Immutable

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$272.74MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-48 points in the past 30 days

About Immutable

Immutable focuses on blockchain technology, specifically in the gaming and non-fungible token (NFT) sectors. The company offers a platform for the creation and trading of NFTs, as well as infrastructure for blockchain-based games, including NFT minting tools and reliable NFT trading endpoints. Immutable primarily serves the gaming industry. Immutable was formerly known as Fuel Games. It was founded in 2018 and is based in Sydney, Australia.

Loading...

ESPs containing Immutable

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The game development solutions market offers technology tools for game creators, studios, and publishers to develop and enhance their games. These solutions include game engines, development tools, middleware, and platforms that enable the creation of interactive gaming experiences. The market includes both traditional development solutions like 3D engines and emerging technologies like blockchain…

Immutable named as Leader among 14 other companies, including Autodesk, Epic Games, and Niantic.

Loading...

Research containing Immutable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

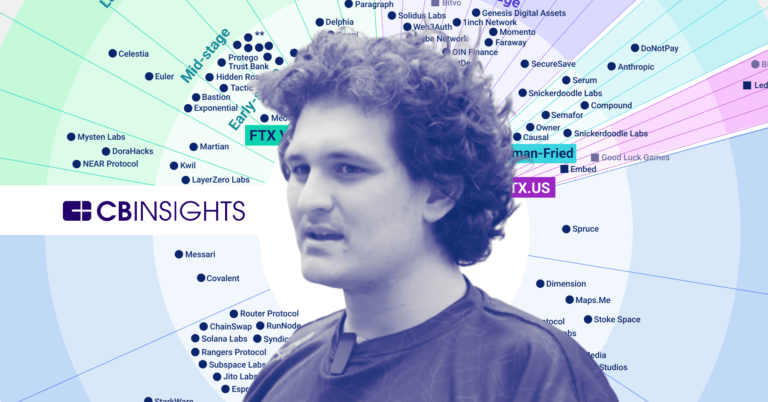

CB Insights Intelligence Analysts have mentioned Immutable in 3 CB Insights research briefs, most recently on Nov 17, 2022.

Expert Collections containing Immutable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Immutable is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

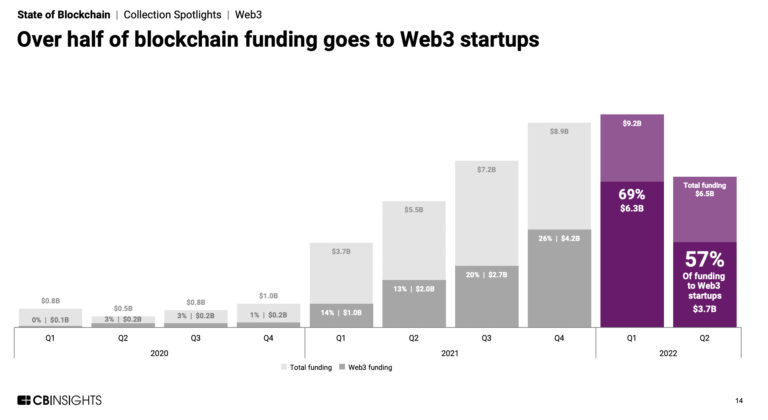

Blockchain

13,515 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Gaming

5,683 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Latest Immutable News

Apr 10, 2025

Most of the tokens that hit the market before 2022 had a healthy portion of their supply locked up and are only being slowly released over the course of several years. Understanding how much of a token's supply is still locked up and the timetable for these unlocks and the token's gradual distribution to the market is necessary knowledge for sociology participants. A great many of these tokens are associated with long-term strategic blueprints, such as issuing community rewards, developing ecosystems, or making reserve allocations. This makes it important to pay attention to these schedules, watch these tokens work their way through their unlocked stages, and even consider what may happen when these operations are finished. Some tokens seem already to be almost finished with their unlocking. Others are still in an earlier stage of their operation and have years—if not decades—to go. Analyzing the Vesting Schedules: Tokens to Watch Many of the tokens that launched prior to 2022 still have a considerable part of their available supply that is not accessible to the market because it is locked in vesting schedules. Let's examine some of the main tokens in today's market that are undergoing this phase. Immutable ($IMX): Near Completion, But Still A Long Way to Go Immutable ($IMX), a leading platform in the NFT space, is relatively close to the completion of its unlock phase. As of now, 90% of the token's total supply is unlocked, with the remaining 10% set to unlock by October 2025. This final batch of tokens is primarily allocated for ecosystem development and project growth. With only 10% left to unlock, the price action of $IMX is likely to be less impacted by future unlocks, as the majority of the supply has already entered circulation. The remaining allocation for ecosystem and project development suggests that Immutable is focused on long-term growth. Filecoin ($FIL): A Long Road Ahead for Unlocking Filecoin ($FIL), a decentralized storage network, still has a significant amount of its supply locked. Currently, 60% of $FIL's supply remains in vesting, and the final unlock isn't expected until July 2030. The remaining locked supply consists of reserves, community allocations, and team tokens. Given that $FIL still has a long way to go before the final unlock, this extended timeline could impact investor sentiment, especially as the token's circulating supply increases over time. With a large portion of the remaining supply dedicated to reserves and community-driven initiatives, $FIL may see gradual inflationary pressure as new tokens enter circulation over the coming years. Yield Guild Games ($YGG): Significant Allocations Still Locked Yield Guild Games ($YGG), a decentralized gaming ecosystem, has now unlocked 78% of its total supply. Meanwhile, 22% of the supply is still locked, with the final unlock not scheduled until February 2027. The remaining allocations are mostly intended for investors, community members, and treasury personnel, as well as founders. The fact that such a large part is still locked up means that for the next few years, a significant influence over the token's supply will be wielded by, well, the investors and founders. Aurora ($AURORA) and Skale ($SKL): Uncertain Final Unlock Dates Gradual token unlocks are also experienced by Aurora ($AURORA) and Skale ($SKL). It is estimated that the percentage of unlocked $AURORA has already crossed 40%. The final unlock is expected to happen in June 2029. The remaining tokens are, as per the structure of the project, tied to community incentives and reserve allocations. By contrast, the final unlock date for $SKL is completely unknown, which adds a layer of uncertainty for investors. Apart from having a fairly substantial amount of $SKL unlocked (63%), the imbalance between unlocked $SKL (63%) and the estimated circulating supply of $SKL (82.5%) may in fact render the project fairly precarious, if not downright toxic, from a market perspective. Taking a look at Tokens launched before 2022 that are still vesting. Who's in control of the remaining supply? % Locked Supply (Final Unlock Date): $IMX : 10% (Oct 2025) $FIL : 60% (Jul 2030) $YGG : 22% (Feb 2027) $DYDX : ~32% (Jul 2026) $CELO : 44% (beyond 2050) … ↓ pic.twitter.com/cFtcWQeIEy — Tokenomist (prev. TokenUnlocks) (@Tokenomist_ai) April 8, 2025 dYdX ($DYDX): A Large Portion Still Locked for the Next Few Years dYdX ($DYDX), a decentralized derivatives exchange, has liberated roughly 68% of its total supply. This leaves portions of the supply that are set aside mostly for investors, team members, and reserves. Those reservists just have to wait until the last of this supply is set to be unlocked—around July of 2026. From a purely mechanical perspective, if price is a function of supply and demand, and if 68% being released doesn't make the price go up, it might mean that a lot of the folks who hold it are just holding it for a coming price dip. Celo ($CELO): A Vesting Schedule That Could Stretch Beyond 2050 Celo ( $ CELO ) , a mobile – first blockchain project , has the most extended vesting period , with the remaining 44 % of its supply not expected to unlock until well beyond 2050 . The long timeframe for unlocking could significantly impact $ CELO ' s market behavior , as the project still has a considerable portion of its supply locked in reserves and community – related allocations . The extended vesting period also suggests that the project ' s founders and stakeholders are in control of a significant portion of the token supply , and their strategic decisions will play a critical role in shaping the token ' s long – term price dynamics . Key Takeaways for Investors For investors, it is very important to understand the vesting schedules of tokens launched before 2022 in order to make predictions about potential price movements and to assess the overall supply-demand dynamics of these assets. If tokens have longer vesting periods, like $CELO, they are not as likely to face immediate inflationary pressure, which we might see as a kind of deflationary moment for immediate price appreciation. On the other hand, they could face some kind of price appreciation moment when tokens finally do start vesting, because we are in a bear market and inflationary moment right now. At the same time, tokens like $IMX, which are almost finished with their unlocks, might have less of a market impact from future unlocks and thus offer more stability. On the other hand, tokens like $FIL and $YGG that still have a lot of their supply locked up could face the opposite situation as the remainder of their locked supply gets released. These unlock schedules are significant for investors to observe because of what they may portend for the price, liquidity, and overall market sentiment of a token. Once a token is released from its vault, it becomes an free agent in the marketplace. The more tokens that get released, the more they can do positive or negative things to a token's price. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news Source: https://nulltx.com/long-term-vesting-a-deep-dive-into-tokens-still-unlocked-post-2022-and-their-market-implications/

Immutable Frequently Asked Questions (FAQ)

When was Immutable founded?

Immutable was founded in 2018.

Where is Immutable's headquarters?

Immutable's headquarters is located at 77 King Street, Sydney.

What is Immutable's latest funding round?

Immutable's latest funding round is Series C - II.

How much did Immutable raise?

Immutable raised a total of $272.74M.

Who are the investors of Immutable?

Investors of Immutable include Framework Ventures, King River Capital, Fabric Ventures, AirTree Ventures, Prosus Ventures and 28 more.

Who are Immutable's competitors?

Competitors of Immutable include Polygon and 2 more.

Loading...

Compare Immutable to Competitors

Provenance Blockchain provides production blockchain protocol. The company provides an online platform that acts like a global ledger, registry, and exchange across assets and markets and it facilitates loans to be originated, financed, sold, and securitized. The company was founded in 2018 and is based in San Francisco, California.

vlayer creates data infrastructure for the web3 space, utilizing its technology in the blockchain sector. The company offers tools for developers to extract and integrate real-world data into Ethereum smart contracts, using zero-knowledge proofs to ensure trust and privacy. Its services are aimed at the web3 developer community, enabling the development of applications that require secure data interactions. The company was founded in 2024 and is based in Warsaw, Poland.

Matter Labs operates as an engineering company with a focus on blockchain technology and mathematical applications. It involves scaling Ethereum using zero-knowledge proofs, a technology that aids in the mainstream adoption of public blockchains. It primarily caters to the cryptocurrency and blockchain industry. The company was founded in 2018 and is based in Berlin, Germany.

Taiko focuses on blockchain scalability solutions. It offers a decentralized, Ethereum-equivalent ZK-Rollup to support all Ethereum virtual machine (EVM) opcodes, providing a layer-2 scaling solution for Ethereum. The company's technology aims to be open source, allowing for community contributions and modifications. Taiko was founded in 2022 and is based in Camana Bay, Cayman Islands.

Albus Protocol is a digital platform that streamlines customer verification for businesses without compromising user data security or privacy, ensuring compliance with digital regulations (KYC, AML, GDPR, CBDC). The platform serves companies in DeFi, Marketing, Fintech, Logistics, Retail, Metaverse & GameFi, and many other industries, and enables businesses to create point systems, issue users membership cards, prevent sibyls attack, make proof-of-fund (PoF) checks, identify suppliers (KYS) and assets, track shipments, prevent counterfeiting and control quality. The company was founded in 2022 and is based in Wollerau, Switzerland.

Category Labs specializes in decentralized systems within the blockchain technology sector. The company offers a layer 1 blockchain named Monad, which is compatible with the Ethereum Virtual Machine and supports 10,000 transactions per second with one-second block times and single-slot finality. Category Labs' solutions are primarily targeted at sectors that require blockchain infrastructure with a focus on performance and decentralization. Category Labs was formerly known as Monad Labs. It was founded in 2022 and is based in New York, New York.

Loading...