Cambridge Mobile Telematics

Founded Year

2010Stage

Corporate Minority | AliveTotal Raised

$502.5MLast Raised

$500M | 6 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-15 points in the past 30 days

About Cambridge Mobile Telematics

Cambridge Mobile Telematics specializes in the telematics and analytics sector, focusing on road safety and driver behavior. The company offers a platform that collects and analyzes data from IoT devices to improve vehicle and driver safety and provides insights for risk assessment and driver improvement programs. Its services cater to auto insurers, automakers, commercial mobility companies, and the public sector. It was founded in 2010 and is based in Cambridge, Massachusetts.

Loading...

ESPs containing Cambridge Mobile Telematics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

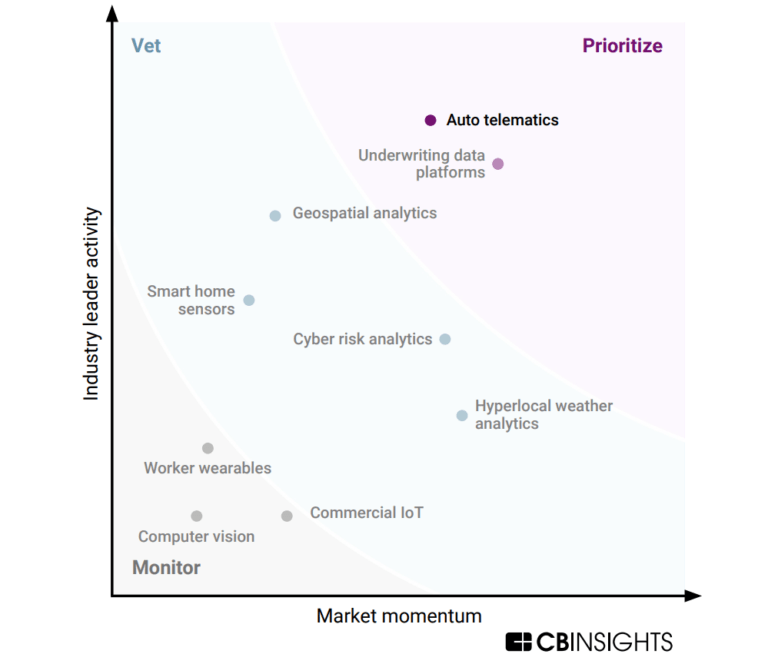

The auto telematics platforms market comprises solutions that gather driver behavior and usage data. Telematics technology is typically installed in the vehicle and can collect data such as driving speed, braking patterns, and distance traveled. Insurance companies can use the data gathered through auto telematics to better assess the risk associated with a policyholder and to determine more accur…

Cambridge Mobile Telematics named as Leader among 14 other companies, including INRIX, CCC Intelligent Solutions, and Earnix.

Cambridge Mobile Telematics's Products & Differentiators

DriveWell Risk

DriveWell Risk provides insurers with an AI-powered risk scoring solution that transforms raw driving data into actionable insights. Using sensor data from smartphones, IoT devices, and connected vehicles, it delivers highly accurate risk assessments to improve underwriting, pricing, and engagement. Insurers use DriveWell Risk to better select risk, retain customers, and reduce claims costs while encouraging safer driving behaviors.

Loading...

Research containing Cambridge Mobile Telematics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cambridge Mobile Telematics in 6 CB Insights research briefs, most recently on Mar 21, 2024.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

May 19, 2022 report

Why P&C insurers are prioritizing auto telematics

Apr 21, 2022 report

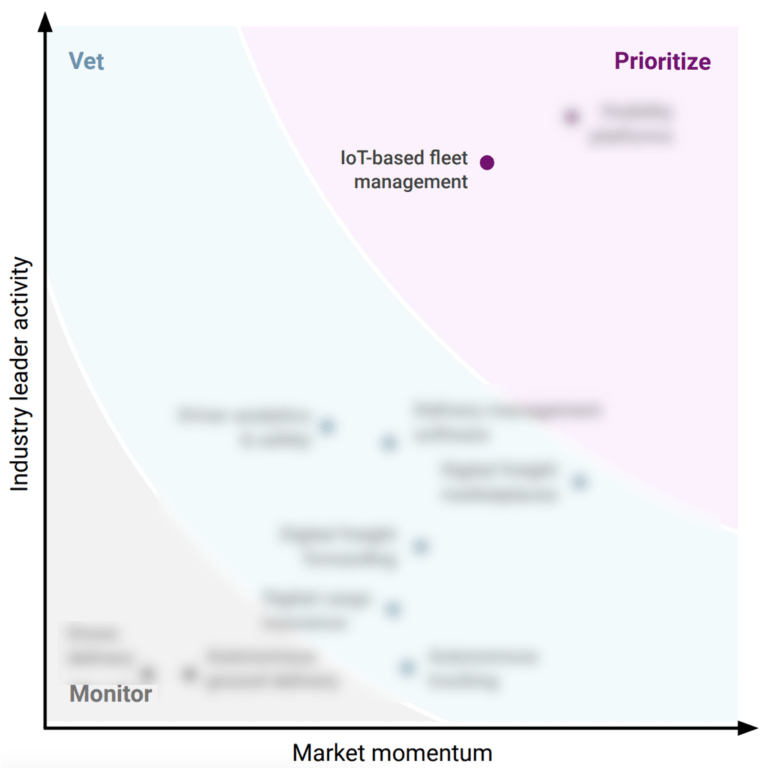

Why retailers are prioritizing IoT-based fleet managementExpert Collections containing Cambridge Mobile Telematics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cambridge Mobile Telematics is included in 8 Expert Collections, including Auto Tech.

Auto Tech

2,609 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

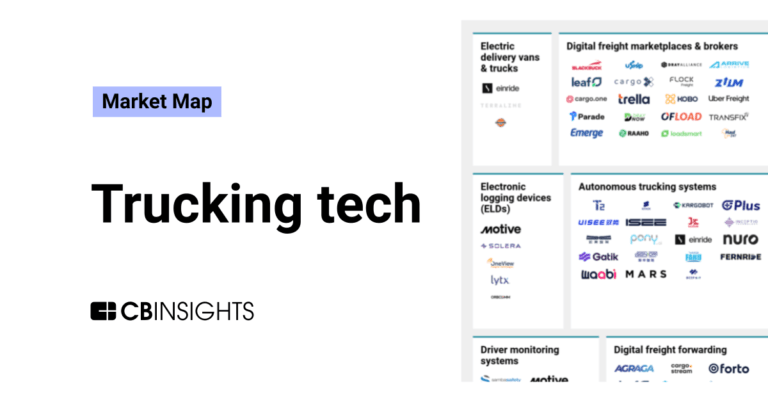

Supply Chain & Logistics Tech

4,736 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Cambridge Mobile Telematics Patents

Cambridge Mobile Telematics has filed 97 patents.

The 3 most popular patent topics include:

- global positioning system

- geolocation

- sensors

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/28/2022 | 2/25/2025 | Sensors, Automotive safety technologies, Diagrams, Global Positioning System, Geolocation | Grant |

Application Date | 2/28/2022 |

|---|---|

Grant Date | 2/25/2025 |

Title | |

Related Topics | Sensors, Automotive safety technologies, Diagrams, Global Positioning System, Geolocation |

Status | Grant |

Latest Cambridge Mobile Telematics News

Apr 7, 2025

Milliman experts highlight challenges and solutions for insurers navigating state-by-state approvals and leveraging predictive analytics for growth. Predictive analytics has transformed the insurance industry, offering insurers—and particularly InsurTech startups, unprecedented opportunities to innovate. However, regulatory complexities bring significant challenges for startups aiming to scale their operations. “Regulatory risk creates uncertainty,” explains Peggy Brinkman, Principal & Consulting Actuary at Milliman (San Francisco, Calif.), and Chief Operating Officer of Milliman Appleseed (Seattle), a regulatory submission advisory organization. “The filing process can be lengthy and unpredictable, impacting the rollout of new models and products.” Navigating Regulatory Complexity Sue Klein, Principal & Consulting Actuary, Milliman. One of the most pressing issues for InsurTechs is the variability in state regulations. Each state has unique requirements for filings, forms, and checklists, which can lead to delays or rejections. “Some states are more demanding than others,” notes Sue Klein, Principal & Consulting Actuary at Milliman, and Chief Actuary Officer, Milliman Appleseed. “InsurTechs need expertise not only to submit filings but also to ensure compliance with evolving standards like artificial intelligence bias or new data requirements.” For instance, Massachusetts recently introduced a four-part instruction guide for filing acceptability, while states like Idaho now require domiciliary state approval before submissions. These shifting rules demand constant vigilance and adaptability. The Role of Advisory Organizations Many insurers are partnering with advisory organizations to file rating factors or loss costs on behalf of subscribers, reducing regulatory risk and expediting approvals. “It’s a shortcut that allows companies to avoid setting up their own legal entities and managing annual licensing requirements,” Brinkman explains. Some startup insurers decide to form their own advisory organization. However, this requires substantial expertise and resources to meet National Association of Insurance Commissioners (NAIC) standards while tailoring models for individual states. “Not every startup has the appetite or capacity for this level of complexity,” Klein adds. Predictive Analytics as a Growth Driver Peggy Brinkman, Principal & Consulting Actuary, Milliman. Predictive analytics has become indispensable for insurers aiming to refine pricing models and improve underwriting efficiency. Advisory organizations help companies identify risk drivers and optimize decision-making processes using granular data. “Actuaries have adapted their skillsets to manipulate atomic-level data for predictive modeling ,” Brinkman says. These advancements enable insurers to reduce loss ratios, improve operating efficiency, and enhance customer satisfaction. Despite its potential, implementing predictive analytics comes with challenges such as data quality issues and legacy system limitations. Also, regulatory scrutiny around AI-driven models raises concerns about bias and compliance risks. Regulatory Approval for Analytics Models Milliman Appleseed’s work with InsurTechs showcases the transformative impact of predictive analytics. For managing general agents (MGAs), adopting pre-approved models has accelerated program launches while reducing costs. “These models lend credibility,” Brinkman says. “When a model is reviewed by multiple states, it reassures our clients that they won’t face regulatory pushback.” Startups like Cambridge Mobile Telematics (Boston) have successfully navigated these challenges by leveraging advisory organizations and predictive modeling expertise. Also, Milliman Appleseed’s partnerships with MGAs have enabled faster scaling through turnkey solutions tailored to regulatory requirements. Building Relationships with Regulators Strong relationships with state regulators are pivotal in overcoming filing obstacles. Klein emphasizes the importance of direct communication: “It’s important to have contacts in states with demanding approval processes who can expedite approvals or clarify objections.” This proactive approach mitigates delays caused by miscommunications or incomplete submissions. Brinkman highlights the satisfaction of bridging knowledge gaps between insurers and regulators: “Teachable moments where we elevate understanding on both sides are rewarding—they pave the way for smoother interactions in future filings.” Advisory Services and Regulatory Filing Success InsurTechs stand at the forefront of innovation in insurance but must navigate a labyrinth of regulatory challenges to realize their full potential. By leveraging advisory organizations, predictive analytics expertise, and strong regulator relationships, startups can overcome barriers while driving growth. Klein summarizes: “When you get a filing approved in a state with complex requirements, it’s a feel-good moment for everyone involved.” Tom Benton // Tom Benton is a recognized thought leader in the insurance industry, with over 20 years of experience driving IT strategy and innovation. As a former insurance CIO and consultant, Tom has worked with insurers and technology providers to develop and implement strategic plans that improve customer experience, reduce risks, and enhance operational efficiency. He leverages his expertise in IT capability assessment, transformation preparedness, and solution provider evaluation to help organizations align their technology strategies with emerging industry needs and trends.Tom was most recently a Partner at ReSource Pro, formerly known as Strategy Meets Action. Tom also served as Vice President of Research and Consulting at Novarica and as Chief Information Officer at Navy Mutual, as well as CIO and CTO for major nonprofit organizations in Washington, DC. Tom holds a master's degree from MIT and a bachelor's degree from Cornell University, and he has contributed to numerous industry reports, publications, and webinars. His passion lies in helping insurers and insuretechs embrace innovative solutions for long-term success in a rapidly evolving market. Leave a Comment

Cambridge Mobile Telematics Frequently Asked Questions (FAQ)

When was Cambridge Mobile Telematics founded?

Cambridge Mobile Telematics was founded in 2010.

Where is Cambridge Mobile Telematics's headquarters?

Cambridge Mobile Telematics's headquarters is located at 314 Main Street, Cambridge.

What is Cambridge Mobile Telematics's latest funding round?

Cambridge Mobile Telematics's latest funding round is Corporate Minority.

How much did Cambridge Mobile Telematics raise?

Cambridge Mobile Telematics raised a total of $502.5M.

Who are the investors of Cambridge Mobile Telematics?

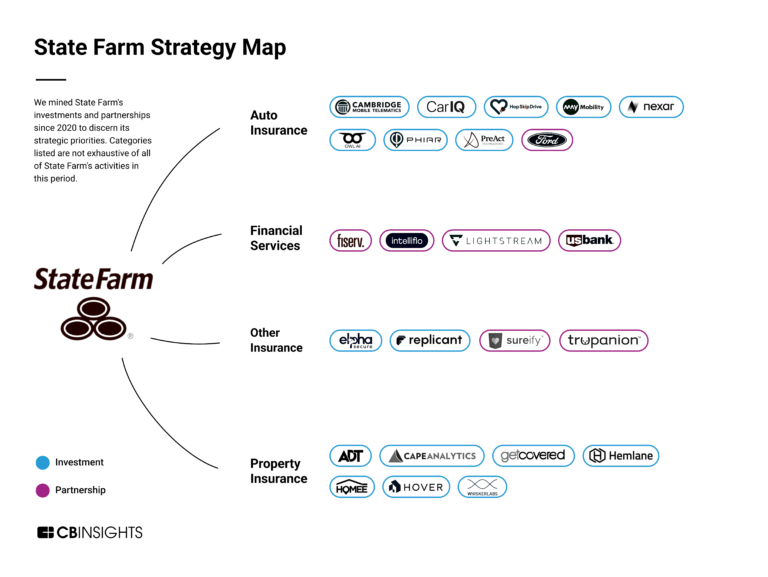

Investors of Cambridge Mobile Telematics include SoftBank, MIT Csail and State Farm Ventures.

Who are Cambridge Mobile Telematics's competitors?

Competitors of Cambridge Mobile Telematics include The Floow, Zendrive, Driver Technologies, Artificient Mobility Intelligence, Amodo and 7 more.

What products does Cambridge Mobile Telematics offer?

Cambridge Mobile Telematics's products include DriveWell Risk and 2 more.

Who are Cambridge Mobile Telematics's customers?

Customers of Cambridge Mobile Telematics include Progressive, #2 US Auto Insurer, USAA, #5 US Auto Insurer, Intact, #1 Canadian Auto Insurer and Discovery Insure, Top South African Auto Insurer.

Loading...

Compare Cambridge Mobile Telematics to Competitors

OSeven is a company specializing in telematics and driving behavior analytics within the insurance and automotive sectors. The company offers a platform that analyzes driving data to help improve driver safety and promote eco-friendly driving habits. OSeven's solutions cater to various industries, including insurance, banking and fintech, telecommunications, rental and leasing, fleet management, and ridesharing. It was founded in 2015 and is based in London, England.

Sentiance specializes in motion insights and focuses on driver behavior to enhance road safety within the technology sector. The company offers AI-powered solutions that analyze driving behavior, detect crashes, and provide insights into mobility and lifestyle patterns, all processed on-device in a privacy-centric manner. Sentiance primarily serves industries such as motor insurance, the gig economy, sustainable mobility, transport authorities, and automotive OEMs. Sentiance was formerly known as Argus Labs. It was founded in 2015 and is based in Antwerp, Belgium.

Reviver specializes in digital license plate technology and operates within the automotive tech industry. The company offers a platform that transforms traditional license plates into digital, smartphone-controlled devices that facilitate vehicle registration renewal, personalization, and integrated telematics for safety. Reviver's products cater to both individual consumers and commercial fleet operators, providing a suite of management tools and services. Reviver was formerly known as Smart Plate, Inc. It was founded in 2009 and is based in Granite Bay, California.

Accuscore (fka Acculitx) is working with many of the major insurance companies to redefine usage-based insurance (UBI) to create a more relevant identification of driver behavior and risk called RBI - Risk Based Insurance. The key differentiator of accuscore is in using continuous vehicle motion data to generate a relevant predictor for driver risk with very strong correlation to actuary data. Because accuscoreSM is not 'event' based, it results in being the most comprehensive and accurate identifier of driver risk and behavior assessment.

The Floow specializes in telematics data management and predictive analytics within the motor insurance and automotive sectors. The company offers solutions that leverage smartphone sensor technology and contextual analysis to provide insights into driver behavior, aiming to enhance safety and customer engagement. It was founded in 2012 and is based in Sheffield, United Kingdom.

Octo specializes in insurance telematics and smart mobility solutions within the connected vehicle and Internet of Things (IoT) sectors. The company offers a range of services including risk scoring, crash and claim management, and safety and security features for drivers. Octo's solutions cater to various sectors such as insurance, automotive, fleet management, and smart cities. It was founded in 2002 and is based in Rome, Italy. Octo operates as a subsidiary of Renova Group.

Loading...