Fabric

Founded Year

2015Stage

Series C | AliveTotal Raised

$336.01MValuation

$0000Last Raised

$200M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+66 points in the past 30 days

About Fabric

Fabric specializes in automated fulfillment solutions for the grocery and health and beauty sectors within the retail technology industry. The company offers products that optimize inventory and automate order processing for both B2C and B2B operations. Fabric's solutions fit various urban spaces and utilize proprietary robotics and software to assist in the fulfillment process. Fabric was formerly known as CommonSense Robotics. It was founded in 2015 and is based in Tel Aviv, Israel.

Loading...

Fabric's Product Videos

ESPs containing Fabric

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated storage and retrieval systems market helps businesses optimize their supply chain operations. These systems use automated machines, including cranes, shuttles, conveyors, and robots, to maximize warehouse space and increase fulfillment efficiency.

Fabric named as Outperformer among 15 other companies, including AutoStore, Locus Robotics, and Symbotic.

Fabric's Products & Differentiators

The Fabric Smart Cube

Our product enables brands and retailers to achieve profitable eCommerce fulfillment with high-throughput and high-density automation. Our cube-based fulfillment solution includes both hardware and software components that enable a wide range of operational activities to improve fulfillment efficiency. Our system is broken down into five parts: lift robots, ground robots, touchpoints, robotic picking arms, and the proprietary software that powers each of our hardware components. Our 3D topology is highly flexible, allowing us to fit into nearly any footprint, no matter the size, shape, or structural design constraints. Because of the flexible nature of our product, we’re able to serve a wide variety of use cases including: micro-fulfillment, back of store fulfillment, and B2B replenishment, and more.

Loading...

Research containing Fabric

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fabric in 9 CB Insights research briefs, most recently on Feb 13, 2025.

Feb 13, 2025

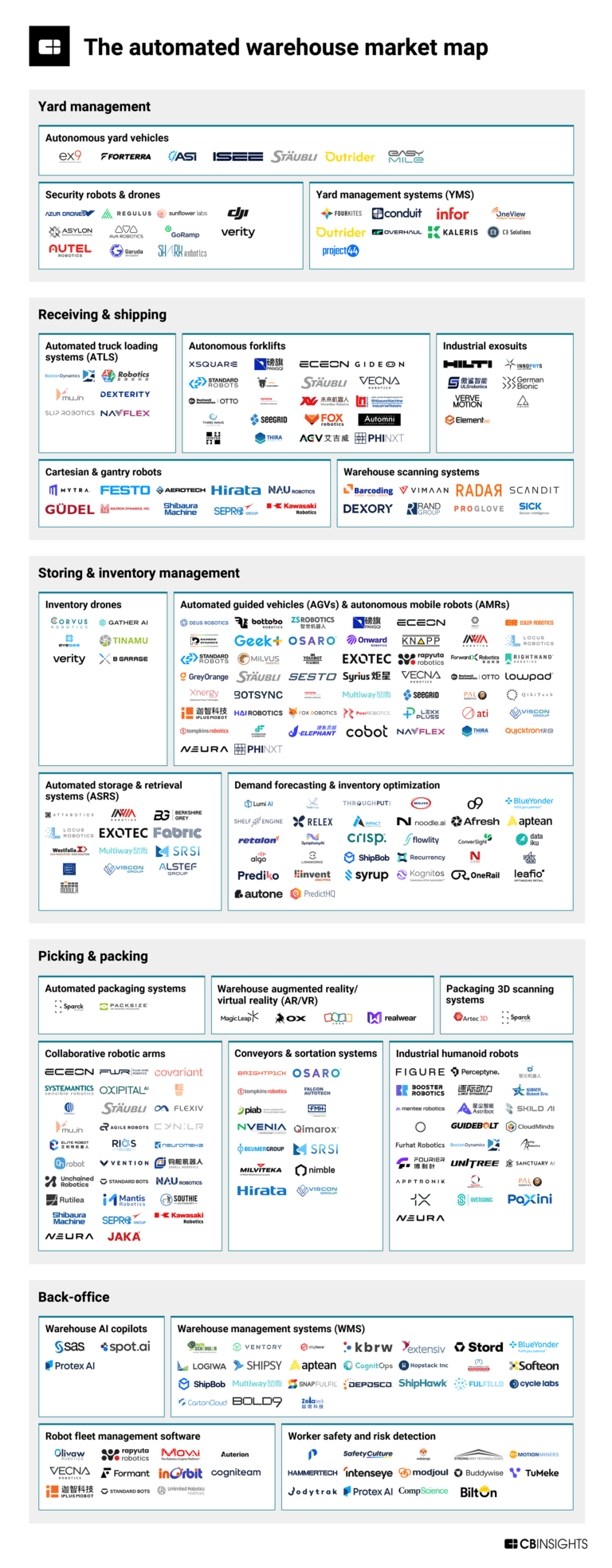

The automated warehouse market map

Sep 28, 2023

The automation in advanced manufacturing market map

Feb 21, 2023

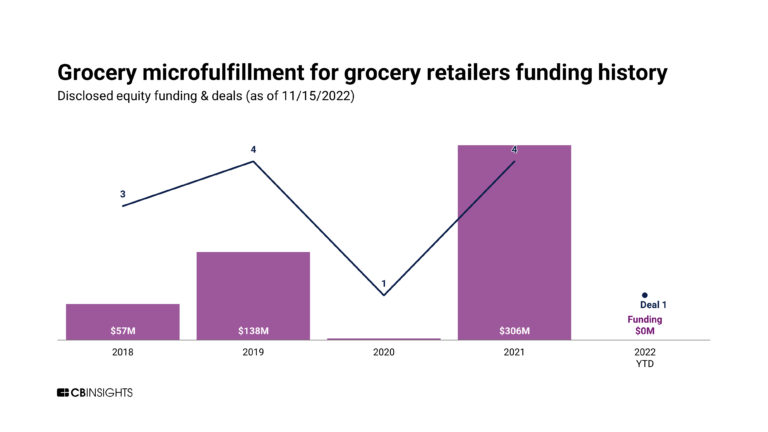

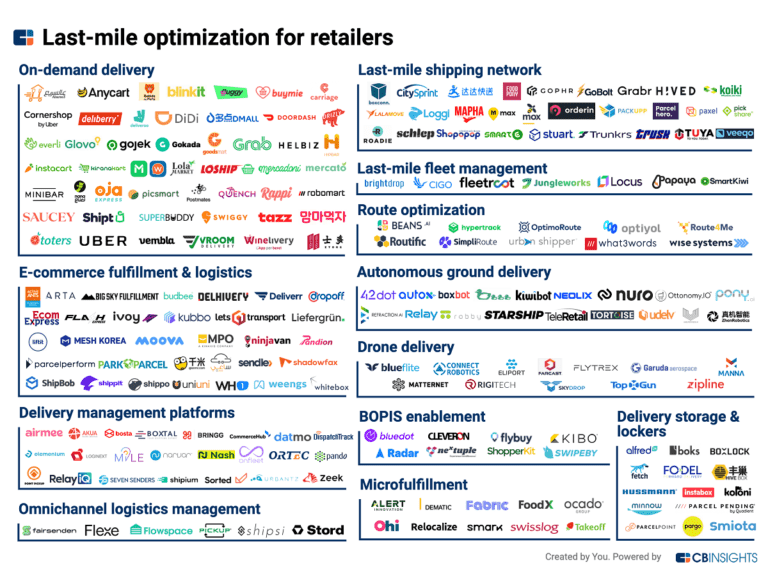

Market Trend Report: Microfulfillment for retailers

Expert Collections containing Fabric

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fabric is included in 9 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,969 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Supply Chain & Logistics Tech

5,978 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

Robotics

2,699 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Grocery Retail Tech

831 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Artificial Intelligence

10,027 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fabric Patents

Fabric has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/8/2016 | 11/12/2019 | Arcade games, Actuators, Gears, Antennas (radio), Control theorists | Grant |

Application Date | 6/8/2016 |

|---|---|

Grant Date | 11/12/2019 |

Title | |

Related Topics | Arcade games, Actuators, Gears, Antennas (radio), Control theorists |

Status | Grant |

Latest Fabric News

Mar 17, 2025

The global market for Micro Fulfillment Centers (MFCs) was valued at US$6.2 Billion in 2024 and is projected to reach US$31.6 Billion by 2030, growing at a CAGR of 31.1% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. Micro fulfillment centers (MFCs) are equipped with advanced automation technologies, such as robotic picking systems and conveyor belts, which allow for the quick assembly and dispatch of orders. By being closer to the end customer, MFCs reduce the time and cost associated with last-mile delivery, making them a key component in the evolving landscape of e-commerce logistics. What's Driving the Growth of the Micro Fulfillment Centers Market? The growth in the micro fulfillment centers market is driven by several factors. The explosive growth of e-commerce is a primary driver, as more consumers opt for online shopping and demand faster delivery times. Retailers are increasingly adopting MFCs as a way to enhance their last-mile delivery capabilities and reduce transportation costs. The push for urbanization and the need for space-efficient logistics solutions in densely populated areas are also contributing to the rise of MFCs. Moreover, advancements in automation and robotics are making MFCs more viable and cost-effective, encouraging more retailers to invest in these centers to stay competitive in the fast-paced e-commerce landscape. Why Are Micro Fulfillment Centers Gaining Popularity? The popularity of micro fulfillment centers is driven by the surge in e-commerce, particularly during and after the COVID-19 pandemic, which saw a dramatic shift in consumer purchasing behavior towards online shopping. Consumers now expect faster delivery times, and MFCs offer a solution by enabling retailers to fulfill orders more quickly and efficiently. Additionally, MFCs help retailers manage inventory more effectively by allowing for quicker replenishment of stock and reducing the need for large, centralized warehouses. The ability to meet customer demands for speed and convenience while reducing operational costs makes MFCs an attractive option for retailers looking to enhance their competitive edge. How Does Technology Power Micro Fulfillment Centers? Technology is at the heart of micro fulfillment centers, enabling their rapid and efficient operations. Automation plays a significant role, with robotic systems handling much of the picking, packing, and sorting of orders, which reduces labor costs and increases accuracy. Advanced inventory management systems ensure that stock levels are optimized and that the right products are available when needed. Furthermore, the use of AI and machine learning allows MFCs to predict demand patterns, optimize space utilization, and streamline operations to ensure that orders are processed as quickly as possible. These technological innovations are crucial in allowing MFCs to meet the demands of the modern consumer. Key Insights: Market Growth: Understand the significant growth trajectory of the Store-Integrated / In-Store MFCs segment, which is expected to reach US$17 Billion by 2030 with a CAGR of a 33.6%. The Standalone MFCs segment is also set to grow at 27.1% CAGR over the analysis period. Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 41.6% CAGR to reach $9.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific. Report Features: Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030. In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa. Company Profiles: Coverage of major players such as Addverb Technologies, Dematic Corp., Exotec SAS, Geekplus Technology Co., Ltd., Get Fabric, Inc. and more. Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments. Key Market Segments Type (Store-Integrated / In-Store MFCs, Standalone MFCs, Dark Store MFCs) Component (Hardware, Software, Services) End-Use (eCommerce End-Use, Traditional Retailers & Distributors End-Use, Manufacturers End-Use) Key Attributes: Report Attribute Details No. of Pages Forecast Period Estimated Market Value (USD) in 2024 $6.2 Billion Forecasted Market Value (USD) by 2030 $31.6 Billion Compound Annual Growth Rate Regions Covered Global Key Topics Covered: MARKET OVERVIEW Influencer Market Insights Micro Fulfillment Centers (MFCs) - Global Key Competitors Percentage Market Share in 2025 (E) Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E) MARKET TRENDS & DRIVERS Rising E-commerce Demand Propels Growth in Micro Fulfillment Centers (MFCs) Increasing Consumer Preference for Same-Day Delivery Expands Addressable Market Opportunity for MFCs Urbanization Trends Drive Adoption of MFCs in High-Density Areas Technological Innovations in Automation Strengthen Business Case for MFCs Growing Need for Inventory Optimization Generates Demand for MFCs Sustainability Trends Spur Growth in Energy-Efficient Micro Fulfillment Centers Competitive Retail Landscape Throws the Spotlight on MFCs as a Strategic Advantage Omni-Channel Retailing Accelerates Demand for Integrated Micro Fulfillment Solutions Real Estate Constraints in Urban Areas Drive Adoption of Space-Efficient MFCs Rising Labor Costs Sustain Growth in Automated and Robotized Micro Fulfillment Centers FOCUS ON SELECT PLAYERS: Some of the 42 major companies featured in this Micro Fulfillment Centers (MFCs) market report include: Addverb Technologies Dematic Corp. Exotec SAS Geekplus Technology Co., Ltd. Get Fabric, Inc. Honeywell Industrial Automation Honeywell International, Inc. Knapp AG Mecalux SA Opex Corporation For more information about this report visit https://www.researchandmarkets.com/r/n6de2v About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. View source version on businesswire.com: https://www.businesswire.com/news/home/20250317493086/en/ Contacts ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Fabric Frequently Asked Questions (FAQ)

When was Fabric founded?

Fabric was founded in 2015.

Where is Fabric's headquarters?

Fabric's headquarters is located at Hamasger 9 Street, Tel Aviv.

What is Fabric's latest funding round?

Fabric's latest funding round is Series C.

How much did Fabric raise?

Fabric raised a total of $336.01M.

Who are the investors of Fabric?

Investors of Fabric include CPP Investments, Temasek, Union Tech Ventures, KSH Capital, Princeville Capital and 14 more.

Who are Fabric's competitors?

Competitors of Fabric include Walmart - Advanced Systems & Robotics, Exotec, TakeOff, Noyes Technologies, GreyOrange and 7 more.

What products does Fabric offer?

Fabric's products include The Fabric Smart Cube .

Who are Fabric's customers?

Customers of Fabric include Superpharm.

Loading...

Compare Fabric to Competitors

Scallog provides robotic solutions for order preparation within the logistics sector. The company offers products including mobile robots, shelving systems, and workstations that are intended to automate and optimize warehouse operations. Scallog's solutions are utilized in e-commerce, industrial, retail, fashion, consumer goods, and cosmetic-pharmaceutical sectors. It was founded in 2013 and is based in Nanterre, France.

Locus Robotics specializes in artificial intelligence (AI) driven warehouse automation solutions within the robotics industry. The company provides autonomous mobile robots that work collaboratively with humans to enhance productivity and operational efficiency in warehouses. Locus Robotics primarily serves sectors such as third-party logistics, retail and eCommerce, healthcare, and industrial sectors. It was founded in 2014 and is based in Wilmington, Massachusetts.

Oxipital AI specializes in visual artificial intelligence solutions within the manufacturing sector. The company offers visual AI inspection systems and vision-guided pick-and-place robotic systems designed to enhance manufacturing efficiency and product quality. Oxipital AI primarily serves industries with high-variability manufacturing environments, such as food processing, agriculture, and consumer packaged goods. Oxipital AI was formerly known as Soft Robotics. It was founded in 2013 and is based in Bedford, Massachusetts.

Osaro provides robotic automation solutions for warehouse operations, focusing on the logistics and e-commerce sectors. The company offers piece-picking robots that utilize AI-driven control software and machine learning to assist with warehouse tasks such as bagging, kitting, and mixed-case depalletizing. Osaro's technology integrates with existing automated material handling systems, transitioning operations from goods-to-person to goods-to-robot stations. It was founded in 2015 and is based in Sacramento, California.

Geek+ operates in the field of robotics solutions for warehouse and logistics automation. The company focuses on the development and deployment of mobile robotics and technologies to support supply chain processes. Geek+ provides products such as shelf-to-person, tote-to-person, and pallet-to-person robotic systems, along with sorting and moving robots, aimed at facilitating order fulfillment and optimizing storage space. It was founded in 2015 and is based in Beijing, China.

Onward Robotics specializes in warehouse automation and order fulfillment solutions within the logistics and supply chain sectors. The company offers technology that facilitates intelligent coordination between people and robots, aiming to optimize warehouse fulfillment processes. Onward Robotics' main offerings include proprietary software for task assignment and workflow optimization, mobile robots for efficient goods-to-person operations, and systems designed to enhance human-robot collaboration. Onward Robotics was formerly known as IAM Robotics. It was founded in 2012 and is based in Pittsburgh, Pennsylvania.

Loading...