Groww

Founded Year

2016Stage

Series E - II | AliveTotal Raised

$399.89MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About Groww

Groww is a financial services company specializing in investment and trading platforms. The company offers a range of services, including equity trading, direct mutual funds, and investment in US stocks, all through a user-friendly online platform. Groww provides tools for both systematic investment plans (SIPs) and lumpsum investments, as well as educational resources to empower investors. It was founded in 2016 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Groww

Get data-driven expert analysis from the CB Insights Intelligence Unit.

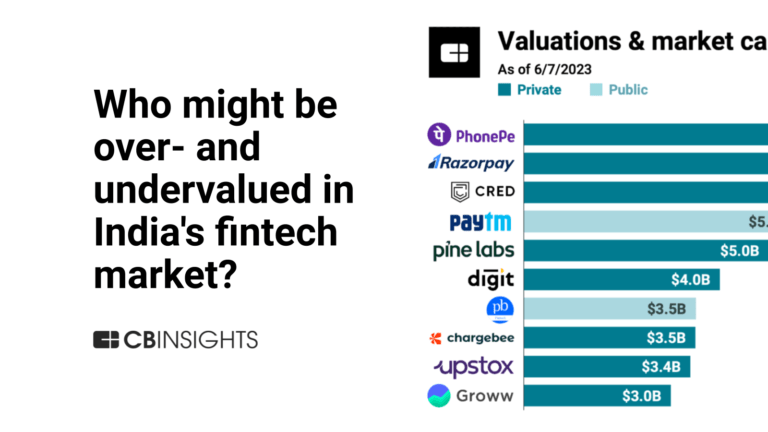

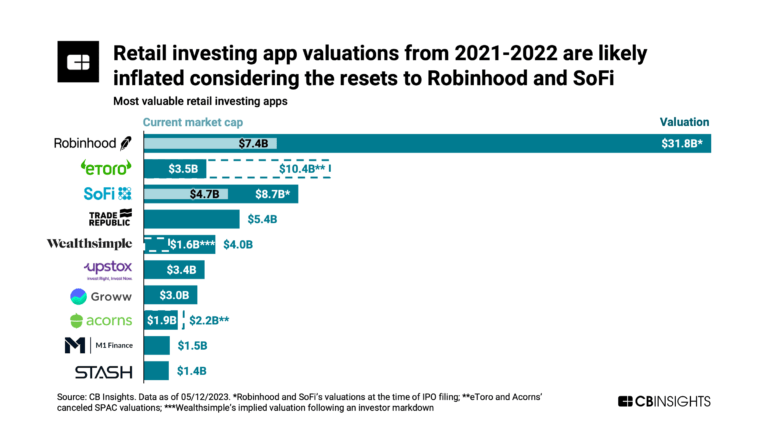

CB Insights Intelligence Analysts have mentioned Groww in 2 CB Insights research briefs, most recently on Jun 14, 2023.

Expert Collections containing Groww

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Groww is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Groww News

Apr 2, 2025

Want this newsletter delivered to your inbox? SUBSCRIBE Thank you for subscribing to Morning Dispatch We'll soon meet in your inbox. Happy Wednesday! Fintech startups are tapping into India’s growing commercial EV market. This and more in today’s ETtech Morning Dispatch. Also in the letter: EV finance companies charged up over electric commercial vehicles Fintech startups are ramping up efforts to capture India’s booming commercial electric vehicle (EV) credit market . With electric two- and three-wheelers rapidly gaining traction in last-mile logistics, fintech firms are stepping in to finance these vehicles. Driving the news: Industry estimates suggest India will need $30 billion in EV financing over the next five years. With banks and non-banking financial companies (NBFCs) focussing on passenger EVs, fintechs are targeting commercial vehicles. Industry insiders say EVs already make up 20-25% of the market in major cities, and this share is rising fast. Innovative models: Unlike combustion engine vehicles, EVs have higher upfront costs due to expensive batteries. VidyutTech offers a pay-per-use model, where users pay per kilometre driven, turning battery costs into an operational expense (much like fuel). Revfin works with manufacturers to assess vehicle and battery lifespan, to improve loan underwriting. Larger context: Investors hope to replicate NBFC successes like Cholamandlam in the EV space. They are betting on fintechs to develop innovative underwriting models that will scale quickly. These startups will have a strong foothold if they succeed before banks and large financial players enter the market. Lalit Keshre, cofounder, Groww What's happening: The approval follows Groww’s reverse flip , which relocated its parent entity from the United States to India in preparation for a public listing. CCI has cleared the acquisition of additional voting rights by select shareholders of Billionbrains Garage Ventures Private Limited, Groww’s parent company. It also approved the issuance of bonus compulsorily convertible preference shares to all existing equity shareholders. The order names major investors Tiger Global, Peak XV Partners, Y Combinator, Ribbit Capital, and Iconiq Strategic Management. Other details: CCI has also sanctioned the removal of Groww's founders' differential voting rights and the alignment of their voting power with that of other shareholders. On March 26, ET reported about Groww’s plans to raise $200 million in equity funding before its listing, potentially valuing the company at $6.5 billion. Sriharsha Majety, CEO, Swiggy Food and grocery delivery company Swiggy has received an income tax assessment order demanding Rs 158.25 crore in unpaid dues , according to a regulatory filing. Details: The tax demand pertains to the 2022 financial year, with authorities citing unpaid taxes on cancellation charges paid to merchants and interest earned on income tax refunds. This follows previous tax notices for Rs 1.1 crore for cancellation charges in 2018 and 2019. Swiggy stated last month that it would appeal those assessments. Tell me more: In addition to income tax demands, the company faces scrutiny over Rs 327 crore in alleged unpaid Goods and Services Tax (GST). The GST department argues that Swiggy and its rival Zomato should pay tax on delivery fees, but both companies contend these fees are passed entirely to gig workers. In December 2024, the GST department issued a tax demand of Rs 803 crore to Zomato . GCC enablers gain by helping mid-sized MNCs open bases Global capability centres (GCCs) in India are evolving beyond captive units , with boutique enablers increasingly helping companies of all sizes set up tech hubs in the country. What’s happening: In the past two years, more than 20 firms, including Confabulators, Bridgepath Innovations, and Torry Harris Business Solutions, have emerged to assist global companies in setting up sourcing or offshore centres in India. Industry experts see this as a growing sector as foreign companies expand their presence in India, shifting from back-office operations to value-driven innovation centres. Future outlook: Industry data suggests the market will surpass $10 billion in the coming years. Experts predict that global startups, mid-sized companies ($1-5 billion), and specialised small and medium businesses (SMBs) will increasingly turn to India to create innovative technology solutions, creating new market opportunities for GCC enablers. Other Top Stories By Our Reporters Zomato lays off 500 employees from customer service roles: Food delivery major Zomato has laid off approximately 500 junior-level employees from its associate programme, which was launched last year, according to sources familiar with the matter. AI mission GPU bidders set to get workloads assigned by April second week: Companies such as Reliance Jio, E2E, NxtGen, Locuz, and CtrlS, which won the IndiaAI Mission GPU tender as L1 bidders, will start receiving artificial intelligence (AI) workloads by the second week of April, a senior government official told ET. Atomberg surpasses Rs 1,000 crore in revenue for FY25: Sibabrata Das | Consumer appliances maker Atomberg Technologies has surpassed Rs 1,000 crore in revenue for the fiscal year ending March 2025, founder Sibabrata Das said. Government support can boost esports industry: Krafton’s India CEO | Krafton India chief executive Sean Hyunil Sohn said on Tuesday that government policies and support can significantly drive the growth of the esports industry . Global Picks We Are Reading ■ Apple and Google app stores host VPNs linked to sanctions-hit Chinese group ( FT ) ■ Microsoft is redesigning the Windows BSOD, and it might change to black ( The Verge ) ■ How is SoftBank funding its mega investment in OpenAI? A lot of debt ( WSJ )

Groww Frequently Asked Questions (FAQ)

When was Groww founded?

Groww was founded in 2016.

Where is Groww's headquarters?

Groww's headquarters is located at Vaishnavi Tech Park, 3rd and 4th Floor, Bengaluru.

What is Groww's latest funding round?

Groww's latest funding round is Series E - II.

How much did Groww raise?

Groww raised a total of $399.89M.

Who are the investors of Groww?

Investors of Groww include Satya Nadella, Y Combinator, Peak XV Partners, Propel Venture Partners, Ribbit Capital and 17 more.

Who are Groww's competitors?

Competitors of Groww include ET Money and 8 more.

Loading...

Compare Groww to Competitors

INDmoney is a financial services platform that specializes in investment management and advisory services. The company offers a comprehensive suite of products that enable users to track their investments, plan financial goals, and invest in a variety of instruments, including stocks, mutual funds, and fixed deposits. It was formerly known as INDwealth. It was founded in 2018 and is based in Gurgaon, India.

InCred Wealth is a modern, agile wealth management company operating in the financial services industry. The company offers a range of wealth solutions, including investment products, portfolio management services, and investment banking solutions. Their primary customers are individuals and businesses seeking wealth management and investment services. It was founded in 2019 and is based in Mumbai, India.

Zerodha is a financial services company specializing in discount broking and online stock trading. The company offers a platform for investing in stocks, derivatives, mutual funds, ETFs, and bonds with a transparent flat fee pricing model. Zerodha provides educational resources and a community for traders and investors. It was founded in 2010 and is based in Bengaluru, India.

Fisdom is a financial technology company that specializes in digital investment services and wealth management. The company provides a platform for online trading in stocks, mutual funds, IPOs, and ETFs and offers services for retirement planning and tax filing. Fisdom serves individual investors and high-net-worth individuals by providing financial advice and a mobile application for managing investments. It was founded in 2015 and is based in Bengaluru, India.

Upstox is an online trading platform that specializes in stock market trading and investment services. The company offers a range of financial products, including demat and trading accounts, mutual funds, IPO applications, and tools for tax planning and investment calculations. Upstox provides a technology-driven trading experience with access to various markets such as equities, futures and options, commodities, and currencies. It was founded in 2009 and is based in Mumbai, India.

Dstreet Games, founded in 2020, is a stock market gaming platform. It is an educational platform aiming that bring awareness among people about financial markets through stock market quizzes and learning. It is based in Bangalore, India.

Loading...