Dataminr

Founded Year

2009Stage

Line of Credit | AliveTotal Raised

$1.044BMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+76 points in the past 30 days

About Dataminr

Dataminr uses artificial intelligence for event and risk detection across various sectors. It's platform analyzes publicly available data to provide alerts on significant events and emerging risks, serving clients that include corporations, public sector agencies, newsrooms, and non-governmental organizations (NGOs). It's main offerings consist of solutions for corporate security and cyber risk management, and tools for journalists to find and report on news stories.. It was founded in 2009 and is based in New York, New York.

Loading...

Loading...

Research containing Dataminr

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dataminr in 2 CB Insights research briefs, most recently on Aug 21, 2023.

Aug 14, 2023

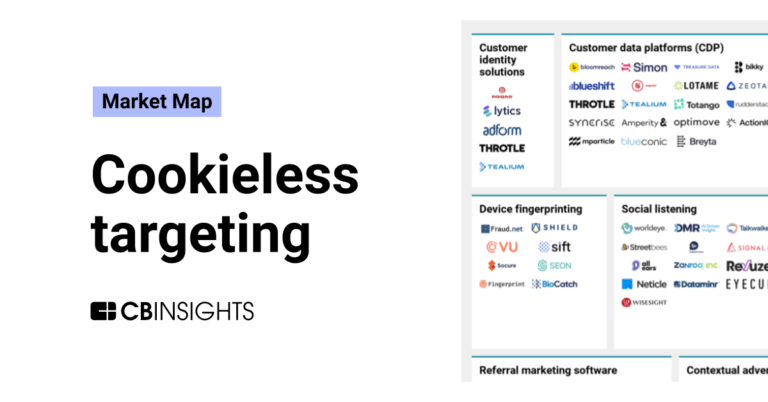

The cookieless targeting market mapExpert Collections containing Dataminr

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dataminr is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

7,632 items

Latest Dataminr News

Mar 28, 2025

Dataminr, which is one of the world’s leading AI companies, announced it has secured $85 million in new funding from NightDragon and HSBC through a combination of convertible financing and credit. This new capital will enable Dataminr to accelerate its growth trajectory and continue to pioneer trailblazing Generative AI and Agentic AI capabilities that shape the future of real-time information. Dataminr will also use this new funding to expand its international go-to-market in Europe, the Middle East, and Asia, as well as to power additional products in new verticals with its Platform API. Geopolitical tensions, economic instability, cybersecurity threats, and technological disruptions are creating challenges for businesses and governments worldwide. As these risks converge, they pose potentially catastrophic consequences for corporations and governments that are unprepared. And without accurate and real-time information, informed decision-making becomes increasingly difficult, leaving organizations vulnerable to missteps, miscalculations, and even disaster. Dataminr has created a transformative real-time AI platform for discovering events, risks, and threats. Using its unique multi-modal Fusion AI—which synthesizes images, video, sound, machine-generated sensor data, and text in 150 languages—Dataminr performs trillions of daily computations across billions of daily multi-modal public data signals and millions of public data sources to deliver the fastest, most accurate, and most comprehensive real-time information. Last year, Dataminr launched ReGenAI, a form of Gen AI that automatically regenerates live event briefs in real time as events unfold. And in April 2025, the company will launch Context Agents, a novel Agentic AI capability that dynamically adds real-time context around breaking events, risks, and threats. Dataminr’s AI platform is powered by more than 50 proprietary LLMs and multi-modal foundation models, all trained on Dataminr’s 12+ year unique event and data archive. KEY QUOTES: “As global risks become increasingly complex, unpredictable, and catastrophic, the demand for real-time, AI-driven intelligence has never been more urgent. When seconds matter and truth is obscure, Dataminr is helping the world’s leading organizations and governments make smarter, more informed decisions in real-time by pushing the boundaries of what’s possible with AI. NightDragon is honored to lead this latest investment in Dataminr, as we work together to build the future of reimagined real-time decision support and become the system of record for a growing number of verticals and industries.” – Dave DeWalt, Founder and CEO, NightDragon; DeWalt will additionally join the Dataminr Board of Directors as Vice Chairman “With this latest financing, HSBC is proud to support Dataminr in their growth as they expand internationally and develop new applications across additional verticals. Dataminr stands out in the current AI landscape through its unique ability to process billions of data signals in real-time, delivering organizations the critical intelligence needed to preempt emerging threats. Their innovative approach to multi-modal AI and real-time decision support enables industry-leading response-times.” – Prasant Chunduru, HSBC Head of Technology Credit Solutions “We are excited to welcome esteemed investors NightDragon and HSBC, and thrilled to have security industry luminary Dave DeWalt join the Dataminr board as Vice Chairman as we seek to turbocharge our go-to-market efforts and meet growing global demand for our products. The era of Gen AI and Agentic AI holds immense new opportunities for Dataminr. We look forward to using this capital to continue pioneering trailblazing AI capabilities that solve tangible real-world problems for our customers.” – Ted Bailey, Founder and CEO, Dataminr Pulse 2.0 focuses on business news, profiles, and deal flow coverage.

Dataminr Frequently Asked Questions (FAQ)

When was Dataminr founded?

Dataminr was founded in 2009.

Where is Dataminr's headquarters?

Dataminr's headquarters is located at 6 East 32nd Street, New York.

What is Dataminr's latest funding round?

Dataminr's latest funding round is Line of Credit.

How much did Dataminr raise?

Dataminr raised a total of $1.044B.

Who are the investors of Dataminr?

Investors of Dataminr include HSBC, NightDragon, Fabrica Ventures, Institutional Venture Partners, MSD Capital and 38 more.

Who are Dataminr's competitors?

Competitors of Dataminr include CloudMargin, Accern, Capitolis, NYSHEX, VULCAiN Ai and 7 more.

Loading...

Compare Dataminr to Competitors

Q4 provides capital markets access platforms, operating within the financial technology sector. The company offers products including IR website products, virtual event solutions, engagement analytics, investor relations CRM, shareholder and market analysis, surveillance, and ESG tools, designed to facilitate efficient communication and engagement between issuers, investors, and the sell-side. Q4 primarily serves public companies across various industries seeking to enhance their investor relations and capital market activities. It was founded in 2006 and is based in Toronto, Canada.

Symphony is a technology company that provides communication infrastructure for the financial services industry. The company offers products including messaging, voice communication, directory services, and analytics tailored for market participants. Symphony's solutions facilitate standardized and automated workflows, catering to the needs of institutions and professionals. It was founded in 2014 and is based in New York, New York.

CloudMargin is a cloud-based collateral management workflow tool. The firm's Software-as-a-Service model helps financial institutions, including exchanges, brokerage firms, banks, asset management firms, and insurance companies, meet regulatory deadlines and reduce costs associated with collateral requirements that are growing. CloudMargin enables clients to experience rapid implementation and access to robust and secure collateral management workflow software. It was founded in 2014 and is based in London, United Kingdom.

Trumid operates as a financial technology company. It offers an electronic trading platform and provides corporate bond market professionals with direct access to anonymous and counterparty-disclosed liquidity. It primarily serves the financial technology sector. The company was founded in 2014 and is based in New York, New York.

NYSHEX focuses on the ocean supply chain through its digital platform in the shipping industry. The company offers services for shippers, carriers, and NVOCCs. NYSHEX primarily serves the global shipping sector, providing a system of record for all parties involved. It was founded in 2014 and is based in New York, New York.

sFOX is a full-service crypto prime dealer that operates in the financial services industry, focusing on institutional investors. The company offers a suite of services including trading, liquidity solutions, secure custody, staking, prime services, and API integration to facilitate digital asset transactions. sFOX caters primarily to institutions, asset managers, financial institutions, advisors, hedge funds, crypto exchanges, family offices, and sophisticated individual traders. sFOX was formerly known as Ox Labs Inc.. It was founded in 2014 and is based in El Segundo, California.

Loading...