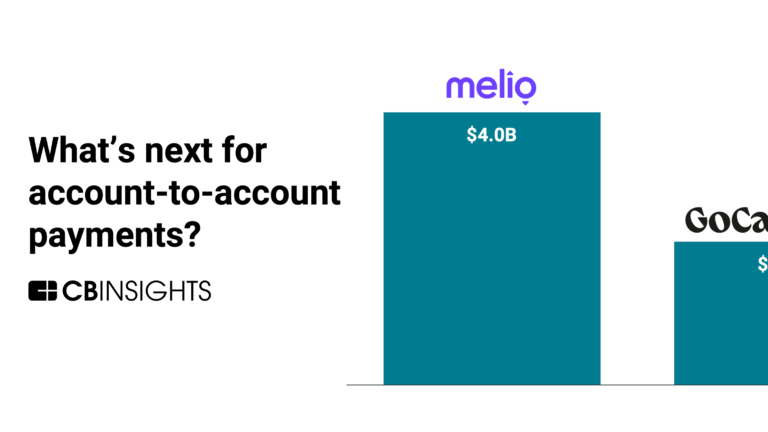

GoCardless

Founded Year

2011Stage

Series G | AliveTotal Raised

$529.32MValuation

$0000Last Raised

$312M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-18 points in the past 30 days

About GoCardless

GoCardless provides online payment processing solutions for various business sectors. The company offers services for one-off, recurring, and invoice payments, including options for subscriptions, installments, and automated payment collection. GoCardless serves sectors that require payment processing and management, such as e-commerce, real estate tech, and cloud computing. It was founded in 2011 and is based in London, United Kingdom.

Loading...

GoCardless's Product Videos

ESPs containing GoCardless

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

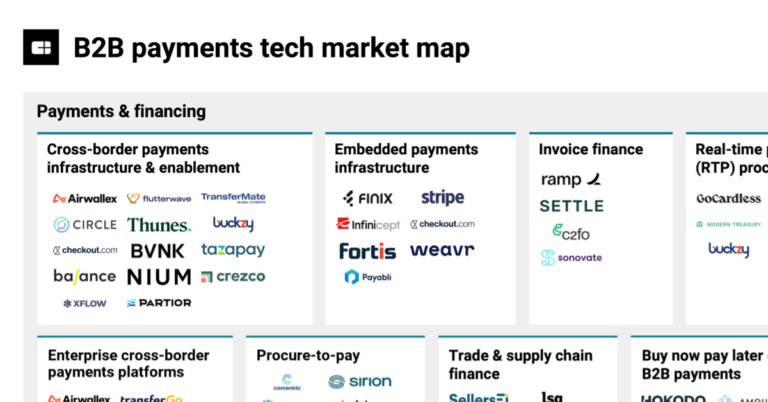

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

GoCardless named as Outperformer among 15 other companies, including Stripe, Tipalti, and Flywire.

GoCardless's Products & Differentiators

GoCardless Payments

GoCardless is the world’s largest direct bank pay network, processing over $30bn in payments every year. We enable businesses to collect payments directly from their customers bank accounts without the need for card network intermediaries. Operate globally, but feel local with bank debit payment options in over 30 countries, including the UK (Bacs Direct Debit), Eurozone countries (SEPA), the USA (ACH), Canada (PAD), Australia (BECS) and New Zealand (PaymentsNZ). Manage your payments from a single platform, customizable to match your needs - whether you’re a small business or global enterprise. It’s time to say goodbye to cards for good.

Loading...

Research containing GoCardless

Get data-driven expert analysis from the CB Insights Intelligence Unit.

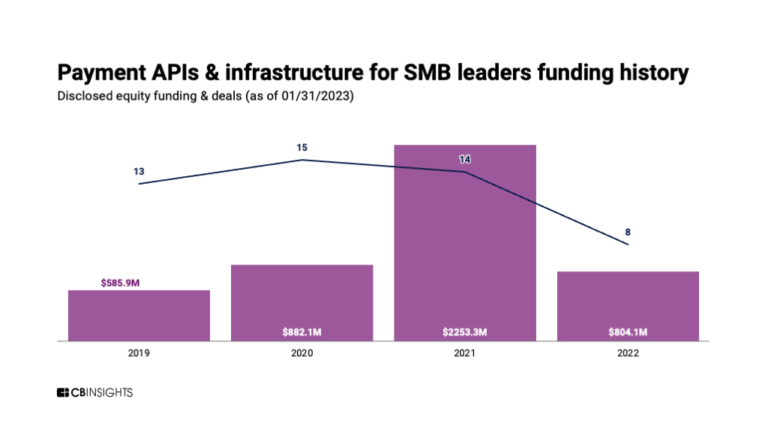

CB Insights Intelligence Analysts have mentioned GoCardless in 8 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing GoCardless

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

GoCardless is included in 9 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,075 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,648 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Latest GoCardless News

Apr 4, 2025

GoCardless bolsters partnership team with two key senior appointments GoCardless bolsters partnership team with two key senior appointments Bank payment company GoCardless has strengthened its partnership team with two strategic hires, both with responsibilities in Australia and New Zealand, to accelerate its path to profitability through its indirect go-to-market channel. Sharp brings 20+ years of experience in the payments and software space, building her career in business development and account management at organisations including SagePay and Paypoint. She transitioned into partnerships during her time at WorldPay and has since held leadership positions at SAP CX and most recently Dojo. In her new role at GoCardless , Sharp is responsible for leading small business partnerships globally, with a focus on enhancing the partner experience and driving value for customers through innovation. In Australia and New Zealand, Sharp will look to strengthen strategic partnerships with the likes of Xero and the accountancy community. In line with GoCardless’ ambition to grow outside of its UK home market, it has also appointed Milo Cilloni as Director of International Partnerships. Based in the Paris office, Cilloni will lead the international partnerships go-to-market strategy, including the Australian and New Zealand markets. Before joining GoCardless, Cilloni held a number of key positions in the technology industry, including at PrestaShop and Visa, where he gained valuable experience in managing strategic international partnerships. Paul Stoddart, President at GoCardless , said, “Partnerships have been a key part of GoCardless since day one, and they’ll remain at the heart of what we do – especially as ANZ businesses look for easy ways to manage all of their operations in one place. We need to ensure GoCardless is seamlessly embedded into the platforms they use every day and we’ll work closely with our partners to deliver the best experience for customers. Having Yasmin and Milo on board will provide a big boost and I’m confident they will help us maximise the opportunities.” Sharp said, “I’m passionate about all things payments and partnerships, so I’m extremely excited to start in this role. With around 350 partners already, our indirect channel has strong foundations. I’m here to take the programme to the next level, particularly in the way we deliver value to small businesses through our partners. I can’t wait to work with our partners and build a best-in-class experience for everyone in our ecosystem.” Cilloni said, “GoCardless has a strong network of partners in the UK and my ambition is to replicate that success in Australia and New Zealand. We see growth opportunities and a lot of upside in all of our markets, so there’s never been a better time to join and grow the business.” The appointment announcements follow a set of strong results for GoCardless. In its latest fiscal year (FY24), GoCardless Ltd. and its subsidiaries generated AUD$267 million in revenue. Its Australian operations demonstrated a 30% year-on-year increase in revenue and transaction volumes. Australian revenues continued to grow, now accounting for 4% of the company’s total revenue, on par with markets such as the United States. Over the same period, GoCardless continued to expand its indirect channels, extending its strategic relationships with key partners such as Xero, Salesforce and Quickbooks, and signing new partners such as InsuredHQ. Join our Newsletter:

GoCardless Frequently Asked Questions (FAQ)

When was GoCardless founded?

GoCardless was founded in 2011.

Where is GoCardless's headquarters?

GoCardless's headquarters is located at 65 Goswell Road, London.

What is GoCardless's latest funding round?

GoCardless's latest funding round is Series G.

How much did GoCardless raise?

GoCardless raised a total of $529.32M.

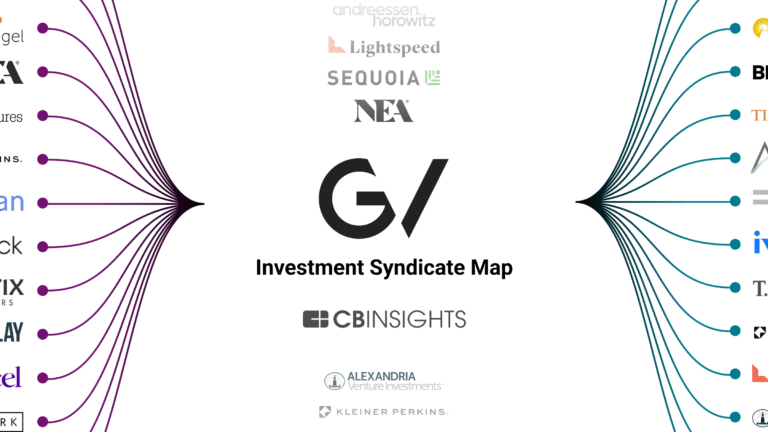

Who are the investors of GoCardless?

Investors of GoCardless include Permira, BlackRock, Accel, Balderton Capital, Notion Capital and 20 more.

Who are GoCardless's competitors?

Competitors of GoCardless include Satispay, Clip, Stripe, PayNearMe, Druo and 7 more.

What products does GoCardless offer?

GoCardless's products include GoCardless Payments and 4 more.

Who are GoCardless's customers?

Customers of GoCardless include Docusign and Gravity Active Entertainment.

Loading...

Compare GoCardless to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

ToneTag specializes in soundwave-based technology for the payments, retail, and mobility sectors. It provides contactless payment solutions, voice-assisted transaction processing, and digital business billing systems. ToneTag's technology allows merchants to offer payment experiences through various channels such as online stores, in-store solutions, and voice commerce. ToneTag was formerly known as Naffa Innovations Private Limited. It was founded in 2013 and is based in Bengaluru, India.

Previse specializes in accelerating B2B payments through data-driven solutions in the financial technology sector. The company offers services that enable instant invoice payments and supply chain payment optimization using artificial intelligence to assess invoices and facilitate early payments. Previse's solutions cater to large enterprises looking to improve their working capital efficiency and supplier payment processes. It was founded in 2016 and is based in London, England.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Loading...