Aspire

Founded Year

2018Stage

Series C | AliveTotal Raised

$300.18MLast Raised

$100M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-11 points in the past 30 days

About Aspire

Aspire develops a full-stack operating financial operation system. It enables accounting, payment, lending, expense management, and more. It provides business credit lines to help solve their working capital needs. It offers users access to funding and financial tools to manage bank accounts, credit cards, invoicing, and expenses, among others. The company was founded in 2018 and is based in Singapore.

Loading...

Aspire's Products & Differentiators

Incorporation

Simple and 100% digital incorporation

Loading...

Research containing Aspire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Aspire in 2 CB Insights research briefs, most recently on Mar 29, 2024.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Aspire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Aspire is included in 5 Expert Collections, including Digital Lending.

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Fintech

13,699 items

Excludes US-based companies

Fintech 100

200 items

Fintech 100 (2024)

100 items

Latest Aspire News

Apr 4, 2025

03 April, 2025 Asia-focused private equity firm Orchestra Private Equity is reportedly divesting its South Korean KFC operations for about $280 million, while fintech firm Aspire said its unit has secured a licence to launch an investment tool in Singapore. Orchestra PE seeks $280m from sale of KFC’s Korean operations Orchestra Private Equity , an Asian lower mid-cap buyout firm, has started divesting its South Korean KFC operations, seeking around 400 billion won (about $280 million), The Korea Economic Daily reported on Thursday. The PE firm had bought a 100% stake in the fast food chain for around $50 million from South Korea’s KG Group in 2023. The deal included the whole ownership of KFC Korea, alongside its domestic business licence. According to the report, the Seoul-based buyout firm has hired Samil PwC to manage the sale, targeting approximately 10 times earnings before interest, taxes, depreciation, and amortization (EBITDA). Since the acquisition, KFC Korea posted steady financial growth, reporting 2024 sales growth of 18% year-on-year to 292 billion won and EBITDA rising 47%, boosted by 15 new outlets nationwide, according to the report. Aspire unit secures capital markets service licence in SG Fintech firm Aspire announced that its unit, ASG2 Pte Ltd, has secured a Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS) to offer regulated investment solutions to businesses. In a statement, Aspire said the CMS licence paves the way for the launch of Aspire Yield, a new investment product embedded in its business account platform. Aspire Yield offers startups and small firms access to money market funds managed by top Singapore asset managers, with no minimum investment, no lock-up period, and next-day liquidity. CEO Andrea Baronchelli said Aspire Yield is a milestone in helping small firms manage and grow their capital. “We are levelling the playing field for global startups and small businesses,” he said. Last year, Aspire secured a $79.15-million investment from its US holding company. It also raised $100 million in its Series C round in 2023 from Lightspeed, Sequoia Capital SEA, PayPal, Tencent, LGT Capital Partners,

Aspire Frequently Asked Questions (FAQ)

When was Aspire founded?

Aspire was founded in 2018.

Where is Aspire's headquarters?

Aspire's headquarters is located at 158 Cecil Street, Singapore.

What is Aspire's latest funding round?

Aspire's latest funding round is Series C.

How much did Aspire raise?

Aspire raised a total of $300.18M.

Who are the investors of Aspire?

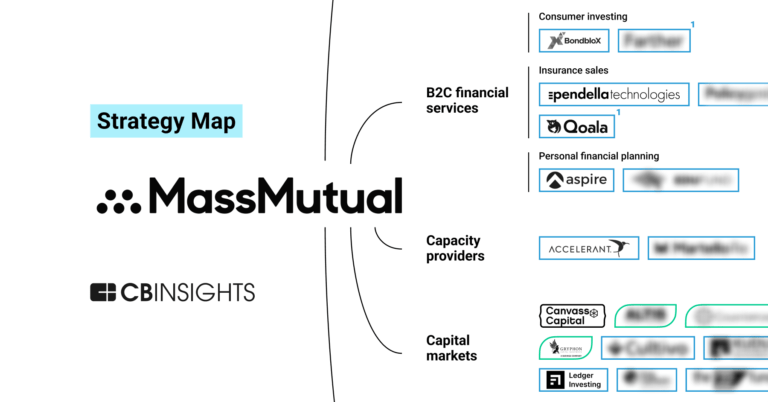

Investors of Aspire include MassMutual Ventures, Picus Capital, Lightspeed Venture Partners, Tencent Exploration, LGT Capital Partners and 24 more.

Who are Aspire's competitors?

Competitors of Aspire include Funding Societies and 4 more.

What products does Aspire offer?

Aspire's products include Incorporation and 4 more.

Loading...

Compare Aspire to Competitors

RABC is a high-tech enterprise specializing in R&D, production, manufacturing, sales, and service of various solid-state power lithium batteries.

CrediLinq.Ai develops a credit lending platform powered by its proprietary artificial intelligence and machine learning algorithms. It aims to create a digital platform for businesses to get quicker access to growth capital. It primarily caters to the e-commerce industry, providing tools for both buyers and sellers. It was founded in 2020 and is based in Singapore.

Alami operates a Sharia-compliant financial institution and operates in the banking and finance industry. It offers peer-to-peer lending services for small and medium-sized enterprises (SMEs), with a focus on transparency, fairness, and social inclusion. Alami primarily serves the SME sector. The company was founded in 2019 and is based in South Jakarta, Indonesia.

Bluevine is a financial technology company that specializes in providing business banking solutions. The company offers business checking accounts with high-yield interest, accounts payable automation, and extensive FDIC insurance, as well as business loans and credit cards designed to meet the needs of small businesses. Bluevine primarily serves the small business sector with its suite of financial products. It was founded in 2013 and is based in Jersey City, New Jersey.

Behalf provides sales and cash flow solutions within the B2B payments sector. The company offers a solution that allows merchants to provide their business customers with net terms and financing options, thereby enabling purchasing power and payment flexibility. Behalf's services are designed to integrate into eCommerce platforms, automating the payment process across various B2B sales channels, including invoicing and managed sales. It was founded in 2012 and is based in New York, New York.

C2FO focuses on providing working capital solutions in the financial sector. The company offers services that allow businesses to get their invoices paid early, providing flexible access to low-cost capital. It helps eliminate the need for loans, paperwork, or other hassles, allowing businesses to control their cash flow and unlock potential in their balance sheets. C2FO was formerly known as Pollenware. It was founded in 2008 and is based in Leawood, Kansas.

Loading...