Bunq

Founded Year

2012Stage

Series B - III | AliveTotal Raised

$368.05MLast Raised

$31.41M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+11 points in the past 30 days

About Bunq

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Loading...

Bunq's Product Videos

Bunq's Products & Differentiators

bunq account in 5 minutes

Bank account that's ready to use in 5 minutes

Loading...

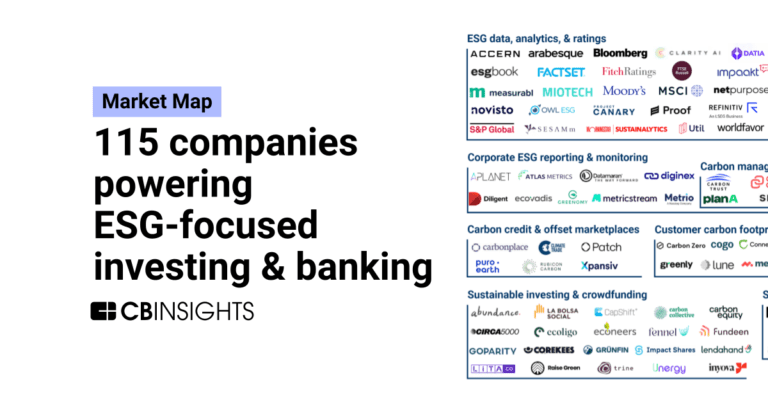

Research containing Bunq

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bunq in 1 CB Insights research brief, most recently on May 24, 2023.

Expert Collections containing Bunq

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bunq is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech

13,699 items

Excludes US-based companies

Digital Banking

1,112 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

100 items

Bunq Patents

Bunq has filed 3 patents.

The 3 most popular patent topics include:

- banking

- banking technology

- international taxation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2017 | 11/6/2018 | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop | Grant |

Application Date | 5/18/2017 |

|---|---|

Grant Date | 11/6/2018 |

Title | |

Related Topics | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop |

Status | Grant |

Latest Bunq News

Mar 27, 2025

These changes will take effect from April 2, with two specific products seeing adjustments from June 4. Existing fixed-term deposit holders will retain their current rates until the end of their fixed term. The revised rates will apply to 6-month, 1-year, 18-month, 3-year, and 5-year fixed-rate deposits, including Interest First and Online fixed-term deposit accounts. Current rates, which range from 2% to 2.75%, will be reduced to a range of 1.5% to 2.25%. Business Bulletin 21-Day Regular Saver: Reduced from 2.5% to 2% 40-Day Notice: Reduced from 1% to 0.5% Business 32-Day Notice: Reduced from 2% to 1.5% Further changes, effective June 4, include: Regular Saver: Reduced from 2.5% to 2% Business Demand: Reduced from 1% to 0.5% These adjustments mark the first deposit rate changes by PTSB since May 2024. The bank had previously increased rates eight times between November 2022 and May 2024. The current reduction aligns with recent European Central Bank (ECB) rate cuts, with the ECB having lowered its deposit rate to 2.5% in response to slowing inflation and economic growth. PTSB’s decision follows similar moves by other financial institutions. These changes will take effect from April 2, with two specific products seeing adjustments from June 4. Bank of Ireland recently decreased interest rates on 12 and 18-month fixed-term deposits by 0.25%, while AIB reduced rates on two fixed-term deposit accounts by 0.25 percentage points. European banks, including N26 and Bunq, have also implemented rate cuts in 2024. ___

Bunq Frequently Asked Questions (FAQ)

When was Bunq founded?

Bunq was founded in 2012.

Where is Bunq's headquarters?

Bunq's headquarters is located at Naritaweg 131-133, Amsterdam.

What is Bunq's latest funding round?

Bunq's latest funding round is Series B - III.

How much did Bunq raise?

Bunq raised a total of $368.05M.

Who are the investors of Bunq?

Investors of Bunq include Pollen Street Capital.

Who are Bunq's competitors?

Competitors of Bunq include Revolut, Monese, Allica Bank, Qonto, Finom and 7 more.

What products does Bunq offer?

Bunq's products include bunq account in 5 minutes and 4 more.

Loading...

Compare Bunq to Competitors

Qonto provides business banking solutions for various company sizes and sectors. The company offers financial services including online business accounts, payment cards, international and local payment processing, loans, invoicing, expense management, and accounting integration. It serves self-employed individuals, freelancers, micro-businesses, small and medium enterprises, and associations across Europe. The company was founded in 2016 and is based in Paris, France.

Lydia is a financial technology company that specializes in mobile and digital banking services. The company offers a range of products, including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2013 and is based in Paris, France.

Tide offers a financial business platform offering digital banking services in the financial sector. The company provides FSCS-protected bank accounts in partnership with ClearBank and e-money accounts through PrePay Solutions, with a suite of business account administration tools including accounting software integration, expense management, and customizable invoicing. Tide caters to UK and Indian SMEs with a focus on saving time and money for its members. It was founded in 2015 and is based in London, United Kingdom.

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

Black Banx offers a real-time money transfer system. The company's platform allows account opening in various currencies, provides digital banking solutions, and protects customers' funds with various security tools. Black Banx was formerly known as WB21. It was founded in 2014 and is based in Toronto, Canada.

ConnectPay is a financial platform operating in the fintech industry. The company offers a range of services including banking for businesses and individuals, cross-border and multi-currency payments, and merchant services. It primarily serves online businesses, marketplaces, and fintechs. It was founded in 2017 and is based in Vilnius, Lithuania.

Loading...