Devoted Health

Founded Year

2017Stage

Series E - II | AliveTotal Raised

$2.256BLast Raised

$112M | 8 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+31 points in the past 30 days

About Devoted Health

Devoted Health is a healthcare company focused on providing medicare advantage plans. It's offerings include healthcare coverage with benefits such as dental, eyewear, gym memberships, and support for medication needs. The company primarily serves the older American population seeking Medicare-related health services. It was founded in 2017 and is based in Waltham, Massachusetts.

Loading...

ESPs containing Devoted Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital health insurance providers market refers to insurtech companies that provide private health insurance plans. Companies in this market often focus on providing distinguished value propositions — like telehealth and preventative care services, direct pay capabilities, or member navigation apps. Digital health insurance providers go beyond just the insurance sales process, and some of the…

Devoted Health named as Highflier among 12 other companies, including Oscar, Clover Health, and Acko.

Devoted Health's Products & Differentiators

Devoted Health Plans

Devoted Health built its Medicare Advantage health insurance plans from scratch. Its plan is purpose-built and optimized from inception to deliver and scale value-based payment and care, creating a better healthcare experience for seniors and their providers.

Loading...

Research containing Devoted Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Devoted Health in 7 CB Insights research briefs, most recently on Nov 14, 2024.

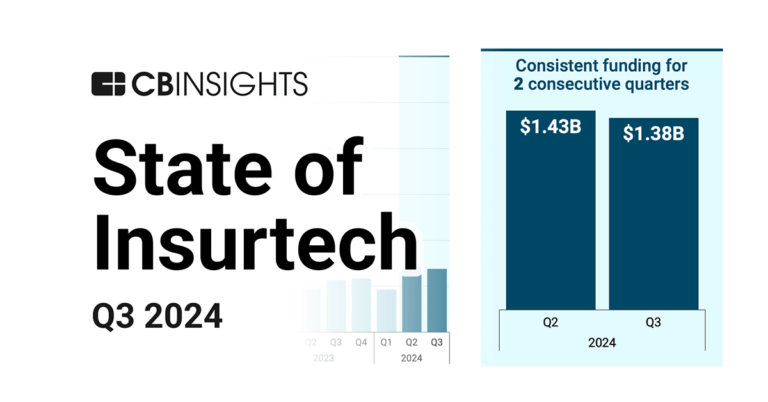

Nov 14, 2024 report

State of Insurtech Q3’24 Report

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

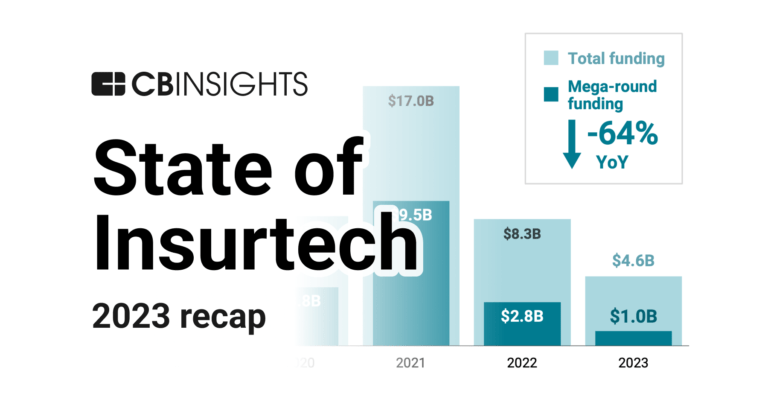

State of Insurtech 2023 Report

Jan 25, 2024 report

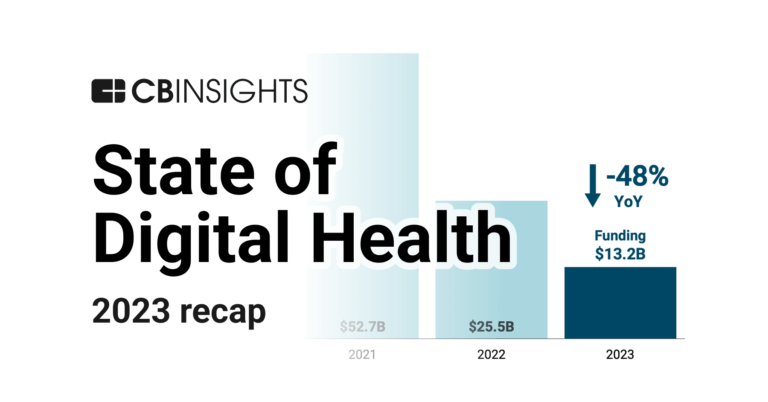

State of Digital Health 2023 Report

Expert Collections containing Devoted Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Devoted Health is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Insurtech

3,304 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Value-Based Care & Population Health

892 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Latest Devoted Health News

Mar 10, 2025

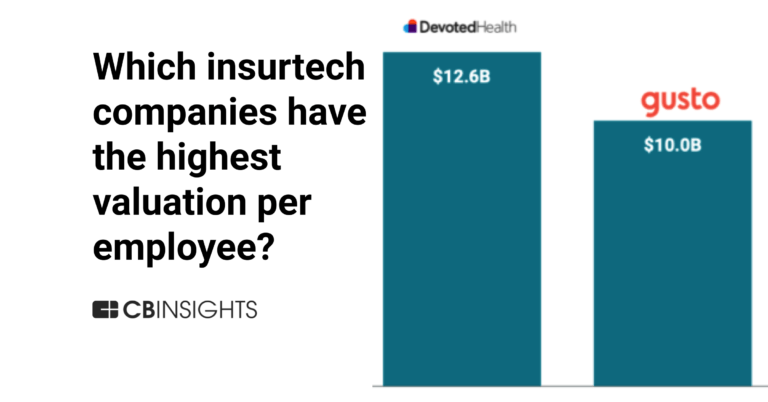

MAMEN PONCE DE LEÓN En la actualidad, hay 36 'start ups' de seguros milmillonariasDREAMSTIMEEXPANSION El año pasado estuvo a punto de cerrarse con el casillero vacío de nuevos unicornios (compañías tasadas en 1.000 millones de dólares, alrededor de 920 millones de euros, o más) provenientes del insurtech. Una sola start up de seguros se convirtió en milmillonaria en este periodo en el mundo. Se trata de Altana AI, un proyecto con base en Estados Unidos y que aplica la inteligencia artificial a la gestión de la cadena de valor de las empresas. Altana AI pasó a integrar el club de los unicorniosen el tercer trimestre de 2024, en julio, después de finalizar con éxito una ronda de financiación por valor de 200 millones de dólares, en la que participaron March Capital, Generation Investment Management, Salesforce Ventures y Friends and Family Capital, entre otros inversores, y que estuvo capitaneada por el Fondo de Tecnología Innovadora de Estados Unidos (US Innovative Technology Fund) del multimillonario Thomas Tull. La exigüidad en la producción de unicornios no es nueva para el insurtech. En 2023 el patrón que siguió el sector fue idéntico y solo un proyecto de tecnología aplicada a los seguros consiguió alcanzar una valoración de 1.000 millones de dólares. Entonces, se trató de Kin, una plataforma constituida también en Estados Unidos en 2016 y cuyo principal ángulo de actividad se dirige a la distribución digital de coberturas aseguradoras para viviendas. Panorama Estos registros tan pobres nada tienen que ver con los de 2021 y 2022, cuando este sector se convirtió en una prolífica fábrica de unicornios, con más de una veintena de nuevas empresas milmillonarias, aprovechando el boom de inversión que entonces había alrededor de la tecnología aplicada a los seguros. En los dos últimos años el panorama ha sido bien diferente. El insurtech ha reducido mucho el potencial atraído en el mercado y apenas se han contabilizado megarrondas de financiación (las operaciones que exceden los 100 millones de dólares), que son las que mueven mayor cantidad de recursos. Esta debilidad también ha hecho que algunas start ups de seguros pierdan valor y la categoría de unicornios. Después de contabilizar las entradas y salidas, el club de start ups milmillonarias está integrado en la actualidad por 36 compañías de seguros, 12 menos que a cierre de 2022, según los registros del servicio de análisis CB Insight. De este total, la mayoría (23) son proyectos originarios de Estados Unidos; Europa aporta nueve; Asia, tres, y Latinoamérica, uno. Los dos unicornios provenientes del insurtechmás valorados son Devoted Health (aseguradora enfocada al ramo de salud y cuyo precio ronda los 12.900 millones de dólares) y Gusto (que también se vuelca en los planes de asistencia sanitaria a empleados y que está tasada en alrededor de 10.000 millones de dólares). La tercera en el ránking está un peldaño por debajo y es Coalition, dedicada a los ciberseguros, valorada en 5.000 millones de dólares. Las tres compañías tienen base en Estados Unidos.

Devoted Health Frequently Asked Questions (FAQ)

When was Devoted Health founded?

Devoted Health was founded in 2017.

Where is Devoted Health's headquarters?

Devoted Health's headquarters is located at 221 Crescent Street, Waltham.

What is Devoted Health's latest funding round?

Devoted Health's latest funding round is Series E - II.

How much did Devoted Health raise?

Devoted Health raised a total of $2.256B.

Who are the investors of Devoted Health?

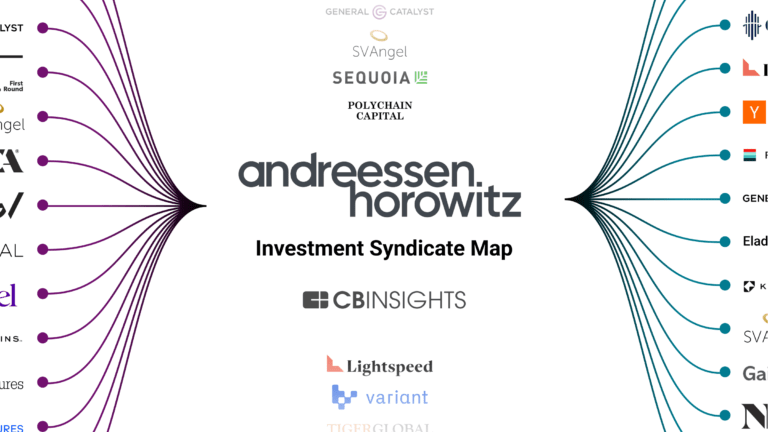

Investors of Devoted Health include The Space Between, Cox Enterprises, White Road Investments, Andreessen Horowitz, F-Prime Capital and 22 more.

Who are Devoted Health's competitors?

Competitors of Devoted Health include NeueHealth and 8 more.

What products does Devoted Health offer?

Devoted Health's products include Devoted Health Plans and 2 more.

Loading...

Compare Devoted Health to Competitors

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. The company serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group Inc. It was founded in 2015 and is based in Minneapolis, Minnesota.

Carelon is a healthcare services company focused on delivering whole-person care across various domains within the healthcare industry. The company offers integrated care models, digital tools, and services that address physical, mental, social, and economic health factors, aiming to simplify healthcare experiences, improve outcomes, and manage costs. Carelon's solutions are designed to support individuals with complex health conditions, provide behavioral health management, and facilitate primary and palliative care, alongside pharmacy services and medical benefits management. It was founded in 2017 and is based in Morristown, New Jersey.

Alignment Health operates as a health insurance provider focused on offering Medicare plans. The company provides on-demand access to healthcare services, including in-person, in-home, and mobile device consultations, along with a range of all-inclusive benefits for its members. The company primarily serves the Medicare beneficiaries sector. It was founded in 2013 and is based in Orange, California.

UnitedHealthcare is a health insurance company that offers various health plans and services, including Medicare Advantage, Medicaid, individual and family plans, dental, vision, and supplemental insurance options. UnitedHealthcare primarily sells to individuals, families, and employers seeking health insurance. UnitedHealthcare was formerly known as Bind. It was founded in 1974 and is based in Hopkins, Minnesota.

Blue Cross and Blue Shield of North Carolina is a health insurance provider offering individual and family health insurance plans, Medicare, dental, and vision options, as well as plans for small and large employers. It was founded in 1933 and is based in Durham, North Carolina.

HPOne operates within the healthcare sector, focusing on health insurance and Medicare plans. The company provides sales, marketing, and member outreach services to facilitate the management of Medicare and health insurance members. It was founded in 2006 and is based in Trumbull, Connecticut.

Loading...