From LLM developers to coding AI agents, we identify the genAI markets with the highest likelihood of exits in the next 2 years.

Generative AI has become a focal point of tech investment, with investors pouring billions into the space at unprecedented valuations for young startups.

The space is already seeing a steady stream of M&A activity, as established players seek to quickly acquire novel capabilities and fill in gaps in their AI talent.

But amid the frenzy, which specific genAI markets are most primed for exits — and what should corporate strategy and M&A teams be doing about it?

What you need to know:

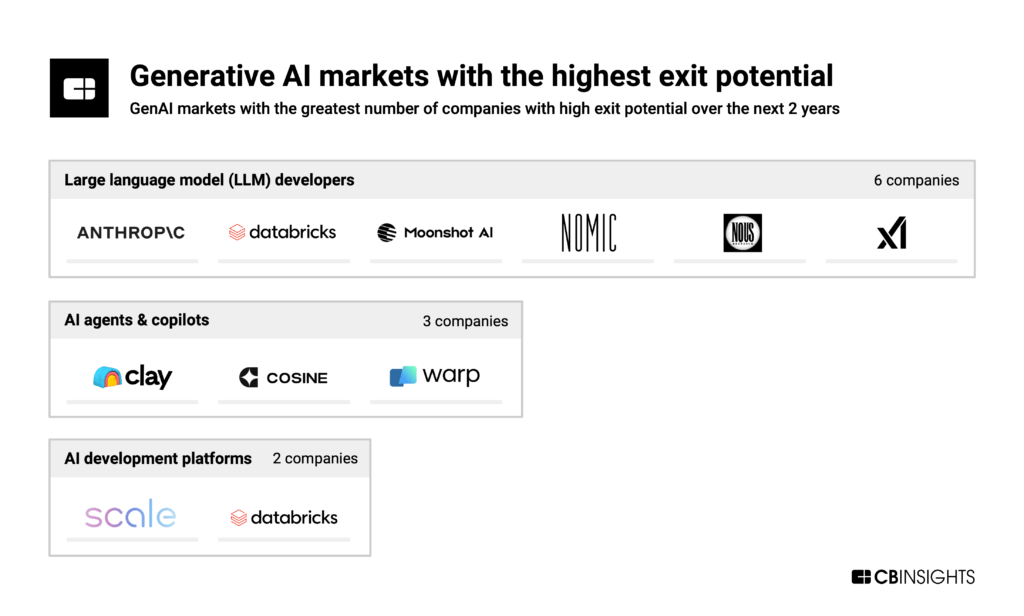

- Three markets — LLM developers, AI agents & copilots, and AI development platforms — have the highest concentration of companies with high exit probabilities.

- Significant funding needs and sky-high valuations may push LLM developers to go public, leading to greater financial scrutiny and potentially higher prices for enterprise customers.

- There are already 100+ companies building enterprise AI agents & copilots, making the space ripe for consolidation. Corporate M&A teams should consider scooping up specialized agent & copilot solutions that fit well with their own products to improve the attractiveness of their offerings.

Source: CB Insights. Note: Exit Probability scores are as of 10/3/24 — data is dynamic and scores are subject to change.

To identify these markets, we used CB Insights’ proprietary Exit Probability score, which measures a company’s likelihood of an exit, either through IPO or M&A, in the next 2 years. It’s calculated using 70+ data points, including company financial metrics and investor track record.

This analysis produced a shortlist of 50 genAI companies with high IPO potential relative to others (top 1%) or high M&A potential relative to others (top 5%). In particular, we saw high concentrations across 3 markets: large language model (LLM) developers, AI agents & copilots, and AI development platforms.

Below, we dig into each market and look at why they’re primed for exits.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.