CoinDCX

Founded Year

2018Stage

Series D | AliveTotal Raised

$244.4MValuation

$0000Last Raised

$135M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-8 points in the past 30 days

About CoinDCX

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Loading...

ESPs containing CoinDCX

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The centralized crypto exchanges market refers to a segment of the cryptocurrency industry that involves trading digital assets through a centralized platform. These exchanges are owned and operated by a central authority, which manages the exchange's infrastructure, order book, and user funds. Centralized exchanges typically charge fees for trading, deposits, and withdrawals, and require users to…

CoinDCX named as Challenger among 15 other companies, including Coinbase, Binance, and HTX.

Loading...

Research containing CoinDCX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

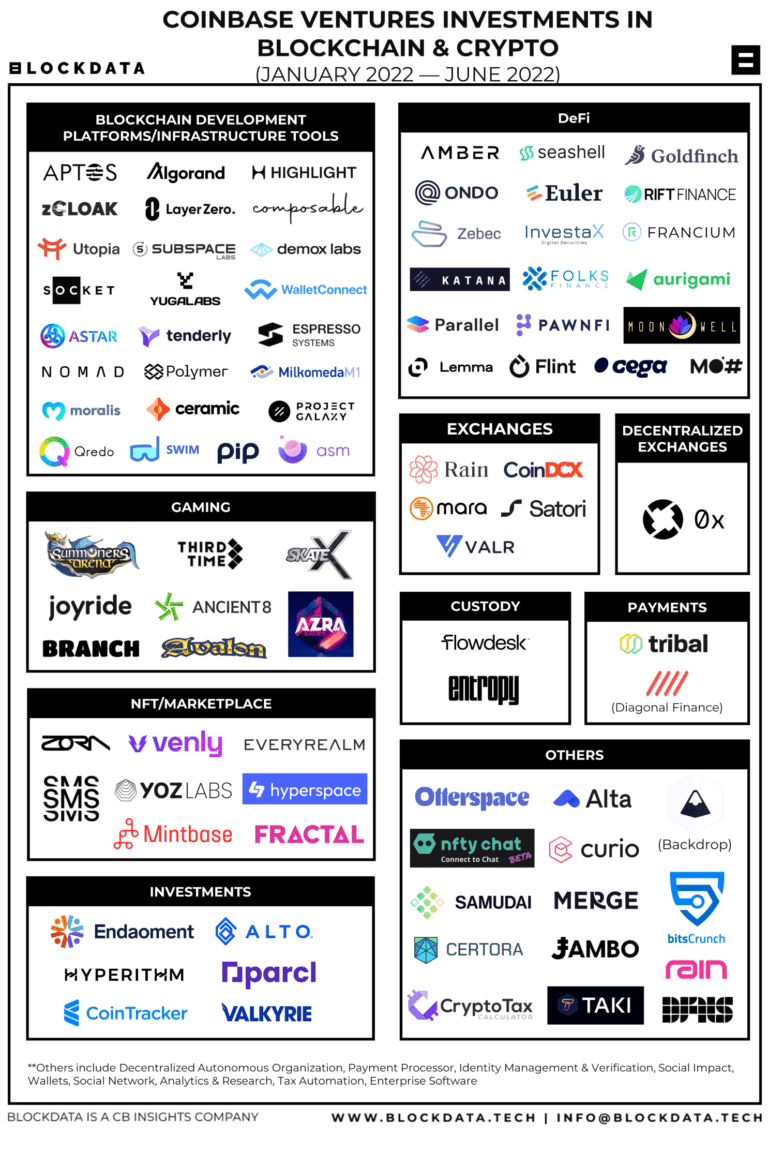

CB Insights Intelligence Analysts have mentioned CoinDCX in 4 CB Insights research briefs, most recently on Sep 10, 2022.

Sep 10, 2022

Where Coinbase Ventures is investing

Expert Collections containing CoinDCX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CoinDCX is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

9,296 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest CoinDCX News

Apr 9, 2025

What began as an effort to bridge the gap in India's nascent crypto market has evolved into a comprehensive digital asset ecosystem. This review delves into CoinDCX's offerings, its innovative business model, security measures, and overall market impact, providing an in‐depth look at why it stands out in the competitive world of crypto trading. A Gateway for Indian Crypto Enthusiasts CoinDCX was conceived at a time when reliable and user‐friendly platforms were scarce in India. The founders' vision was to democratize access to digital assets by creating an interface that caters to both beginners and experienced traders. Today, CoinDCX boasts a robust suite of features ranging from spot trading to advanced tools like margin and futures trading, staking, and lending services. By aggregating liquidity from top global exchanges, it offers Indian traders a seamless entry into the crypto world with the ease of local fiat integration (viz., Indian Rupees). Comprehensive Trading Suite At its core, CoinDCX provides a diverse array of trading options: Spot Trading: The platform offers real‑time trading of popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and several altcoins. The user-friendly dashboard, enhanced with TradingView's charting capabilities, makes it simple to track market movements and execute trades efficiently. Margin & Futures Trading: For more seasoned traders, CoinDCX enables margin trading with up to 6x leverage and futures trading up to 15x. While these leverage limits might seem modest compared to some global competitors, they are designed to balance risk and reward in a market that is still evolving within India. Staking & Lending: CoinDCX also allows users to stake their crypto assets to earn rewards or lend them for additional interest income. These features not only increase the utility of the platform but also provide avenues for passive income, encouraging long-term investment. CoinDCX Staking This multifaceted approach makes CoinDCX a one-stop shop for cryptocurrency enthusiasts, whether they are simply looking to invest or engage in sophisticated trading strategies. Security as a Cornerstone One of the most critical concerns in cryptocurrency trading is security. CoinDCX addresses this head-on by implementing industry-leading security protocols. The platform utilizes multi-signature wallets through partnerships with BitGo and integrates Ledger hardware wallet support for an added layer of safety. With two-factor authentication, withdrawal whitelists, and regular security audits, CoinDCX ensures that user funds remain secure, even as cyber threats continue to evolve. Their recent transparency report—published in March 2025—highlights robust reserve metrics and the growth of its insurance protection fund (CIPF), reinforcing the platform's commitment to trust and resilience. CoinDCX Security Innovative Business Model CoinDCX's business model is built primarily on a trading fee structure, with fees typically ranging from 0.1% to 0.3% per transaction. This model not only drives revenue but also allows the platform to reinvest in technology and security enhancements. Moreover, as India's first hybrid liquidity aggregator, CoinDCX benefits from sourcing liquidity from major global exchanges such as Binance, HitBTC, and Huobi Global, ensuring competitive pricing and minimal market slippage. The company's revenue streams extend beyond mere trading fees. With additional income from premium services, sponsored promotions, and innovative features like referral bonuses and airdrop campaigns, CoinDCX has created a vibrant ecosystem. This diverse revenue model has played a significant role in its rise to unicorn status, a rare achievement among startups in India's competitive financial services sector. User-Centric Approach and Educational Outreach CoinDCX has not only built a powerful trading engine but also focused on making cryptocurrency accessible to a broad audience. Their suite of educational tools—including blogs, tutorials, webinars, and live support—helps demystify crypto trading for newcomers. Initiatives like “CoinDCX Go” are specifically tailored for beginners, enabling them to understand market dynamics without feeling overwhelmed by technical jargon. Create a CoinDCX Account The emphasis on user education has been pivotal in driving crypto adoption in India. As reported in industry surveys, this commitment has helped reduce entry barriers, allowing even first-time investors to participate confidently in the crypto market. This user-centric approach underlines CoinDCX's mission to democratize finance and foster a culture of informed investing. Market Impact and Strategic Positioning CoinDCX has managed to carve a niche for itself in a highly competitive market. With over 16 million registered users and a significant portion of India's growing crypto community relying on its services, CoinDCX has proved its mettle. The platform's ability to attract a diverse user base—from retail investors in metropolitan areas to budding traders in tier‑II cities like Jaipur, Lucknow, and Patna—speaks volumes about its widespread appeal. Strategic partnerships and robust funding from notable investors such as Bain Capital, Polychain Capital, and Coinbase Ventures have further bolstered CoinDCX's market position. These partnerships not only enhance the platform's technological capabilities but also ensure that it remains agile in an industry marked by rapid regulatory and market changes. By aligning itself with global crypto leaders while focusing on the unique needs of Indian investors, CoinDCX has successfully positioned itself as a trailblazer in the digital asset space. Balancing Innovation with Caution Despite its many strengths, CoinDCX is not without its challenges. Some users have raised concerns regarding the limited number of listed coins compared to other global exchanges, and occasional issues with withdrawal processing have been reported. While these concerns are important, they reflect the growing pains typical of rapidly expanding platforms in a still-maturing market. CoinDCX appears to be addressing these issues through continuous updates, customer support enhancements, and expanding its coin listings gradually to meet market demand. Moreover, the leverage offered on margin and futures trading, while safer for risk management, might not satisfy traders looking for aggressive high-leverage opportunities. Nonetheless, this conservative approach has likely contributed to the platform's robust security record and long-term sustainability, ensuring that user funds remain protected in volatile market conditions. Transparency and Trust Transparency has become a key differentiator for CoinDCX. The release of regular transparency reports—such as the February 2025 report—shows its commitment to openness about reserves, insurance funds, and overall financial health. These reports not only build user trust but also set a benchmark for accountability in an industry that has seen its share of scams and security breaches. CoinDCX February Transparency Report This dedication to transparency reassures users that CoinDCX is not just about profit but also about safeguarding the interests of its community. In an environment where trust is paramount, such initiatives play a critical role in retaining and attracting investors. Future Outlook Looking ahead, CoinDCX is poised for further expansion and innovation. The company continues to explore new product offerings, such as advanced DeFi solutions and enhanced lending/borrowing features. There are also plans to broaden its geographical footprint beyond India, tapping into emerging markets where crypto adoption is on the rise. Investments in technology, regulatory compliance, and strategic partnerships will be crucial for sustaining its growth trajectory. As the cryptocurrency landscape evolves, CoinDCX's ability to adapt to regulatory changes and market demands will determine its long-term success. With a focus on both innovation and user protection, CoinDCX appears well-equipped to navigate future challenges while maintaining its leadership in India's digital asset revolution. With strong backing from global investors and a clear strategic vision, CoinDCX is well-positioned to lead the next phase of India's crypto revolution. For anyone looking to enter the world of cryptocurrency—whether as a beginner or an experienced trader—CoinDCX offers a secure, user-friendly, and dynamic platform that not only simplifies digital asset trading but also paves the way for broader financial inclusion. Frequently Asked Questions What is CoinDCX and why is it popular in India? CoinDCX is one of India's leading cryptocurrency exchanges, offering a full suite of services including spot, margin, and futures trading, as well as staking and lending. Its user-friendly interface, INR integration, and strong security make it a go-to platform for both beginners and experienced crypto traders in India. Is CoinDCX safe to use? Yes. CoinDCX employs top-tier security measures including multi-signature wallets (via BitGo), Ledger hardware wallet integration, two-factor authentication (2FA), and regular audits. The platform also publishes transparency reports and maintains an insurance protection fund to safeguard user assets. What trading options are available on CoinDCX? Users can engage in spot trading, margin trading with up to 6x leverage, and futures trading up to 15x. CoinDCX also offers staking and crypto lending for users seeking passive income opportunities. What are the fees on CoinDCX? Trading fees on CoinDCX typically range from 0.1% to 0.3% per transaction. These competitive rates are supported by deep liquidity sourced from global exchanges like Binance and Huobi, which helps reduce slippage. Does CoinDCX support beginners? Absolutely. CoinDCX offers beginner-friendly tools like CoinDCX Go, educational resources, and tutorials. The platform focuses on financial literacy and aims to simplify the crypto experience for Indian users just getting started. Mushumir Butt is a seasoned crypto journalist with over three years of experience reporting on the world of blockchain and cryptocurrency. At Blockchain Reporter, he delivers insightful news, in‐depth project reviews, and precise price analysis and predictions. With a strong background in SEO and digital marketing, Mushumir excels at breaking down complex trends into clear, accessible content, ensuring readers stay ahead in the fast‐paced crypto space. Source: https://blockchainreporter.net/coindcx-review-2025/

CoinDCX Frequently Asked Questions (FAQ)

When was CoinDCX founded?

CoinDCX was founded in 2018.

Where is CoinDCX's headquarters?

CoinDCX's headquarters is located at Andheri Kurla Road, Near Metal Estate, Andheri street, Marol Naka, Mumbai.

What is CoinDCX's latest funding round?

CoinDCX's latest funding round is Series D.

How much did CoinDCX raise?

CoinDCX raised a total of $244.4M.

Who are the investors of CoinDCX?

Investors of CoinDCX include Polychain Capital, Coinbase Ventures, B Capital, Kingsway Financial Services, Kindred Ventures and 20 more.

Who are CoinDCX's competitors?

Competitors of CoinDCX include Binance, Bitstamp, Nomoex, Kraken, bitFlyer and 7 more.

Loading...

Compare CoinDCX to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Circle provides a financial technology solution for users to send and receive funds globally. It offers crypto treasury management solutions for businesses to manage digital assets. The company serves asset managers, financial technology companies, and financial institutions. It was founded in 2013 and is based in Boston, Massachusetts.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Bitpanda focuses on providing an investment platform. The company offers investment options including stocks, cryptocurrencies, and precious metals, serving individuals with different investment budgets. It operates in the financial technology sector. The company was founded in 2014 and is based in Vienna, Austria.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Loading...