics tools Ø Solutions that work and thrive with existing infrastructure

Loading...

Research containing Amount

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amount in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

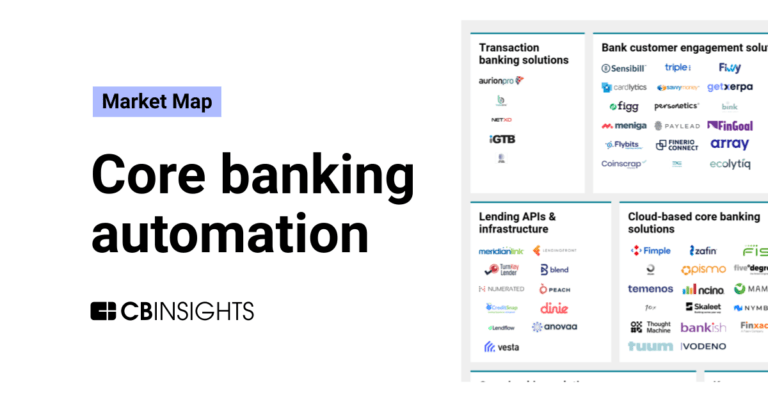

The core banking automation market mapExpert Collections containing Amount

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amount is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,774 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,083 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Amount Patents

Amount has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/14/2015 | 9/13/2016 | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers | Grant |

Application Date | 10/14/2015 |

|---|---|

Grant Date | 9/13/2016 |

Title | |

Related Topics | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers |

Status | Grant |

Latest Amount News

Mar 20, 2025

Amount, a leader in consumer and small business deposit and loan origination software solutions, today announced an integration with Q2's Digital Banking Platform via the Q2 Partner Accelerator Program. Q2 Holdings, Inc. NYSE: QTWO ) is a leading provider of digital transformation solutions for banking and lending. As part of the Q2 Partner Accelerator Program, financial institutions can purchase Amount and then offer their consumer & small business credit card account opening product via the Q2 Digital Banking Platform, empowering banks and credit unions to launch and manage consumer and small business credit card programs with ease. By automating manual tasks, enhancing risk management, and seamlessly integrating with existing systems, financial institutions can reduce processing time, minimize errors, and scale their card offerings efficiently. Meanwhile, customers and members benefit from intuitive application experiences that simplify the credit card journey, offering faster decisions, tailored offers, and secure processes. These adaptive workflows enhance satisfaction and foster lasting engagement. The Q2 Partner Accelerator is a program through the Q2 Innovation Studio that allows in-demand financial services companies who are leveraging the Q2 SDK to pre-integrate their technology to the Q2 Digital Banking Platform. This enables financial institutions to work with these partners, purchase their solutions and rapidly deploy their standardized integrations to their customers or members. Craig Rismiller, EVP of New Products and Strategic Partnerships at Amount, shared: "We're excited to bring enhanced benefits to Q2 clients through this seamless integration, offering a smoother and more efficient small business and consumer credit card application process. By leveraging Q2's 360-degree view of customer data, financial institutions can make more informed risk decisions while providing a better experience for their customers and members." Amount's integration with the Q2 Digital Banking Platform simplifies and enhances the consumer and small business credit card application process for financial institutions. Here's how: Faster applications : Existing customers and members can apply for small business and consumer credit cards with pre-filled data from their authenticated Q2 accounts, reducing redundant data entry. Seamless experience : By incorporating Q2's data into the decisioning process, financial institutions can improve credit decision accuracy and efficiency. Optimized operations : The integration streamlines workflows while ensuring a secure, frictionless experience for customers and members. Single Sign-On (SSO) : Q2's SDK enables a secure, centralized SSO system, allowing users to seamlessly transition between Q2 and Amount's Platform. To learn more about the Q2 Innovation Studio Partner Accelerator Program, please click here About Amount Amount provides a unified digital origination and decisioning platform that helps financial institutions meet the moment. Designed to scale with banks and credit unions at any stage of their digital journey, Amount delivers a seamless, digital-first experience—streamlining everything from loan origination to deposit account opening. With built-in fraud orchestration and risk management, Amount enables financial institutions to control risk across any product while optimizing performance and enhancing security. Our flexible, modular platform is backed by enterprise-grade infrastructure and compliance, allowing institutions to launch new offerings in months, not years. Amount's clients include financial institutions collectively managing over $3.1T in assets and serving more than 50 million U.S. consumers. Learn more at www.amount.com About Q2 Holdings, Inc. Q2 is a leading provider of digital banking and lending solutions to banks, credit unions, alternative finance, and fintech companies in the U.S. and internationally. Q2 enables its financial institutions and fintech companies to provide comprehensive, secure, data-driven digital client engagement solutions – from consumers to small businesses and corporate clients. Headquartered in Austin, Texas, Q2 has offices throughout the world and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com. Follow us on LinkedIn and Twitter to stay up-to-date. View source version on businesswire.com: https://www.businesswire.com/news/home/20250320702400/en/ Contacts Media Contact Gregory FCA amount@gregoryfca.com

Amount Frequently Asked Questions (FAQ)

When was Amount founded?

Amount was founded in 2014.

Where is Amount's headquarters?

Amount's headquarters is located at 222 North LaSalle Street, Chicago.

What is Amount's latest funding round?

Amount's latest funding round is Series E.

How much did Amount raise?

Amount raised a total of $253.2M.

Who are the investors of Amount?

Investors of Amount include Hanaco Ventures, WestCap, Goldman Sachs, QED Investors, Curql and 11 more.

Who are Amount's competitors?

Competitors of Amount include Figure, Dinie, equipifi, MoneyView, Lendflow and 7 more.

What products does Amount offer?

Amount's products include Retail Banking and 1 more.

Loading...

Compare Amount to Competitors

Best Egg operates as a consumer financial technology platform in the fintech sector. The company offers a digital financial platform that provides personal loans, credit cards, and financial health resources to help individuals manage their everyday finances. It primarily serves the personal finance management sector. Best Egg was formerly known as Marlette Holdings. It was founded in 2014 and is based in Wilmington, Delaware.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

ChargeAfter provides embedded consumer finance solutions within the financial services industry. The company offers a multi-lender platform for point-of-sale financing that allows merchants to offer financing options to customers online and in-store. ChargeAfter's services include a matching engine for lenders, a platform for managing compliance and underwriting, and tools for post-sale management and analytics. It was founded in 2017 and is based in New York, New York.

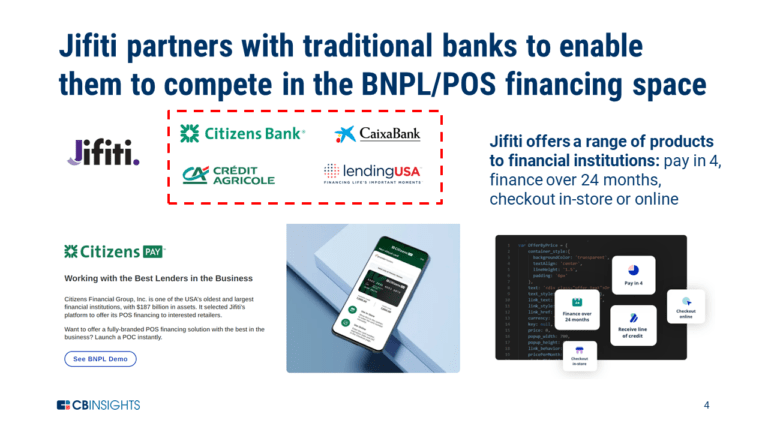

Jifiti provides embedded lending solutions within the financial services sector. The company has a platform that allows banks, lenders, and merchants to offer consumer and business financing options at points of sale, including online, in-store, and via call centers. Jifiti's platform includes financing options such as installment loans, lines of credit, split payments, and Buy Now, Pay Later services for B2C and B2B customers. It was founded in 2011 and is based in Columbus, Ohio.

Achieve offers digital financial solutions. Its services include home equity loans, personal loans and debt resolution, and financial education. It caters to individuals and families. Achieve was formerly known as Freedom Financial Network. It was founded in 2002 and is based in Tempe, Arizona.

Zirtue is a company that operates in the financial technology sector, focusing on relationship-based lending. It provides a platform for individuals to lend and borrow money from friends and family, facilitating loan requests and automated repayments, while offering a framework for managing personal loans. Zirtue serves the personal finance sector by allowing lending without traditional banks or predatory lenders. It was founded in 2018 and is based in Dallas, Texas.

Loading...