eToro

Founded Year

2007Stage

Series F | AliveTotal Raised

$460.46MValuation

$0000Last Raised

$250M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-3 points in the past 30 days

About eToro

eToro offers a social investment platform that operates in the financial services industry. The company provides a platform for investing in stocks and digital assets, trading contracts for difference (CFDs), and a community feature for users to exchange investment strategies and share market insights. eToro primarily serves retail investors looking to engage in stock and cryptocurrency investments and trading. It was founded in 2007 and is based in Limassol, Cyprus.

Loading...

ESPs containing eToro

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Active trading platforms provide retail investors, active traders, and institutional clients with access to a diverse array of investment options, including stocks, ETFs, options, and cryptocurrencies, often with commission-free trading. They typically feature capabilities such as fractional share trading, advanced charting tools, and educational resources to enhance the trading experience. These …

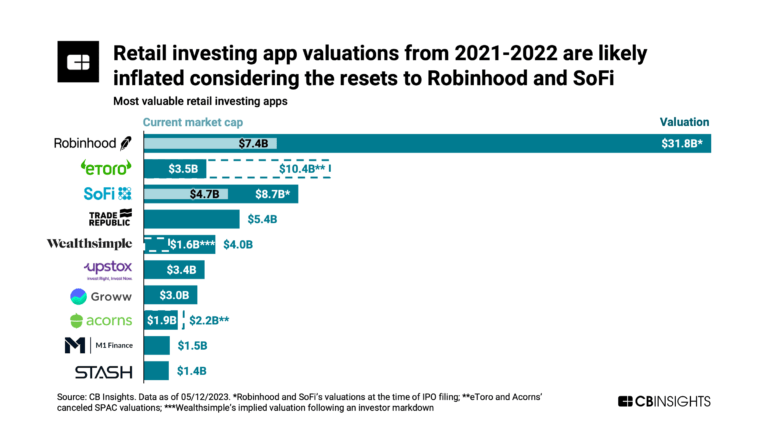

eToro named as Challenger among 8 other companies, including Charles Schwab, Robinhood, and Interactive Brokers.

eToro's Products & Differentiators

CopyTrader

Our patented CopyTrader offering allows users to copy the investment strategy of other investors on our platform by assigning some of the user’s capital to proportionally mimic the portfolio of another investor on our platform. Each user’s past performance is displayed on their profile alongside their risk score and details of their investment approach. Users can stop copying at any time, and there is no additional charge for this service.

Loading...

Research containing eToro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned eToro in 3 CB Insights research briefs, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

May 26, 2022

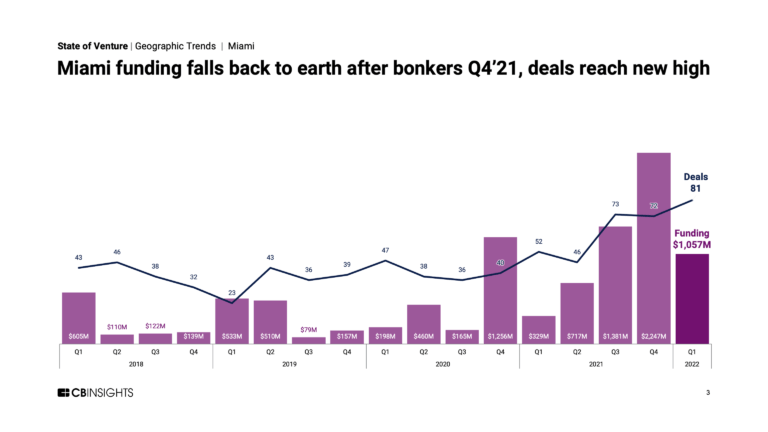

Where are the next US tech hubs?Expert Collections containing eToro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

eToro is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

9,296 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,699 items

Excludes US-based companies

eToro Patents

eToro has filed 11 patents.

The 3 most popular patent topics include:

- financial markets

- collective intelligence

- derivatives (finance)

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/12/2018 | 11/26/2019 | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, User interfaces | Grant |

Application Date | 3/12/2018 |

|---|---|

Grant Date | 11/26/2019 |

Title | |

Related Topics | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, User interfaces |

Status | Grant |

Latest eToro News

Apr 6, 2025

The Israeli fintech joins Klarna, Medline, and StubHub in shelving multibillion-dollar listings amid growing market turmoil. CTech Israeli fintech company eToro is delaying its planned initial public offering (IPO) in the United States, according to a report by Bloomberg. The company joins several others that have postponed multi-billion-dollar offerings following market volatility triggered by former President Donald Trump's announcement of a sweeping new round of tariffs. According to the Financial Times, other companies delaying their IPOs in response to the instability include Swedish fintech Klarna, which was valued at $15 billion; medical technology firm Medline, valued at $50 billion; and ticketing platform StubHub. (Photo: Shaul Golan) All four companies had filed prospectuses in recent months ahead of planned listings, but those plans have now been put on hold due to sharp fluctuations in the market since Trump's tariff announcement. eToro, for example, was expected to begin its investor roadshow in the coming week, but has postponed the process indefinitely. Similarly, Klarna and Medline, backed by private equity giants such as Blackstone and Carlyle, had planned to advance its IPO plans this week but are now holding off. Sources familiar with the matter said StubHub has also postponed its roadshow, which had been scheduled for the coming weeks. However, they emphasized that the company is under no immediate obligation to go public and could still proceed in the near future. These delays come just as the U.S. IPO market had begun showing signs of recovery after three years of stagnation driven by high interest rates. However, Trump’s tariff announcement sparked a sharp selloff in capital markets, wiping out trillions in value from companies on the S&P 500. Losses deepened further when China responded with its own round of retaliatory tariffs on Thursday. Related articles:

eToro Frequently Asked Questions (FAQ)

When was eToro founded?

eToro was founded in 2007.

Where is eToro's headquarters?

eToro's headquarters is located at 4 Profiti Ilia Street, Germasogeia, Limassol.

What is eToro's latest funding round?

eToro's latest funding round is Series F.

How much did eToro raise?

eToro raised a total of $460.46M.

Who are the investors of eToro?

Investors of eToro include Social Leverage, Velvet Sea Ventures, SoftBank, Spark Capital, ION Group and 23 more.

Who are eToro's competitors?

Competitors of eToro include Ziglu, Starting Finance, BurjX, AlgoPear, Webull and 7 more.

What products does eToro offer?

eToro's products include CopyTrader and 4 more.

Loading...

Compare eToro to Competitors

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Public is an investing platform that offers a diverse range of financial products across multiple asset classes. The company provides tools for trading stocks, options, and cryptocurrencies, as well as investing in bonds, ETFs, and treasuries, complemented by high-yield cash accounts and tailored investment plans. Public also integrates AI-powered data and analysis into the investment experience, fostering a community-driven environment for sharing insights and educational content. Public was formerly known as TapX Trading & Analytics. It was founded in 2019 and is based in New York, New York.

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

BlockFi is a financial services company that offers wealth management products for cryptocurrency investors, operating within the fintech and blockchain technology sectors. The company provides USD loans backed by cryptocurrency, interest-earning accounts for digital assets, and a platform for trading various cryptocurrencies. It was founded in 2017 and is based in Jersey City, New Jersey.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Loading...