Eve

Founded Year

2023Stage

Series A | AliveTotal Raised

$61MLast Raised

$47M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+119 points in the past 30 days

About Eve

Eve provides legal artificial intelligence solutions for plaintiff law firms. The offerings include artificial intelligence (AI) powered tools for case intake, medical overviews, drafting legal documents, and managing discovery processes, aiming to streamline the legal workflow from intake to litigation. Eve's technology is designed to improve the efficiency of legal practices, allowing firms to handle cases with speed and accuracy. It was founded in 2023 and is based in Redwood City, California.

Loading...

Eve's Product Videos

ESPs containing Eve

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

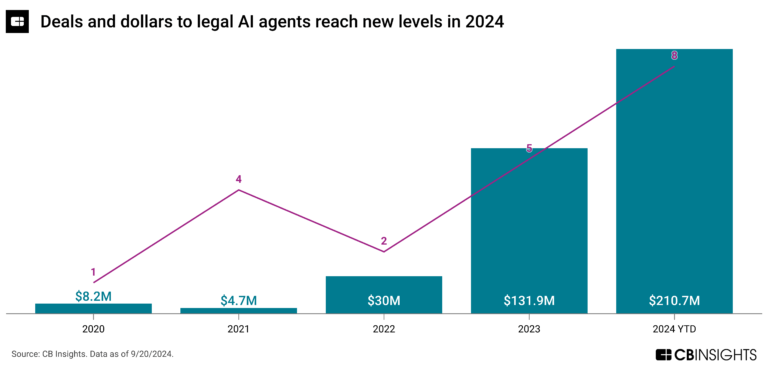

The legal AI agents & copilots market provides AI-powered tools that follow natural language instructions to assist lawyers in their day-to-day work. Common functionalities of these solutions include document summarization, contract review and revision, and legal research. Most companies in this market use generative AI technology as the basis for their solutions.

Eve named as Highflier among 12 other companies, including Thomson Reuters, Luminance, and Harvey.

Eve's Products & Differentiators

Eve

Eve is your first personalized AI-based legal assistant that helps you with time-consuming tasks throughout your case lifecycle. Eve is pre-trained to assist with common legal work: with a robust collection of "skills" for various use cases and practice areas, Eve is ready to use out-of-the-box. Easily teach and train Eve to perform new “skills” based on your existing process, and to work according to your preferences and high standard.

Loading...

Research containing Eve

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Eve in 3 CB Insights research briefs, most recently on Mar 6, 2025.

Mar 6, 2025

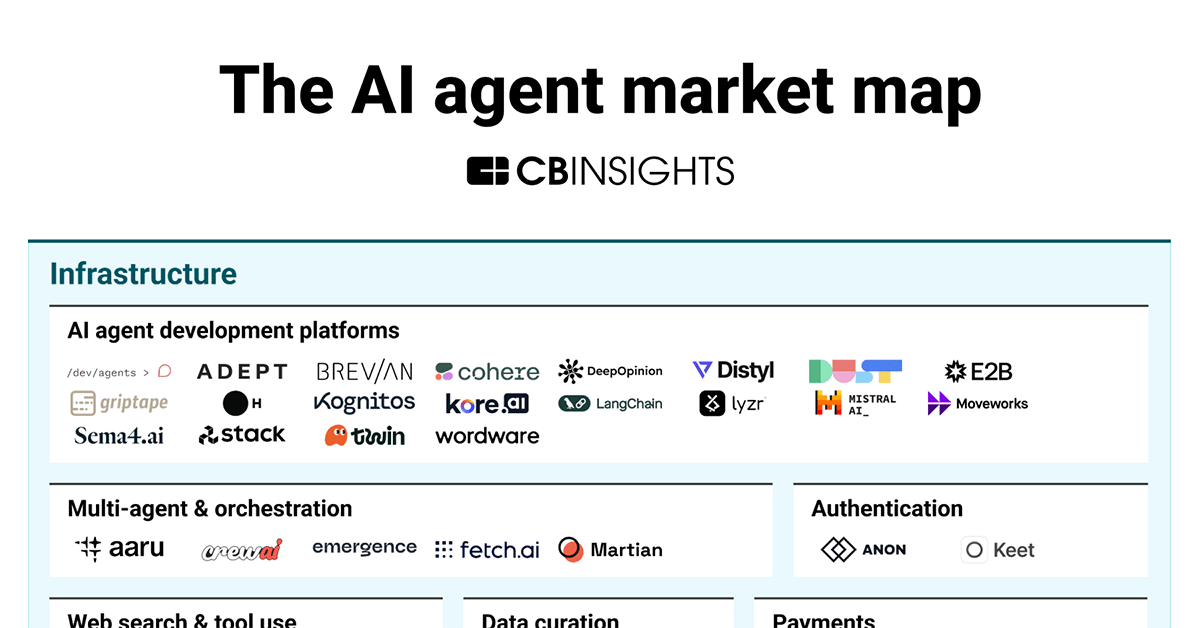

The AI agent market map

Aug 7, 2024

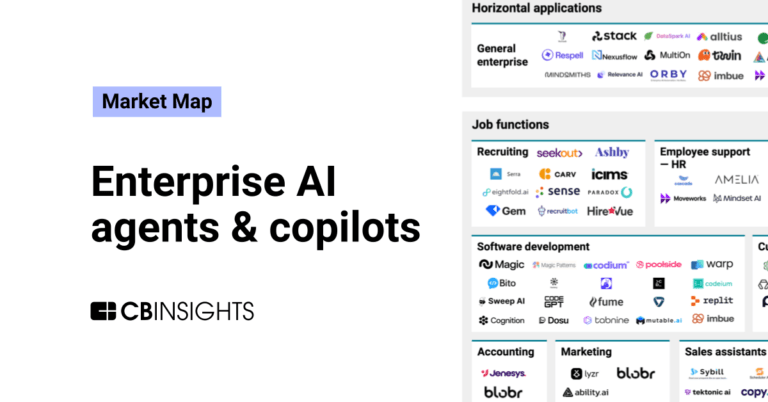

The enterprise AI agents & copilots market mapExpert Collections containing Eve

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Eve is included in 5 Expert Collections, including Auto Tech.

Auto Tech

1,790 items

Companies developing battery electric vehicles (BEVs) and fuel cell vehicles (FCEVs) as well as companies working on improvements to battery design, building out charging infrastructure, and launching EV sharing services to help accelerate adoption.

Generative AI

1,299 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence

7,221 items

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

AI agents

286 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Latest Eve News

Mar 6, 2025

Maybe we’re looking in the wrong places for AI-driven legal transformation. As Jay Madheswaran, CEO of Eve – whose company just bagged $47m funding led by Andreessen Horowitz – puts it: ‘AmLaw 100 firms are fear-tripping about AI, while plaintiff firms see profits.’ His startup, which has some serious backers now, focuses on small-to-medium size law firms, especially on the plaintiff side. It provides a suite of tech tools, heavily backed by AI, to help lawyers triage potential cases, manage a litigation, and handle many of the laborious doc-centred tasks. ‘With plaintiff law firms we go in and change things,’ he observes, and adds that with Eve the firms see they can process more potential cases and grow their business, but with the same number of lawyers. ‘[With AI] they are not labour-constrained in terms of growth,’ Madheswaran says. He goes on to explain that plaintiff firms ‘care about different things’ to large defence law firms, and importantly ‘they do not rely on billable hours’. This means that the arrival of AI and greater efficiency is welcome, in fact, it’s a promise of far greater profits and much less time spent on process work they don’t get paid for. ‘In a personal injury case there can be 10,000 pages of medical records, there is a lot of data,’ with AI reviewing it, this work can be reduced to a few hours, he notes. ‘What might take 100 hours to prepare manually, Eve can now do in minutes.’ As these firms use tech to streamline their processes they can in turn ‘focus on how to organise their labour’. I.e. lawyers can be deployed on higher value tasks. And because laborious work is of no monetary value to such firms, they can really make this happen. (At this point we have a discussion about Adam Smith, the famous pin factory essay, tech-driven efficiency, and the division of labour.) And it’s so very refreshing to hear all of this. Artificial Lawyer has been writing about ‘changing the means of legal production’ since 2016, and about the inherent barriers to using legal tech to change the game, rather than make some small modifications around the edges of it. Some large law firms have indeed taken purposeful steps with certain workflows to transform how things are done, which is great – but it’s still a minority of firms that do this, if we’re going to be frank. Moreover, it feels like many BigLaw lawyers are still not engaging with the idea of tech-based transformation with great enthusiasm. (And of course, why would they….given how things are working at present…?) But, now, we can take a look at a different segment of the market: smaller, plaintiff firms – and we find a group of lawyers who see a major upside to using AI tools. In turn there are now companies, such as Eve, ready to help them. Or as Madheswaran puts it, to help them to become ‘AI native’, even if they didn’t start that way. I.e. their entire approach to the main ‘process workflows’, e.g. finding and triaging potential cases, onboarding matters and paperwork, managing cases, handling high volume tasks like reviewing 100s of documents, changes to one that is AI-backed, and where AI is central to how the firm operates. ‘They have a more intelligent intake, and handling of knowledge, and they get better outcomes and better revenue,’ he adds. He adds that using Eve and bringing AI tools (and other forms of automation) into the business, the firms they work with can move from 1 or 2 cases per lawyer per month, to 10 cases per month. Madheswaran explains that they did initially talk to plenty of major law firms, but decided to focus on plaintiff firms because there was a genuine welcoming of what could be achieved with tech. ‘On the defence side we could give them efficiencies [with our tech] but they [would want to] put it on non-billable work. Plus, there is also an inherent fear [about AI]. If they are more efficient, then they can’t charge as much.’ So, Eve has found a market segment eager to be helped, rather than nervous about what’s on offer. What now? They have about 30 people so far, but use AI throughout the company as a force-multiplier. Moreover, with the new funding they have plenty of resources to grow headcount if they wish to. But, the main goal is to build market share among what is a vast number of small-to-medium size law firms. ‘The plan is to go deeper; we want to be the software partner for plaintiff cases. If it can be done by AI, then it should be done by AI,’ Madheswaran concludes. – As noted, this is a breath of fresh air to Artificial Lawyer. Rather than a tech founder having to be stoic about the battle to help transform a segment of the market that is – and let’s be honest here – still reticent about really moving forward at speed, Madheswaran is able to speak happily about the apparent lack of barriers to adoption. As ever, this comes back to the business model and culture of the firms. And this leads us back to the first point: what if legal tech has been barking up the wrong tree all these years? What if the real great hope for legal transformation is among the thousands of smaller law firms that see no structural obstacles to adopting AI and other legal tech tools? Because for them, efficiency is always a win-win. While for BigLaw, it’s always a much more complex discussion. It’s going to be fascinating to see how things change across the wider market. —

Eve Frequently Asked Questions (FAQ)

When was Eve founded?

Eve was founded in 2023.

Where is Eve's headquarters?

Eve's headquarters is located at 1112 Eden Bower Lane, Redwood City.

What is Eve's latest funding round?

Eve's latest funding round is Series A.

How much did Eve raise?

Eve raised a total of $61M.

Who are the investors of Eve?

Investors of Eve include Menlo Ventures, Lightspeed Venture Partners and Andreessen Horowitz.

Who are Eve's competitors?

Competitors of Eve include Harvey, Alexi, Clearbrief, Casetext, Fileread AI and 7 more.

What products does Eve offer?

Eve's products include Eve and 1 more.

Who are Eve's customers?

Customers of Eve include Frontier Law Center and Smith and Barid.

Loading...

Compare Eve to Competitors

Legalyze.ai specializes in artificial intelligence solutions for the legal sector, focusing on case data management and document analysis. The company offers a platform that enables law firms and legal departments to create summaries, timelines, and procedural documents efficiently, as well as provide insights and answers to specific questions about case documents. It was founded in 2023 and is based in Dallas, Texas.

Legora operates an artificial intelligence platform designed to support legal professionals within the legal sector. The company offers tools that aid in legal document review, drafting, and legal research, thus improving the efficiency of teams. Legora's solutions are tailored to the needs of firms, providing a collaborative workspace that integrates with existing workflows for research, document analysis, and drafting. Legora was formerly known as Leya. It was founded in 2023 and is based in Stockholm, Sweden.

LegalMation provides artificial intelligence solutions for the legal sector, focusing on litigation and dispute resolution. The company offers tools that assist in the creation of legal documents such as responsive pleadings, discovery requests, and demand letters, along with analytics and matter profiling to support legal workflows. LegalMation serves corporate legal departments, law firms, and insurance companies. It was founded in 2017 and is based in Los Angeles, California.

Alexi specializes in generative artificial intelligence (AI) for the legal sector. It focuses on enhancing litigation processes. The company offers AI enabled solutions that generate legal research memos, assist in litigation argument brainstorming, and automate routine litigation tasks. Alexi primarily serves law firms of various sizes and in-house legal teams. It was founded in 2017 and is based in Toronto, Canada.

Darrow operates within the legal technology sector. The company provides a platform that connects plaintiffs' attorneys with cases and tools for developing case strategies. Darrow primarily serves the legal profession, focusing on business development for law firms. It was founded in 2020 and is based in New York, New York.

Harvey serves as a generative AI company that specializes in the legal sector and provides AI-driven solutions for professional services. The company offers a platform for legal workflows with domain-specific models for research, drafting, analysis, and document management. Harvey's primary clientele includes lawyers and law firms seeking to augment legal processes with AI tools. It was founded in 2022 and is based in San Francisco, California.

Loading...