Ather Energy

Founded Year

2013Stage

Series E - IV | AliveTotal Raised

$549.19MValuation

$0000Last Raised

$71M | 8 mos agoRevenue

$0000About Ather Energy

Ather Energy focuses on the development and production of electric vehicles, specifically in the automotive industry. The company's main offerings include smart and connected electric scooters, as well as public and private charging infrastructure. Ather Energy primarily sells to the electric vehicle industry. It was founded in 2013 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Ather Energy

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ather Energy in 1 CB Insights research brief, most recently on Oct 3, 2024.

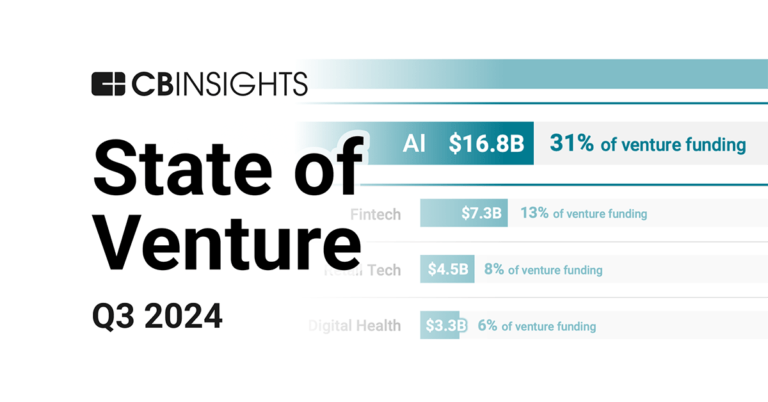

Oct 3, 2024 report

State of Venture Q3’24 ReportExpert Collections containing Ather Energy

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ather Energy is included in 4 Expert Collections, including Auto Tech.

Auto Tech

3,978 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,270 items

Bike & Scooter Tech

544 items

We define bike and scooter technology startups as companies working on shared vehicle networks, vehicle design, and charging infrastructure for bicycles, scooters, mopeds, and other compact vehicles for one to two passengers.

Conference Exhibitors

5,302 items

Latest Ather Energy News

Apr 8, 2025

Startups not getting price they want may pause IPOs amid Trump’s tariff turmoil SECTIONS By Rate Story Synopsis Almost a dozen venture-backed startups are in different stages of going public in the current financial year. These include Bluestone, Ather Energy, PhysicsWallah, Shadowfax, Zepto, Captain Fresh, Groww, Lenskart, Meesho, OfBusiness, Urban Company and Boat. Bluestone, Ather Energy, Boat and PhysicsWallah have already filed their draft papers with the stock market regulator. ETMarkets.com The broader stock market rout following US President Donald Trump’s move to impose “reciprocal tariffs” could prompt new-age companies in India to take a hard look at their plans to go public, founders, investors and bankers told ET. On Monday, as the benchmark 30-stock index Sensex closed nearly 4% down, industry executives said public investor sentiment could shift in favour of safer asset classes such as blue-chip stocks or gold, away from new-age companies attempting a stock market debut. “Public market multiples have compressed because of which companies planning IPOs (initial public offerings) will need to adjust their multiples and their valuations attractive enough to investors and provide them necessary safety margins,” said Ashish Dave, CEO, Mirae Asset Venture Investments India. “As a result of this, we could see some companies defer their IPOs. Investors will be less keen to buy newer assets, which are mostly small or midcap, because of the massive uncertainty.” Profitable companies, on the other hand, which aren’t excessively priced may still perform well, though they might also get slightly lower valuations, he said, adding that some companies might file for the approval of the Securities and Exchange Board of India (Sebi) and wait for an optimal market window to secure the desired pricing of the IPO. Almost a dozen venture-backed startups are in different stages of going public in the current financial year. These include Bluestone , Ather Energy , PhysicsWallah, Shadowfax , Zepto , Captain Fresh, Groww , Lenskart , Meesho , OfBusiness , Urban Company and Boat . Bluestone, Ather Energy, Boat and PhysicsWallah have already filed their draft papers with the stock market regulator. Live Events “If founders aren't happy with how the street is willing to price them, they might delay the IPOs… at least 20-30% founders might take that call,” said Kashyap Chanchani, managing director at The Rainmaker Group, a homegrown investment bank. “When the volatility ends, the market will settle into a new normal… and the founders will have to take a call whether they are ready to list at a valuation that reflects the new reality. If there’s maturity in the company, familiarity with the street and continued growth with improving profitability… then it’s just pricing that’ll stop you from going public,” he said. Wait and see A founder of a public markets-bound company, which has appointed bankers but is yet to file its papers, said that the startup is not in a hurry. “We can afford to wait because we recently closed a large-ish round. Right now the secondary public markets are in a weak situation, which means we won’t likely get the right valuation even though we are not at an expensive multiple,” said the founder, who did not wish to be identified. However, for certain investors, pressure to exit their holdings – now tough via the public markets – could lead them to finding liquidity from the private markets, which are yet to fully recover from the post-2022 funding winter. “Companies such as Zepto or OfBusiness, which are either looking to raise primary capital or are valued at rich PE (price-to-earnings) multiples will find it tough to crack deals… both in the public as well as private markets,” a venture capital investor, who has backed tech firms, told ET on condition of anonymity. “The importance of the right valuations was evident in the Delhivery-Ecom Express deal, where investors were not able to find the ideal value in the public markets and settled for a price that the buyer was offering,” the person said. New-age logistics player Delhivery acquired its rival Ecom Express – which was planning to go public – in a distress sale valuing the latter at Rs 1,407 crore, a nearly 80% cut from its last private market valuation of more than Rs 7,000 crore. Investors expect a rollover effect on private market investments. In 2024, local startups raised nearly $11 billion, slightly more than $9.6 billion raised in 2023, data from Venture Intelligence showed. “I expect most IPO plans will be pushed back by at least 12 to 18 months… and while we haven’t seen any repricing or pulled term sheets in the private market yet, deals will definitely take longer to close,” said Navin Honagudi, founder and managing partner, Elev8 Venture Partners, which has backed the likes of Smallcase and Astrotalk. A recent report by The Rainmaker Group said that about three dozen companies are in the pipeline to go public by 2026-27 and that collectively these companies are valued at around $100 billion. The pricing of these companies in the waitlist for the stock markets could also depend on their listed peers, which are also under pressure as a result of the broader selloff.

Ather Energy Frequently Asked Questions (FAQ)

When was Ather Energy founded?

Ather Energy was founded in 2013.

Where is Ather Energy's headquarters?

Ather Energy's headquarters is located at 4/1, Bannerghatta Main Road, Bengaluru.

What is Ather Energy's latest funding round?

Ather Energy's latest funding round is Series E - IV.

How much did Ather Energy raise?

Ather Energy raised a total of $549.19M.

Who are the investors of Ather Energy?

Investors of Ather Energy include National Investment and Infrastructure Fund, Stride Ventures, Hero MotoCorp, Tarun Mehta, Swapnil Jain and 10 more.

Who are Ather Energy's competitors?

Competitors of Ather Energy include River and 5 more.

Loading...

Compare Ather Energy to Competitors

Emflux Motors is a company focused on the electric vehicle (EV) industry, specializing in the development of components for 2/3 wheeler EVs. The company provides services including the design and development of electric drives, Battery Management Systems (BMS), motors, controllers, and EV charging solutions, as well as prototype development and certification services. Emflux Motors serves the electric mobility sector, offering products and services related to electric vehicles. It was founded in 2016 and is based in Bengaluru, India.

Bounce Infinity is a provider of smart mobility solutions in the transportation sector. The company offers a keyless bike rental service that operates through an app, allowing users to access bikes using a one-time password (OTP) for a hassle-free commute experience. Bounce Infinity primarily serves individuals looking for convenient and reliable transportation options for their daily commute. Bounce Infinity was formerly known as Metro Bikes. It was founded in 2014 and is based in Gurgaon, India.

HOP Electric is a climate-tech startup operating in the new energy automotive industry. The company primarily focuses on building products, technologies, and solutions for high-efficiency mobility, with a particular emphasis on electric motorcycles. HOP Electric primarily serves the electric vehicle industry. It was founded in 2019 and is based in Rajasthan, India.

Ampere Vehicles specializes in electric scooters, focusing on energy-efficient transportation within the electric vehicle industry. The company offers a range of electric scooters designed for affordability, efficiency, and support for the clean last mile. Ampere Vehicles provides comprehensive electric vehicle ecosystem support, including battery maintenance and financing options. It was founded in 2008 and is based in Coimbatore, India. Ampere Vehicles operates as a subsidiary of Greaves Cotton.

Oben Electric is a company focused on the design, development, and manufacturing of electric motorcycles and critical EV components within the electric vehicle industry. The company offers high-performance electric motorcycles equipped with advanced LFP battery technology, providing a safer and longer-lasting ride. Oben Electric primarily caters to eco-conscious consumers looking for a powerful and sustainable riding experience. It was founded in 2020 and is based in Bangalore, India.

Chetak Technology is a company in the electric vehicle sector of the automotive industry. It offers electric scooters with features like Bluetooth connectivity, tamper alerts, geo-fencing, and over-the-air updates through a dedicated app. The company serves the urban mobility sector with its transportation solutions. It was founded in 2019 and is based in Pune, India.

Loading...