HighRadius

Founded Year

2006Stage

Series C | AliveTotal Raised

$475MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-31 points in the past 30 days

About HighRadius

HighRadius specializes in AI-enabled autonomous finance solutions for the office. The company provides a suite of products designed to automate and optimize order-to-cash, treasury, and record-to-report processes for businesses. Its solutions aim to reduce days sales outstanding (DSO), enhance working capital management, accelerate financial close, and improve overall productivity without the need for extensive technical knowledge. It was founded in 2006 and is based in Houston, Texas.

Loading...

HighRadius's Product Videos

ESPs containing HighRadius

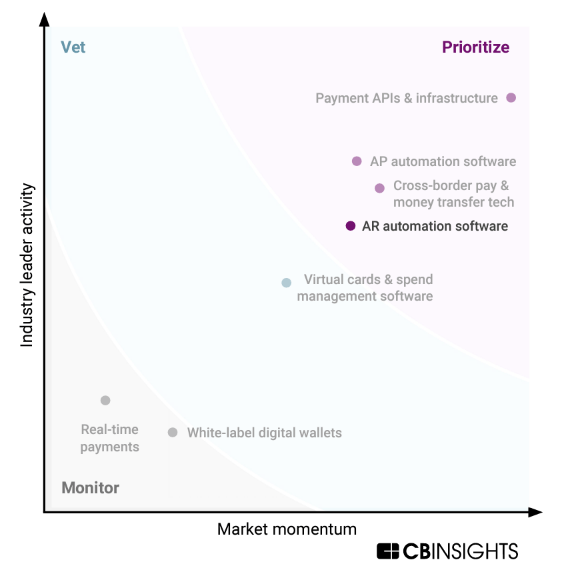

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

HighRadius named as Outperformer among 15 other companies, including Stripe, Tipalti, and Flywire.

HighRadius's Products & Differentiators

Credit

HighRadius Autonomous Receivable platform has 5 solutions. Customers can subscribe to them individually or any combination. Each Solution has 4 editions with base capabilities to suit varying customer sizes and demands. 1. Credit onboards prospective customers and proactively manages credit risk of existing customers through real-time monitoring of external data. AI models predict upcoming blocked orders and provide recommendations to the collections team.

Loading...

Research containing HighRadius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned HighRadius in 2 CB Insights research briefs, most recently on Oct 26, 2023.

Oct 26, 2023

The CFO tech stack market mapExpert Collections containing HighRadius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HighRadius is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

SMB Fintech

355 items

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Artificial Intelligence

7,221 items

HighRadius Patents

HighRadius has filed 23 patents.

The 3 most popular patent topics include:

- parallel computing

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/26/2022 | 3/18/2025 | Parallel computing, Cushitic-speaking peoples, Biotechnology, Natural language processing, Distributed computing architecture | Grant |

Application Date | 7/26/2022 |

|---|---|

Grant Date | 3/18/2025 |

Title | |

Related Topics | Parallel computing, Cushitic-speaking peoples, Biotechnology, Natural language processing, Distributed computing architecture |

Status | Grant |

Latest HighRadius News

Apr 3, 2025

In a 2022 study of 320 controllers using the Jobs To Be Done framework, Excel was voted the #1 software over niche Record-to-Report (R2R) vendors. The study found that 80% of close and consolidation work still happens in Excel. Accountants spend less than 20% of their time in ERPs or specialist R2R software. Traditional close software can't replace Excel - Companies rely on over 2,000 Excel sheets for close, reconciliation, and consolidation tasks. Each sheet reflects a logical unit of work, such as PO accruals, bank recon, or credit card recon. Niche R2R vendors support generic workflows for GL and sub-GL activities like close checklists, approvals, and audit trails. But all the real math happens in Excel and is simply attached to the tasks. HighRadius LiveCube R2R Agents - Companies can upload their 2,000+ R2R Excel sheets into LiveCube no-code platform. LiveCube generates an AI Agent for each R2R use case by parsing each Excel and all of its sheets. Pre-trained on thousands of R2R use cases, LiveCube AI agents run daily or monthly to automate over 60% of the work. The accountant's role evolves to verifying results rather than running reports, exporting to Excel, and manually calculating GL balances ( see how it works in this video Holly DeSantis, EVP & CFO at Konica Minolta said, “With HighRadius, we achieved 75% faster daily bank reconciliations. AI/ML-powered transaction matching automates nearly 99% of our 45,000+ line items processed monthly.” Close is still a month-end cram - While continuous close has been discussed for decades, accountants remain overloaded during the 10-day window around month-end. Capacity constraints force them to focus on high-risk areas rather than reviewing the full ledger. CFOs still wait 2–3 weeks after the month-end for financial reporting. Niche R2R vendors lack the architecture for anomaly detection and automation of R2R tasks across the month. HighRadius Anomaly Detection - HighRadius' AI-based anomaly detection monitors all GL and sub-GL transactions in real time. Over 15 machine learning algorithms flag errors and omissions daily to enable continuous close. Up to 70% of anomalies are auto-detected and resolved across the month. Month-end workload is reduced by 30%, allowing accountants to work normal hours while still performing a comprehensive review of the books. Eva Forberger, EVP of Finance at ConferenceDirect said, “With HighRadius, we reduced our close time from 10 days to under 5. By automating 75% of our revenue and commission journal entries, we uncovered anomalies in commission calculations that could've cost us millions. ” “I was shocked to realize Excel is still the #1 tool in R2R! LiveCube No-Code Platform was born out of necessity to build a mini SaaS app for every GL account. With 200+ pre-built AI agents, our focus has always been value creation, not AI hype. Each agent is tied to a guaranteed business outcome, collectively automating up to 60% of R2R tasks. This is expected to exceed 90% as the platform becomes autonomous by 2027,” said Sashi Narahari, Founder & CEO at HighRadius. Read the full Gartner report to learn why HighRadius was named a Challenger [ here ] Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved. About HighRadius HighRadius provides a single Agentic AI platform for the Office of the CFO. It integrates 200+ agents that orchestrate end-to-end processes across Order-to-Cash Close & Reconciliation Consolidation & Reporting Accounts Payable B2B Payments , and Treasury . HighRadius guarantees operational KPI improvements by mapping them to specific agents on the platform. With a 3-6 month go-live period, HighRadius drives value creation at 1100+ enterprises such as 3M, Unilever, Bristol-Myers Squibb Company, Red Bull, Lufthansa, and more. HighRadius has been consistently recognized as a market leader by IDC and Forrester. For more information, visit HighRadius' Website View source version on businesswire.com: https://www.businesswire.com/news/home/20250401179773/en/ Contacts Media Contact HighRadius Communications Team press@highradius.com

HighRadius Frequently Asked Questions (FAQ)

When was HighRadius founded?

HighRadius was founded in 2006.

Where is HighRadius's headquarters?

HighRadius's headquarters is located at 2107 CityWest Boulevard, Houston.

What is HighRadius's latest funding round?

HighRadius's latest funding round is Series C.

How much did HighRadius raise?

HighRadius raised a total of $475M.

Who are the investors of HighRadius?

Investors of HighRadius include Susquehanna Growth Equity, Tiger Global Management, Howie Liu, Michael Scarpelli, Frank Slootman and 8 more.

Who are HighRadius's competitors?

Competitors of HighRadius include OnPay, Cforia Software, Tipalti, Coupa, Billtrust and 7 more.

What products does HighRadius offer?

HighRadius's products include Credit and 4 more.

Who are HighRadius's customers?

Customers of HighRadius include Land O’Lakes, Inc. is a member-owned agricultural cooperative based in the Minneapolis-St. Paul suburb of Arden Hills, Minnesota, focusing on the dairy industry., Mattel is a toy manufacturing and entertainment company.It is headquartered at El Segundo, California., Duracell Inc. is an American manufacturing company that produces batteries and smart power systems., J. J. Keller & Associates, Inc. is a publisher and service organization, providing a wide spectrum of regulatory and information products and services ,complementary forms and supply products to customers regulated by the Department of Transportation, Occupational Safety and Health Administration, and more than 300 state agencies. and 3 more.

Loading...

Compare HighRadius to Competitors

Global PayEx focuses on B2B payments modernization and working capital optimization within the financial technology sector. The company offers a suite of services including automation of accounts receivable and payable, electronic invoice presentment, and payment reconciliation, all powered by artificial intelligence to enhance financial operations for businesses. It was founded in 2011 and is based in Rockville, Maryland.

Billtrust provides accounts receivable automation and order-to-cash solutions within the financial services sector. The company offers services that improve the invoicing process, support multi-channel payments, and allow matching and posting for business-to-business transactions. Billtrust's solutions serve various industries, improving cash application and electronic handling of invoices and payments. It was founded in 2001 and is based in Hamilton, New Jersey.

Routable is a financial technology company that specializes in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Kyriba operates within the financial technology sector and focuses on liquidity performance. Its offerings include a platform for cash and treasury management, risk management, and payment processing. Kyriba serves sectors such as finance, technology, retail, manufacturing, and insurance, targeting CFOs, treasurers, and IT leaders. It was founded in 2000 and is based in San Diego, California.

CHERRY is a B2B payment processing solution that specializes in integrating accounting software with bank payment platforms. The company offers a plugin that automates payments, streamlines approvals, and facilitates reconciliation, thereby reducing manual processes for businesses. CHERRY primarily serves businesses looking to enhance their accounting and financial workflows through automation. It was founded in 2018 and is based in Brooklyn, New York.

Chargezoom provides accounts receivable automation and payment processing within the financial technology sector. The company offers services such as digital invoicing, recurring payments, payment terminals, and customer portals, utilizing artificial intelligence to assist in the billing and collection process. Chargezoom's platform aims to reduce administrative workload and ensure PCI compliance for businesses. It was founded in 2019 and is based in Irvine, California.

Loading...