Cover Genius

Founded Year

2014Stage

Series E | AliveTotal Raised

$240.5MLast Raised

$80M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+34 points in the past 30 days

About Cover Genius

Cover Genius is the insurtech company that specializes in embedded protection for various industries. Its main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables instant claims payments in over 90 currencies. It primarily serves sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Loading...

ESPs containing Cover Genius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

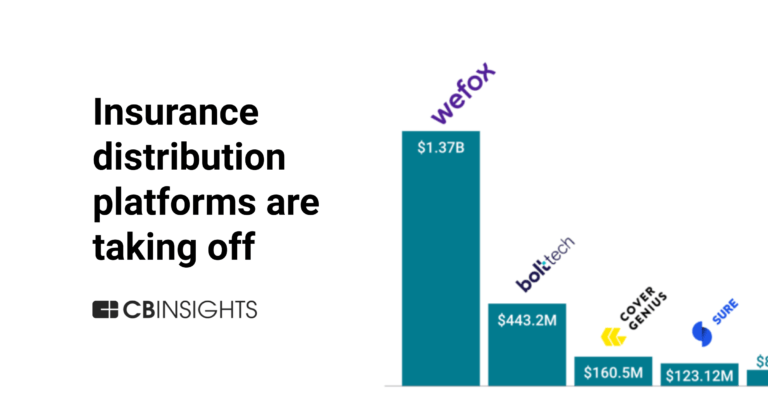

Cover Genius named as Leader among 15 other companies, including Bolttech, Igloo, and Socotra.

Cover Genius's Products & Differentiators

XCover

XCover is Cover Genius’ award-winning global distribution platform. It protects the customers of the world’s largest digital companies with seamless, end-to-end experiences. Licensed or authorized in over 60 countries and all 50 US States, XCover enables merchants to embed and sell multiple lines of insurance and other types of protection, backed by an industry-leading post-claims Net Promoter Score (NPS).

Loading...

Research containing Cover Genius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cover Genius in 7 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Dec 18, 2023

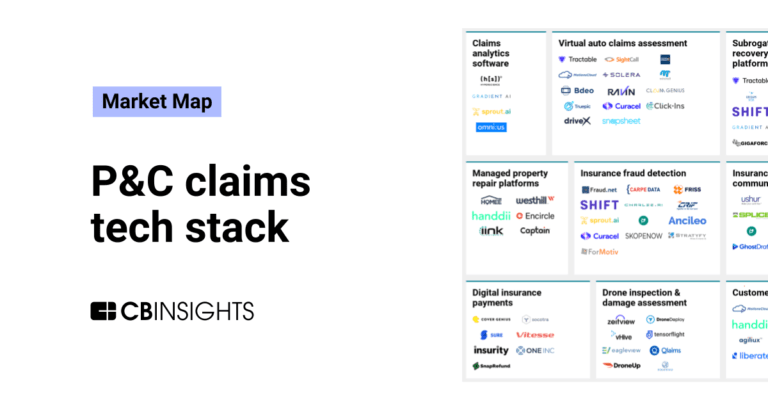

The P&C claims tech stack market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Cover Genius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cover Genius is included in 7 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,391 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Cover Genius Patents

Cover Genius has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/15/2016 | Social networking services, User interfaces, Usability, Virtual communities, Pricing | Application |

Application Date | 7/15/2016 |

|---|---|

Grant Date | |

Title | |

Related Topics | Social networking services, User interfaces, Usability, Virtual communities, Pricing |

Status | Application |

Latest Cover Genius News

Apr 10, 2025

Cover Genius Teams Up With Luxury Escapes Latest partnership news from Cover Genius for you; Luxury Escapes , a leading Australian exclusive travel provider, and Cover Genius , a leader in embedded protection, have expanded their longstanding partnership with the launch of Cancellation Protection, a new protection product available for Australian and New Zealand customers booking domestic travel, as well as for international travellers worldwide. The partnership extension brings additional peace of mind to customers travelling from Europe, North America, the Middle East and Asia with cancellation protection backed by a seamless claims process, reinforcing both companies’ commitment to offering a superior experience for customers. This protection provides a 100% refund for cancellations due to unforeseen events including but not limited to: sickness, accident, injury, pre-existing medical conditions, flight disruption, adverse weather, theft of documents, transport failure, home emergencies, professional obligations, workplace redundancy and other unexpected events that may disrupt travel plans. Cover Genius’ embedded cancellation solution provides a seamless, customer-friendly experience for travellers booking through Luxury Escapes. Whether it’s for flights, hotels, or unique travel experiences, the protection ensures that customers are refunded swiftly and efficiently in almost any currency, protecting getaways and bucket-list moments. As part of this latest development, customers can now also purchase Cancellation Protection from within the Luxury Escapes app as well as on the website or through the call centre, making the travel booking experience even simpler regardless of how customers make their booking, building on the protection offering previously available for customers travelling from Australia, New Zealand and Singapore. Cover Genius is a trusted protection, compliance and regulatory partner for major digital brands worldwide, offering global reach with licenses or authorisations in over 60 countries and the ability to co-create tailored protection solutions for customers. As a reliable partner for insurers and underwriters, Cover Genius enables its partners to access key markets and expand their customer base across the globe. “This expansion reflects our ongoing dedication to providing our customers with a reliable, one-stop-shop for all their travel protection needs,” said Luxury Escapes CEO and Co-Founder Adam Schwab. “With the addition of Cancellation Protection which now also covers experiences, we’re offering even greater flexibility and protection to travellers, ensuring they can book with confidence, no matter their destination.” “We are proud to continue our strong partnership with Luxury Escapes, expanding our protection services to more regions as they continue to grow worldwide,” said Angus McDonald, CEO and Co-founder of Cover Genius. “Globally, we are seeing customers shift towards protection solutions tailored to their specific needs and demographics, rather than traditional bundled offerings. By integrating these solutions into the online and app-based Luxury Escapes booking journey, we’re making it easier for customers to confidently choose the right travel protection and tick cancellation coverage off their pre-travel to-do list.” This milestone marks another significant step in the collaboration between the two companies, which has been expanding over several years. With a shared vision of delivering superior value to customers, this partnership continues to evolve, providing more tailored and accessible protection options across a growing list of destinations and experiences. Share this:

Cover Genius Frequently Asked Questions (FAQ)

When was Cover Genius founded?

Cover Genius was founded in 2014.

Where is Cover Genius's headquarters?

Cover Genius's headquarters is located at 11 West 42nd Street, New York.

What is Cover Genius's latest funding round?

Cover Genius's latest funding round is Series E.

How much did Cover Genius raise?

Cover Genius raised a total of $240.5M.

Who are the investors of Cover Genius?

Investors of Cover Genius include King River Capital, G Squared, Dawn Capital, Spark Capital, Atlas Merchant Capital and 8 more.

Who are Cover Genius's competitors?

Competitors of Cover Genius include Bolttech, Insuritas, Boost, AIG Kenya Insurance, Curacel and 7 more.

What products does Cover Genius offer?

Cover Genius's products include XCover and 4 more.

Who are Cover Genius's customers?

Customers of Cover Genius include https://www.priceline.com.

Loading...

Compare Cover Genius to Competitors

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform as a service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

Bolttec focuses on ecosystems for protection and insurance. The company provides an embedded insurance platform that includes a distribution engine, product configurator, and sales and servicing solutions. Bolttech serves the insurance and protection product industries, connecting insurers, distributors, and customers. Bolttech was formerly known as EdirectInsure Group. It was founded in 2020 and is based in Singapore.

Ancileo is a provider of insurance technology solutions, specializing in the digital distribution of insurance products and services. The company offers a suite of enterprise solutions including API integration, white label services, agent portal management, AI-driven claims automation, policy management, and localized premium billing, all designed to enhance the operations of insurers, re-insurers, brokers, and affinity partners. Ancileo's technology is tailored to support the insurance industry, with a focus on travel insurance portfolios. It was founded in 2016 and is based in Singapore, Singapore.

Boost focuses on providing digital insurance solutions in the insurance technology sector. It offers a digital insurance platform that provides compliance, capital, and technology infrastructure for insurance technology companies, MGAs, and embedded insurance. It primarily sells to the insurance technology industry, as well as to MGAs, brokers, agents, and embedded insurance platforms. The company was founded in 2017 and is based in New York, New York.

Root specializes in low-code, API-first insurance technology within the insurtech sector. The company offers an end-to-end insurance platform that enables clients to build, launch, and manage digital and embedded insurance products with ease. Root's platform serves a diverse range of clients, including large brands, retailers, insurance providers, and captives, primarily in the insurance industry. It was founded in 2016 and is based in Cape Town, South Africa.

Loading...