Coda Payments

Founded Year

2011Stage

Series C | AliveTotal Raised

$715.27MValuation

$0000Last Raised

$690M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-13 points in the past 30 days

About Coda Payments

Coda Payments provides payment solutions and e-commerce services within the digital content and gaming industry. The company offers products such as web stores, payment processing integration, and a marketplace for in-game content. Coda Payments serves the gaming and digital content sectors, facilitating transactions and distribution for publishers and developers. It was founded in 2011 and is based in Singapore, Singapore.

Loading...

Coda Payments's Products & Differentiators

Codashop

Coda Payments operates Codashop, a trusted source of games and in-game currencies for millions of gamers worldwide. It enables users to choose from more than 250 safe and convenient payment methods and is visited more than 90 million times per month. Codapay, its proprietary payments engine, simplifies cross-border monetization for digital publishers

Loading...

Research containing Coda Payments

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Coda Payments in 7 CB Insights research briefs, most recently on Oct 24, 2024.

Oct 24, 2024 report

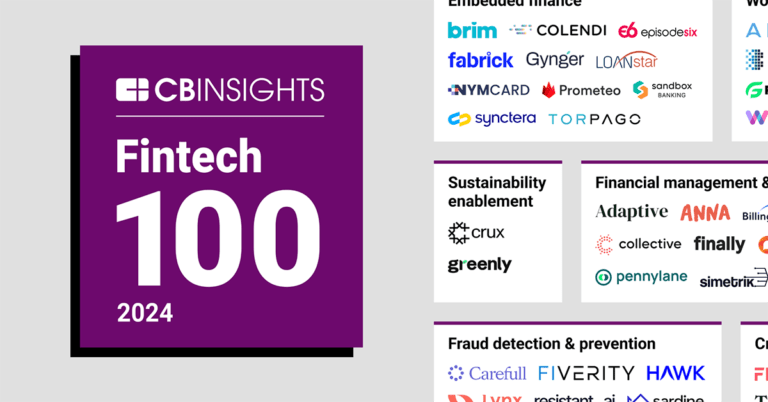

Fintech 100: The most promising fintech startups of 2024

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Jul 19, 2022 report

State of Fintech Q2’22 Report

Expert Collections containing Coda Payments

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Coda Payments is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

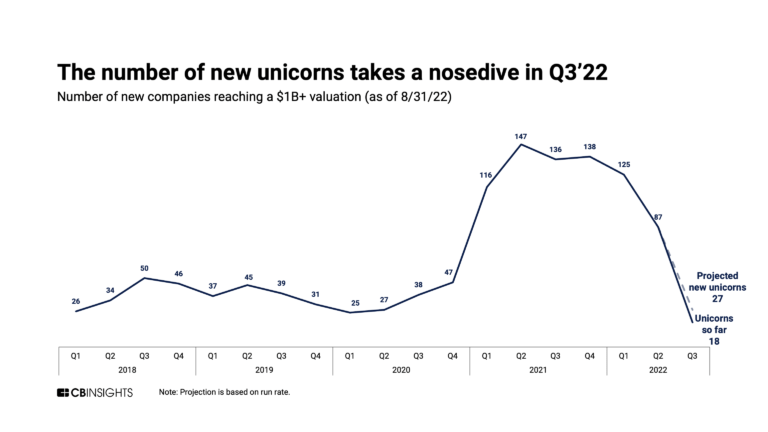

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,335 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech 100 (2024)

100 items

Latest Coda Payments News

Apr 10, 2025

The pay behind play: Evolving content monetization Mobile gaming is a lucrative industry, projected to reach $270 billion by 2032. Surpassing the combined value of the video and music industries, mobile gaming’s growth is moving full steam ahead. Its ubiquity has transformed how we play and, crucially, how we pay. Forget one-time purchases; gamers today transact frequently in a free-to-play world. Yes, you heard it right – gamers are spending money. They’re investing in their experiences, and in return, they demand choice, affordability, and seamless convenience. Think minimal friction and maximum value. At Coda, we partner with publishers to deliver precisely that. Publishers are cashing in smartly But it’s not all about ads. While ads are lucrative – PwC projects the advertising revenue of the entertainment and media industry to hit $1 trillion in 2026 – they break the immersion and flow of the experience. Instead, game publishers should focus on the combination of in-game ads and in-game purchases. Some of the most popular in-game purchases include paying for customizable ‘skins’, in-game credits, and currency. Loot boxes have also soared in popularity, especially amongst ‘ whales ’, synonymous with the more famous term ‘high roller’, despite regulatory efforts to clamp down on them. While the average basket for mobile games is relatively small, the frequency of purchases is high, as is the volume of gamers for popular titles. We’re talking tens, if not hundreds, of millions of players worldwide. As gamers pay to unlock new worlds and levels, the possibilities for gamers expand, and publishers rake in new revenue. It’s about the gameplay, and more Monetization now extends beyond the game itself. Reaching audiences on third-party platforms is crucial, particularly in regions like Southeast Asia, where 70 percent of the population is either underbanked or unbanked. By being creative about content monetization, publishers and creators are discovering more ways to engage with their audiences. Some even use monetization to reward customer loyalty and keep consumers returning for more. For example , Fortnite, one of the world’s biggest gaming success stories, starts free for users, with options later given for small in-game purchases such as limited edition skins. These extras have proved so popular that 69% of players choose to make more purchases. Another success story is Genshin Impact, where limited edition ‘banners’ generated on HoYoverse achieved record revenue. The monetization trend isn’t confined to gaming. Even dating apps like Tinder offer premium features to paying subscribers, promised increased visibility (hopefully more right swipes! ), and an extra shot at finding love online. Here’s the underlying principle: give end users a reason to spend money with you. Opportunity breeds competition Let’s face it: this lucrative landscape breeds fierce competition. Publishers are vying for every dollar, even challenging app store giants like Apple and Google over commission fees. Fortunately, that’s not the end game. At Coda, we offer alternative monetization solutions, navigating complex cross-border payments and providing significantly more favorable commission rates. Our agility and global reach resonate with publishers and end users alike. Direct fan relationships are key for some publishers. They want control, not payments processed through third parties. White-labeled solutions offer that direct connection, building stronger, longer-lasting relationships with fans that extend beyond the walls of the app. Influencers are essential. They promote games, new content, and even offline events to their massive audiences. This makes content more accessible and varied, boosting engagement. Plus, it gives creators more ways to earn, like ads and sponsorships. And fans are spending real money to support their favorite creators with digital gifts on livestreaming platforms and popular apps like TikTok. What’s next? Two interconnected catalysts drive end users toward spending more in the digital economy. First, it’s the demand for elevated entertainment experiences. Second, it’s the expectation that technology is empowering and must be used to facilitate engagement. Publishers looking to cash in on these two trends must crack the psyche behind how end users pay. There’s no doubt that pay has truly transformed the world of play over the years. With innovations for content monetization creating endless options for content publishers to engage with their fans worldwide, the possibilities for expanding the relationship between publisher and consumer are only beginning to be explored. Ultimately, the most successful monetization strategies will generate revenue and prioritize enjoyable player experiences that keep them coming back for more – striking the right balance is where today’s gaming companies can hit the jackpot. Abhi Sharma is the Chief Financial Officer at Coda, a global leader in out-of-app monetization and commerce solutions, where he leads Coda’s financial strategy. He joined Coda in 2021 and brings extensive experience in finance and investment to his role. With a background spanning tech-focused M&A, growth capital, and economic consulting, Abhi brings a wealth of experience from firms like Arma Partners and Catalyst Investment Partners. He holds a Master of Business Administration from Harvard Business School and a Bachelor of Arts in Economics and Mathematics from Pomona College.

Coda Payments Frequently Asked Questions (FAQ)

When was Coda Payments founded?

Coda Payments was founded in 2011.

Where is Coda Payments's headquarters?

Coda Payments's headquarters is located at 16 Raffles Quay, #33-03, Singapore.

What is Coda Payments's latest funding round?

Coda Payments's latest funding round is Series C.

How much did Coda Payments raise?

Coda Payments raised a total of $715.27M.

Who are the investors of Coda Payments?

Investors of Coda Payments include Apis Partners, GIC, Smash Ventures, Insight Partners, Toivo Annus and 10 more.

Who are Coda Payments's competitors?

Competitors of Coda Payments include Opn and 2 more.

What products does Coda Payments offer?

Coda Payments's products include Codashop and 2 more.

Loading...

Compare Coda Payments to Competitors

Airwallex develops a global financial platform that focuses on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

KredX is a leading provider of supply chain finance solutions, operating in the financial technology sector. The company offers a range of services including working capital solutions, invoice discounting, and cash flow management for businesses, as well as alternative investment opportunities for investors. KredX serves various sectors including enterprises, small and medium-sized businesses, and the global trade industry. It was founded in 2015 and is based in Bengaluru, India.

Finly provides accounts payable automation and finance operations for enterprises across various sectors. The company offers products that automate and facilitate finance processes including expense management, vendor payments, and e-procurement. Finly's solutions are aimed at improving financial governance and control within organizations. It was founded in 2015 and is based in Bengaluru, India.

Open Financial Technologies is a connected banking platform for simplifying business payments and cash flow management for Small and Medium-sized Enterprise (SMEs) and startups. The company offers financial tools that enable businesses to integrate their bank accounts for seamless vendor payments, receivables tracking, and automatic reconciliation with accounting software. Open primarily serves the e-commerce industry, retail, manufacturing, real estate, healthcare, hospitality, and professional services sectors. It was founded in 2017 and is based in Bengaluru, India.

EnKash is a financial technology company that operates in the business finance industry. The company provides services including accounts payable and receivable, expense management, and corporate card solutions. EnKash serves various sectors within this industry, offering tools for payment processing, expense tracking, and financial reporting. It was founded in 2017 and is based in Mumbai, India.

C2FO focuses on providing working capital solutions in the financial sector. The company offers services that allow businesses to get their invoices paid early, providing flexible access to low-cost capital. It helps eliminate the need for loans, paperwork, or other hassles, allowing businesses to control their cash flow and unlock potential in their balance sheets. C2FO was formerly known as Pollenware. It was founded in 2008 and is based in Leawood, Kansas.

Loading...