Capsule

Founded Year

2015Stage

Series D | AliveTotal Raised

$570MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-16 points in the past 30 days

About Capsule

Capsule focuses on the healthcare and technology sectors, specifically within the pharmacy industry. The company offers a service that delivers prescriptions to customers on the same day and allows them to manage their medications from their phones. Capsule primarily serves the healthcare industry. It was founded in 2015 and is based in New York, New York.

Loading...

ESPs containing Capsule

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-service virtual pharmacy market provides a convenient way to access prescription medications and healthcare services remotely, eliminating the need for in-person visits to traditional pharmacies. Through virtual platforms, patients can consult with healthcare professionals, manage their prescriptions, and receive medication reminders. Patients can benefit from personalized care as well as…

Capsule named as Leader among 12 other companies, including TELUS, CVS Health, and Truepill.

Loading...

Research containing Capsule

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Capsule in 3 CB Insights research briefs, most recently on Apr 8, 2024.

Apr 8, 2024

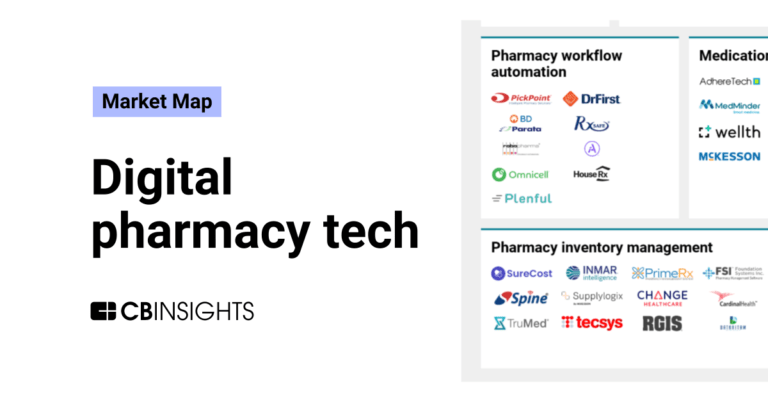

The digital pharmacy tech market map

Feb 23, 2024

The pharma supply chain tech market mapExpert Collections containing Capsule

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Capsule is included in 8 Expert Collections, including E-Commerce.

E-Commerce

11,245 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Future Unicorns 2019

50 items

Digital Health 50

150 items

The winners of the second annual CB Insights Digital Health 150.

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Latest Capsule News

Nov 20, 2024

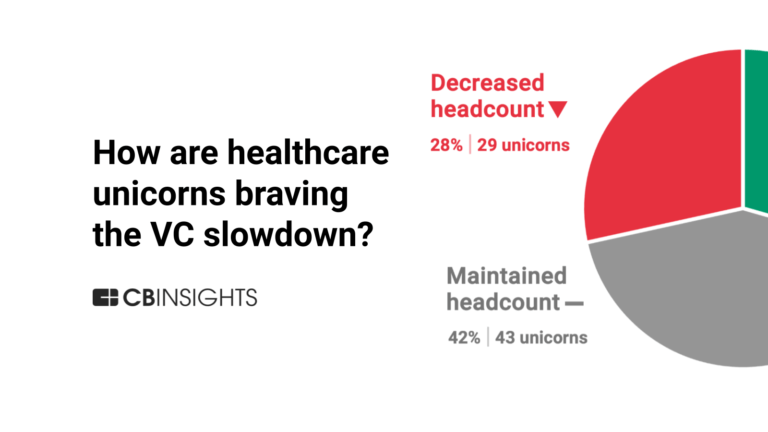

Nov 20, 2024 • Stephen Hurford Telemedicine didn't solve the fundamental cost problem in healthcare, but new AI models may be tackling this. The CEO of Abi Global Health thinks that AI is the key to making telemedicine work as a business model. Telemedicine emerged as an exciting new prospect before the pandemic, with insurers adding it to the services they could offer customers. But, says Kim-Fredrik Schneider, nobody stopped to consider a crucial flaw in the model. “None of [the telemedicine startups] directly attacked that fundamental unit of cost, which is the time of a healthcare professional,” he says. Covid saw healthcare providers eagerly turn to telemedicine and digital health as ways to see patients while enforcing social distancing. In 2021, at the height of the pandemic, funding rounds for telemedicine startups surged, with investors putting in more cash even as there were early signs in the US that demand might be falling as restrictions eased. Beneficiaries of the boom period include Cerebral, a US mental health telemedicine unicorn that raised $300m in 2021 in a round led by SoftBank Vision Fund 2. In the same year, Capsule, a digital pharmacy startup, raised $300m; Kry, a Swedish provider of virtual and in-person healthcare, raised $312m. But in 2022 the sector saw a downturn. Cerebral laid off about 20% of its workforce, Capsule 13%, while Kry pulled its operations out of Germany and made around 400 redundancies. Schneider says that if investors in 2021 saw telemedicine as the future of post-pandemic healthcare, they were mistaken. “What’s wrong with that business model that it took a global pandemic for people to actually use the service?” Kim-Fredrik Schneider, Abi Global Health “I would look at it the other way around,” he says. “[And I would ask] what’s wrong with that business model that it took a global pandemic for people to actually use the service?” Schneider believes that companies like his, Abi Global Health, can use artificial intelligence to finally achieve the efficiencies the telemedicine sector originally hoped for. The company uses a machine learning algorithm to match patients with doctors in their area whose specialties suit their needs. It also uses AI to support healthcare professionals during the consultation and to help with administration and quality assurance afterwards. “We’re delivering on the promise of technology, which is that you get more for less.” It is just one startup among many that are using AI in healthcare provision. With advances in sophistication coming rapidly, the hope is that trained models can provide more efficient or effective care at a time when healthcare systems across the world are under pressure from ageing populations and an undersupply of medical personnel. Uniqa Ventures, the CVC arm of the Austrian insurance company Uniqa is an investor in Abi Global Health. It co-led its $4.9m series A funding round in April 2023. Bori Farkas-Fozy, principal at Uniqa Ventures, says she sees a lot of potential for AI medical technology to improve the offerings of insurance companies. “Speeding up the [healthcare provision] process has multiplying positive effects,” she says. “We know that if care is delayed there can be complications, making it costly both for the patient and the insurer.” Her fund has also invested in Ifeel, a Spanish startup that provides employee assistance mental health care. It surveys a workforce and uses AI to triage them based on the results to decide what level of care, if any, is necessary. But she says that the insurance industry needs to move slowly when considering the offerings of healthcare companies using new technologies. “In healthcare, we see tremendous application opportunities. But it is happening with a great deal of caution, and rightfully so.” Kim-Fredrik Schneider similarly stresses that there is a danger of getting caught up in hype. “AI is not a panacea,” he says. “It’s something that should be selectively deployed to solve a good problem.” A disruptive cure AI-assisted diagnostic tools could also make a difference for the life insurance industry. Lapetus, a US startup that uses machine learning to analyse a patient’s face as a biomarker for their health, is targeting the life insurance providers for its services. Lapetus CEO, Karl Ricanek, says it provides a way of assessing a person’s longevity and giving early signs of conditions they may be suffering. “We take a medical selfie and then quickly extract information about your health and wellness, as well as demographic information. So that’s available in a matter of seconds versus sending someone over to your home to do that.” Ricanek says the technology could assist medical underwriting, where a patient’s life insurance policy is valued according to their health and life expectancy. But he says the life insurance sector has been slow to take on novel technologies like AI. “We’re the poster child for what’s wrong with the insurance industry. Adoption should have been worldwide by now.” Karl Ricanek, Lapetus “We’re the poster child for what’s wrong with the insurance industry,” says Ricanek. “We’re 10 years into [development of Lapetus’s technology] and adoption should have been worldwide by now.” “But what we’re now seeing is that insurance companies have no choice but to start thinking about reducing the cost of insurance. That’s where we come in.” Gen Re, the US multinational reinsurance company, is one of the companies that has partnered with Lapetus. It has offered Lapetus’s technology to life and health insurance applicants. The startup has deployed in Africa, the Middle East and the US so far. Ricanek says the training data has been specifically chosen to contain a broad coverage of skin tones and socioeconomic backgrounds, both of which can affect the inferences drawn from a facial analysis. And it goes beyond lower costs. There’s also a need to keep pace with the kind of technological convenience seen in other sectors. “We have very sophisticated end users,” says Ricanek. “They are not going to settle for a paper form. They’re not going to settle for [having to visit] a medical clinic. They expect things to be easy.” Schneider says that insurance companies have three “chronic” problems that a startup can make itself very valuable by solving. These are customer engagement, product differentiation, and the loss ratio. In other words, a startup needs to offer a strong, unique end user experience and should improve the insurance company’s profits. Farkas-Fozy of Uniqa Ventures agrees. “I think the more you can offer a policyholder, the higher your retention or acquisition of new customers.” Elsewhere, there are signs that the telemedicine market is entering a new AI-driven phase. Hippocratic AI, a US startup building generative AI healthcare chatbots, raised $53 in series A funding in March. In a September extension round it received another $17m, this time led by NVentures, the CVC arm of Nvidia, the world’s leading AI chip designer which has been recently taking an increased interest in healthcare startups. The Swedish startup Kry, which had to scale back its workforce and shut down its German operations in 2022, offers a hopeful sign. After that turbulent year, it managed to apply generative AI techniques to its business model to drastically reduce admin costs associated with each virtual visit. In February, Sifted reported that the company had turned a profit for the first time. Stephen Hurford

Capsule Frequently Asked Questions (FAQ)

When was Capsule founded?

Capsule was founded in 2015.

Where is Capsule's headquarters?

Capsule's headquarters is located at 122 West 146th, New York.

What is Capsule's latest funding round?

Capsule's latest funding round is Series D.

How much did Capsule raise?

Capsule raised a total of $570M.

Who are the investors of Capsule?

Investors of Capsule include T. Rowe Price, Scottish Mortgage Investment Trust, Durable Capital Partners, IPD Capital, Whale Rock Capital Management and 8 more.

Who are Capsule's competitors?

Competitors of Capsule include Alto Pharmacy, Blink Health, Surescripts, Truepill, OneroRx and 7 more.

Loading...

Compare Capsule to Competitors

Phil facilitates medication access within the life sciences industry. Its main offering is the PhilRx Digital Hub Platform, which assists in the medication access process for patients and providers, focusing on patient outcomes and brand performance. The platform serves retail and specialty-lite manufacturers, supporting patient access and covered dispenses. It was founded in 2015 and is based in San Francisco, California.

Blink Health operates as a digital health company. The company's main service includes a cloud-based pharmacy platform to allow patients to access prescription medications at the lowest possible price, with the option for home delivery or local pharmacy pickup. The company primarily serves the healthcare industry. It was founded in 2014 and is based in New York, New York.

Nimble provides pharmacy and prescription management solutions within the healthcare sector. The company offers services that focus on digital ordering and operational processes, as well as marketing strategies aimed at patient retention and adherence to prescriptions. Nimble serves pharmacies, patients, and manufacturers in the healthcare industry. Nimble was formerly known as Nimble Pharmacy. It was founded in 2015 and is based in Redwood City, California.

ScriptDrop focuses on medication access and prescription delivery within the healthcare sector. The company offers a platform for pharmacies, providers, and patients to facilitate medication delivery. ScriptDrop primarily serves pharmacies and healthcare providers. It was founded in 2016 and is based in Columbus, Ohio.

Arrive Health is a healthcare technology company that focuses on improving care decisions for patients and providers. The company offers solutions that provide accurate clinical, cost, and coverage data within electronic health record (EHR) systems and other healthcare workflows to support informed decision-making. Arrive Health primarily serves sectors such as health systems, providers, health plans, pharmacy benefit managers (PBMs), and technology vendors in the healthcare industry. Arrive Health was formerly known as RxRevu. It was founded in 2013 and is based in Denver, Colorado.

MediSafe is a medication management platform in the digital health sector. The company provides guidance, medication adherence, and support through its digital platform. MediSafe serves the healthcare industry, with a focus on patient engagement and health outcomes. It was founded in 2012 and is based in Needham, Massachusetts.

Loading...