iCapital Network

Founded Year

2013Stage

Corporate Minority | AliveTotal Raised

$729.22MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+154 points in the past 30 days

About iCapital Network

iCapital Network operates in the financial technology sector and focuses on the alternative investment marketplace. It provides a digital platform that offers access to private market investments, hedge funds, and defined outcome solutions, along with educational resources and analytics for financial advisors and their clients. The platform is designed to streamline the investment process and integrate with clients' existing infrastructure. It was founded in 2013 and is based in New York, New York.

Loading...

ESPs containing iCapital Network

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The alternative investment product platforms market provides the infrastructure through which wealth managers, independent broker-dealers, RIA aggregators, financial advisors, banks, and trust companies can provide accredited investors and qualified purchasers access to alternative asset classes, strategies, and investment products. These include private equity, private credit, hedge funds, real e…

iCapital Network named as Leader among 8 other companies, including CAIS, Securitize, and YieldStreet.

Loading...

Research containing iCapital Network

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned iCapital Network in 5 CB Insights research briefs, most recently on Sep 27, 2024.

Expert Collections containing iCapital Network

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

iCapital Network is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,490 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,617 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,163 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest iCapital Network News

Mar 27, 2025

blackrock/private-markets/managed-accounts/public-markets/ BlackRock has unveiled a “first-of-its-kind” model portfolio for US investors that delivers access to both private and public market assets in a single account. The global asset management giant’s public-private model portfolio was produced using GeoWealth’s unified managed account (UMA) technology and iCapital’s underlying technology capabilities. GeoWealth is a financial technology and turnkey asset management platform, while iCapital is a fintech platform that enables asset managers and distributors to expand access to private markets. Related News: According to BlackRock, this marks the first time that a customisable model portfolio offers access to both private and public markets alongside each other via an UMA structure. It was launched off the back of rising adviser demand for allocations to both markets as investors seek greater diversification and returns. The announcement also follows BlackRock’s completed acquisition of private markets research house Preqin earlier this month for a total consideration of US$3.2 billion ($4.8 billion). “This launch represents a significant step forward, helping advisers allocate across both public and private markets all in one unified, professionally managed portfolio,” commented Jaime Magyera, co-head of BlackRock’s US wealth advisory business. “BlackRock’s mission is to make investing easier and help more people access the full power of capital markets. Through our partnership with GeoWealth and iCapital, we are doing just that, helping advisers deliver differentiated service and outcomes for their clients across their whole portfolio.” Netwealth and JP Morgan Asset Management (JPMAM) also have existing partnerships with iCapital to boost investors’ access to alternative and private market assets. Earlier this month, Lonsec announced it will be utilising the deal with Netwealth and iCapital to launch a wholesale individually managed account (IMA) option focused on alternative assets. While the product is only available to BlackRock’s US customers, Toby Potter, chair of the Institute of Managed Account Professionals (IMAP) said he was already seeing private markets come to fore in the managed account space. Drummond Capital Partners launched a private markets separately managed account (SMA) for wholesale investors last year on the BT Panorama platform and this is expected to be opened up to the retail market in due course. “This move is symptomatic of the drive to have private markets included in managed accounts. The interest in private markets is growing rapidly, he said. “I could see something like this offered in Australia; there are already listed vehicles which invest in private markets so nothing would stop people from putting these or an active ETF in their model portfolio or as part of their separately managed account.” BlackRock said it expects managed model portfolios to double in assets over the next four years from US$5 trillion ($8 billion) today to approximately US$10 trillion ($16 billion). In Australia, the firm has been offering managed accounts for a decade now . BlackRock accounts for $6.5 billion in assets under management in the managed account space, with its range including ESG, index, active, ETF and international options. Lawrence Calcano, chairman and CEO of iCapital, said the partnership with BlackRock will enable advisers to easily incorporate alternative investments into their strategies in a simplified way. “We believe models will be an important way for advisers to allocate to private markets, and iCapital’s underlying technology allows our clients to customise what they want to buy or deliver into the market,” he said. Colin Falls, chief executive of GeoWealth, recognised that while advisers and asset managers have long appreciated the role of private market investments, the real challenge has been integrating them at scale in a wealth management business. “GeoWealth’s UMA technology and workflow solutions, in partnership with BlackRock and iCapital, creates an entirely new paradigm for advisers considering a public-private portfolio,” he also said. Demand for private market investments continues to grow in Australia as the space is further democratised for retail investors. According to Hamilton Lane , Australian advised clients exhibit the highest enthusiasm for the asset class out of all the regions, with 61 per cent of clients described as “very interested”. Read more about:

iCapital Network Frequently Asked Questions (FAQ)

When was iCapital Network founded?

iCapital Network was founded in 2013.

Where is iCapital Network's headquarters?

iCapital Network's headquarters is located at 60 East 42nd Street, New York.

What is iCapital Network's latest funding round?

iCapital Network's latest funding round is Corporate Minority.

How much did iCapital Network raise?

iCapital Network raised a total of $729.22M.

Who are the investors of iCapital Network?

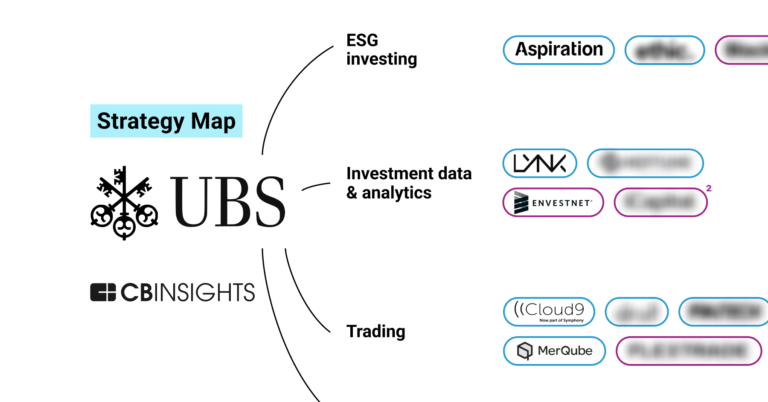

Investors of iCapital Network include Bank of America, WestCap, Temasek, Apollo Global Management, UBS and 27 more.

Who are iCapital Network's competitors?

Competitors of iCapital Network include Enfusion, Carbon Equity, AirFund, Opto Investments, Private Markets Alpha and 7 more.

Loading...

Compare iCapital Network to Competitors

Canoe Intelligence provides alternative investment data management within the financial technology sector. The company offers cloud-based solutions that facilitate document collection, data extraction, and data science initiatives, allowing financial institutions to process complex investment documents. Canoe's technology is utilized by institutional investors, asset servicers, capital allocators, and wealth managers to manage their data workflows. It was founded in 2017 and is based in New York, New York.

Moonfare specializes in providing access to private equity investments through its digital platform. The company offers a range of services, including the ability to invest in individual funds, a diversified portfolio of funds, a private market ELTIF strategy for suitable investors, and a secondary market for buying and selling allocations before maturity. It was founded in 2016 and is based in Berlin, Germany.

CAIS is a fintech company that focuses on transforming the world of alternative investing. The company provides a platform that connects independent financial advisors with alternative asset managers, enabling them to transact alternative investments and structured notes at a large scale. The company primarily serves the financial advisory sector and the alternative asset management industry. It was founded in 2009 and is based in New York, New York.

Pando Alts is a platform for alternative investments, serving the wealth management and financial services sectors. The company connects wealth managers, general partners, broker-dealers, and service providers, enabling investment in private market alternatives. Pando Alts caters to the financial services industry, including wealth managers, family offices, and broker-dealers. It was founded in 2023 and is based in Bozeman, Montana.

Private Wealth Systems focuses on portfolio management and reporting software within the financial technology sector. The company offers a platform that allows clients to aggregate investment data, validate accuracy, and report on multi-asset class portfolio performance. Private Wealth Systems serves clients including family offices, registered investment advisors, endowments, foundations, pensions, and institutional consultants. It was founded in 2015 and is based in Mooresville, North Carolina.

BridgeFT focuses on wealth technology (WealthTech) infrastructure. It provides services within the financial technology sector. The company offers a WealthTech-as-a-Service platform that includes financial data aggregation, advanced analytics, and applications essential for wealth management. BridgeFT primarily serves FinTech companies, registered investment advisors (RIAs), turnkey asset management platforms (TAMPs), and other financial institutions. It was founded in 2015 and is based in Chicago, Illinois.

Loading...