EBANX

Founded Year

2012Stage

Series C | AliveTotal Raised

$460MLast Raised

$430M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+8 points in the past 30 days

About EBANX

EBANX specializes in cross-border payment solutions within the financial technology (fintech) industry, providing payment services for companies looking to operate in rising markets. The company offers a platform for processing online purchases, managing funds from pay-ins to payouts, and facilitating transactions in various currencies and payment methods, including alternative options. It serves e-commerce, gaming, and digital advertising sectors, helping businesses operate in Latin America, Africa, and India. It was founded in 2012 and is based in Curitiba, Brazil.

Loading...

ESPs containing EBANX

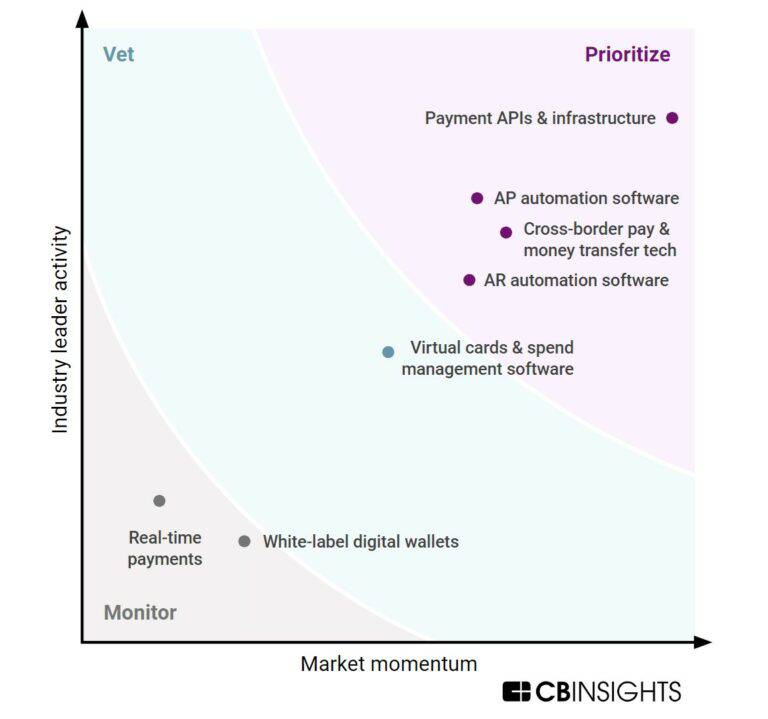

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. Companies in this market offer APIs and technology solutions that enable businesses to process payments across currencies and platforms, make payouts, verify user identities, issue credit cards, and manage international transactions. These s…

EBANX named as Challenger among 15 other companies, including Ripple, Circle, and Adyen.

Loading...

Research containing EBANX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EBANX in 9 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

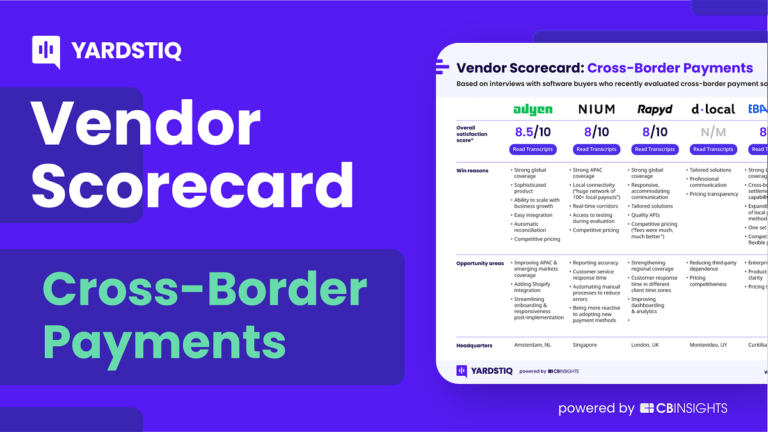

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose them

Nov 28, 2022

The Transcript from Yardstiq: Feel the churn

Sep 21, 2022 report

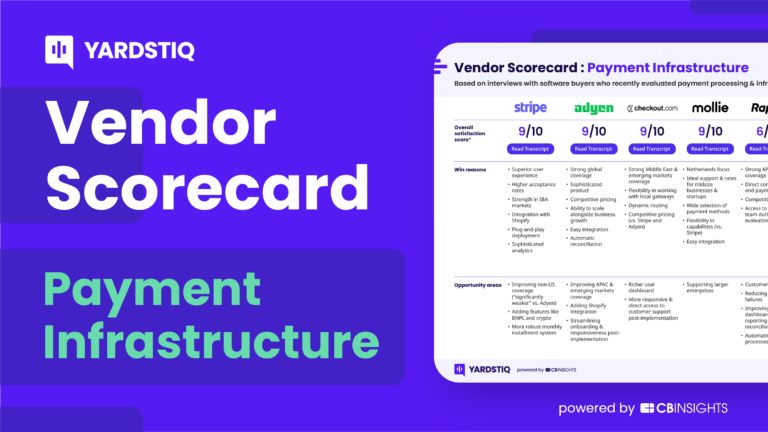

Top payment infrastructure companies — and why customers chose themExpert Collections containing EBANX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EBANX is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,462 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest EBANX News

Mar 25, 2025

Digital players are transforming credit card transactions in Latin America's e-commerce, reveals EBANX EBANX PTE. Ltd. Share: In a region with strong adoption of alternative payment methods, credit cards maintain their strong traction through digital players, now accounting for up to 41% of online card transactions CURITIBA, Brazil, March 25, 2025 /PRNewswire/ -- Digital-first financial companies have become key drivers behind cards' sustained presence and growth in rising economies, where alternative payment methods (APMs) have been growing substantially. According to internal data from EBANX , a global Payment Service Provider (PSP) that specializes in APMs and card processing for emerging markets and has already processed transactions for nearly 70% of Brazil's credit cardholders, fintech companies and digital players now account for 41% of the total value transacted through credit cards for online purchases in Brazil, the largest market in Latin America. This trend is gaining traction in other countries across the region, mainly Colombia (21%) and Argentina (19%), where digital banking expansion and intense fintech activity are pushing card issuance. "This is a clear indication of how the fast and massive adoption of alternative payment channels by consumers in emerging countries is also influencing the credit card industry in these regions," says João Del Valle, CEO and Co-founder of EBANX. "E-wallets and other real-time payments like Pix, in Brazil, and PSE, in Colombia, have raised the bar and driven innovation across all segments, including credit cards. These digital solutions have pushed traditional payment methods to evolve and adapt to meet modern consumer expectations." Fintechs and neobanks' key contributions to the credit card market include user-friendly platforms, reward programs, and enhanced customer experiences that have reshaped how consumers engage with card payments. As a result, these institutions now have nearly the same reach as the major traditional banks in emerging markets. According to the Central Bank of Brazil , the user base of fintech and neobanks jumped from 25 million individuals to 100 million in three years. Four out of ten of these people are credit card holders, a group that has tripled in size in the country since 2019, led by digital players. As Brazil has seen a rapid transformation in digital financial services, other emerging markets are also experiencing an increase in credit card ownership. EBANX's latest edition of Beyond Borders shows that 46% of adults in these countries already have credit cards, according to data from the World Bank. Though this penetration rate is lower than in more mature markets, like Japan (70%) and South Korea (68%), the expansion is notable, and the card market has room to grow even further in rising economies. In Brazil and Argentina, for example, the rates of credit card ownership among adults stand at 40% and 29%, respectively, after having grown from 29% and 22% over 10 years, according to the World Bank. The expansion of credit cards in these regions is closely linked to their sustained position as one of the leaders in e-commerce across emerging markets. These methods accounted for a USD 270 billion share of Latin America's e-commerce last year, or 42% of the total sales volume, per data from Payments and Commerce Market Intelligence (PCMI) in Beyond Borders, and are expected to reach nearly USD 380 billion by 2027, after growing at a 13% CAGR. Credit cards' sustained position in e-commerce growth walks along with the increasing need for seamless transaction solutions, especially for cross-border e-commerce. With its deep experience processing payments for global businesses in these markets, EBANX has witnessed firsthand and played an active role in this evolution. The company helps APAC merchants grow their consumer base by offering local payment solutions adapted to local consumer behavior – including card payment methods of local card schemes. What's next in credit cards Incumbent banks have followed in the footsteps of digital-first financial institutions and are also investing in innovations further to advance the online purchasing experience in rising economies. Consumers are the ultimate beneficiaries, gaining access to more straightforward and secure checkout systems, such as click-to-pay technology, which reduces the number of clicks needed to complete a purchase, improving convenience and efficiency. Network tokenization stands out as another prime example, as it replaces sensitive card data with encrypted identifiers for each transaction, reducing fraud risk without compromising approval rates. Additionally, the technology lowers fraud-related declines and enhances the overall quality of transactions. In tests conducted by EBANX in Brazil, network tokens reduced the decline of transactions by more than 86% due to card security issues. Furthermore, the adoption of network tokens led to an increase of up to 7 percentage points in overall approval rates for online retail merchants and up to 5 percentage points for subscription-based merchants. "In today's dynamic payments landscape, the focus isn't on opposing Pix or e-wallets to cards or choosing between traditional and new payment methods," explains Del Valle. "Instead, it's about expanding opportunities and creating an ecosystem where different payment solutions can coexist and complement each other, ultimately providing consumers with more choices and better experiences in their digital transactions." Debit cards in emerging markets While credit cards account for approximately 80% of online purchases in emerging markets, according to data from Payments and Commerce Market Intelligence (PCMI) in Beyond Borders, debit cards have become an important avenue for attracting new online customers in countries like Peru, Mexico, and South Africa. Especially in markets where access to credit is more restricted, financial inclusion has catapulted the usage of debit cards, which are linked to existing account balances, and brought new consumers into e-commerce. Peru exemplifies this pattern, where 60% of first-time online shoppers use debit cards, according to EBANX's internal data. In Mexico, this figure reaches 55%. Not surprisingly, in these two countries, debit cards account for a larger share of online transaction volume than credit cards, at 49% compared to 27% in Peru and 38% versus 31% in Mexico. "However, it's worth noting that this share will likely decrease in some key economies from emerging markets such as Brazil and Colombia as alternative payment methods mature in these countries," reflects Del Valle. In Brazil, where Pix holds 40% of the online sales volume, debit cards now account for only 1% of digital commerce transaction value. ABOUT EBANX EBANX is the leading payment platform connecting global businesses to the world's fastest-growing digital markets. Founded in 2012 in Brazil, EBANX was built with a mission to expand access to international digital commerce. Leveraging proprietary technology, deep market expertise, and robust infrastructure, EBANX enables global companies to offer hundreds of local payment methods across Latin America, Africa, and Asia. More than just payments, EBANX drives growth, enhances sales, and delivers seamless purchase experiences for businesses and consumers alike. For further information, please visit:

EBANX Frequently Asked Questions (FAQ)

When was EBANX founded?

EBANX was founded in 2012.

Where is EBANX's headquarters?

EBANX's headquarters is located at Marechal Deodoro, 630, Curitiba.

What is EBANX's latest funding round?

EBANX's latest funding round is Series C.

How much did EBANX raise?

EBANX raised a total of $460M.

Who are the investors of EBANX?

Investors of EBANX include Advent International, FTV Capital, Endeavor and Bossa Invest.

Who are EBANX's competitors?

Competitors of EBANX include CloudWalk, Pismo, Klasha, Payall, HedgeWiz and 7 more.

Loading...

Compare EBANX to Competitors

Rapyd is a fintech company focused on global payment processing and financial services infrastructure. The company provides products including online payment acceptance, in-store payment solutions, and financial services for businesses, such as global accounts and multi-currency management. Rapyd's platform supports e-commerce transactions, lending, and remittances, and offers compliance and risk management solutions. Rapyd was formerly known as CashDash.. It was founded in 2016 and is based in Essex, United Kingdom.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Nium specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. Nium primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. Nium was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

Fincra is a payment gateway provider focused on payment processing for businesses across various sectors. The company offers services including virtual accounts, multicurrency accounts, and API integrations for online and offline payments. Fincra serves sectors such as ecommerce, financial institutions, global businesses, and developers. It was founded in 2019 and is based in Toronto, Ontario.

Loading...