Consensys

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$732.5MLast Raised

$14M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-37 points in the past 30 days

About Consensys

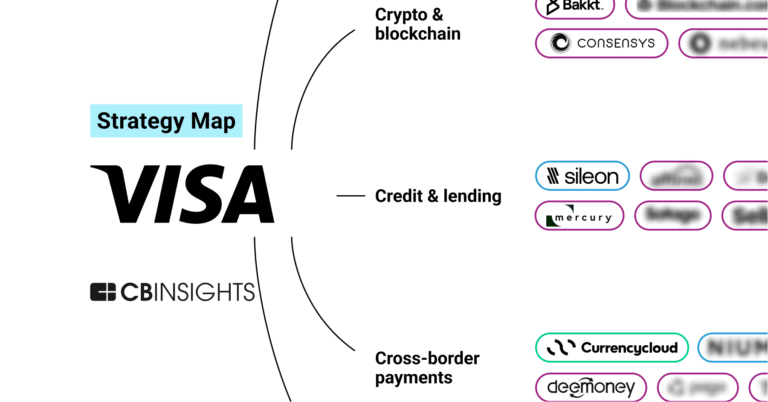

Consensys is a blockchain and web3 software company focused on developing products for the decentralized web. The company offers services including self-custodial wallet solutions, tools for building decentralized applications, zkEVM rollup technology for scaling Ethereum, smart contract auditing, and staking services. Consensys serves developers, creators, and users within the web3 ecosystem. It was founded in 2014 and is based in Fort Worth, Texas.

Loading...

Consensys's Product Videos

ESPs containing Consensys

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

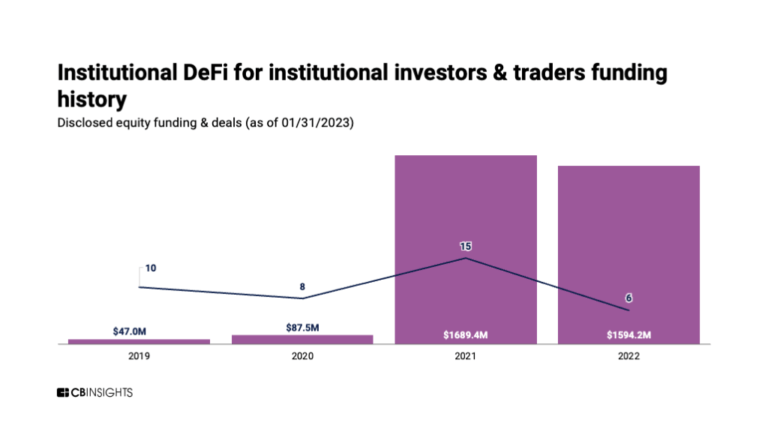

The institutional decentralized finance (DeFi) market refers to the use of decentralized finance protocols and platforms by institutional investors, such as hedge funds, asset managers, and corporations, to access DeFi services and generate returns. Technology vendors in this market offer end-to-end software solutions. These solutions provide secure access to top distributed networks, offering sec…

Consensys named as Leader among 15 other companies, including Circle, BitGo, and Fireblocks.

Consensys's Products & Differentiators

MetaMask

Mobile Wallet and Browser Extension

Loading...

Research containing Consensys

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Consensys in 17 CB Insights research briefs, most recently on Jul 6, 2023.

Dec 14, 2022

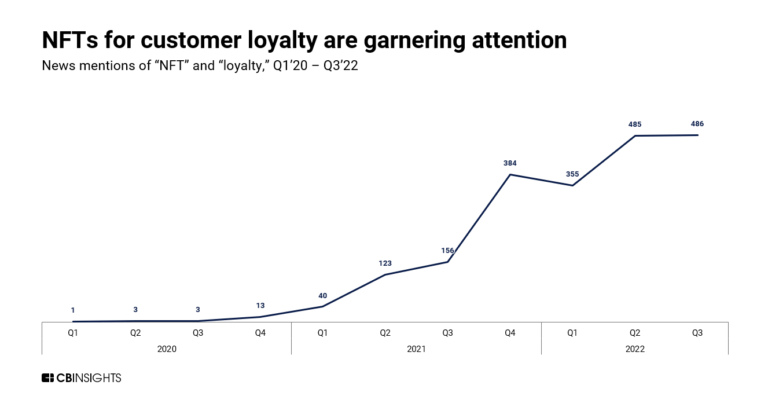

What L’Oréal, Nike, and LVMH are doing in Web3

Nov 19, 2022

State of Enterprise Blockchain 2022Expert Collections containing Consensys

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Consensys is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

14,491 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Conference Exhibitors

5,302 items

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Consensys Patents

Consensys has filed 5 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- alternative currencies

- blockchains

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/4/2020 | 12/31/2024 | Cryptocurrencies, Cryptography, Anonymity networks, Blockchains, Network protocols | Grant |

Application Date | 12/4/2020 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Cryptocurrencies, Cryptography, Anonymity networks, Blockchains, Network protocols |

Status | Grant |

Latest Consensys News

Apr 5, 2025

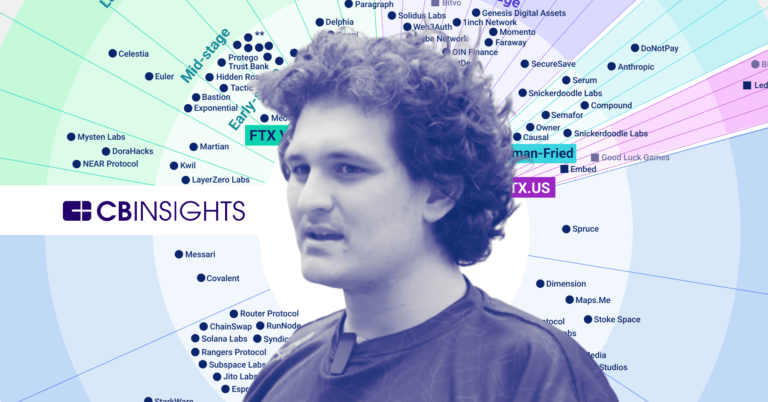

The action is being taken under Executive Order 14192 , titled “Unleashing Prosperity Through Deregulation,” and on recommendations from the Department of Government Efficiency (DOGE). President Trump issued the order on January 31, aimed at reducing regulatory burdens on businesses and individuals in the US. The executive order encourages federal agencies to cut back on unnecessary regulations that could stifle innovation or economic growth. The order targets regulatory rollbacks with a sweeping “10-for-1” mandate, requiring federal agencies to eliminate at least ten existing rules for every new one proposed. It marks a sharp escalation from the “2-for-1” policy implemented during Trump’s first term. The SEC staff’s review could lead to simplified or clarified rules for crypto companies, or possibly less oversight depending on the outcome. “The purpose of this review is to identify staff statements that should be modified or rescinded consistent with current agency priorities,” Uyeda stated. Under the second Trump administration, the SEC is expected to undergo plenty of changes in its priorities and regulatory approach. The regulator has adopted a more crypto-friendly approach compared to previous administrations. Over the past few weeks, the SEC has dismissed pending cases against major crypto companies like Coinbase, Consensys, and Kraken, to name a few. SEC states covered stablecoins are not securities The securities watchdog is also working to clarify the status of various crypto assets, determining which are securities and which are not. On April 4, the SEC declared that ‘covered’ stablecoins, such as Tether’s USDT and Circle’s USDC, are not classified as securities. These tokens, fully backed by fiat reserves or liquid instruments and redeemable at a 1:1 ratio with US dollars, will not require transaction reporting with the commission. The criteria exclude algorithmic stablecoins that use software for their dollar peg. The guidelines also restrict covered stablecoin issuers from mingling reserves with operational funds or offering yields to token holders. With pro-innovation Paul Atkins potentially leading the SEC, there may be a more accommodating stance toward digital assets. Market observers hope that Atkins’ appointment could lead to more approvals of digital asset ETFs. The Senate Banking Committee on Thursday approved Paul Atkins’ nomination as US SEC Chair, with proceedings moving to a full Senate vote. Atkins could assume his position shortly after he is confirmed by the Senate. Share this article

Consensys Frequently Asked Questions (FAQ)

When was Consensys founded?

Consensys was founded in 2014.

Where is Consensys's headquarters?

Consensys's headquarters is located at 5049 Edwards Ranch Road, Fort Worth.

What is Consensys's latest funding round?

Consensys's latest funding round is Secondary Market.

How much did Consensys raise?

Consensys raised a total of $732.5M.

Who are the investors of Consensys?

Investors of Consensys include Fabrica Ventures, Mindrock Capital, ParaFi Capital, Marshall Wace Asset Management, Third Point Ventures and 35 more.

Who are Consensys's competitors?

Competitors of Consensys include Phantom, Taurus, Emtech, vlayer, Fireblocks and 7 more.

What products does Consensys offer?

Consensys's products include MetaMask and 4 more.

Loading...

Compare Consensys to Competitors

Hyperledger is an open source initiative focused on blockchain technologies within the decentralized systems domain. The organization provides services including the development of ledger technologies, interoperability solutions, decentralized identity systems, and cryptographic protocols. Hyperledger serves sectors that require financial infrastructures, digital identity solutions, and secure systems. It was founded in 2015 and is based in San Francisco, California.

R3 focuses on the digitization of financial services within the enterprise technology sector. It offers a private, permissioned distributed ledger technology (DLT) platform named Corda, designed to enable secure and direct digital collaboration among regulated institutions. R3's solutions cater to various sectors, including banks, central banks, corporations, exchanges, central counterparties, and fintech, providing services such as tokenization of digital assets and currencies, streamlined inter-bank transactions, and modernization of legacy workflows. It was founded in 2014 and is based in New York, New York.

Ripple provides digital asset infrastructure for financial services, focusing on cross-border payments and digital asset management. The company offers solutions for payment settlement, liquidity management, and a global payout network, as well as services for storing and managing digital assets. Ripple was formerly known as OpenCoin. It was founded in 2012 and is based in San Francisco, California.

SettleMint provides a platform for the development and integration of blockchain applications across various sectors. The company offers tools for smart contract creation, asset tokenization, and non-fungible token (NFT) management, aimed at facilitating blockchain adoption for enterprises. Its platform supports a range of use cases relevant to businesses utilizing blockchain technology. The company was founded in 2016 and is based in Leuven, Belgium.

Try Your Best is a community rewards platform in the brand loyalty and engagement sector. The company facilitates a system where brands can create challenges and fans can earn rewards for participating, which can be redeemed for discounts on purchases. TYB primarily serves the ecommerce industry, enabling brands to foster deeper connections with their customers and measure loyalty effectively. Try Your Best was formerly known as TYB, Inc.. It was founded in 2020 and is based in Tucson, Arizona.

BlockInvest focuses on the tokenization of real-world assets within the financial technology sector. The company offers a platform for creating digital securities, enabling the digitization and management of asset sales and investments on the blockchain. It serves financial institutions and market participants looking to optimize alternative asset transactions. It was founded in 2019 and is based in Milano, Italy.

Loading...