Clearco

Founded Year

2015Stage

Series D | AliveTotal Raised

$1.158BLast Raised

$60M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+96 points in the past 30 days

About Clearco

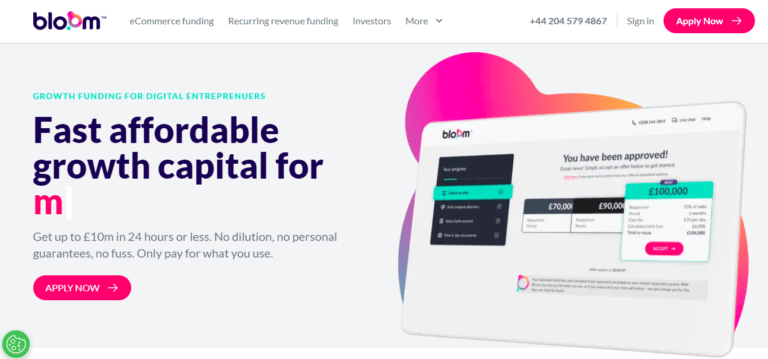

Clearco specializes in providing working capital to the e-commerce sector and focuses on funding invoices and receipts for businesses. The company offers a rapid funding process that allows e-commerce businesses to receive capital in as little as 24 hours without the need for collateral, personal guarantees, or equity dilution. Clearco's services are designed to help e-commerce businesses manage cash flow and invest in growth by funding operational expenses such as inventory, marketing, and logistics. Clearco was formerly known as Clearbanc. It was founded in 2015 and is based in Toronto, Canada.

Loading...

ESPs containing Clearco

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The revenue-based financing platforms market offers an innovative approach to funding for businesses seeking capital without traditional equity or debt financing and instead exchange a percentage of their future revenues. This arrangement enables entrepreneurs to access growth capital without diluting ownership or incurring fixed interest payments. These platforms use advanced algorithms and data …

Clearco named as Leader among 15 other companies, including Capchase, Pipe, and Liberis.

Clearco's Products & Differentiators

Invoice Funding

Clearco provides ecommerce businesses with working capital to fund invoices.

Loading...

Research containing Clearco

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clearco in 1 CB Insights research brief, most recently on May 31, 2022.

Expert Collections containing Clearco

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clearco is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,586 items

Fintech

13,699 items

Excludes US-based companies

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Canadian fintech

345 items

Latest Clearco News

Mar 25, 2025

TechBullion The rise of digital entrepreneurship has transformed the business landscape. Online entrepreneurs need financing options that cater to their unique needs. Traditional business loans are often rigid and not designed for digital ventures. Fortunately, innovations in business loans have created flexible and accessible funding solutions. These new financing options are tailored to the dynamic nature of online businesses . The Changing Terrain of Business Loans Traditional banks have long been the go-to source for business loans. However, their lending criteria can be strict, requiring collateral and extensive credit history. This makes it difficult for online entrepreneurs, especially startups, to secure funding. The digital revolution has led to the emergence of alternative financing options. These new solutions are more accessible and designed to meet the specific needs of online businesses. Alternative Lending Platforms: A Game Changer Online lending platforms have disrupted the traditional lending industry. These platforms use technology to streamline the loan application process. Unlike banks, alternative lenders consider various factors beyond credit scores. They analyze business performance, cash flow, and digital presence. As a result, online entrepreneurs have a better chance of securing funding . Peer-to-Peer (P2P) Lending P2P lending connects borrowers directly with individual lenders. It eliminates the need for intermediaries like banks. This model reduces costs and increases accessibility. Online entrepreneurs can obtain funds quickly without the cumbersome procedures of traditional loans. Moreover, interest rates in P2P lending are often competitive. Popular P2P platforms include LendingClub, Prosper, and Funding Circle. Revenue-Based Financing (RBF) RBF is an innovative funding model where businesses receive capital in exchange for a percentage of future revenue. This option is ideal for online businesses with fluctuating incomes. Repayments adjust based on earnings, providing financial flexibility. Companies like Clearco and Pipe offer RBF solutions tailored to e-commerce and subscription-based businesses. Crowdfunding: Raising Capital from the Masses Crowdfunding has become a popular way for online entrepreneurs to raise funds. It allows businesses to secure capital from multiple investors or supporters. There are different types of crowdfunding, including reward-based, equity-based, and debt-based. Reward-Based Crowdfunding – Entrepreneurs offer incentives to backers in exchange for funding. Platforms like Kickstarter and Indiegogo facilitate this model. Equity Crowdfunding – Investors receive equity in the business. Websites like SeedInvest and Crowdcube enable businesses to raise funds from investors. Debt Crowdfunding – Also known as peer-to-business lending, this model involves borrowing from multiple investors. Platforms such as Funding Circle offer these services. Crowdfunding provides online entrepreneurs with capital while also validating business ideas. It engages potential customers and creates brand awareness. Fintech Solutions for Online Entrepreneurs Financial technology (fintech) has revolutionized business financing. Fintech lenders leverage artificial intelligence and big data to assess creditworthiness. They provide fast and flexible loan options tailored to online businesses. AI-Powered Loan Approvals AI-driven lending platforms assess applications in real-time. They analyze alternative data sources, such as social media presence and transaction history. This allows entrepreneurs with limited credit history to access funding. Fintech companies like Kabbage and OnDeck use AI to provide quick loan approvals. Blockchain and Smart Contracts Blockchain technology enhances transparency and security in lending. Smart contracts automate loan agreements, reducing paperwork and processing time. These contracts execute automatically when conditions are met. This eliminates intermediaries and lowers costs. Blockchain lending platforms like SALT and Celsius provide innovative loan solutions. Buy Now, Pay Later (BNPL) for Businesses BNPL financing has gained traction in e-commerce. It allows businesses to purchase inventory or services upfront and pay in installments. Platforms like Klarna and Affirm offer BNPL solutions tailored to online entrepreneurs. This financing method improves cash flow and supports business growth. Government and Institutional Support for Online Businesses Governments and financial institutions recognize the importance of digital businesses. They have introduced initiatives to support online entrepreneurs. Microloans and Grants Microloans provide small amounts of capital to startups and small businesses. Organizations like the Small Business Administration (SBA) in the U.S. offer microloans to online entrepreneurs. Additionally, grants are available for businesses in specific industries. These funds do not require repayment, making them an attractive option. Business Incubators and Accelerators Business incubators and accelerators offer financial and mentorship support. They provide funding, networking opportunities, and expert guidance. Programs like Y Combinator and Techstars help startups scale their businesses. Many of these programs focus on digital enterprises and e-commerce ventures. The Coming Opportunities of Business Loans for Online Entrepreneurs The future of business financing is evolving with technological advancements. Emerging trends indicate further innovations in lending for online businesses. Decentralized Finance (DeFi) Lending DeFi platforms use blockchain to facilitate peer-to-peer lending. They eliminate banks and intermediaries, providing direct access to funds. DeFi lending platforms like Aave and Compound enable businesses to borrow against crypto assets. This approach offers transparency and reduced fees. AI-Driven Personalized Loan Offers AI advancements will lead to highly personalized loan offers. Machine learning algorithms will analyze business needs and tailor financing solutions. This will enhance accessibility and efficiency in loan approvals. Sustainable and Ethical Lending Sustainability in lending is gaining importance. Lenders are focusing on ethical financing practices. Green loans and impact investing are becoming popular. Online businesses with sustainable practices may access special financing options. Conclusion Innovations in business loans have transformed financing for online entrepreneurs. Alternative lending platforms, fintech solutions, and government support provide diverse funding options. Emerging trends like DeFi and AI-driven lending will further enhance accessibility. Online entrepreneurs now have more opportunities than ever to secure funding. By leveraging these innovations, they can scale their businesses and achieve long-term success .

Clearco Frequently Asked Questions (FAQ)

When was Clearco founded?

Clearco was founded in 2015.

Where is Clearco's headquarters?

Clearco's headquarters is located at 33 Yonge Street, Toronto.

What is Clearco's latest funding round?

Clearco's latest funding round is Series D.

How much did Clearco raise?

Clearco raised a total of $1.158B.

Who are the investors of Clearco?

Investors of Clearco include Inovia Capital, Founders Circle Capital, Kensington, Pollen Street Capital, SVB Financial Group and 25 more.

Who are Clearco's competitors?

Competitors of Clearco include Boopos, SellersFi, Brex, AIZEN, Valerian Funds and 7 more.

What products does Clearco offer?

Clearco's products include Invoice Funding and 4 more.

Loading...

Compare Clearco to Competitors

Pipe specializes in embedded financial solutions within the software sector, offering services that provide access to financial tools for businesses. Its main offerings include a platform that provides working capital and a card issuing service, both designed to integrate with existing software solutions. Pipe serves vertical SaaS and payments platform industries, enhancing their offerings with financial products. It was founded in 2019 and is based in San Francisco, California.

Wayflyer operates as a financial services company focusing on providing funding solutions for electronic commerce businesses. The company offers financing options, including working capital, inventory funding, and growth capital. It primarily serves the eCommerce sector, supporting brands that sell products through online and retail channels. The company was founded in 2019 and is based in Dublin 2, Ireland.

Arc Technologies specializes in financial technology with a focus on private credit. The company provides an artificial intelligence (AI) platform for private credit, cash management, treasury services, and capital markets solutions. Arc primarily serves startups and businesses that aim to manage finances, generate yield, and secure funding. It was founded in 2021 and is based in San Francisco, California.

Payability is a fintech company that provides financial solutions for eCommerce sellers. The company provides daily payouts and working capital to assist sellers with their cash flow and business operations. Payability serves Amazon, Walmart, and Newegg sellers, allowing them access to their sales revenue without the necessity for credit checks. It was founded in 2014 and is based in New York, New York.

Vitt focuses on investment management. The company offers services that allow customers to invest their idle cash in money market funds. The company's funds are managed by Goldman Sachs Asset Management and are held with a Financial Conduct Authority-regulated custodian, mitigating counterparty risk. It was formerly known as Rail. It was founded in 2021 and is based in London, United Kingdom.

Levenue provides revenue-based financing within the financial services industry, offering capital solutions to businesses with recurring revenue. The company offers funding based on a business's future Annual Recurring Revenue (ARR), which can assist with working capital and growth initiatives without requiring equity dilution. Levenue serves subscription-based and SaaS companies across Europe and provides access to capital through a marketplace platform. It was founded in 2021 and is based in Breda, Netherlands.

Loading...