Clara

Founded Year

2020Stage

Series B - III | AliveTotal Raised

$470MLast Raised

$60M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+20 points in the past 30 days

About Clara

Clara operates a management platform in the business payments sector. It offers corporate credit cards, bill payment services, cross-border payments, and a software platform for expense management and financial operations. Clara primarily serves large and growing companies across various industries. The company was founded in 2020 and is based in Sao Paulo, Brazil.

Loading...

Clara's Product Videos

ESPs containing Clara

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management platforms market enables businesses to efficiently manage and control their expenditures through integrated software solutions, including virtual corporate cards, expense management systems, procurement software, and budget tracking tools. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operational systems, allowing for real-…

Clara named as Challenger among 15 other companies, including Ramp, Coupa, and Pleo.

Clara's Products & Differentiators

Card

Clara-issued charge card (have premium, business, and virtual offerings)

Loading...

Research containing Clara

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clara in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 5, 2023 report

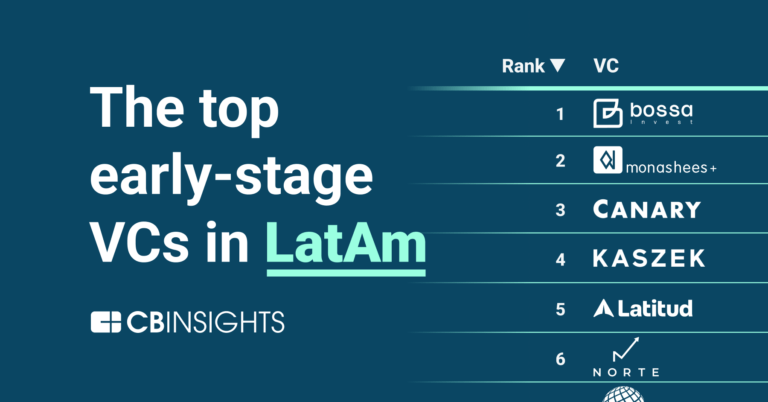

The top 25 early-stage LatAm VCs

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Clara

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clara is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

100 items

Latest Clara News

Apr 1, 2025

Reinsurance News Aon, a risk management and professional services firm, has provided its 2024 UK Risk Settlement Market Update, highlighting a year of significant milestones for the bulk annuity and longevity swap markets. According to the report, the UK bulk annuity market witnessed exceptional activity in 2024, setting new records in both transaction volume and deal numbers. The total volume of bulk annuities reached £47.6 billion, with 293 deals transacted, far surpassing the previous record of 227 deals in 2023. The second half of 2024 was particularly remarkable, with £32.5 billion in transactions completed—an all-time high for any six-month period. Notably, 12 deals over £1 billion each were completed in the second half of 2024, a record number for any half-year. Aon notes that this surge was driven by a combination of factors, including strong reinsurance market capacity, significant insurer solvency surpluses, and product innovations such as streamlined pricing offerings, which made transactions more accessible for smaller schemes. Approximately 78 percent of the deals completed in 2024 were under £100 million, indicating a broad market capacity to cater to schemes of all sizes. The longevity swap market, while slightly quieter than in previous years, still saw £5.8 billion in transactions in 2024. This was lower than in recent years, primarily due to smaller transactions, with two deals valued around £400 million each. However, as funding positions remained strong, many pension schemes opted for bulk annuities instead. Despite the decrease in volume, the longevity swap market is expected to rebound in 2025, with volumes likely to exceed £15 billion by year-end, driven by ongoing transactions such as those involving the BT Pension Scheme and two Lloyds Banking Group pension schemes. This trend also highlights the increasing ability of longevity swaps to hedge non-pensioner liabilities in addition to the traditional focus on in-payment risks. Aon’s report also highlights the increasing trend of restructuring existing longevity swaps in 2024. Specifically, several previously executed longevity swaps were successfully converted into bulk annuities, driven by evolving scheme objectives and circumstances. In addition to these developments, Aon’s analysis reveals a shift in the dynamics of the bulk annuity market, with the entry of new insurers such as Utmost and the re-entry of M&G, expanding competition and providing further capacity to the market. Just Group wrote over 40 percent of all transactions in 2024. Aon’s report also highlights the growing activity within the Superfund market, with Clara being a key player in this space. Clara successfully completed its £600 million transaction with the Debenhams Retirement Scheme, which included restoring full benefits for 10,400 members. Additionally, Clara made its first deal with an active business, the £230 million Wates Pension Fund transaction. This trend demonstrates that Superfunds are becoming increasingly viable for a wider range of pension schemes, including those with active sponsors, and is expected to drive interest from trustees and sponsors looking for alternatives to traditional insurance solutions. Share this:

Clara Frequently Asked Questions (FAQ)

When was Clara founded?

Clara was founded in 2020.

Where is Clara's headquarters?

Clara's headquarters is located at R. Dr. Renato Paes de Barros. 33, Sao Paulo.

What is Clara's latest funding round?

Clara's latest funding round is Series B - III.

How much did Clara raise?

Clara raised a total of $470M.

Who are the investors of Clara?

Investors of Clara include General Catalyst, DST Global, Picus Capital, Monashees+, Alter Global and 33 more.

Who are Clara's competitors?

Competitors of Clara include Mendel and 6 more.

What products does Clara offer?

Clara's products include Card and 2 more.

Who are Clara's customers?

Customers of Clara include Banco Sabadell, Enseña por México, OnFly and Gulf.

Loading...

Compare Clara to Competitors

Mendel is a technology company that focuses on streamlining and optimizing financial management for large enterprises in the finance and technology sectors. The company offers an integrated solution for intelligent expense management and control, providing real-time reporting, automated workflows, and smart corporate Visa cards. Mendel primarily serves large corporations seeking to digitize their financial processes and increase payment transparency. It was founded in 2021 and is based in Mexico City, Mexico.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Ramp is a financial operations platform that provides spend management services for businesses. The company offers a suite of services including corporate cards, expense management, accounts payable solutions, and accounting automation. Ramp's platform serves startups, small businesses, mid-market companies, and enterprises across various sectors. It was founded in 2019 and is based in New York, New York.

Pluto is a spend management and corporate card platform that provides financial workflow automation across various industries. The company offers services, including corporate cards with budget controls, employee reimbursements, digital petty cash management, procurement and accounts payable solutions, accounting automation, and invoice management. Pluto primarily serves sectors such as retail and e-commerce, agencies, trucking and fleet, consulting firms, small to medium-sized businesses, and large enterprises. Pluto was formerly known as Pluto Technologies. It was founded in 2021 and is based in Dubai, United Arab Emirates.

CondoConta is a financial institution that provides banking services to condominiums and property managers within the real estate sector. The company offers financial products including condominium accounts for managing finances, tools for issuing condominium fees, guaranteed monthly revenue, and financing options for property improvements. CondoConta serves the real estate management industry, offering solutions that integrate with property management systems. It was founded in 2020 and is based in Santa Catarina, Brazil.

Loading...