Gemini

Founded Year

2015Stage

Series A | AliveTotal Raised

$400MValuation

$0000Last Raised

$400M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-47 points in the past 30 days

About Gemini

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Loading...

ESPs containing Gemini

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

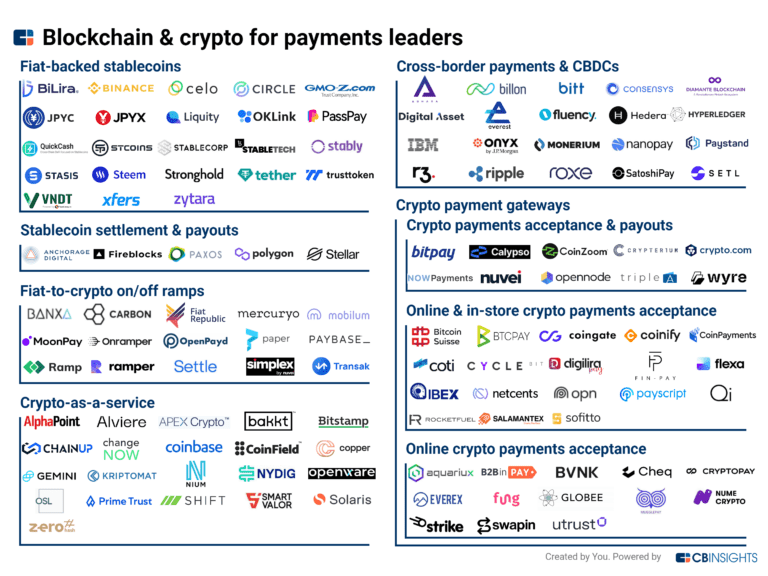

The fiat-backed stablecoins market provides digital currencies that maintain stable value by being fully backed by fiat currency reserves held in bank accounts or other financial instruments. These stablecoins offer protection against cryptocurrency volatility while enabling fast, global transactions, cross-border payments, and digital asset trading. Companies in this market issue stablecoins pegg…

Gemini named as Highflier among 14 other companies, including Coinbase, Circle, and Binance.

Loading...

Research containing Gemini

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gemini in 9 CB Insights research briefs, most recently on May 8, 2024.

Expert Collections containing Gemini

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gemini is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

10,506 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Gemini News

Apr 1, 2025

Recently, numerous crypto users reported receiving fraudulent emails claiming that the Gemini exchange had filed for bankruptcy. Meanwhile, Coinbase Exchange has admitted that an employee illegally accessed user account information. Gemini Exchange Addresses Bankruptcy Allegations Multiple accounts highlighted the scam on social media, indicating that an email circulating falsely claims that Gemini has filed for bankruptcy. The email instructed users to withdraw to an Exodus wallet and provided a seed phrase. These phishing emails, shared on April 1, urged recipients to withdraw their funds into a specified crypto wallet to protect their assets. This was an attempt to deceive users into transferring their cryptocurrencies to wallets controlled by scammers. “Do not follow these directions. Please retweet to protect those that may have been doxxed and sent this email,” wrote Jason Williams, a contributor to Fox Business. Phishing email targeting Gemini users. Source: Jason Williams on X The deceptive emails alleged a substantial loss of $1.2 billion by Gemini Exchange. Understandably, some novice investors would heed this email and even move their assets to the address. After all, some victims of FTX Exchange contagion continue to pursue their funds even years after the incident. “I got one also. It is better than your typical ‘Coin Base' one, but still not quite there. Might fool a boomer though,” one X user remarked. However, security experts advise users to always verify information through official channels, avoid clicking on unsolicited links, and refrain from sharing personal data. Gemini issued an official warning in response to the scam, acknowledging the threat against its users. “We recently learned that some Gemini customers are being targeted with scam emails requesting users to transfer their crypto to outside wallets. Please be aware that Gemini will never request that you send crypto to outside wallets,” the exchange articulated. Coinbase Admits Employee Illegally Accessed User Account Data Coinbase exchange acknowledged a privacy violation by one of its staff in a somewhat related development. Specifically, a customer service employee accessed user account information without authorization. This breach has raised concerns about potential scams targeting Coinbase users. Mike Dudas, a crypto investor and co-founder at The Block, shared an email from Coinbase acknowledging the incident. “That explains the fake Coinbase phishing emails and phone calls today,” he stated. Coinbase note to customers. Source: Mike Dudas on X This breach coincides with reports of phishing attempts, as users have received fake emails and calls purporting to be from Coinbase. These incidents reflect a broader wave of crypto-related fraud. Blockchain investigator ZachXBT reported that Coinbase users lost over $65 million to social engineering scams between December 2024 and January 2025. “Coinbase did not detect it; I sent them the intel,” the blockchain investigated noted. Additionally, crypto analyst Cobie suggested Kraken might be experiencing a similar issue. Per his post, a new attack may be budding, where attackers infiltrate customer service roles to exfiltrate data. “Kraken also recently hit with this too. Maybe a new scheme from attackers (get a CS agent employee in, exfil data),” the analyst remarked. Amidst these events, ZachXBT recently explained how to avoid crypto scams. He emphasizes the importance of conducting thorough research before engaging with new DeFi protocols, especially those forked from existing projects on newly launched EVM chains. Additionally, he advises caution when dealing with projects with few credible followers, as these may indicate potential scams. Therefore, it is imperative that users remain vigilant against sophisticated phishing scams and unauthorized data breaches. Disclaimer In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated. Source: https://beincrypto.com/gemini-exchange-bankruptcy-scam-phishing/

Gemini Frequently Asked Questions (FAQ)

When was Gemini founded?

Gemini was founded in 2015.

Where is Gemini's headquarters?

Gemini's headquarters is located at 600 3rd Avenue, New York.

What is Gemini's latest funding round?

Gemini's latest funding round is Series A.

How much did Gemini raise?

Gemini raised a total of $400M.

Who are the investors of Gemini?

Investors of Gemini include United Talent Agency, Commonwealth Bank of Australia, VanEck, Jane Street Group, Morgan Creek Digital and 14 more.

Who are Gemini's competitors?

Competitors of Gemini include BurjX, Ledger, BitGo, Alt 5 Sigma, Fordefi and 7 more.

Loading...

Compare Gemini to Competitors

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

BitGo provides digital asset custody and financial services within the cryptocurrency sector. The company offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. BitGo serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

Fireblocks is an enterprise-grade platform that specializes in secure infrastructure for moving, storing, and issuing digital assets within the blockchain and cryptocurrency sectors. The company offers a suite of applications for digital asset operations management and a comprehensive development platform for building blockchain-based businesses. Fireblocks' solutions cater to a variety of sectors, including financial institutions, exchanges, and fintech startups. It was founded in 2018 and is based in New York, New York.

eToro offers a social investment platform that operates in the financial services industry. The company provides a platform for investing in stocks and digital assets, trading contracts for difference (CFDs), and a community feature for users to exchange investment strategies and share market insights. eToro primarily serves retail investors looking to engage in stock and cryptocurrency investments and trading. It was founded in 2007 and is based in Limassol, Cyprus.

Loading...