GOAT

Founded Year

2015Stage

Series F | AliveTotal Raised

$491.62MValuation

$0000Last Raised

$195M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+67 points in the past 30 days

About GOAT

GOAT is a global e-commerce platform that specializes in authentic sneakers, apparel, and accessories. It offers a marketplace for new and used items, catering to sneaker enthusiasts and fashion-forward consumers. GOAT Group operates multiple brands, including GOAT, Flight Club, Grailed, and Alias, serving a community of over 50 million members. It was founded in 2015 and is based in Los Angeles, California.

Loading...

ESPs containing GOAT

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

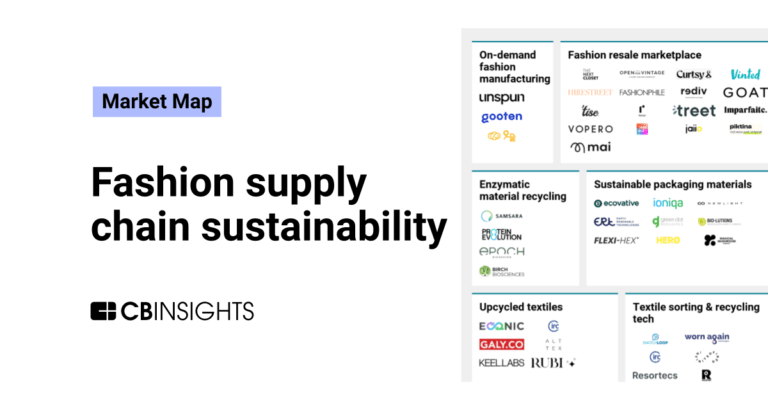

The peer-to-peer fashion resale marketplace market offers a dynamic platform for individuals to buy and sell pre-owned fashion items directly. These marketplaces provide an eco-friendly and cost-effective way for consumers to extend the lifecycle of their clothing and accessories. The market facilitates direct interactions between buyers and sellers, fostering a sense of community and trust. Busin…

GOAT named as Highflier among 15 other companies, including eBay, Vestiaire Collective, and Mercari.

Loading...

Research containing GOAT

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned GOAT in 1 CB Insights research brief, most recently on Jul 26, 2023.

Jul 26, 2023

The fashion supply chain sustainability market mapExpert Collections containing GOAT

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

GOAT is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,245 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

Luxury Tech

419 items

Tech-enabled companies launching new luxury brands, as well as startups providing tech solutions to the luxury industry, including e-commerce tools, marketing, and more. While these companies may not exclusively target luxury companies, they have notable luxury partners.

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Future Unicorns 2019

50 items

a16z Marketplace 100

200 items

The a16z Marketplace 100 is a ranking of the largest consumer-facing marketplace startups and private companies created by venture firm, Andreessen Horowitz.

Latest GOAT News

Apr 3, 2025

On April 1, 2025, Memecoin Central, aka the Chainlink, saw a trending increase of what seems to be memecoiners reinforcing their conviction to the hilarious, highly volatile, and oh-so-speculative nature of these tokens. According to on-chain analytical data, recorded for the sake of due diligence, the memecoin market, on the whole, was very much pumping on that day, with a net inbound volume of inflows outweighing the volume of outflows by the amount of $2.3 million. April 1st Inflow and Outflow Trends On April 1, the total trading volume in the memecoin space came to $5.1 million. With a net inflow of $2.3 million, this means there was significant movement within the memecoin market. Yet despite this action, the market sentiment appeared skewed towards accumulation and buying, not the profit-taking, sell-side activity that usually coincides with pronounced bullish trends. Intelligent capital—that is often used to mean institutional or, at the very least, well-informed investors—appeared to be making strategic moves, and it was concentrating its efforts (and its cash) on a few specific ones in particular. It was these specific memecoins that were attracting the attention of investors in this intelligent capital category. Key Memecoins Drawing Inflows On April 1st, several tokens attracted significant investments, signaling perhaps a trend of future price action. One of those investments was FARTCOIN, which saw $1.5 million flow into it. Given the nature of the token, one might interpret this seriously speculative bet as some sort of comment on large investors' mental health. But there is no denying that FARTCOIN is a token that exists, and the investment world is one in which the speculative pricing of assets holds sway. GOAT, another memecoin, received an inflow of $267,000 that was more moderate but still significant. The inflow into this token, which is known for its strong community base, could indicate that smart money investors are positioning themselves in the expectation of price movements that often accompany tokens driven by their communities. GRASS also got a look, with $211,000 flowing into it. And here, too, the upward trend of inflow might suggest that investors are diversifying their portfolios in the memecoin space and trying to grab hold of multiple tokens— integral to this movement— with small but important communities. Even smaller-scale projects such as POPCAT ($136,000) and E/ACC ($65,000) attracted investment, indicating that capital is seeking the next breakout project, the next speculative event, in that way reminiscent of the memecoin market. This overall trend among these tokens seems to signal a mix of larger, well-established projects (like GOAT, a project we couldn't quite figure out, and the comprehensively humorous FARTCOIN) and smaller, more niche projects (like POPCAT, a project whose very name elicits the kind of laughter economists like to pretend is only found in the playground) that are comfortable bets for future growth. Memecoins Experiencing Outflows Despite some tokens attracting substantial amounts of capital, there were also several that were experiencing outflows. Memecoins like CHEX (-$27,000), SOBA (-$16,000), and STINKDEX (-$30,000) all saw minor outflows. If nothing else, these seem to show that investor confidence in these tokens has waned somewhat, as otherwise there should be sufficient buy-side support to prevent even minor sell-offs. But what might be behind these small sell-offs? Possible answers include reduced market interest, lower engagement from the communities that support these projects, or simple profit-taking by early holders. The outflow from TITCOIN (-$34,000) and TRUMP (-$33,000) may suggest that certain investors are moving away from projects that are possibly losing their initial luster or are facing declining market sentiment. This may reflect the cyclical nature of the memecoin market, where interest can quickly fade, leading to sharp price declines and subsequent outflows. Recap: Smart money on chain activities in the memecoin market for 01/04/25 Yesterday, there was more inflow than outflow Inflow: $3.7M Outflow: $1.4M Volume: $5.1M Net Volume: $2.3M There was inflow into: $POPCAT ($136K) $GRASS ($211K) $GOAT ($267K) #FARTCOIN ($1.5M) #E /ACC… pic.twitter.com/EuTQwaqKQo — Stalkchain (@StalkHQ) April 2, 2025 The Current Landscape of Memecoin Investing The memecoin market is acknowledged for its instability, where tokens may face wild price changes, usually driven by the project's community or social media hype. On the 1st of April, the net inflow into FARTCOIN, GOAT, and other speculative assets was still very much in the positive, showing that people seem to still want to throw money at things they cannot comprehend. For investors—especially the savvy kind—the endgame is clear: secure a spot in projects poised for serious profits. And in the case of FARTCOIN, GOAT, and GRASS, these ones show some promise of being not just past but also future performers in the memecoin market. They could, in short, be described as potential Chads. And smart investors seem to have unfurled the red carpet for them and these other tokens, seeking them out in spaces populated by not just one but two active communities, and in the process flooding their prices with what in some quarters could be described as borderline illegal levels of hype. Conversely, the outflows from tokens such as TITCOIN and TRUMP reflect the rapid changes in investor sentiment that memecoins often experience. They show how fast capital can depart from these speculative assets, particularly when the market decides to shift its momentum or when other tokens start to command more attention. Looking Ahead: What Does the Data Tell Us? The data from April 1st gives a fascinating look at the memecoin market's dynamics. This is because there was a very strong net inflow. So it suggests that, at least for the moment, there's more optimism than pessimism in the market. But it's also important to remember that this is a very speculative asset class. So any sudden shift in the market or doubts about future growth can quickly turn this optimism into a memecoin market that's not so merry. For those who are keen on investing in this area, it would be prudent to watch the significant inflows and outflows, because they yield good insights into which tokens have momentum behind them and which ones are, for lack of a better term, going sideways. The memecoin market is very much in flux. Keeping a healthy skepticism about the on-chain data and where the smart money is flowing and just trying to make sense of it all is going to be an imperative for making good decisions in this space. To sum up, the money coming into certain memecoins indicates that some tokens are drawing in the kinds of institutional and speculative investors that, in recent years, have made traditional assets like art and sports collectibles more valuable. It's a sign, to be sure, that what is in a token's smart contract or underlying project matters less to many of its buyers than the sheer fun—and potential profits—of it all. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news Source: https://nulltx.com/smart-money-movements-in-the-memecoin-market-april-1st-2025/

GOAT Frequently Asked Questions (FAQ)

When was GOAT founded?

GOAT was founded in 2015.

Where is GOAT's headquarters?

GOAT's headquarters is located at 3433 West Exposition Place, Los Angeles.

What is GOAT's latest funding round?

GOAT's latest funding round is Series F.

How much did GOAT raise?

GOAT raised a total of $491.62M.

Who are the investors of GOAT?

Investors of GOAT include Accel, Y Combinator, D1 Capital Partners, Andreessen Horowitz, Ulysses Management and 27 more.

Who are GOAT's competitors?

Competitors of GOAT include SODA and 6 more.

Loading...

Compare GOAT to Competitors

StockX provides a platform that focuses on the retail industry, particularly in the realm of fashion, collectibles, and electronics. Its services include providing a marketplace for buying and selling items such as sneakers, streetwear, trading cards, handbags, and watches. It primarily caters to consumers who are interested in hard-to-find fashion items and collectibles. StockX was formerly known as Campless. The company was founded in 2016 and is based in Detroit, Michigan.

Poizon is an online fashion marketplace specializing in the sale of sneakers, apparel, and accessories. The company offers a platform for buying and selling authenticated products, leveraging AI technology and expert verification to ensure the quality and authenticity of items. Poizon caters to a global audience with a focus on the Gen Z demographic, providing a social commerce experience that includes user-generated content and community engagement. It was founded in 2015 and is based in Shanghai, China.

SODA is a company focused on creating innovative online marketplaces for the seamless buying and selling of sneakers and luxury goods. Their main service includes operating Japan's largest authenticated sneaker and trading card marketplace, which caters to a diverse audience seeking to express their individuality through unique items. They also offer a fashion collective online store that features trendy items. It was founded in 2018 and is based in Tokyo, Japan.

KYX World is a limited-release sneaker subscription platform.

Streetwear Official specializes in streetwear fashion, offering a range of clothing and accessories. The company provides a selection of graphic tees, hoodies, jeans, and snapbacks, including both popular and underground brands. Streetwear Official also offers mystery boxes and various items on sale. It is based in Orange, California.

Complex Shop is a retail platform that focuses on the e-commerce industry. The platform offers a marketplace that features drops, auctions, and collections of sneakers, apparel, and collectibles. Complex Shop collaborates with artists, brands, and sellers to provide products and experiences. The company was formerly known as The NTWRK. It was founded in 2018 and is based in Los Angeles, California.

Loading...