Wheel

Founded Year

2018Stage

Series C | AliveTotal Raised

$215.6MLast Raised

$150M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+110 points in the past 30 days

About Wheel

Wheel is a health technology company that provides a virtual care platform and a network of clinicians to deliver urgent and condition care, along with healthcare programs. Wheel serves digital health companies, health plans, life science companies, retailers, and pharmacies. Wheel was formerly known as Enzyme Health. It was founded in 2018 and is based in Austin, Texas.

Loading...

Wheel's Product Videos

ESPs containing Wheel

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual & hybrid menopause care market provides care and support for individuals going through menopause. Companies in this market offer telehealth services, digital health platforms, virtual lifestyle and wellness programs, hormone replacement therapy (HRT) management, and hybrid care models to connect patients with clinicians that can help them manage the symptoms and physical changes during…

Wheel named as Leader among 11 other companies, including Midi, Visana Health, and Evernow.

Wheel's Products & Differentiators

Virtual care platform

Wheel’s virtual care platform enables emerging and established enterprises to deliver their brand of virtual care – without committing the capital and resources to build and maintain it themselves. The platform merges everything companies need to deliver virtual care – including the virtual care technology, regulatory infrastructure and leading nationwide clinician network – while providing cohesive, connected customer experiences across telehealth, labs, and pharmacies.

Loading...

Research containing Wheel

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wheel in 3 CB Insights research briefs, most recently on Mar 28, 2024.

Mar 28, 2024

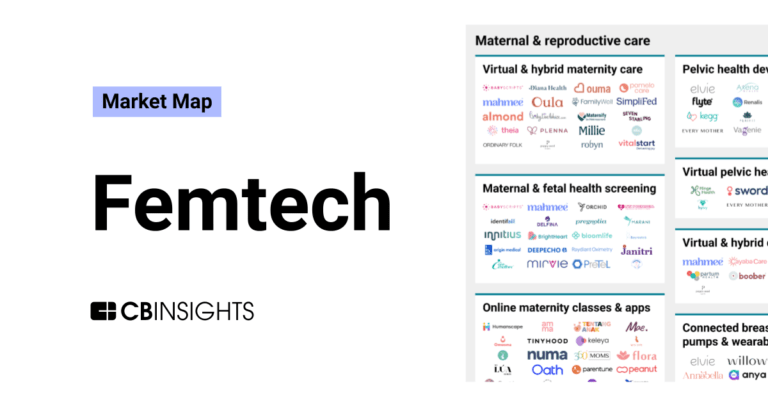

The femtech market map

Sep 22, 2023

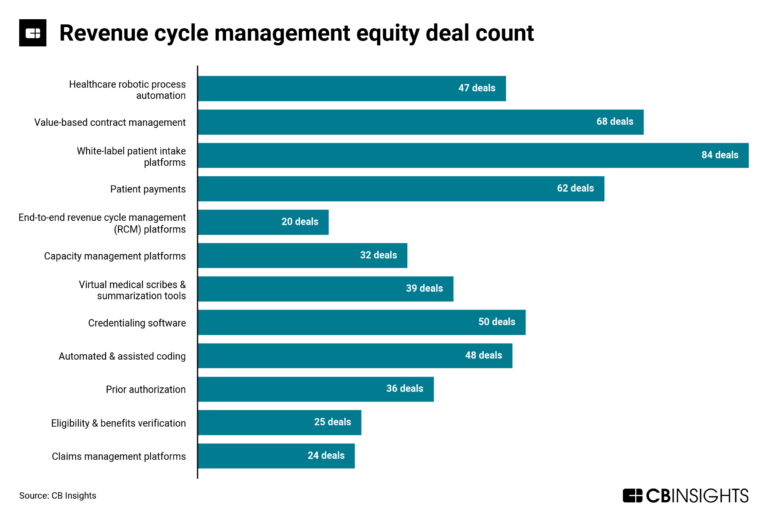

The revenue cycle management market map

May 26, 2022

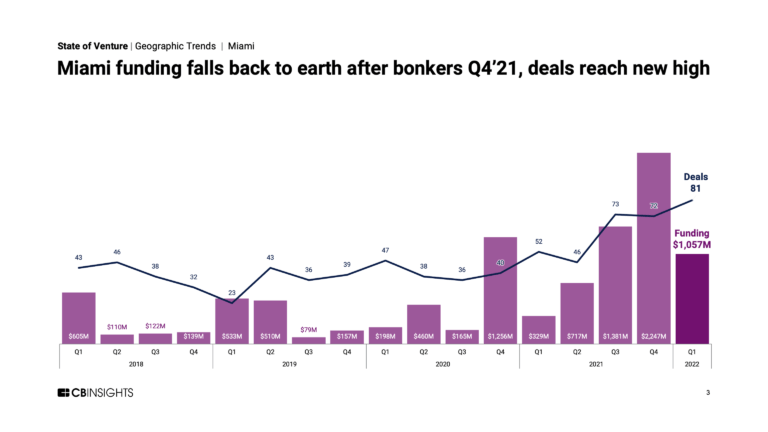

Where are the next US tech hubs?Expert Collections containing Wheel

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wheel is included in 6 Expert Collections, including HR Tech.

HR Tech

5,785 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,270 items

Conference Exhibitors

5,302 items

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Digital Health 50

150 items

The winners of the third annual CB Insights Digital Health 150.

Latest Wheel News

Jan 16, 2025

Health Tech Correspondent You’re reading the web edition of STAT’s Health Tech newsletter, our guide to how technology is transforming the life sciences. Sign up to get it delivered in your inbox every Tuesday and Thursday. Hospitals and insurers are adopting health AI to save time and money, even as there are a many questions about what safeguards need to be put in place around the powerful technology. STAT’s Casey Ross unpacks some of the challenges facing health regulators in the incoming Trump administration, including what to do about AI agents that help with tasks like filling out clinical notes and other administrative use cases often characterized as “low risk,” even if they have the potential to cause serious harm. As Casey notes, “An incorrectly recorded diagnosis or treatment plan can lead to inappropriate care and inaccurate bills.” You can read the whole story here. advertisement Virtual care companies make their GLP-1 pitches At the J.P. Morgan Health Care conference, the future outlook for GLP-1 drugs used to treat obesity was a key focus, including for digital health companies flogging offerings to help ensure that the pricey drugs deliver the desired results without breaking the bank. Virtual care company Omada last year landed a significant deal with Cigna subsidiary Evernorth to make its behavioral change program available alongside GLP-1s. At the conference, it presented limited data showing people using Omada who discontinued GLP-1s, on average, maintained their weight for 16 weeks. Meanwhile competitor Virta, which has downplayed the need for drugs in favor of a nutrition-first approach, also framed its program as a way to help people maintain weight loss. advertisement DEA telehealth rules at last! But will they survive? The Drug Enforcement Administration yesterday announced a special registration process that will allow approved clinicians to prescribe controlled substances like Adderall and buprenorphine over telehealth. The rules come 16 years after Congress first mandated them in 2008. If finalized, it would offer a path forward for telehealth companies and other providers that ramped up virtual prescribing when restrictions were temporarily lifted during the Covid-19 pandemic. As STAT’s Lev Facher reports , the rules come with a number of restrictions that were immediately criticized by industry groups. For example, it requires that prescribers of riskier drugs, like Adderall and Ritalin, write 50% of their prescriptions for the drugs to patients seen in person. Telehealth advocates have argued that any in-person requirement would cause some telehealth companies to shut down, hindering access to care. Still, it’s possible that the new administration will not carry proposed rule forward. In fact, this morning the American Telemedicine Association called on President-elect Donald Trump to withdraw the proposal as “his first priority in office.” Besides the draft rules for special registration, DEA finalized rules that would allow a clinicians to prescribe a six-month supply of buprenorphine, which is used to treat opioid addiction, without first examining a patient in person. Because this is a final rule, it will be much more difficult for the new administration to repeal it. De-identified health data deals are legal — but are they ethical? Earlier this week Truveta announced a deal with Regeneron and Illumina to collect and sell patients’ de-identified genomic data, and as STAT’s Brittany Trang reports , there are a slew of companies doing similar things, many of them with medical imaging. These companies, including Avandra, Gradient Health, Segmed, and Protege advertise themselves as a way for hospitals to make “passive income” from their troves of patient data. These data brokers pitch themselves as “one-stop shops” for “locally sourced data” to companies looking to train AI models. advertisement It’s all legal. The health care privacy law HIPAA permits sharing de-identified patient data without patients’ permission. But the rise of new business models raises questions about whether rules and practices should be updated to reflect today’s technological realities. AI investment in focus In the past week we’ve seen a series of impressive AI fundraises announced, including mega deals for buzzy companies like Hippocratic AI. I spoke to VCs, including Bessemer Venture Partners’ Sofia Guerra, Flare Capital’s Parth Desai, and Define Ventures’ Chirag Shah for a story this week about what’s driving the dealmaking . At a high-level, there’s a lot of enthusiasm among health systems and payers — the adopters — for the potential of automated clinical documentation tools and other products to improve the experience of clinicians and patients, as well as for financial tools that can start delivering economic payoff quickly. The adopters have budgets allotted to try out tech and that helps drive investor confidence. Bottom line: Even as overall health tech funding is down, AI still has a lot of appeal. We’ll have to see if the momentum keeps up for the rest of the year. Separately, I appreciated some new work put out by Lux Capital’s Deena Shakir and Shailee Samar looking specifically at AI funding for women’s health startups. Women’s health in general receives less funding than other areas, and the authors write that despite the tremendous growth in AI investment and adoption, “its application in women’s health remains notably limited.” The authors describe opportunities and also offer a list of startups working in the space and VCs known to fund women’s health. JPM notebook: Wheel, Absci, Included Katie Palmer writes: Virtual health company Wheel announced a joint venture with international digital health company Huma, building a platform that partners, including pharma and health systems, can use to quickly stand up digital-first care. “We can launch in a matter of days what would have taken us months and years to launch,” said Wheel CEO Michelle Davey. ICYMI: My write up on Chuck Divita‘s first prominent public appearance as the CEO of Teladoc Health. After seeing huge growth during the pandemic, the company’s revenue has plateaued, and it has faced challenges stabilizing user numbers for its online therapy offering BetterHelp. Divita outlined his priorities, including international expansion, securing insurance coverage for BetterHelp, and growing users in its chronic disease programs. Brittany Trang writes: Absci’s CEO Sean McClain spent the majority of his time explaining why the AI drug development company partnered with chipmaker AMD, which coincidentally last week made a $20 million investment in Absci. He played a 7-minute video of him chatting with AMD CTO Mark Papermaster, followed by 3 minutes of explaining why AMD’s chips are good news for Absci — which came across more like a justification of why Absci didn’t get Nvidia chips instead. McClain spent the rest of the session not talking about the company’s most developed clinical candidate for inflammatory bowel disease, but on its drug candidate for hair regrowth. That candidate is expected to reach first-in-human studies next year and McClain says it will be Absci’s flagship internal asset. Owen Tripp, the CEO of Included Health, a company that offers tech-forward health benefits for companies like Walmart, outlined many of the well established frustrations around employee sponsored health care. He reminded the audience about the company’s high-profile deal to provide benefits for CalPERS, the retirement plan for California state workers. The risk-structured deal is the future for the sector, Tripp said. He also teased new offerings around pharmacy benefits, home-based care, and more. What we’re reading

Wheel Frequently Asked Questions (FAQ)

When was Wheel founded?

Wheel was founded in 2018.

Where is Wheel's headquarters?

Wheel's headquarters is located at 2330 South Lamar Boulevard, Austin.

What is Wheel's latest funding round?

Wheel's latest funding round is Series C.

How much did Wheel raise?

Wheel raised a total of $215.6M.

Who are the investors of Wheel?

Investors of Wheel include Silverton Partners, Tusk Ventures, Charles River Ventures, Lightspeed Venture Partners, Salesforce Ventures and 7 more.

Who are Wheel's competitors?

Competitors of Wheel include hellocare, Memora Health, Legion Health, Synapticure, Truepill and 7 more.

What products does Wheel offer?

Wheel's products include Virtual care platform and 1 more.

Loading...

Compare Wheel to Competitors

Luma Health provides patient engagement solutions within the healthcare sector, focusing on the Patient Success Platform. The company offers services including automated scheduling, referral management, patient communication, and feedback management, aimed at operational efficiency and patient experience. Luma Health serves enterprise health systems, specialty groups, regional and rural care, and primary care providers. It was founded in 2015 and is based in San Mateo, California.

Homedoc Technologies focuses on the development of medical technology, particularly in the domain of digital healthcare and artificial intelligence. The company's main offerings include research and experimental development aimed at creating medical devices for the diagnosis of COVID-19, utilizing large data analysis and technology prototypes. These innovations are designed to enhance virtual healthcare experiences through the integration of robotic automation and AI. It was founded in 2020 and is based in Miami, Florida.

Included Health offers healthcare navigation and virtual care within the healthcare sector. It offers services including primary care, behavioral health, urgent care, specialty care, and mental health support. It primarily serves employers, health plans, labor unions, and the public sector. Included Health was formerly known as ConsultingMD. It was founded in 2011 and is based in San Francisco, California.

Happier Living is a behavioral healthcare provider offering mental health services that include therapy and medication management for conditions such as anxiety, depression, ADHD, and substance abuse. The company serves individuals and clinicians looking for mental health support. It was founded in 2011 and is based in Los Angeles, California.

Thirty Madison focuses on virtual-first specialized healthcare within the healthcare industry. It offers a care model that provides treatments for individuals with ongoing conditions, serving sectors that require specialized healthcare management. It was founded in 2017 and is based in New York, New York.

Maven serves as a virtual clinic that specializes in women's and family health within the healthcare sector. The clinic offers continuous, holistic care services, including fertility and family building, maternity, parenting, pediatrics, and menopause management. Maven primarily serves employers and health plans, aiming to improve health outcomes and reduce healthcare costs. It was founded in 2014 and is based in New York, New York.

Loading...