Anchorage Digital

Founded Year

2017Stage

Series D | AliveTotal Raised

$487MValuation

$0000Last Raised

$350M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+9 points in the past 30 days

About Anchorage Digital

Anchorage Digital offers a cryptocurrency platform that provides financial services and infrastructure solutions for institutions. It offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Anchorage Digital

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

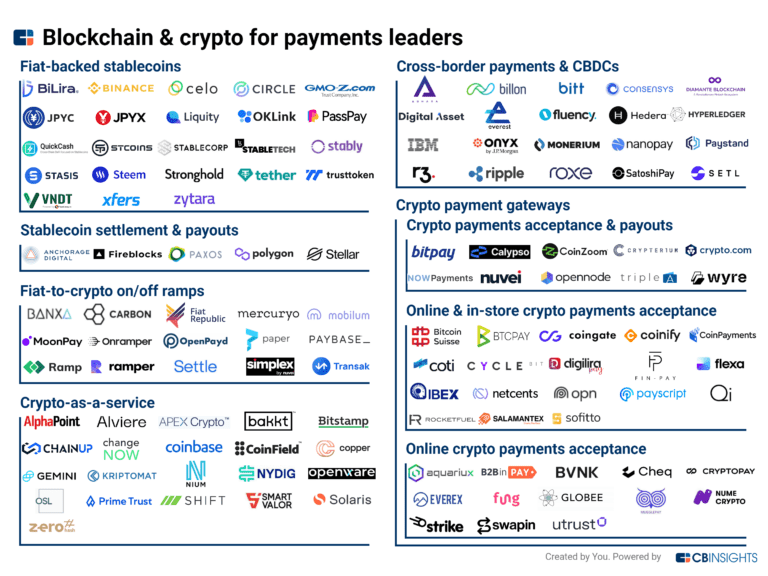

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Anchorage Digital named as Challenger among 7 other companies, including Circle, Fireblocks, and Stellar.

Anchorage Digital's Products & Differentiators

Custody

Safekeeping of over 60 digital assets

Loading...

Research containing Anchorage Digital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Anchorage Digital in 7 CB Insights research briefs, most recently on Feb 23, 2023.

Oct 15, 2022

What is institutional staking?

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing Anchorage Digital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Anchorage Digital is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

8,905 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Capital Markets Tech

1,163 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Anchorage Digital News

Apr 10, 2025

Atkins has pledged to build a firm regulatory foundation for digital assets, continuing the crypto-friendly measures initiated by acting SEC Chair Mark Uyeda. Dennis M.Kelleher, co-founder of Better Markets, criticized Atkins's past, blaming him for deregulation that contributed to the 2008 financial crisis. On Wednesday, April 9, the US Senate finally announced Paul Atkins as the permanent Chairman of the US Securities and Exchange Commission (SEC) in a 52-44 vote largely along party lines. This close voting among the Senate members suggests that Atkins's selection remains a matter of contestation for many. The crypto community has been cheering Paul Atkins's appointment, hoping for better regulatory reforms in the industry after four years of crackdown by former chair Gary Gensler. Atkins has been closely watching the developments in the crypto industry and has a $5 million stake in a crypto investment firm, where he serves as a limited partner. As of February 2025, he held equity valued between $250,000 and $500,000 in the crypto custodian Anchorage Digital, along with a similar amount in call options for Securitize, a blockchain firm backed by BlackRock. Paul Atkins to Continue with US SEC's Crypto-Friendly Approach Atkins previously served as an SEC commissioner from 2002 to 2008, a tenure that spanned the global financial crisis. However, in one of his recent speeches, Atkins told Senators that one of the top areas of attention during his chairmanship would be providing “a firm regulatory foundation for digital assets through a rational, coherent, and principled approach.” Over the last few months, SEC's acting chair Marky Uyeda took several bold and crypto-friendly measures while working along with SEC Commissioner Hester Peirce. Positive developments in lawsuits against Ripple, Coinbase, and Binance will provide greater freedom for these big crypto giants to function with ease. Atkins is most likely to continue with this crypto-friendly approach moving ahead. Expressing confidence in Paul Atkins's leadership, Senate Banking Committee Chairman Tim Scott said: “Chairman Atkins will also provide regulatory clarity for digital assets, allowing American innovation to flourish, and ensuring we remain competitive on the global stage.” The Other Side of Atkins and Why He Could Be Bad to Markets Following Paul Atkins's appointment as the US SEC Chair, Dennis M. Kelleher, co-founder of Better Markets, noted that Atkins was the reason behind the capital markets crash during the 2008 financial crisis. “Atkins can be expected to take orders from the White House, politicize the SEC, mindlessly cut key staff, deregulate the industry, gut the enforcement professionals, side with management over investors, and generally undermine the mission and mandate of the SEC,” Kelleher stated. next Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content. SEC Crypto News, Cryptocurrency News, News Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills. Bhushan Akolkar on X Source: https://www.coinspeaker.com/is-us-sec-chair-paul-atkins-good-or-bad-for-crypto/

Anchorage Digital Frequently Asked Questions (FAQ)

When was Anchorage Digital founded?

Anchorage Digital was founded in 2017.

Where is Anchorage Digital's headquarters?

Anchorage Digital's headquarters is located at One Embarcadero Street, San Francisco.

What is Anchorage Digital's latest funding round?

Anchorage Digital's latest funding round is Series D.

How much did Anchorage Digital raise?

Anchorage Digital raised a total of $487M.

Who are the investors of Anchorage Digital?

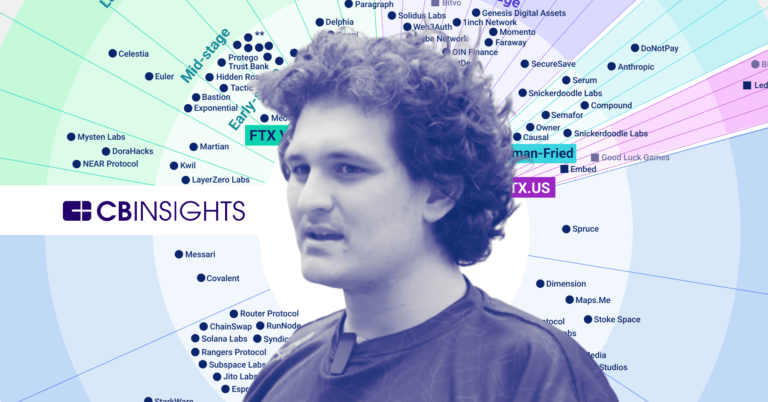

Investors of Anchorage Digital include Andreessen Horowitz, Blockchain Capital, GIC, Elad Gil, Alameda Research and 25 more.

Who are Anchorage Digital's competitors?

Competitors of Anchorage Digital include Hex Trust, BitGo, Signature Bank, Fireblocks, Standard Custody & Trust Company and 7 more.

What products does Anchorage Digital offer?

Anchorage Digital's products include Custody and 2 more.

Who are Anchorage Digital's customers?

Customers of Anchorage Digital include Visa.

Loading...

Compare Anchorage Digital to Competitors

BitGo provides digital asset custody and financial services within the cryptocurrency sector. It offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. It serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. The company offers services including custody and management of crypto operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. Fireblocks serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Hex Trust offers services including custody, staking, and market services for digital assets. Hex Trust serves protocols, foundations, financial institutions, and the Web3 and Metaverse sectors. It was founded in 2018 and is based in Hong Kong, Hong Kong.

Custonomy provides digital asset and real-world asset custody solutions within the fintech sector. The company offers a non-custodial enterprise wallet suite that utilizes multi-party computation technology for asset management across multiple blockchain networks. Custonomy serves sectors such as financial institutions, decentralized finance (DeFi), investment funds, custodians, and mining pools. It was founded in 2020 and is based in Hong Kong.

Loading...