Gaming investment rallied in 2024. Here’s how emerging tech is making gaming more immersive, responsive, and secure.

The number of global gamers has nearly doubled over the past decade, reaching 3.4B in 2023. Despite this growth, increased accessibility and platform diversity have made it harder for gaming companies to build sustainable revenue streams.

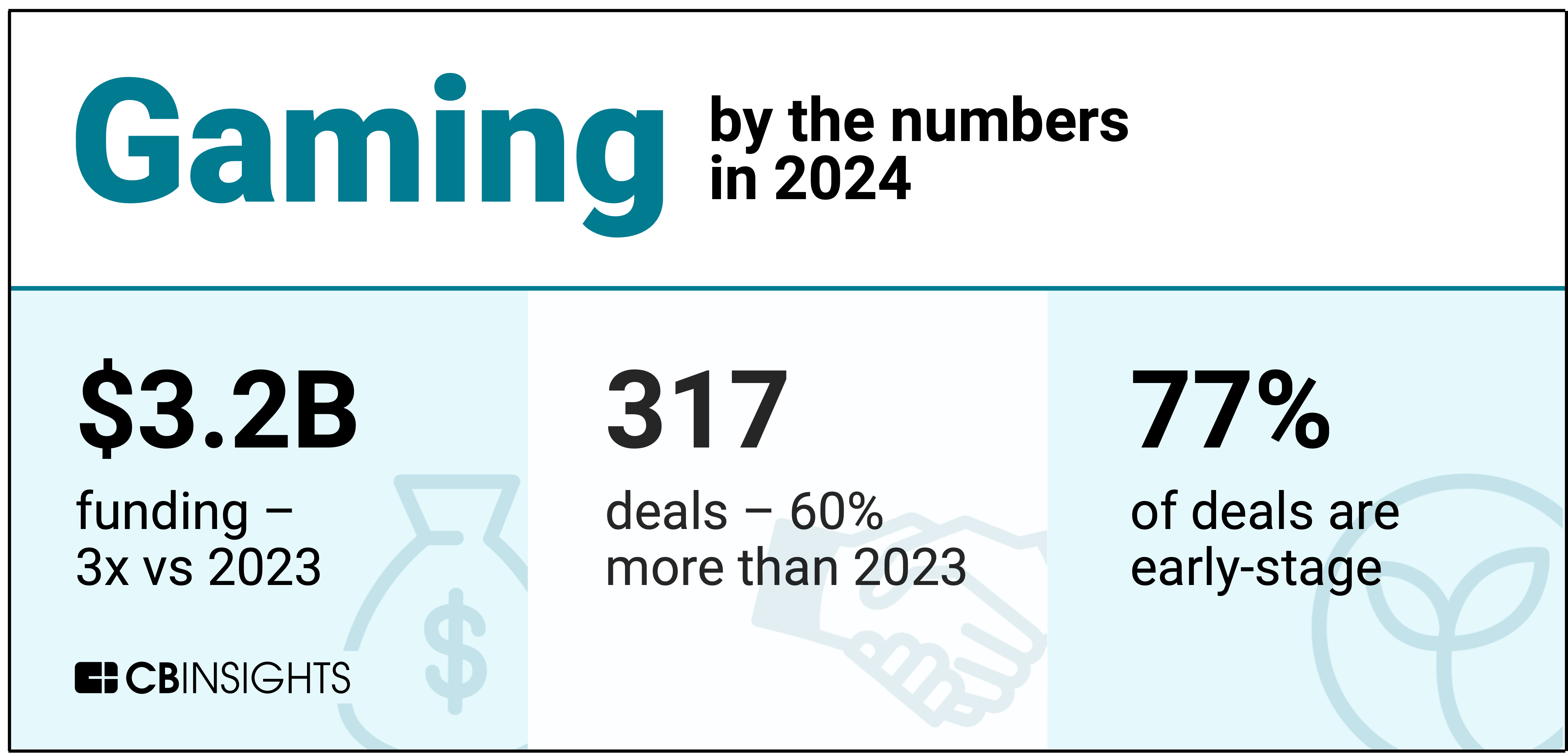

But AI and blockchain solutions are driving innovation to create new revenue streams and stoke the existing ones. Early-stage deals in those spaces helped drive a rally in funding and dealmaking in gaming in 2024. Annual funding nearly tripled to $3.2B across 317 deals, with early-stage companies securing 77% of investments — up from 70% in 2023.

M&A activity has also picked up as entertainment companies and gaming leaders make land grabs in the splintered market.

To understand the latest innovation in gaming, we looked at early-stage activity in 2024, filtering for startups with Mosaic health scores of 600+, signaling high momentum and strong business health. We also analyzed exit activity to see where acquirers are identifying emerging opportunities.

Here are 3 key takeaways from our analysis of the state of gaming:

- Web3 gaming investment is accelerating. Blockchain and Web3 gaming platforms accounted for a third of 2024’s high-momentum startups — more than doubling the share of 14% from 2023. Across all early-stage deal activity, 52 Web3 and blockchain companies raised early-stage rounds in 2024, vs. just 22 in 2023. This rebound reflects a growing appetite for digital assets and crypto technology in gaming, fueled by the promise of more immersive, interoperable, and secure experiences through NFTs, decentralized economies, and cross-platform asset ownership.

- AI is democratizing game development and automating content creation. A 2024 survey by a16z’s gaming team highlighted that nearly three-quarters of studios are already using AI, with 40% reporting productivity gains exceeding 20%. Investors are following suit: 4 of 10 high-momentum startups in gaming development are deploying AI to make game creation more convenient and to make games more responsive.

- Gaming leaders, decentralized finance, and payments companies alike are using M&A to grow their reach in the industry. Gaming M&A accelerated in 2024, more than doubling 2023 activity with 88 exits. Big gaming companies led the way in cross-platform expansion, while acquirers like fintech firms are using gaming acquisitions to boost digital engagement. Expect gaming giants to expand further while players from outside the industry enter the space, competing for global gamer attention.

We dive into each point below.

Web3 gaming investment is accelerating

Web3 and blockchain gaming platforms were regular targets for early-stage investors last year: they made up nearly a third (9) of the 33 high-momentum (those with CB Insights Mosaic scores of 600+) companies that raised early-stage gaming deals in 2024. Web3 and blockchain companies aim to decentralize gaming and allow players to own in-game assets and earn real value from gaming. The companies build games on blockchain networks optimized for gaming, introduce tokenized assets and rewards, and create metaverses and virtual worlds.

Want to see more research? Join a demo of the CB Insights platform. If you’re already a customer, log in here.