Branch

Founded Year

2017Stage

Series D | AliveTotal Raised

$221.47MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-1 points in the past 30 days

About Branch

Branch specializes in providing home and auto insurance services within the insurance industry. The company offers a process for customers to obtain insurance quotes and purchase policies online, with options for personalizing coverage and bundling insurance products for potential savings. It was founded in 2017 and is based in Columbus, Ohio.

Loading...

Branch's Product Videos

ESPs containing Branch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — home market comprises insurtech carriers that underwrite homeowners and renters insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for…

Branch named as Leader among 13 other companies, including Lemonade, Digit Insurance, and Acko.

Branch's Products & Differentiators

Auto Insuramce

instant, bundled car insurance available with just name and address.

Loading...

Research containing Branch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Branch in 2 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

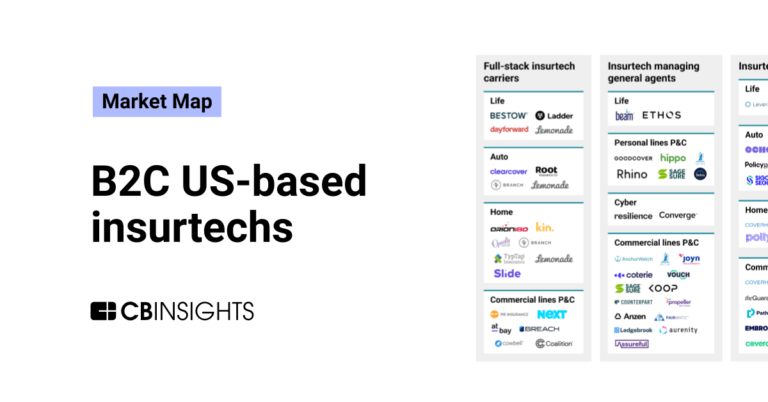

The B2C US insurtech market map

Jun 15, 2022 report

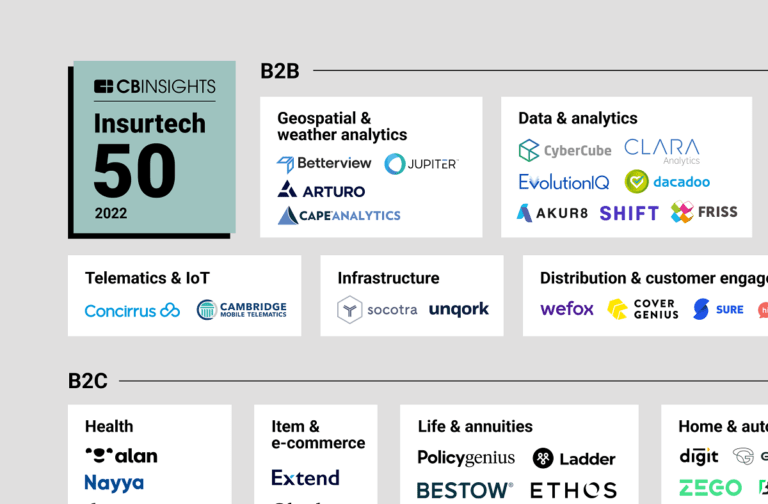

Insurtech 50: The most promising insurtech startups of 2022Expert Collections containing Branch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Branch is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,490 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,270 items

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Branch News

Feb 26, 2025

The initial phase of Falcon's Liberate Voice AI FNOL implementation is scheduled to commence in early March. February 26, 2025 With Liberate Voice AI FNOL integration, Falcon can collect essential claims information 24/7. Falcon Insurance Group has selected Liberate Voice AI FNOL to modernise its first notice of loss (FNOL) process, aiming to provide a bilingual, 24/7 claim response. As a non-standard auto insurance carrier and managing general agent, Falcon operates across several US states including Arizona, Colorado, Illinois, Indiana, Oklahoma, Texas and Utah. Go deeper with GlobalData With Liberate Voice AI FNOL integration, Falcon can collect essential claims information 24/7. Liberate’s technology was previously integrated with Falcon’s core policy management and claims system, Insuresoft. The initial phase of Falcon’s Liberate Voice AI FNOL implementation is scheduled to commence in early March. In phase two, Falcon intends to connect the solution to its text message provider and introduce a digital FNOL option. Liberate CEO Amrish Singh said: “Like call centres, our solution provides bilingual and affordable options for insurers. But unlike call centres, our solution delivers 100% consistent customer service with zero wait times – and that is true 24/7.” Falcon chief technology officer Brandon Miller said: “We chose Liberate due to the quality of the engineering team, the honesty of the management team and the quality of the claims accuracy. If we don’t receive the FNOL right away, important details are forgotten. We find that many people don’t like completing forms, so a 24/7 phone option is important to us.” In November 2024, home and auto insurance provider Branch collaborated with Liberate to simplify the claims process by using digital FNOL and Voice AI technology. Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

Branch Frequently Asked Questions (FAQ)

When was Branch founded?

Branch was founded in 2017.

Where is Branch's headquarters?

Branch's headquarters is located at 20 East Broad Street, Columbus.

What is Branch's latest funding round?

Branch's latest funding round is Series D.

How much did Branch raise?

Branch raised a total of $221.47M.

Who are the investors of Branch?

Investors of Branch include Gaingels, Greycroft, SignalFire, American Family Ventures, Tower IV and 14 more.

Who are Branch's competitors?

Competitors of Branch include Hippo and 4 more.

What products does Branch offer?

Branch's products include Auto Insuramce and 4 more.

Loading...

Compare Branch to Competitors

Openly is a home insurance provider focusing on high-value homeowners insurance. The company offers customizable coverage and is sold exclusively through independent agents. Openly uses technology to streamline the quoting process. It was founded in 2017 and is based in Boston, Massachusetts.

Branch Media provides home, auto, and umbrella insurance. The company offers options to customize policies and bundle different types of insurance. Branch Media serves individuals looking for personal insurance solutions. Branch Media was formerly known as Roundtable Media. It is based in New York, New York. Branch Media operates as a subsidiary of Meta.

Swyfft is a company that focuses on the insurance industry, specifically homeowners insurance. The company uses unique data sources and analytics to provide homeowners insurance quotes in a quick and efficient manner. Swyfft primarily serves the insurance industry. It is based in Morristown, New Jersey.

Kin provides affordable home insurance solutions within the insurance industry. The company offers a range of products, including homeowners, mobile homes, condos, flood, landlord, and hurricane insurance, all designed to protect customers' properties and interests in the event of disasters or other damages. Kin's insurance products are tailored to meet the needs of homeowners and property investors, offering customizable policies and direct purchasing options to keep costs down. Kin was formerly known as Bright Policy. It was founded in 2016 and is based in Chicago, Illinois.

Surround Insurance focuses on providing insurance services in the financial sector. The company offers a range of insurance products, including auto insurance, non-owner auto insurance, renters insurance, and coverage for biking and walking. The company's services are designed to cater to the needs of modern consumers, particularly those in their 20s and 30s, offering fast, simple, and personalized insurance solutions. It was founded in 2018 and is based in Cambridge, Massachusetts.

Allegory `works as a company that operates within the mobility sector and provides a mobile application with features including driving performance analytics, family safety solutions, and an insurance wallet. The application is designed to assist with mileage tracking for tax purposes. It was founded in 2019 and is based in Toronto, Canada.

Loading...