Coalition

Founded Year

2017Stage

Corporate Minority | AliveTotal Raised

$800MLast Raised

$30M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About Coalition

Coalition serves as a provider of Active Insurance in the cybersecurity domain. The company offers cyber insurance products, including coverage for ransomware and email compromise, as well as cybersecurity tools and services. Coalition serves a diverse range of sectors by providing insurance and security solutions to manage digital risks. It was founded in 2017 and is based in San Francisco, California.

Loading...

Coalition's Product Videos

ESPs containing Coalition

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Coalition named as Leader among 6 other companies, including Cowbell Cyber, Next Insurance, and At-Bay.

Coalition's Products & Differentiators

Active Cyber Insurance

Coalition's Active Cyber Insurance provides comprehensive protection from fast-moving cyber and digital risks.

Loading...

Research containing Coalition

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Coalition in 7 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

May 24, 2023

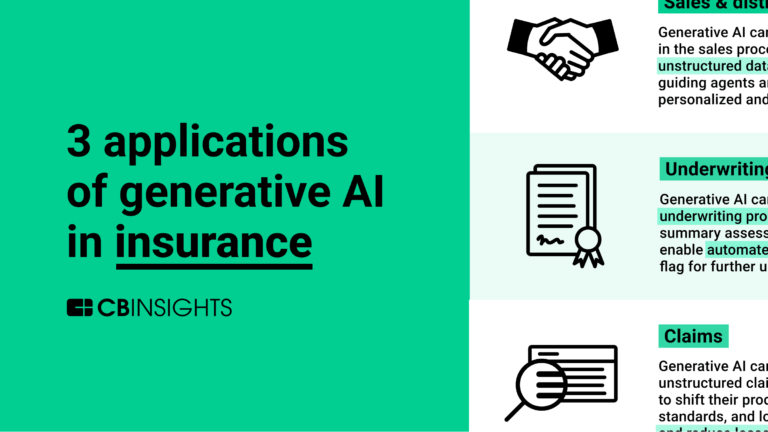

3 applications of generative AI in insuranceExpert Collections containing Coalition

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

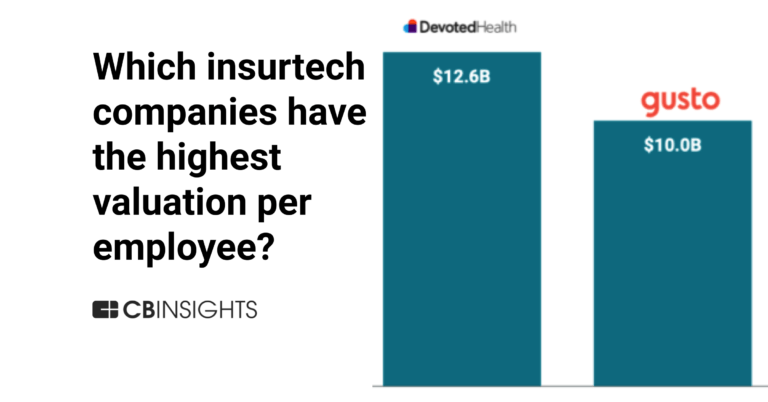

Coalition is included in 10 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

SMB Fintech

1,586 items

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Cybersecurity

10,544 items

These companies protect organizations from digital threats.

Coalition Patents

Coalition has filed 1 patent.

The 3 most popular patent topics include:

- computer memory

- data management

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/25/2023 | 7/2/2024 | Computer memory, Rotating disc computer storage media, Data management, Diagrams, Parallel computing | Grant |

Application Date | 10/25/2023 |

|---|---|

Grant Date | 7/2/2024 |

Title | |

Related Topics | Computer memory, Rotating disc computer storage media, Data management, Diagrams, Parallel computing |

Status | Grant |

Latest Coalition News

Apr 10, 2025

The new policy is available to organisations with annual revenues up to $5bn, and offers limits of up to $15m. April 10, 2025 The policy also extends coverage to include AI-related security events such as deepfake-enabled FTF and security failures caused by AI. Coalition, a provider of Active Insurance, has launched a new surplus lines cyber insurance product to protect businesses against digital risks in the US. The new policy, dubbed Coalition Active Cyber Policy, introduces data-driven coverage enhancements to protect businesses in the evolving digital risk environment. Go deeper with GlobalData According to Coalition, the policy offers expanded protections tailored to modern digital threats and specific benefits for policyholders that actively engage in cyber risk management. The policy is structured to reduce retention costs to zero for each year for policyholders that demonstrate proactive risk management, the company added. It includes provisions for early reporting of funds transfer fraud (FTF), offering reduced retentions for clients that report FTF incidents within a 72-hour window. The policy also extends coverage to include AI-related security events such as deepfake-enabled FTF and security failures caused by AI. The policy also features Any One Claim Coverage, which allows the full policy limit to reset for each incident within the policy period. Coalition has consolidated 11 coverages that were previously offered as endorsements into the base policy’s insuring agreements. The new policy is available to organisations with annual revenues up to $5bn, and offers limits of up to $15m. Coalition chief revenue officer Shawn Ram said: “With the launch of the Active Cyber Policy, Coalition is setting the standard for market-leading coverage that includes expanded protection against emerging digital threats and specific advantages for security-conscious policyholders. “Active Insurance is built on the predication that proactive security measures significantly reduce the frequency and severity of claims – in fact, our data proves it. And now, brokers can offer improved policy terms that enhance coverage to clients who actively participate in their cyber risk management.” Last month, Coalition secured a $30m (Y4.39bn) equity investment from Mitsui Sumitomo Insurance, a subsidiary of MS&AD Insurance Group. This investment strengthens their existing relationship, which includes a multi-year capacity agreement in Australia and a joint initiative to provide cybersecurity solutions to small and medium-sized enterprises in Japan. Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

Coalition Frequently Asked Questions (FAQ)

When was Coalition founded?

Coalition was founded in 2017.

Where is Coalition's headquarters?

Coalition's headquarters is located at 548 Market Street, San Francisco.

What is Coalition's latest funding round?

Coalition's latest funding round is Corporate Minority.

How much did Coalition raise?

Coalition raised a total of $800M.

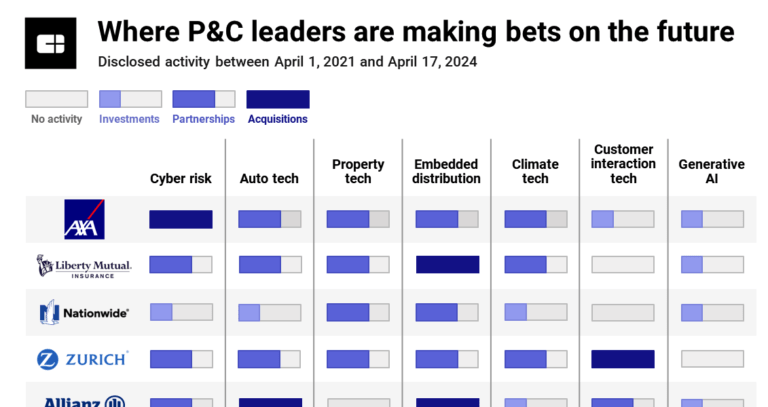

Who are the investors of Coalition?

Investors of Coalition include Mitsui Sumitomo Insurance, Valor Equity Partners, Allianz X, Kinetic Partners, Ribbit Capital and 14 more.

Who are Coalition's competitors?

Competitors of Coalition include Converge, Cyberwrite, Elpha Secure, Eye Security, Cowbell Cyber and 7 more.

What products does Coalition offer?

Coalition's products include Active Cyber Insurance and 3 more.

Loading...

Compare Coalition to Competitors

At-Bay provides cyber insurance and cybersecurity technology solutions within the insurance industry. It offers insurance products including cyber, tech errors and omissions (E&O), and miscellaneous professional liability (MPL), as well as cybersecurity advisory services, managed detection and response, and response and recovery services. It serves businesses seeking coverage against digital risks. At-Bay was formerly known as CyberJack. It was founded in 2016 and is based in Mountain View, California.

Cowbell Cyber specializes in providing cyber insurance solutions within the insurance industry. The company offers cyber coverage tailored to small and medium-sized enterprises (SMEs), utilizing artificial intelligence for continuous risk assessment and underwriting. Cowbell Cyber's products are designed to assist businesses in managing cyber risks through a closed-loop approach, including risk prevention, mitigation, and incident response services. It was founded in 2019 and is based in Pleasanton, California.

Resilience specializes in cyber risk management and insurance solutions within the cybersecurity industry. The company offers cyber insurance, risk management services, and technology errors and omissions (E&O) insurance to help organizations mitigate and manage cyber threats. Resilience's solutions are designed to enhance cyber resilience by integrating risk mitigation, risk acceptance, and risk transfer strategies. It was founded in 2016 and is based in San Francisco, California.

CyberCube specializes in cyber risk analytics for the insurance sector, leveraging a cloud-based technology platform to facilitate data-driven decision-making. The company offers a suite of products and services that enable insurance organizations to quantify cyber risk, optimize portfolio management, and manage cyber risk aggregation. CyberCube's solutions cater to various stakeholders within the insurance industry, including brokers, insurers, reinsurance brokers, and reinsurers. It was founded in 2015 and is based in San Francisco, California.

Cyberwrite specializes in cyber insurance analytics and risk assessment within the insurance industry. The company offers AI-driven risk analysis and reporting tools to help insurers, reinsurers, agents, and brokers understand and manage cyber risk. Cyberwrite primarily serves the insurance industry, providing actionable insights for underwriting, risk management, and sales efficiency in cyber insurance. It was founded in 2017 and is based in New York, New York.

Surance specializes in personal cyber insurance technology and provides an end-to-end platform for insurance carriers. The company offers a comprehensive suite of cyber protection and prevention tools, including 24/7 recovery services, cyber response expertise, and AI-driven risk management. Surance primarily serves the insurance industry, enhancing household cyber insurance offerings with their technology. It was founded in 2017 and is based in Ramat Hasharon, Israel.

Loading...