Investments

1770Portfolio Exits

244Funds

73Partners & Customers

3Service Providers

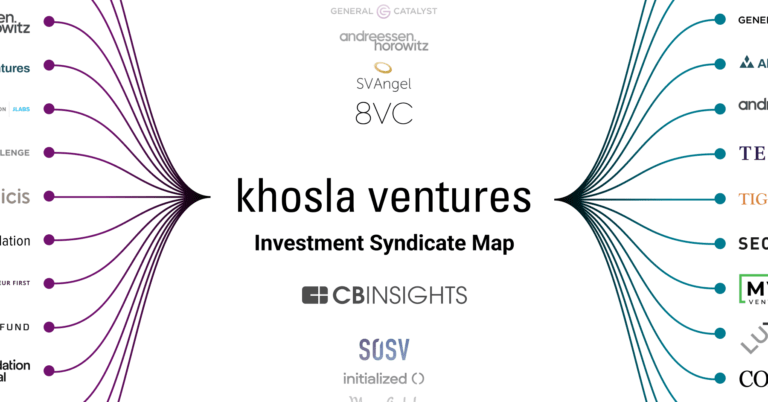

3About Andreessen Horowitz

Andreessen Horowitz (a16z) is a venture capital firm with $4.2 billion under management. The firm invests in entrepreneurs building companies at every stage, from seed to growth. It seeks to invest in sectors such as bio and healthcare, consumer, cryptocurrency, enterprise, fintech, and games. It was founded in 2009 and is based in Menlo Park, California.

Expert Collections containing Andreessen Horowitz

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Andreessen Horowitz in 18 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Agriculture Technology (Agtech)

28 items

Companies that are using technology to make farms more efficient

Vitamin & Supplement Startups

237 items

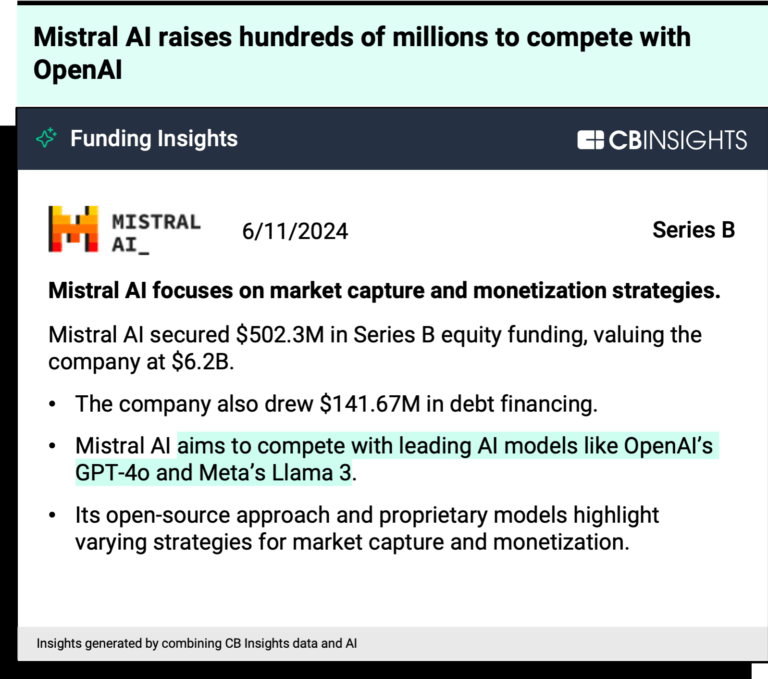

Research containing Andreessen Horowitz

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Andreessen Horowitz in 26 CB Insights research briefs, most recently on Oct 3, 2024.

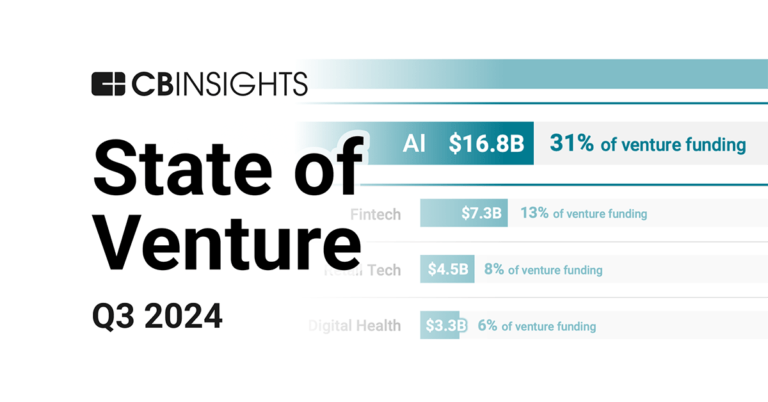

Oct 3, 2024 report

State of Venture Q3’24 Report

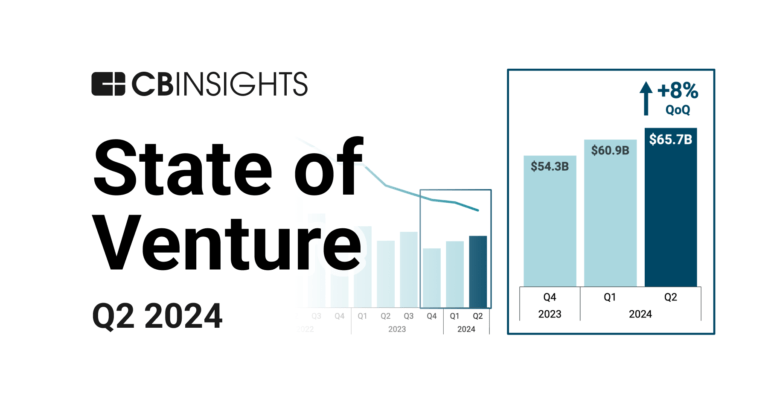

Jul 3, 2024 report

State of Venture Q2’24 Report

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Mar 5, 2024 report

The top 20 venture investors in North America

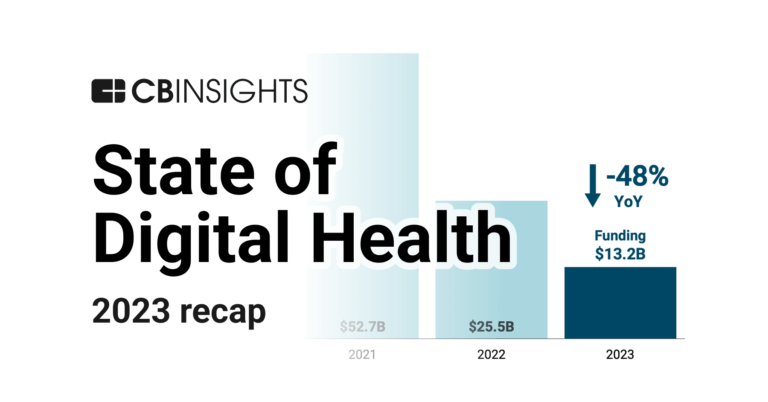

Jan 25, 2024 report

State of Digital Health 2023 ReportLatest Andreessen Horowitz News

Nov 11, 2024

Strike While the Crypto Iron is Hot Under Trump, Says Andreessen Horowitz Coin Prices Strike While the Crypto Iron is Hot Under Trump, Says Andreessen Horowitz Now is the time for projects that have held back on using tokens due to regulatory concerns, venture capital firm a16z said Sunday. Create an account to save your articles. Andreessen Horowitz’s (a16z) crypto arm sees former President Donald Trump’s re-election as a catalyst for a new era in crypto regulation, urging projects to embrace decentralized solutions and build confidently in the U.S. The venture capital firm, which has invested heavily in crypto and web3 startups, sees Trump’s pro-crypto stance as a way forward, according to a blog post on Monday. The firm’s crypto legal and policy experts—Miles Jennings, Michele Korver, and Brian Quintenz—outlined how the new political climate could pave the way for regulatory clarity. With the election now decided, “we believe this is an incredible opportunity to build on the bipartisan progress from the last Congress,” they wrote. The experts’ core message to crypto founders is to leverage the new administration’s openness towards digital assets. “Where there is trust, there is regulation,” the experts reminded builders, urging them to eliminate centralized dependencies to stay compliant. The trio notes now is the time for projects that have held back on using tokens due to regulatory concerns. With Trump’s pro-crypto approach, founders should feel confident in using tokens as “legitimate and lawful tools,” according to experts. “Today’s all-time high, driven by a Trump election win, signals that we are in the midst of a potential paradigm shift into the next phase of growth for crypto,” OKX chief legal officer Mauricio Beugelmans told Decrypt. Much of the optimism stems from Trump’s campaign promises to ease restrictions on crypto and replace Securities and Exchange Commission Chair Gary Gensler , whose strict enforcement approach has been a thorn in crypto’s side. “We hope forward-looking regulation that protects the industry and users and cultivates crypto innovation in America will become a bipartisan topic in the future,” Beugelmans added. Trump’s re-election has sparked enthusiasm in the markets, with Bitcoin reaching new all-time highs well above $80,000. “The confirmation of Republicans winning the House could provide an additional boost to the risk rally, but we may see some profit-taking in the coming weeks or months as actual policies are tested,” Aurelie Barthere, Nansen’s principal research analyst, told Decrypt.

Andreessen Horowitz Investments

1,770 Investments

Andreessen Horowitz has made 1,770 investments. Their latest investment was in Infinite Machine as part of their Seed VC on October 29, 2024.

Andreessen Horowitz Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

10/29/2024 | Seed VC | Infinite Machine | $9.3M | Yes | Adjacent, Necessary Ventures, Nico Rosberg, Otherwise Fund, and Undisclosed Angel Investors | 2 |

10/25/2024 | Series C | Waymo | $5,600M | No | 18 | |

10/25/2024 | Seed VC | Concourse | $4.7M | Yes | BoxGroup, CRV, Undisclosed Investors, and Y Combinator | 2 |

10/24/2024 | Seed VC | |||||

10/23/2024 | Series C |

Date | 10/29/2024 | 10/25/2024 | 10/25/2024 | 10/24/2024 | 10/23/2024 |

|---|---|---|---|---|---|

Round | Seed VC | Series C | Seed VC | Seed VC | Series C |

Company | Infinite Machine | Waymo | Concourse | ||

Amount | $9.3M | $5,600M | $4.7M | ||

New? | Yes | No | Yes | ||

Co-Investors | Adjacent, Necessary Ventures, Nico Rosberg, Otherwise Fund, and Undisclosed Angel Investors | BoxGroup, CRV, Undisclosed Investors, and Y Combinator | |||

Sources | 2 | 18 | 2 |

Andreessen Horowitz Portfolio Exits

244 Portfolio Exits

Andreessen Horowitz has 244 portfolio exits. Their latest portfolio exit was Aerodome on October 16, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/16/2024 | Acquired | 2 | |||

10/9/2024 | Asset Sale | 2 | |||

9/30/2024 | Acq - Fin | 2 | |||

Date | 10/16/2024 | 10/9/2024 | 9/30/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Asset Sale | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 2 |

Andreessen Horowitz Fund History

73 Fund Histories

Andreessen Horowitz has 73 funds, including Crewcial AH 2024 Fund Multiplexer.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

6/21/2024 | Crewcial AH 2024 Fund Multiplexer | $64M | 1 | ||

4/16/2024 | Andreessen Horowitz Fund IX | $7,200M | 2 | ||

5/25/2022 | a16z Crypto Fund IV | $4,500M | 1 | ||

5/18/2022 | Games Fund One | ||||

1/7/2022 | A16z Bio Fund IV |

Closing Date | 6/21/2024 | 4/16/2024 | 5/25/2022 | 5/18/2022 | 1/7/2022 |

|---|---|---|---|---|---|

Fund | Crewcial AH 2024 Fund Multiplexer | Andreessen Horowitz Fund IX | a16z Crypto Fund IV | Games Fund One | A16z Bio Fund IV |

Fund Type | |||||

Status | |||||

Amount | $64M | $7,200M | $4,500M | ||

Sources | 1 | 2 | 1 |

Andreessen Horowitz Partners & Customers

3 Partners and customers

Andreessen Horowitz has 3 strategic partners and customers. Andreessen Horowitz recently partnered with Bassett Healthcare Network on November 11, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

11/7/2022 | Partner | United States | Through this partnership , Bassett Healthcare Network will have access to the companies Andreessen Horowitz has backed as well as the broader Andreessen Horowitz ecosystem , which comprises innovative companies in relevant fields including enterprise tech , fintech and consumer services . | 2 | |

12/19/2017 | Partner | ||||

Vendor |

Date | 11/7/2022 | 12/19/2017 | |

|---|---|---|---|

Type | Partner | Partner | Vendor |

Business Partner | |||

Country | United States | ||

News Snippet | Through this partnership , Bassett Healthcare Network will have access to the companies Andreessen Horowitz has backed as well as the broader Andreessen Horowitz ecosystem , which comprises innovative companies in relevant fields including enterprise tech , fintech and consumer services . | ||

Sources | 2 |

Andreessen Horowitz Service Providers

4 Service Providers

Andreessen Horowitz has 4 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | |||

|---|---|---|---|

Associated Rounds | |||

Provider Type | Counsel | ||

Service Type | General Counsel |

Partnership data by VentureSource

Andreessen Horowitz Team

43 Team Members

Andreessen Horowitz has 43 team members, including current Founder, General Partner, Marc Lowell Andreessen.

Name | Work History | Title | Status |

|---|---|---|---|

Marc Lowell Andreessen | Founder, General Partner | Current | |

Name | Marc Lowell Andreessen | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, General Partner | ||||

Status | Current |

Compare Andreessen Horowitz to Competitors

Sequoia Capital serves as a venture capital firm that focuses on supporting startups from inception to IPO within various sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Accel serves as a global venture capital firm operating in the financial sector. The company's main service is providing financial backing to exceptional teams at all stages of private company growth. Accel primarily sells to the tech industry, with investments in companies across various sectors such as social media, cloud computing, and ecommerce. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

New Enterprise Associates (NEA) provides venture capital to help entrepreneurs and business leaders build transformational, industry-leading companies. It mainly focuses on companies in the early stages of development, while a portion of its dollars is invested in venture growth equity opportunities. NEA also invests in foreign markets, including China and India, across sectors including information technology, healthcare, and energy technology. It was founded in 1977 and is based in Menlo, California.

Loading...