Earnix

Founded Year

2001Stage

Secondary Market | AliveTotal Raised

$98.5MLast Raised

$120M | 10 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-64 points in the past 30 days

About Earnix

Earnix provides predictive analytics solutions for the financial services industry. It focuses on strategies, processes, and an evolving ecosystem of technologies to help insurers and banks operate. It helps in business operations, pricing and rating, customer engagement, product personalization, and more. It serves the telematics, health, and insurance industries. The company was founded in 2001 and is based in Ramat Gan, Israel.

Loading...

Earnix's Product Videos

ESPs containing Earnix

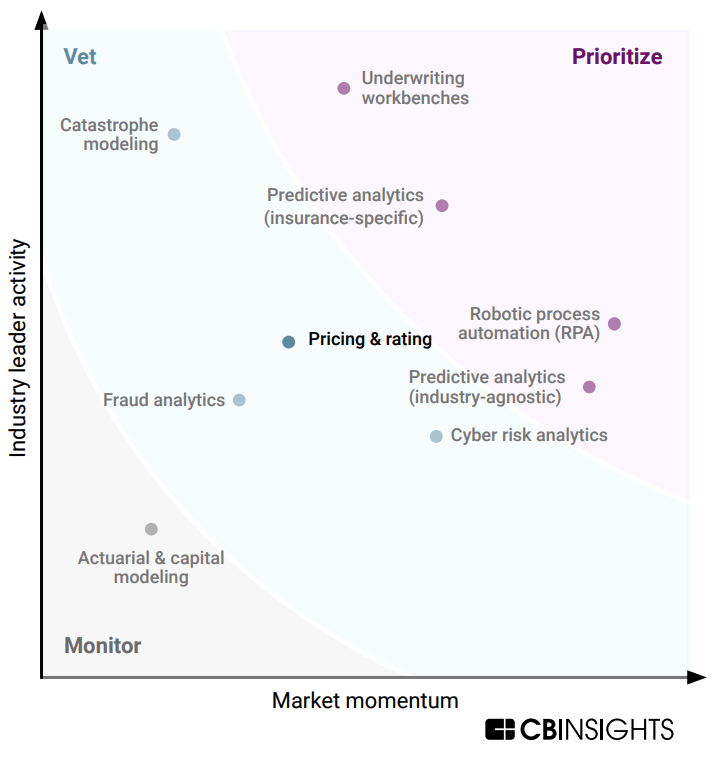

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance pricing software market offers solutions that help insurance companies determine the appropriate premium rates for their policies. These solutions use advanced algorithms and data analytics techniques to analyze various factors such as risk, claims history, demographics, and other relevant information. The goal is to provide accurate pricing recommendations that balance profitability…

Earnix named as Leader among 9 other companies, including Akur8, Federato, and Hyperexponential.

Earnix's Products & Differentiators

Earnix Price-it

Earnix is the only end to end solution from pricing through rating, enabling speed to market, governance and full automation with open integration and management of any and all machine learning and always-on dynamic monitoring of business performance.

Loading...

Research containing Earnix

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Earnix in 5 CB Insights research briefs, most recently on Aug 9, 2023.

May 10, 2022

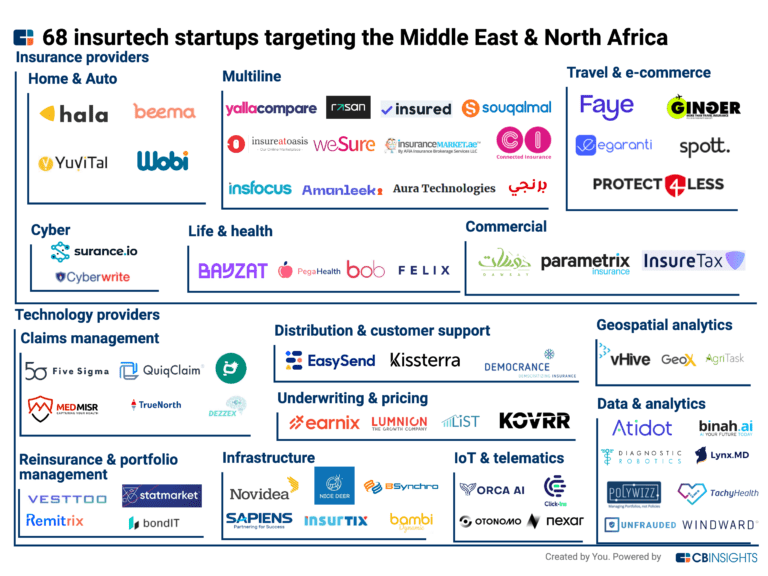

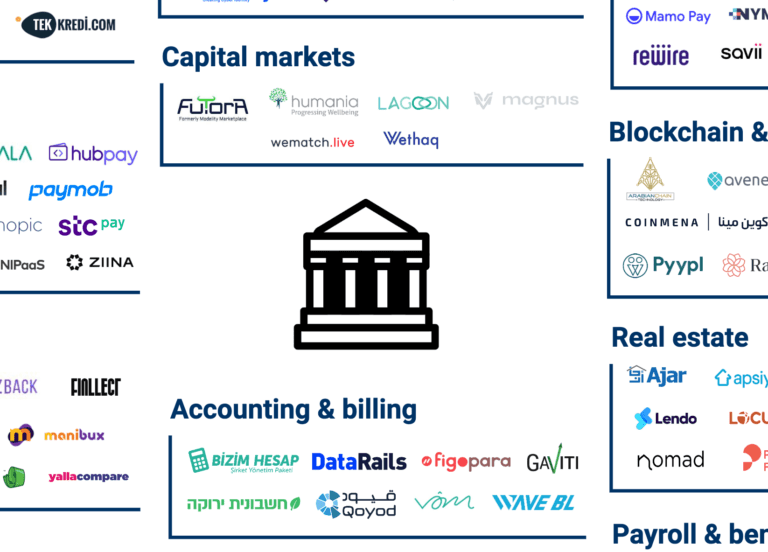

130+ startups driving the Middle East’s fintech boomExpert Collections containing Earnix

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Earnix is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

10,027 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

50 items

Digital Banking

867 items

Latest Earnix News

Feb 19, 2025

BOSTON--(BUSINESS WIRE)--Earnix, ein weltweit führender Anbieter von intelligenten SaaS-Lösungen für die Entscheidungsfindung in regulierten Branchen, gab heute die Einführung von Earnix Copilot, „Alix“, bekannt. Dieser generative KI-gesteuerte Agent wurde entwickelt, um die Entscheidungsfindung innerhalb der Earnix-Plattform zu beschleunigen und außergewöhnliche Geschäftsergebnisse und eine unübertroffene Produktivität für Versicherungs- und Bankunternehmen zu erzielen. Mit dem Earnix Copilot

Earnix Frequently Asked Questions (FAQ)

When was Earnix founded?

Earnix was founded in 2001.

Where is Earnix's headquarters?

Earnix's headquarters is located at 2 Ze’ev Jabotinsky Street, Ramat Gan.

What is Earnix's latest funding round?

Earnix's latest funding round is Secondary Market.

How much did Earnix raise?

Earnix raised a total of $98.5M.

Who are the investors of Earnix?

Investors of Earnix include Jerusalem Venture Partners, Vintage Investment Partners, Israel Growth Partners, Insight Partners, PropertyCasualty360 Insurance Luminaries and 4 more.

Who are Earnix's competitors?

Competitors of Earnix include Federato, Akur8, Lumnion, Hyperexponential, Swallow and 7 more.

What products does Earnix offer?

Earnix's products include Earnix Price-it and 3 more.

Who are Earnix's customers?

Customers of Earnix include Gore Mutual and Suncorp.

Loading...

Compare Earnix to Competitors

Quantee specializes in dynamic insurance pricing software within the insurance industry. The company offers a platform that enhances the precision and granularity of insurance pricing models, facilitates targeted outcomes, and supports instant deployment and real-time monitoring. Quantee's solutions cater to insurers, MGAs, and InsurTechs seeking to optimize their pricing strategies and operational efficiency. It was founded in 2018 and is based in Warsaw, Poland.

Atidot provides AI and predictive analytics solutions for the life insurance sector. The company offers a cloud-based platform that combines internal data with external sources to support decision-making for insurers. Atidot's technology is utilized by various stakeholders in the life insurance industry, including executives, marketing teams, policy distributors, and actuaries, focusing on improving profitability, lead generation, policy accuracy, and risk analysis. It was founded in 2016 and is based in Palo Alto, California.

Akur8 provides pricing and reserving platforms for the insurance industry. The company offers a suite of software solutions that utilize machine learning and predictive analytics for actuarial pricing and reserving processes. Akur8's platforms aim to support insurance pricing and reserving for personal and commercial lines insurers, managing general agents, insurers, and health insurers. It was founded in 2019 and is based in Paris, France.

UnderwriteMe is a technology provider that offers underwriting solutions for the life insurance industry. The company provides products such as decision platforms, underwriting engines, and analytics tools that aim to facilitate the insurance application process and support decision-making. UnderwriteMe serves the life insurance sector by providing technology solutions to insurers and intermediaries. It was founded in 2012 and is based in London, United Kingdom.

Arturo specializes in property intelligence and offers solutions in the insurance sector. The company provides an artificial intelligence-based platform that facilitates insurance underwriting, risk management, and claims processing by leveraging data analytics and computer vision models. Arturo primarily serves the insurance industry, enhancing decision-making processes for insurers. Arturo was formerly known as Deep Image Analytics. It was founded in 2018 and is based in Denver, Colorado.

Zesty AI specializes in leveraging artificial intelligence for property and climate risk assessment within the insurance and real estate sectors. The company provides a suite of products that deliver detailed insights into property value and risk exposure to natural disasters, utilizing advanced technologies such as computer vision. Zesty AI primarily serves the insurance industry, including personal and commercial lines, as well as the real estate sector. Zesty AI was formerly known as PowerScout. It was founded in 2015 and is based in San Francisco, California.

Loading...