HealthSnap

Founded Year

2015Stage

Series B | AliveTotal Raised

$46MLast Raised

$25M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-30 points in the past 30 days

About HealthSnap

HealthSnap is a virtual care management platform that includes Remote Patient Monitoring (RPM) and Chronic Care Management (CCM) services. The company provides tools for care coordination, virtual care delivery, and billing solutions for healthcare providers managing chronic conditions. HealthSnap serves healthcare organizations, including provider groups, health systems, and Accountable Care Organizations (ACOs). It was founded in 2015 and is based in Miami, Florida.

Loading...

ESPs containing HealthSnap

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The chronic care management platforms market consists of tech-enabled solutions that help healthcare providers manage and coordinate care for patients with chronic conditions. These solutions include patient engagement tools, remote patient monitoring (RPM), care planning, and/or advanced analytics to improve clinical outcomes and reduce costs. Companies in this space leverage AI and other technol…

HealthSnap named as Leader among 11 other companies, including ThoroughCare, Vironix Health, and Clinii.

HealthSnap's Products & Differentiators

HealthSnap Remote Patient Monitoring

HealthSnap helps healthcare organizations proactively monitor patients with chronic conditions, reduce readmissions, and generate additional revenue with EHR-integrated Remote Patient Monitoring (RPM) programs.

Loading...

Research containing HealthSnap

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned HealthSnap in 3 CB Insights research briefs, most recently on Dec 5, 2023.

Aug 10, 2023

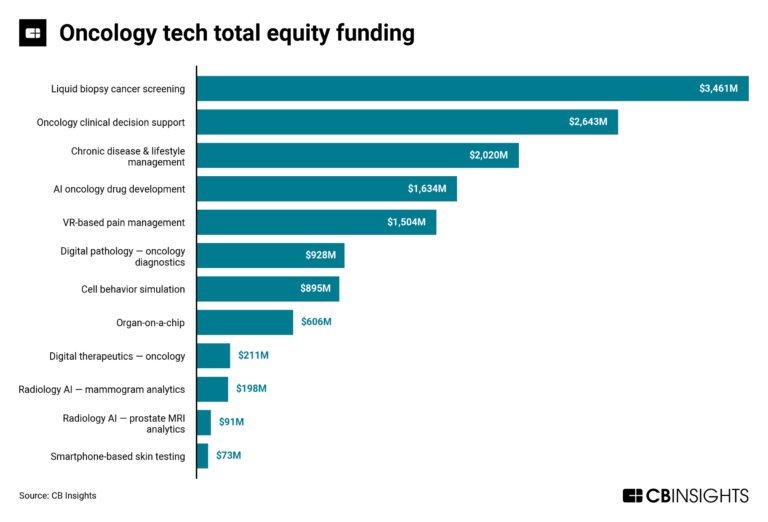

The oncology tech market mapExpert Collections containing HealthSnap

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HealthSnap is included in 6 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Value-Based Care & Population Health

1,068 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

11,306 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Digital Health 50

50 items

Artificial Intelligence

7,221 items

HealthSnap Patents

HealthSnap has filed 4 patents.

The 3 most popular patent topics include:

- graphical control elements

- graphical user interface elements

- graphical user interfaces

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/31/2020 | 3/26/2024 | Data management, Network protocols, Computer networking, Wireless networking, Diagrams | Grant |

Application Date | 12/31/2020 |

|---|---|

Grant Date | 3/26/2024 |

Title | |

Related Topics | Data management, Network protocols, Computer networking, Wireless networking, Diagrams |

Status | Grant |

Latest HealthSnap News

Mar 17, 2025

. By Nancy Dahlberg Funding rounds in female-founded companies in South Florida rebounded in 2024. That’s the good news, and there’s more: It was the third-highest year on record, after 2021 and 2022. However, by percentage share, female fundings in the region closely follow the national trend – just 20% of the venture dollars fo female-funded startups and for all-women founded companies, it’s a measly 2%. Let’s look at the national trends first and then see where the Miami-Fort Lauderdale metro area stands, as well as South Florida’s top deals. What’s the national picture? In the US, female founders collectively raised nearly $38.8 billion in 2024, according to Pitchbook’s recently released 2024 US All In report that highlights the evolving landscape for female founders in the VC ecosystem. Despite progress in overall funding levels, female-founded companies continue to face systemic challenges in securing investment. While the funding growth was 27% higher than 2023, deal count dropped 13.1%, concentrating capital in fewer startups. What’s more, the share of funding awarded to women dropped year-over-year. Nationally, female-founded companies raised 19.9% of the venture capital in 2024, a trend that dipped slightly from 2023 and is up from about 15% a decade ago. By deal count, female-founded startups raised 25.5% of the deals, also down slightly in 2023 but up from a decade ago. (Note that Pitchbook defines female-founded startups as startups with at least one female co-founder. She may or may not be the CEO and doesn’t have to be currently active in the startup.) However, companies a started solely by women in the US raised just 2% of the venture capital, a figure that has barely increased since 2008. Consider this: All-female teams raised a total of $3.7 billion (across 813 deals) while all-male teams raised $154 billion (9,340 deals), according to the Pitchbook report. Another important finding in the report was that more female-founded companies reached venture-growth stages last year, although valuation disparities with male-founded companies widened. Nationally, 13 new female-founded unicorns emerged in 2024, joining Anthropic, Scale AI, Deel, Flexport and others. The valuation of female-founded unicorns was up 15% year-over-year, the report said. There was also stronger exit activity among female-founded companies in 2024: They secured a record 24.3% share of total US VC exit count. What’s the local picture? South Florida startups with at least one woman founder secured $577 million (across 85 deals) from investors in 2024, according to Pitchbook data. That’s up 270% compared to 2023, when female-founded startups secured just $156 million (72 deals), but down from the peak years of 2021 and 2022, when they raised about $800 million each year. In the Miami-area, startups with by all-women founders raised $145 million of that $577 million pie. Seed-stage startups with female founders accounted for 41 of the 85 deals and collectively attracted $112 million 2024. Startups that raised Series A rounds secured $123 million over 21 deals and later-stage startups (Series B and higher) raised $342 million over 23 deals, according to Pitchbook’s data. Collectively, these startups accounted for 21% of what South Florida startups raised in total, according to my research, and by deal count, 23.7%. What’s more, all-female startups in the Miami metro accounted for 5% of the total, a larger share than the national trend. Here’s a look at South Florida fundings of female-founded startups through the years. Source: Pitchbook Who got funded in South Florida? Here are the top female-founded startup fundings in 2024, according to Pitchbook’s data. At least one founder is female and they are not necessarily the CEO; they may not even be currently active in the startup. Finally , a Miami-based startup with a financial platform for businesses, raised $200 million in equity & debt. NovoPayment, a Miami-based financial services startup, raised $40 million. Passes , a Miami-based startup with a platform for creators raised $40 million (and also sercured another $17 million a few months later.) Unrivaled Basketball, a Miami creator of a female basketball league, raised $28 million HealthSnap, the Miami-based healthtech for remote patient monitoring, raised $25 million Carewell , the Miami-based startup that created a marketplace for caregivers, $24.7 million Gorgie, a Boca Raton-based energy drink startup, raised $19.8 million Max Retail , the retail productivity software startup based in West Palm Beach, raised $15 million. BeMe Health , a healthtech focused on teens and based in Surfside, raised $14 million. Influur , the Miami-based influencer marketing startup founded by four women, raised $10 million. What about the numbers of female funders? Increasing the female representation of check-writing roles in VC firms can create more opportunities for women founders because female investors can identify and back startups that may otherwise not be considered, the US ALL IN report said. However the data indicates that just 17.3% of the partners, principals and managing directors at VC firms with $50 million or more in assets under management across the country are female. That percentage is 19.5% for smaller US VC firms. The share of larger VC firms with a majority of female partners is just 8.3%; for smaller VC firms, it’s 13.8%. The report also found that the number of active angel investors who are women has been falling since the high of 2021. San Francisco-based nonprofit All Raise notes that gains have been made in the US. It’s data shows that in 2018, just 9% of people working in venture capital at partner level and above were women and by late 2024 that had risen to 17%. Still, said All Raise CEO Paige Hendrix Buckner in a story in the Financial Times , “not every VC firm has a clear path to promotion – and a path to promotion is not always possible.” Katelin Holloway, a founding partner at VC firm Seven Seven Six, said the result of such disparities means entire categories of innovation such as in women’s health, caregiving and female-focused consumer products can be overlooked. “These are massive markets that were underfunded for decades because the people controlling capital didn’t personally experience the pain points,” she told FT.

HealthSnap Frequently Asked Questions (FAQ)

When was HealthSnap founded?

HealthSnap was founded in 2015.

Where is HealthSnap's headquarters?

HealthSnap's headquarters is located at 1951 North West 7th Avenue, Miami.

What is HealthSnap's latest funding round?

HealthSnap's latest funding round is Series B.

How much did HealthSnap raise?

HealthSnap raised a total of $46M.

Who are the investors of HealthSnap?

Investors of HealthSnap include Florida Funders, MacDonald Ventures, Asclepius Growth Capital, Acronym Venture Capital, Sands Capital and 16 more.

Who are HealthSnap's competitors?

Competitors of HealthSnap include Optimize Health and 5 more.

What products does HealthSnap offer?

HealthSnap's products include HealthSnap Remote Patient Monitoring and 1 more.

Who are HealthSnap's customers?

Customers of HealthSnap include Montefiore, Mayo Clinic, Life Line Screening, Cardiology Consultants of Philadelphia and UHealth.

Loading...

Compare HealthSnap to Competitors

MedSys Health focuses on disrupting healthcare delivery through a comprehensive virtual care platform in the healthcare technology sector. The company offers a suite of services including remote patient monitoring, telemedicine, and patient engagement solutions designed to improve health outcomes and patient care. It primarily serves healthcare organizations looking to implement value-based care through technology. It was founded in 2019 and is based in Fort Lauderdale, Florida.

Veta Health specializes in AI-enabled virtual care solutions within the healthcare industry. The company offers a platform that facilitates real-time and asynchronous communication between healthcare providers and patients, remote monitoring of patient vitals, personalized engagement, and care coordination tools. Veta Health primarily serves health systems, clinicians, and patients, aiming to improve patient outcomes and healthcare delivery efficiency. It was founded in 2016 and is based in Miami, Florida.

CoachCare provides remote patient monitoring and virtual health solutions within the healthcare technology sector. The company offers software for virtual health visits, remote monitoring, and connected devices that deliver health data to healthcare providers. It serves individual practices, hospitals, and health systems. CoachCare was formerly known as Selvera. It was founded in 2013 and is based in New York, New York.

OnTrack Technologies provides Adaptive Data Exchange (ADE) technology for the government and military sectors. The company offers Data Delivery as a Service, which uses ADE to deliver insights and data access across various sensing modalities. It serves sectors that require personal security, asset tracking, remote medical monitoring, and patient tracking solutions. It was founded in 2005 and is based in Benson, North Carolina.

Life365 is a telehealth company that specializes in remote patient monitoring and care management solutions. The company offers a digital health platform that collects biometric measurements and other health data from patients at home, providing clinicians with insights for informed care and timely interventions. Life365's solutions are designed to support healthcare providers in reducing hospital readmissions, managing chronic conditions, and improving patient engagement and adherence to therapy. Life365 was formerly known as RainLife365. It was founded in 2015 and is based in Scottsdale, Arizona.

Optimize Health specializes in chronic disease management and remote patient monitoring within the healthcare sector. The company offers a platform that enables healthcare providers to monitor patient health data in real-time, engage patients more effectively, and optimize clinical workflows, while also aiming to increase healthcare revenue and improve clinical outcomes. Optimize Health primarily serves various healthcare organizations, including physician practices, hospitals, and health systems, across different specialties and chronic conditions. Optimize Health was formerly known as Pillsy. It was founded in 2015 and is based in Seattle, Washington.

Loading...