Apptronik

Founded Year

2016Stage

Series A | AliveTotal Raised

$423.04MLast Raised

$403M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+136 points in the past 30 days

About Apptronik

Apptronik specializes in the development of humanoid robots for various automation tasks across multiple industries. Its main product, Apollo, is a general-purpose humanoid robot designed to perform a wide range of tasks that typically require human effort, such as case picking, palletization, and machine tending. Apptronik's robots are intended to address labor shortages, reduce workplace injuries, and improve operational efficiency in sectors like third-party logistics (3PL), retail, and manufacturing. It was founded in 2015 and is based in Austin, Texas.

Loading...

ESPs containing Apptronik

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The industrial humanoid robot developers market focuses on the development and deployment of robots with human-like form designed specifically for industrial applications. These robots feature bipedal mobility, articulated limbs, and advanced sensors that enable them to navigate complex environments and perform tasks traditionally done by humans. Industrial humanoid robots enhance automation in in…

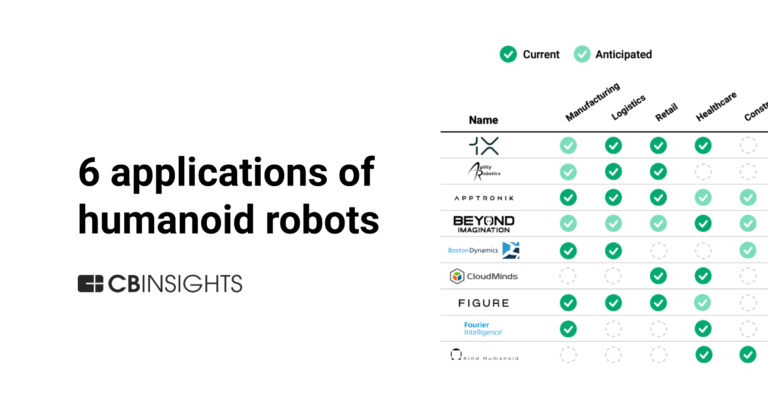

Apptronik named as Outperformer among 15 other companies, including Tesla, Foxconn, and Boston Dynamics.

Apptronik's Products & Differentiators

Apollo

Humanoid Robot (Pilot Stage)

Loading...

Research containing Apptronik

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Apptronik in 10 CB Insights research briefs, most recently on Apr 3, 2025.

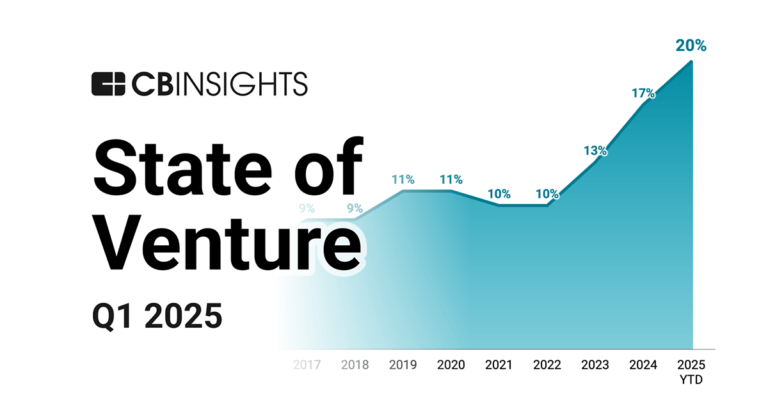

Apr 3, 2025 report

State of Venture Q1’25 Report

Feb 13, 2025

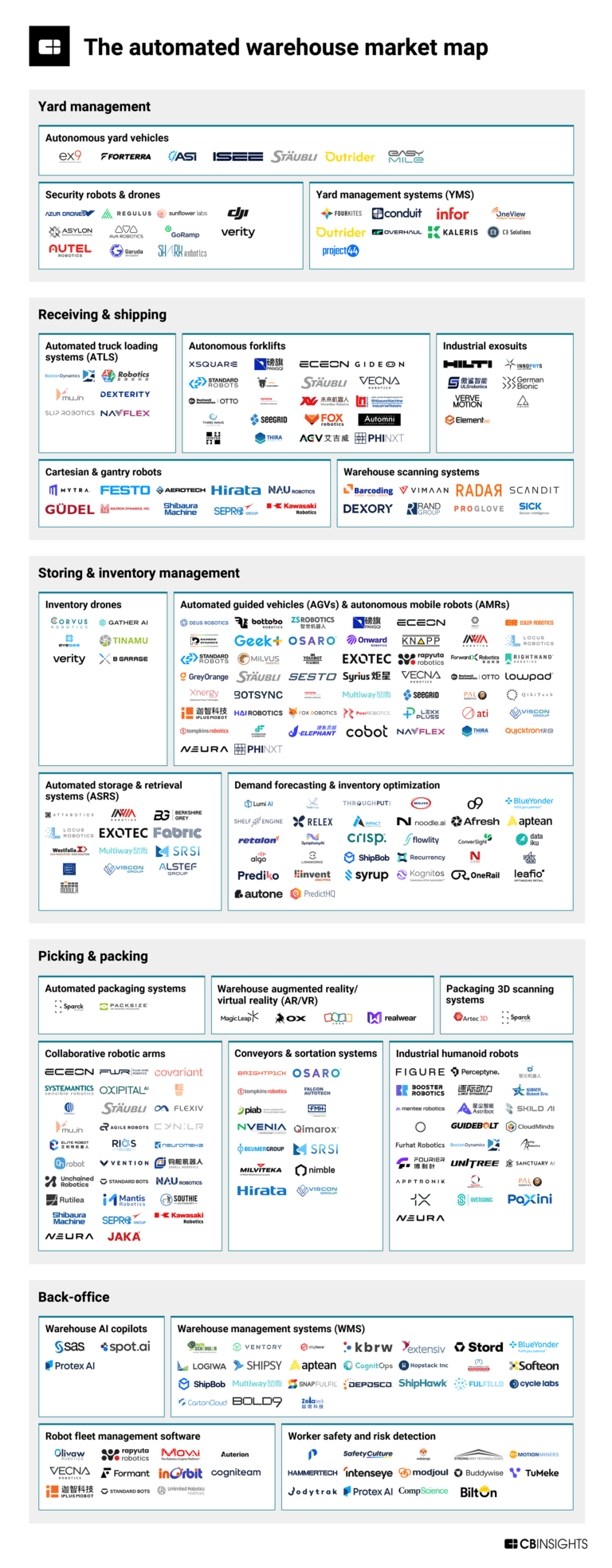

The automated warehouse market map

May 31, 2024

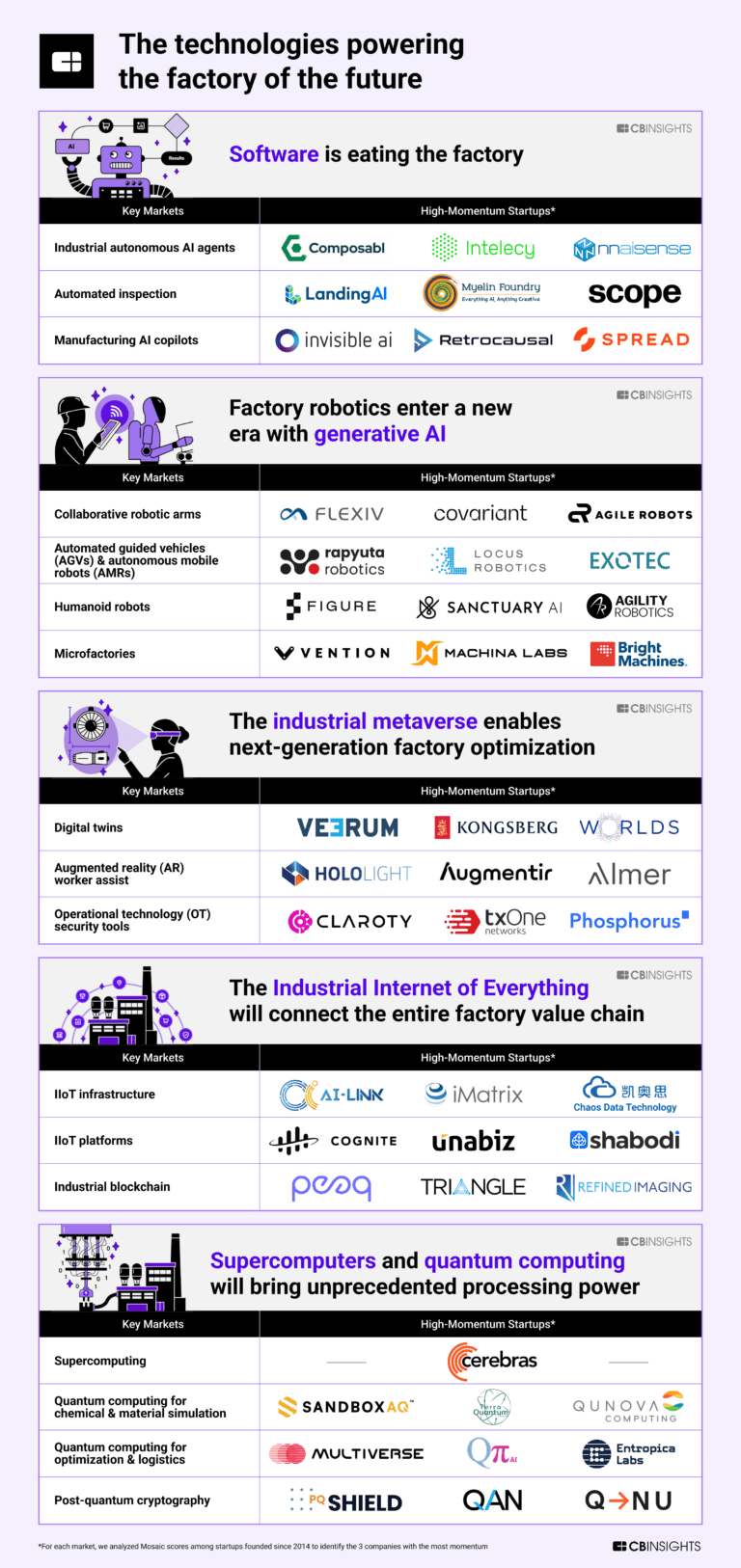

3 applications of generative AI in manufacturing

Mar 26, 2024

6 applications of humanoid robots across industriesExpert Collections containing Apptronik

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Apptronik is included in 7 Expert Collections, including Robotics.

Robotics

2,699 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Supply Chain & Logistics Tech

5,064 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Advanced Manufacturing

6,609 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Construction Tech

1,467 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Job Site Tech

925 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Future of the Factory (2024)

436 items

This collection contains companies in the key markets highlighted in the Future of the Factory 2024 report. Companies are not exclusive to the categories listed.

Apptronik Patents

Apptronik has filed 9 patents.

The 3 most popular patent topics include:

- actuators

- bipedal humanoid robots

- fluid dynamics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/7/2023 | 1/14/2025 | Aerodynamics, Fluid dynamics, Actuators, Force, Gas discharge lamps | Grant |

Application Date | 6/7/2023 |

|---|---|

Grant Date | 1/14/2025 |

Title | |

Related Topics | Aerodynamics, Fluid dynamics, Actuators, Force, Gas discharge lamps |

Status | Grant |

Latest Apptronik News

Apr 4, 2025

This report describes and explains the humanoid robot market and covers 2018-2023, termed the historic period, and 2023-2028, 2033F termed the forecast period. The report evaluates the market across each region and for the major economies within each region. The global humanoid robot market reached a value of nearly $2.37 billion in 2023, having grown at a compound annual growth rate (CAGR) of 40.69% since 2018. The market is expected to grow from $2.37 billion in 2023 to $19.85 billion in 2028 at a rate of 52.91%. The market is then expected to grow at a CAGR of 41.81% from 2028 and reach $113.89 billion in 2033. Growth in the historic period resulted from the increased demand for robots in the defense and security sector, rising labor costs or labor shortages, rising adoption of automated material handling in the retail sector. Factors that negatively affected growth in the historic period include data privacy and security concerns. The humanoid robot market is segmented by component into hardware and software. The hardware market was the largest segment of the humanoid robot market segmented by component, accounting for 64% or $1.52 billion of the total in 2023. Going forward, the software segment is expected to be the fastest growing segment in the humanoid robot market segmented by component, at a CAGR of 54.51% during 2023-2028. The humanoid robot market is segmented by motion type into biped and wheel drive. The wheel drive market was the largest segment of the humanoid robot market segmented by motion type, accounting for 70.2% or $1.66 billion of the total in 2023. Going forward, the biped segment is expected to be the fastest growing segment in the humanoid robot market segmented by motion type, at a CAGR of 54.47% during 2023-2028. The humanoid robot market is segmented by application into education and entertainment, research and space exploration, personal assistance and caregiving, search and rescue, public relations and other applications. The personal assistance and caregiving market was the largest segment of the humanoid robot market segmented by application, accounting for 35.1% or $834.47 million of the total in 2023. Going forward, the personal assistance and caregiving segment is expected to be the fastest growing segment in the humanoid robot market segmented by application, at a CAGR of 56.83% during 2023-2028. North America was the largest region in the humanoid robot market, accounting for 51% or $1.21 billion of the total in 2023. It was followed by Asia-Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the humanoid robot market will be Asia-Pacific and Africa, where growth will be at CAGRs of 56.20% and 55.65% respectively. These will be followed by the Middle East and South America, where the markets are expected to grow at CAGRs of 55.00% and 53.94% respectively. The global humanoid robot market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up 20.5% of the total market in 2023. Toyota Motor Corp. was the largest competitor with a 5% share of the market, followed by PARK24 CO., LTD. (Puke 24 Co., Ltd.) with 4.6%, UBTECH Robotics Corp. Ltd. with 2.4%, Boston Dynamics Inc. with 2.2%, Softbank Robotics Corp. with 1.4%, Universal Robots AS with 1.3%, Kawasaki Robotics Corporation with 1.2%, Qihan Technology Co. Ltd. with 1.2%, Agility Robotics Inc. with 0.6% and Apptronik Inc. with 0.5%. The top opportunities in the humanoid robot market segmented by component will arise in the hardware segment, which will gain $ 10.81 billion of global annual sales by 2028. The top opportunities in the humanoid robot market segmented by motion type will arise in the wheel drive segment, which will gain $11.95 billion of global annual sales by 2028. The top opportunities in the humanoid robot market segmented by technology will arise in the personal assistance and caregiving segment, which will gain $7.08 billion of global annual sales by 2028. The humanoid robot market size will gain the most in the USA at $7.59 billion. Market-trend-based strategies for the humanoid robot market include launch of new humanoid robot innovation centers, revolutionizing business operations with semi-humanoid robots, introduction of new humanoid robot series, innovative bio-inspired designs in robotics, showcasing advancements in humanoid robotics, introduction of generalist robot technology, collaborative humanoid robots redefining efficiency in warehouse operations and strategic investments to accelerate AI-powered humanoid robotics innovation. Player-adopted strategies in the humanoid robot market include focuses on strengthening business expertise through new product developments and enhancing operational capabilities through strategic partnerships and launching new products. To take advantage of the opportunities, the analyst recommends the humanoid robot companies to focus on innovation centers for growth, focus on advancing semi-humanoid robot capabilities, focus on diversification of humanoid robot offerings, focus on innovative bio-inspired designs, focus on enhancing generalist robot technology, focus on advancing humanoid robots for warehouse efficiency, focus on strategic investment in AI-powered humanoid robotics, expand in emerging markets, continue to focus on developed markets, focus on expanding distribution channels through partnerships, focus on competitive pricing strategies for humanoid robots, focus on targeted marketing campaigns, focus on educational content and focus on targeting personal assistance and caregiving markets. Key Attributes:

Apptronik Frequently Asked Questions (FAQ)

When was Apptronik founded?

Apptronik was founded in 2016.

Where is Apptronik's headquarters?

Apptronik's headquarters is located at 11701 Stonehollow Drive, Austin.

What is Apptronik's latest funding round?

Apptronik's latest funding round is Series A.

How much did Apptronik raise?

Apptronik raised a total of $423.04M.

Who are the investors of Apptronik?

Investors of Apptronik include Capital Factory, Japan Post Capital, Google Ventures, Magnetar Capital, B Capital and 23 more.

Who are Apptronik's competitors?

Competitors of Apptronik include Agility Robotics and 5 more.

What products does Apptronik offer?

Apptronik's products include Apollo and 1 more.

Who are Apptronik's customers?

Customers of Apptronik include Sanctuary.

Loading...

Compare Apptronik to Competitors

Figure engages in the development of general-purpose humanoid robots. Its main product is a commercially viable autonomous humanoid robot designed to perform a variety of tasks across multiple industries, combining human-like dexterity with advanced artificial intelligence. Its humanoid robots are engineered to support sectors such as manufacturing, logistics, warehousing, and retail. It was founded in 2022 and is based in Sunnyvale, California.

Agility Robotics focuses on advanced automation solutions for the supply chain and manufacturing sectors. The company's main offerings include the humanoid robot Digit, designed to integrate into material handling workflows, and the cloud automation solution Agility Arc, which enhances various industrial processes. Agility Robotics primarily serves sectors such as third-party logistics, manufacturing, retail and eCommerce, and distribution. It was founded in 2015 and is based in Pittsburgh, Pennsylvania.

Oversonic Robotics is a company that specializes in cognitive humanoid robotics within the industrial automation and heavy-duty task sectors. The company provides humanoid robots that assist in manufacturing processes, product handling, quality detection, and data analysis, particularly in challenging environments. Oversonic Robotics serves industries that require automation support. It was founded in 2020 and is based in Besana Brianza, Italy.

Sanctuary AI focuses on the development of humanoid robots equipped with artificial intelligence to address labor challenges across various industries. The company specializes in creating robots that can perform tasks requiring dexterity, tactile feedback, and fine manipulation, mimicking human cognitive processes and movements. Sanctuary AI primarily serves sectors that require automation for dull, dirty, or dangerous jobs, such as automotive, manufacturing, and logistics. It was founded in 2018 and is based in Vancouver, British Columbia.

Mentee Robotics specializes in the development of humanoid robots with advanced artificial intelligence capabilities within the robotics and AI technology sectors. Their robots are equipped with full-body motion planning and control, capable of performing complex tasks through dynamic interaction with their environment. The company's products are designed to serve sectors that require automation through sophisticated robotics, such as manufacturing, logistics, and healthcare. It was founded in 2022 and is based in Herzliya, Israel.

Foundation focuses on the development of general-purpose robotics within the technology sector. The company offers advanced humanoid robots designed to operate in complex environments, aimed at reducing human risk in conflict zones and improving efficiency in labor-intensive industries. It was founded in 2024 and is based in San Francisco, California.

Loading...