Chainalysis

Founded Year

2014Stage

Unattributed VC | AliveTotal Raised

$536.72MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About Chainalysis

Chainalysis is a blockchain data platform that offers blockchain intelligence to assist in detecting crypto crime, ensuring regulatory compliance, and supporting financial institutions. The company serves law enforcement agencies, regulators, and centralized exchanges. It was founded in 2014 and is based in New York, New York.

Loading...

Chainalysis's Product Videos

ESPs containing Chainalysis

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

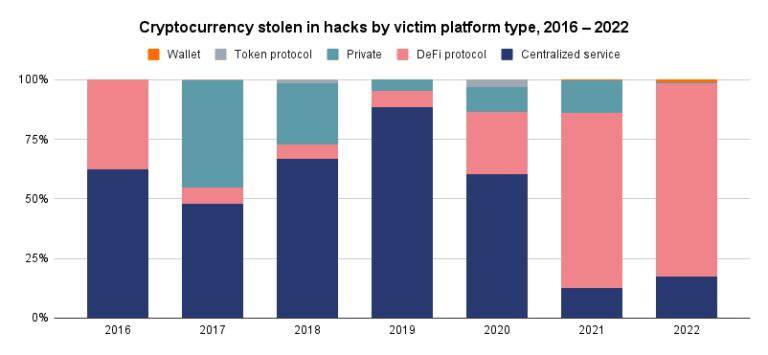

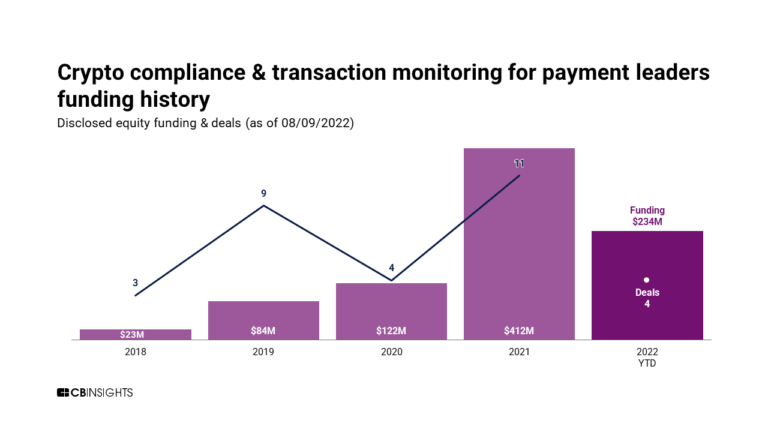

The crypto compliance & transaction monitoring market helps organizations comply with regulatory requirements in the cryptocurrency industry, including anti-money laundering (AML) and counter-terrorism financing (CTF) standards. These solutions leverage blockchain technology and proprietary risk algorithms to monitor transactions for potential illicit activity, such as money laundering, terrorism …

Chainalysis named as Leader among 13 other companies, including ComplyAdvantage, Sardine, and Elliptic.

Chainalysis's Products & Differentiators

Chainalysis KYT

Chainalysis KYT (Know Your Transaction) combines industry-leading blockchain intelligence, an easy-to-use interface, and a real-time API. It helps organizations reduce manual workflows, stay compliant with local and global regulations, and safely interact with emerging technologies such as DeFi.

Loading...

Research containing Chainalysis

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chainalysis in 8 CB Insights research briefs, most recently on Mar 14, 2024.

Expert Collections containing Chainalysis

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chainalysis is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,708 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Chainalysis Patents

Chainalysis has filed 12 patents.

The 3 most popular patent topics include:

- alternative currencies

- blockchains

- cryptocurrencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/11/2023 | 10/22/2024 | Grant |

Application Date | 1/11/2023 |

|---|---|

Grant Date | 10/22/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Chainalysis News

Apr 4, 2025

Iran-Backed Houthi Group Faces Sanctions On Cryptocurrency Wallets Funding War Efforts Enter your email to get Benzinga's ultimate morning update: The PreMarket Activity Newsletter Comments Loading... The Treasury Department took action against a Houthi financial network, imposing sanctions on cryptocurrency wallets used by the Iran-backed militant group to fund its war machine. What Happened: According to a Wednesday press release, the Department of the Treasury's Office of Foreign Assets Control identified eight digital wallets used by the Yemen-based group to help procure millions worth of weapons and commodities, including stolen Ukrainian grain, from Russia. The sanctions targeted Russian-based Afghan nationals Hushang and Sohrab Ghairat, who have facilitated commercial operations on behalf of the Houthis, and particularly Sa'id al-Jamal, who had cryptocurrency addresses included in his December 2024 sanctions designation. Further investigation by Chainalysis, a firm that tracks illicit cryptocurrency activity, revealed that the wallets moved nearly $1 billion worth of funds linked to sanctioned entities. The majority of the transactions funded Houthi operations in Yemen and the Red Sea region. Moreover, Houthis used deposit addresses at Russia-based cryptocurrency Garantex, a known facilitator of money laundering, which received over $45 million. The group processed nearly $2.5 million involving wallets previously identified as being involved in funding Hamas, the group embroiled in a conflict with Israel, Chainalysis said. Why It Matters: The U.S. airstrikes in Yemen earlier this month resulted in several casualties , leading the Houthis to issue a warning of retaliation. This retaliation threat has escalated tensions in the region. The Houthis are an armed rebel group from Yemen known for their opposition to Israel. They are backed by Iran’s Islamic Revolutionary Guards. The group has been attacking ships in the Red Sea, a key global trade route, since late 2023, following the breakout of the Israel-Hamas war . The U.S. has responded with airstrikes to weaken the Houthis' ability to launch these attacks. Read Next:

Chainalysis Frequently Asked Questions (FAQ)

When was Chainalysis founded?

Chainalysis was founded in 2014.

Where is Chainalysis's headquarters?

Chainalysis's headquarters is located at 114 5th Avenue, New York.

What is Chainalysis's latest funding round?

Chainalysis's latest funding round is Unattributed VC.

How much did Chainalysis raise?

Chainalysis raised a total of $536.72M.

Who are the investors of Chainalysis?

Investors of Chainalysis include Haun Ventures, Plug and Play Crypto & Digital Assets, Accel, FundersClub, Blackstone and 31 more.

Who are Chainalysis's competitors?

Competitors of Chainalysis include AnChain.AI, Elliptic, Allium, Gray Wolf, Four Pillars and 7 more.

What products does Chainalysis offer?

Chainalysis's products include Chainalysis KYT and 4 more.

Loading...

Compare Chainalysis to Competitors

Elliptic provides blockchain analytics and crypto compliance solutions within the financial technology sector. The company offers services such as wallet screening, transaction monitoring, forensic investigations, and risk assessment for virtual asset service providers (VASPs). Elliptic serves financial institutions, crypto businesses, law enforcement agencies, and regulators. Elliptic was formerly known as Bitxchange. It was founded in 2013 and is based in London, United Kingdom.

TRM Labs detects and investigates crypto-related financial crime and fraud within the financial sector. The company provides services such as forensics, tactical investigations, compliance solutions like transaction monitoring and wallet screening, and incident response. TRM Labs serves government agencies, financial institutions, and crypto businesses, equipping them with tools to address crypto-facilitated crime and ensure regulatory compliance. It was founded in 2018 and is based in San Francisco, California.

Merkle Science is a predictive cryptocurrency risk and intelligence platform that operates in the financial technology sector. The company provides tools for detecting, investigating, and preventing illegal activities involving cryptocurrencies, with services that include transaction monitoring, compliance training, and forensic analysis. Its offerings cater to crypto businesses, DeFi participants, financial institutions, government agencies, and insurers. It was founded in 2018 and is based in Manhattan, New York.

Glassnode is a blockchain data and intelligence platform that provides on-chain market insights for the digital assets sector. The company offers analytics tools that allow users to analyze blockchain data, market trends, and financial metrics to support trading and investment decisions. Glassnode serves the digital asset market, including traders, investors, researchers, and content creators. It was founded in 2017 and is based in Baar, Switzerland.

Notabene specializes in crypto compliance within the financial technology sector. The company offers solutions for Travel Rule compliance, including counterparty verification, wallet identification, and tools to identify and prevent high-risk crypto activities. Notabene serves financial institutions and virtual asset service providers (VASPs) seeking to comply with global regulations such as the FATF's Travel Rule. It was founded in 2020 and is based in Brooklyn, New York.

Messari is a cryptocurrency research startup that provides data services and market intelligence in the blockchain and cryptocurrency sectors. The company offers data ingestion and analysis services to support token projects, exchanges, and information service providers. Messari's market intelligence services are designed to monitor cryptocurrency circulation and provide insights into the crypto economy. It was founded in 2017 and is based in New York, New York.

Loading...