Shopify is positioning itself as the go-to infrastructure layer for global commerce — challenging incumbents like Salesforce and Adobe. We examine how its recent partnerships, acquisitions, and product expansions reflect near- and long-term strategic priorities.

Shopify is back in growth mode.

After divesting its logistics business in 2023, the company refocused on its core strength: powering commerce infrastructure. Since then, Shopify has accelerated its growth through targeted partnerships, acquisitions, and product development — growing its share of the US e-commerce market from 10% to 12% and boosting revenue by 26% in FY2024.

Now, Shopify is primed to take on new challenges. From enabling immersive shopping experiences to onboarding enterprise clients and monetizing its data through advertising, the company is laying the foundation for a more ambitious role in global commerce.

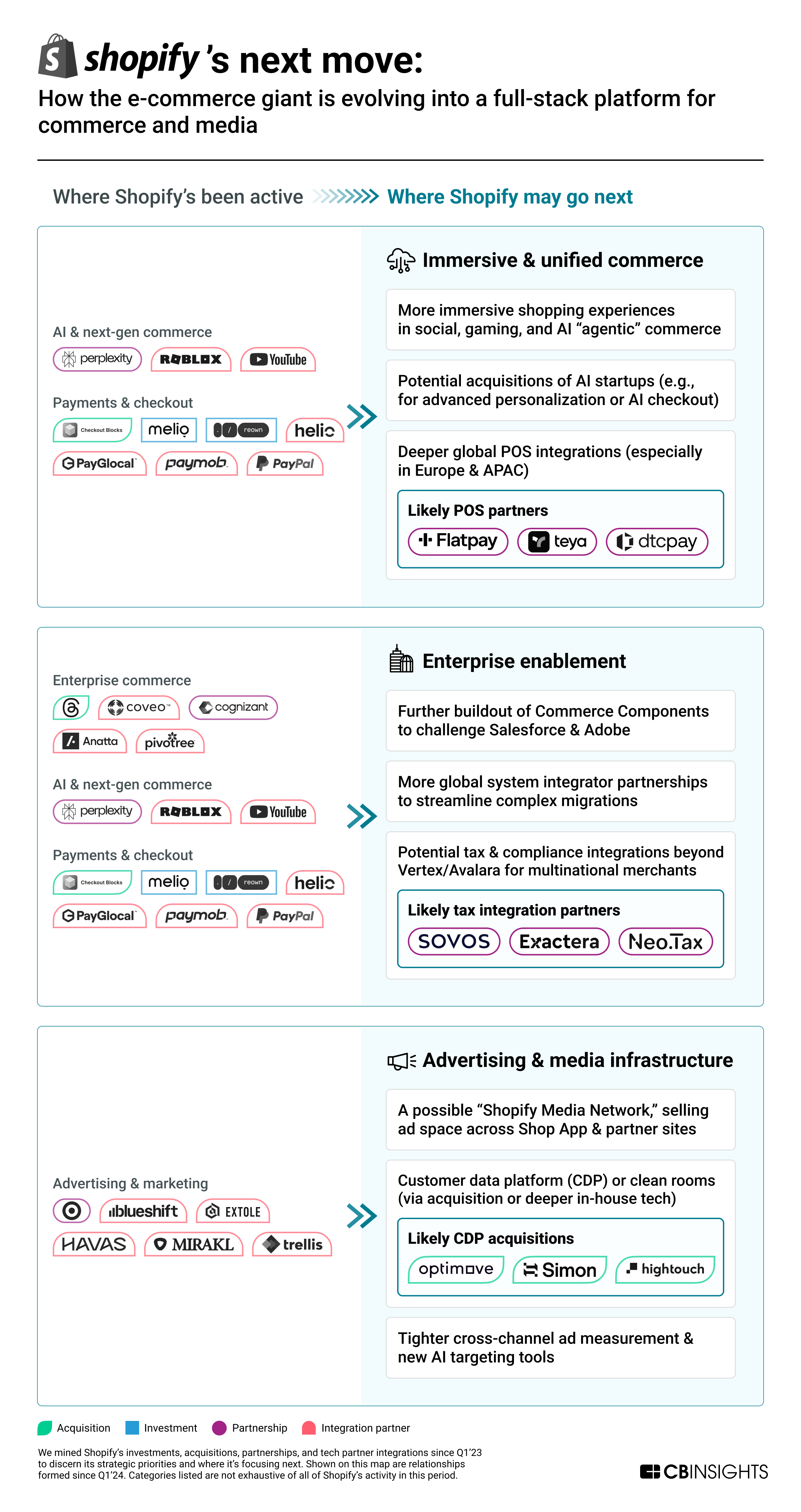

Drawing on CB Insights data across investments, acquisitions, integrations, and earnings transcripts, we identify 3 key areas that reveal where Shopify is heading next:

- Powering immersive and unified shopping experiences: Shopify’s relationships with gaming, payments, and agentic commerce players will enable always-on, cross-platform shopping — with Shopify infrastructure at the ecosystem’s core.

- Becoming the go-to enterprise commerce platform: Through system integrator partnerships, composable solutions like Commerce Components, and unbundled tools like Shop Pay, Shopify is positioning itself as a modular alternative to Salesforce and Adobe.

- Turning customer data into new ad revenue streams: With proprietary tools like Shopify Audiences and new integrations with CDPs and campaign platforms, Shopify is laying the groundwork for a retail media network — creating new ways to monetize merchant and shopper data at scale.

In the graphic below, we show where Shopify has already built momentum across its three strategic pillars — and where we think it’s heading next, including our predictions on future partners and acquisitions.

These priorities signal how the e-commerce giant could reshape buying experiences and challenge established players across advertising, enterprise software, and commerce infrastructure.

We dive into each prediction below.

1. Powering immersive and unified shopping experiences.

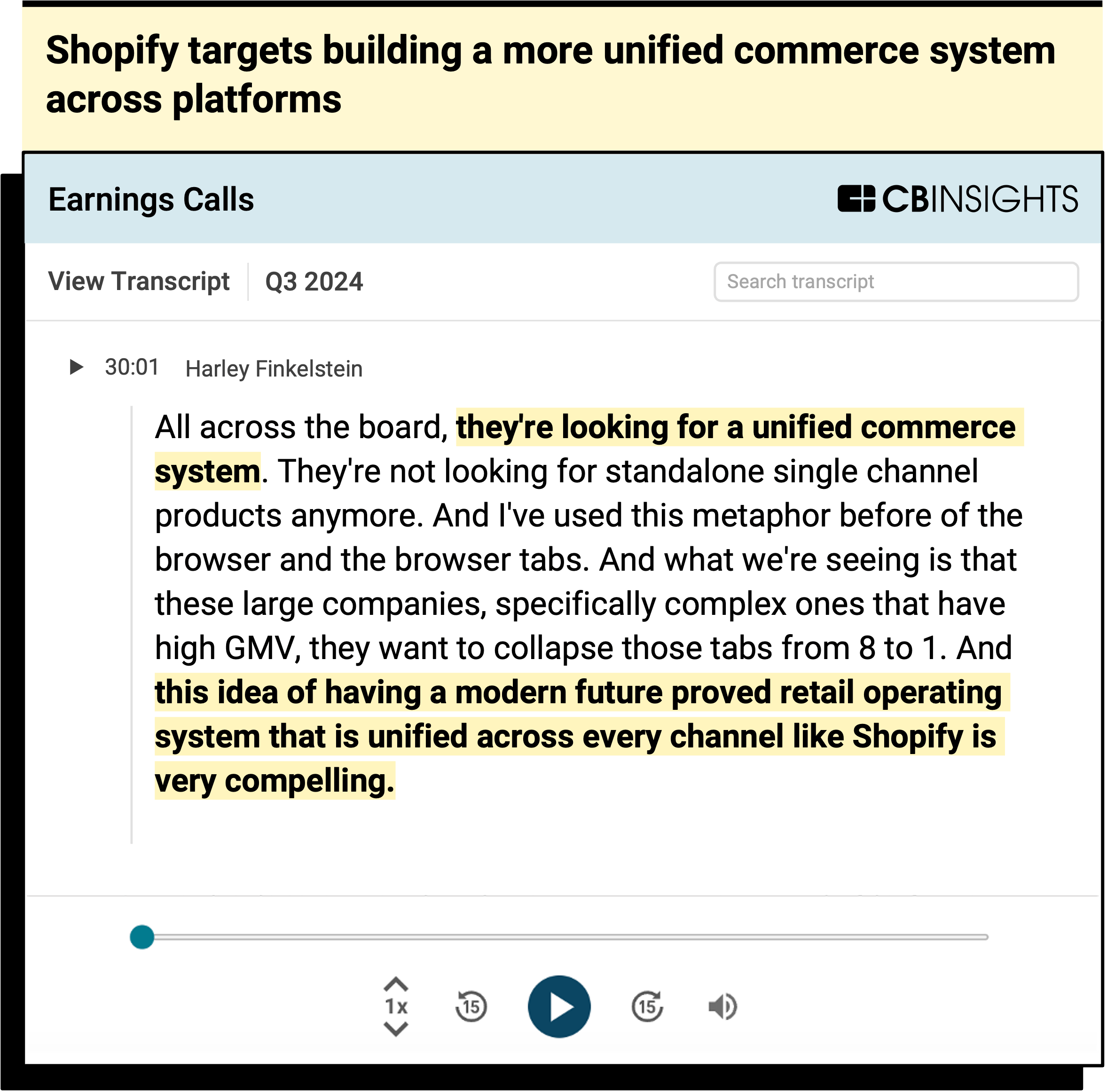

Shopify’s growing US e-commerce share reflects a deliberate strategy to embed commerce capabilities into more contexts. Its integrations with platforms like Roblox and Perplexity AI suggest a vision of always-on, channel-agnostic shopping where Shopify is the core infrastructure across both traditional and emerging environments.

Enabling shopping at any time, on any platform

In late 2024, Shopify took a step into the world of agentic commerce by integrating with Perplexity’s new AI shopper, Buy with Pro. This has enabled consumers to browse and transact directly via Shop Pay within Perplexity’s interface.

Around the same time, it became Roblox’s first commerce integration partner, giving Shopify merchants access to 80M+ daily users through in-game storefronts powered by Shopify Checkout.

Source: CB Insights — Shopify Q3’24 earnings call

To that end, Shopify is expanding the functionality of its own products. For example, in 2024, it introduced “tap to pay” for its Point of Sale (POS) app and introduced offline payment capabilities, reinforcing its commitment to connecting online and physical experiences. Its integration with loyalty platform Gatsby enables merchants to engage customers across both environments.

Meanwhile, its partnership with India-based Cashfree Payments — enabling local on-site card processing — is part of a broader effort to tap into local economies through regional POS providers.

Using CB Insights’ Mosaic score, which measures business momentum, we sorted early- and mid-stage POS companies in a few key markets (EU and APAC) where Shopify could expand. Focusing on companies that serve retailers, we surfaced these 3 potential partners:

- Flatpay (Mosaic: 783) is a Danish company offering simplified payment processing solutions for small and medium-sized businesses.

- Teya (Mosaic: 758), based in London, provides payment processing and financial services for small and medium-sized businesses across Europe.

- Dtcpay (Mosaic: 735) is a Singapore-based digital payment platform. Its solution includes multi-currency swaps to convert fiat and stablecoins.

2. Becoming the go-to enterprise commerce platform.

Shopify has built the foundation to move beyond its traditional small-business customer base and compete directly with enterprise commerce platforms like Salesforce Commerce Cloud and Adobe Commerce. The company is positioning itself as a modular, flexible infrastructure layer — designed to meet the needs of large, complex merchants.

Partnerships with migration solutions clear a big hurdle

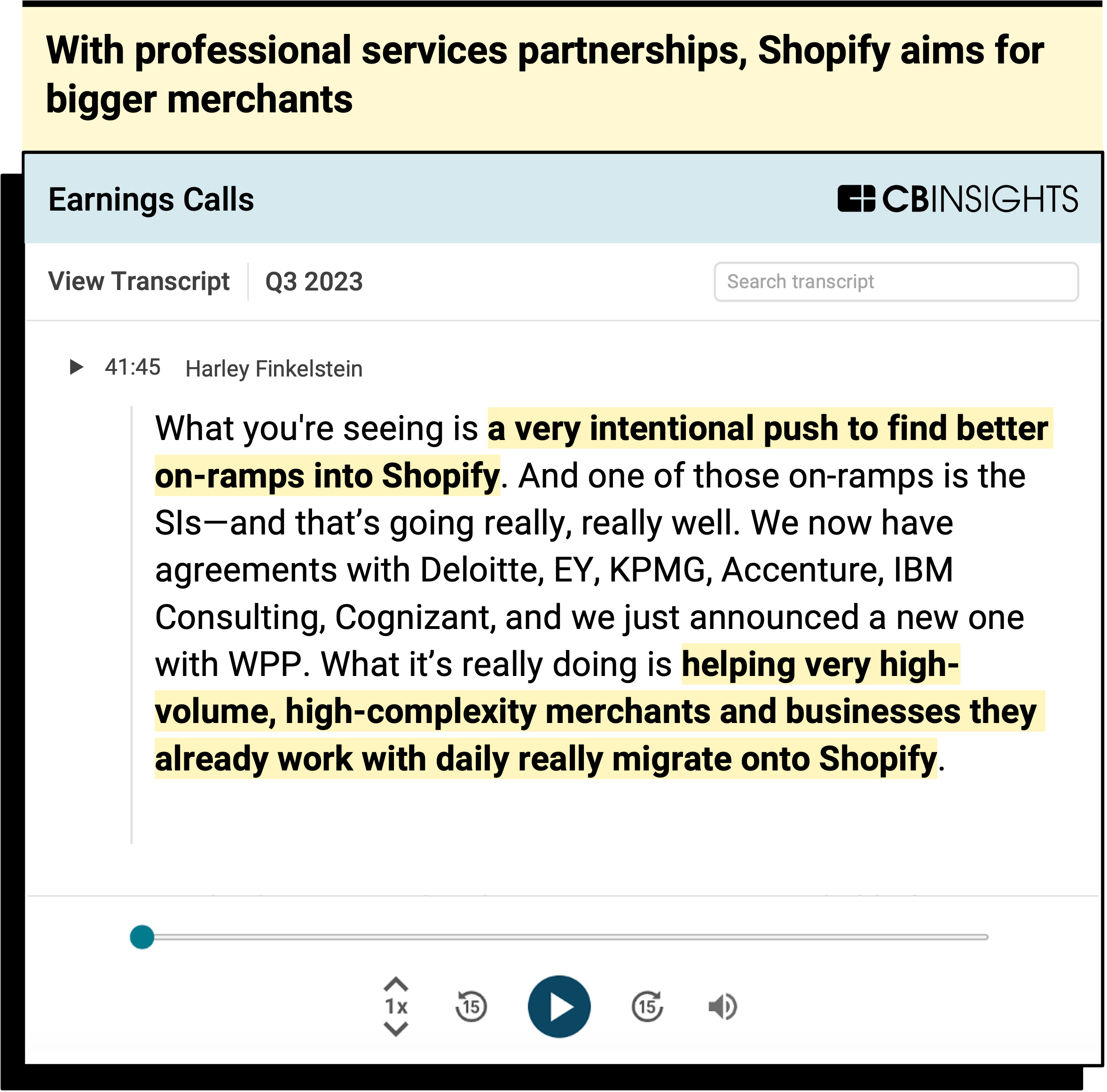

One of the biggest barriers for enterprise merchants is the complexity of migrating from legacy platforms. To address this, Shopify has steadily expanded its network of system integrators (SIs) since 2022, forming partnerships with Deloitte, EY, and KPMG to streamline onboarding and implementation.

Source: CB Insights — Shopify Q3’23 earnings call

In April 2024, Shopify deepened this strategy with a joint partnership alongside Google Cloud and Cognizant to offer end-to-end digital commerce solutions. These alliances signal Shopify’s increasing traction among enterprise IT buyers — and the company’s evolving go-to-market motion.

Shopify has also added specialized migration and enablement partners to its app store. In August 2024, it onboarded Pivotree, a digital commerce design firm, and in January 2025, expanded its relationship with Anatta to support enterprise migration needs.

Streamlining checkout and payments for large merchants

Simplifying payment workflows remains a core part of Shopify’s enterprise pitch. Its a la carte checkout solution, Shop Pay, is now offered independently and has been adopted by large brands like Coach. Shopify has layered on key partnerships to support broader payment functionality:

- In June 2023, it partnered with Adyen to enable more efficient processing for global enterprise merchants.

- In September 2024, it expanded its integration with PayPal, making it a card processor for Shopify and streamlining order management, reporting, and chargebacks.

Shopify has also supported crypto payments via its app store. In 2024, Solana Pay — powered by Helio (now owned by MoonPay) — added support for more tokens, loyalty programs, and stablecoin conversion, expanding Shopify’s optionality for cutting-edge payment rails.

The company is also offering other point solutions to serve enterprise merchants’ needs. In October 2024, it partnered with AI search company Coveo to offer tools for AI-driven product discovery, personalized recommendations, and more, focusing on more prominent retailers.

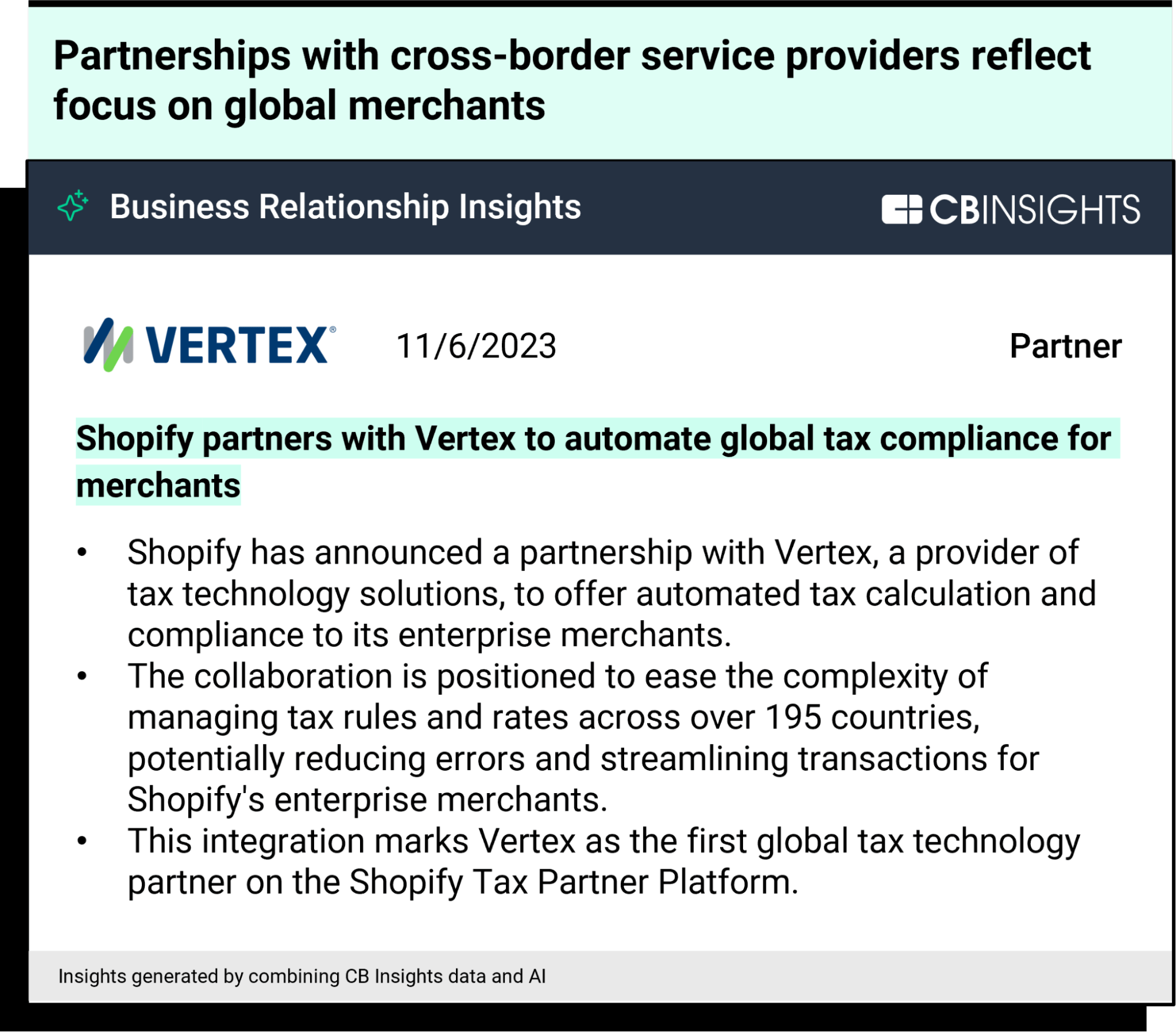

Its integrations with tax technology leaders Vertex and Avalara further support its enterprise expansion, enabling complex compliance for cross-border transactions.

Source: CB Insights — Shopify business relationship insights

The tax compliance software market offers Shopify more potential tax compliance partners as it expands its reach with enterprise customers. Using the market’s ESP, which identifies and ranks leading private companies in a given technology landscape, we can highlight challenger companies on the rise that could be valuable relationships for Shopify:

- Sovos provides global tax compliance and regulatory reporting software solutions.

- Exactera offers AI-powered tax compliance solutions for transfer pricing, income tax provision, and R&D tax credits.

- Neo.Tax also builds AI-powered tax automation software for startups and small businesses.

These moves underscore Shopify’s shift toward a composable, enterprise-grade stack — built to compete with legacy vendors by offering faster implementation, flexible tooling, and global readiness.

3. Shopify will use its reach and first-party data to power advertising for its merchants.

Shopify has long equipped its merchants with tools for personalization and customer acquisition. But its recent product upgrades and tech partnerships point to a broader ambition: turning its vast merchant network and rich first-party data into a full-fledged advertising business.

The activity hints at Shopify building its own version of a retail media network—one that could allow the company to sell ad space to merchants and outside brands, putting it in competition with advertising leaders like Amazon, Google, and Walmart.

To start, Shopify has expanded access to 2 of its own ad-focused products:

- The newest iteration (v2.4) of its customer acquisition tool, Shopify Audiences, launched in June 2024, helps merchants target narrower customer groups and maximize ad performance across networks and platforms. Some merchants have seen CAC reductions of up to 50%.

- In December 2024, the company made its advertising tool, Shop Campaigns, available to all merchants in the US and Canada. Previously, only higher-tier Shopify Plus merchants could use the product.

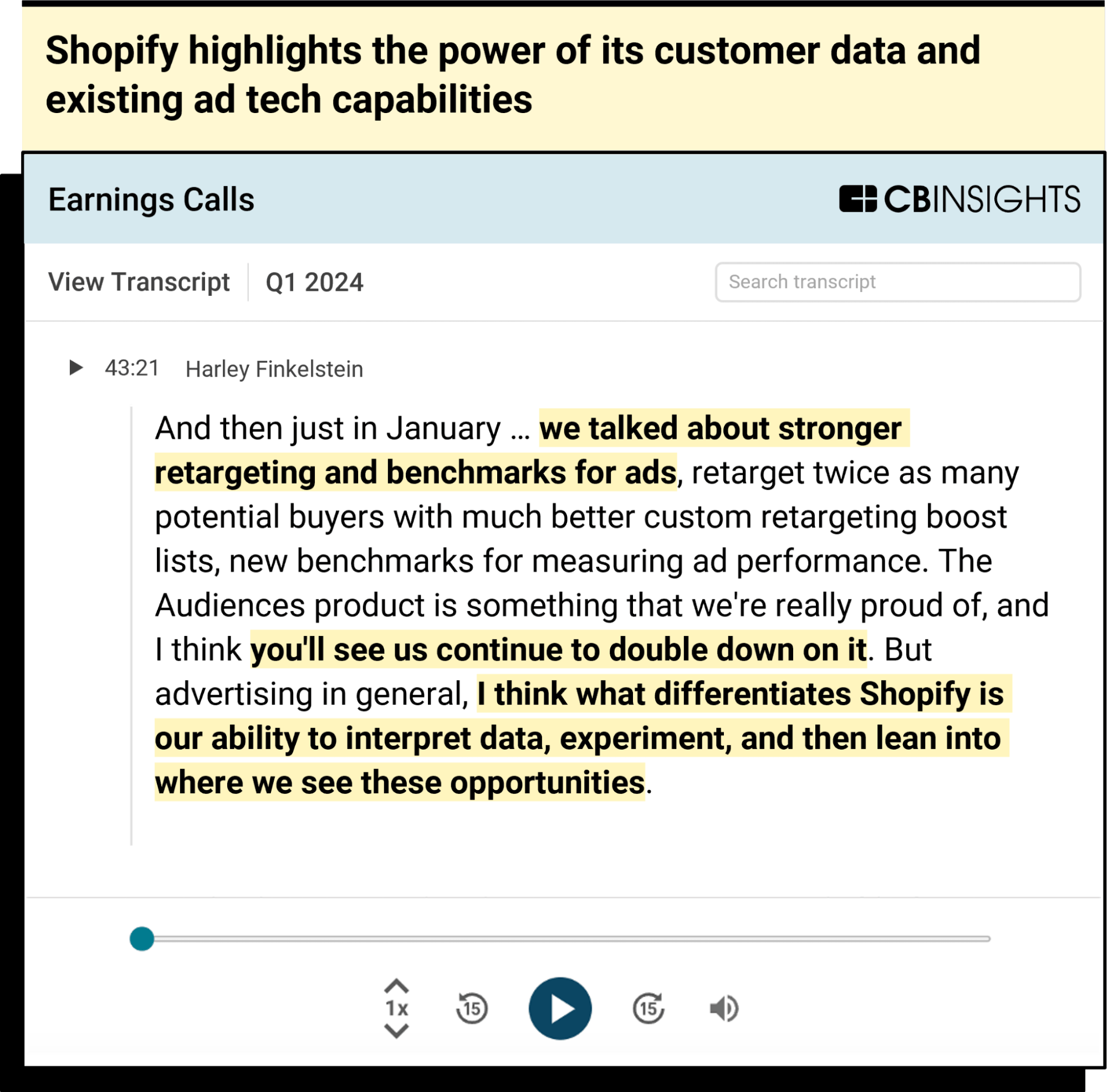

But Shopify’s leadership sees potential in advertising for Shopify beyond its proprietary products:

Source: CB Insights — Shopify Q1’24 earnings call

To unify and activate customer data, Shopify has partnered with third-party platforms that aggregate behavioral and transactional insights:

- In October 2024, Blueshift made its solution available on the Shopify app store. Its tools include a customer data platform, automated decision-making for recommendations, and a cross-channel marketing platform.

- Also in October 2024, Trellis announced an integration with Shopify. The relationship integrates shopper data into Amazon Marketing Cloud, connecting shopper insights across platforms to more effectively target messaging.

Looking ahead, Shopify may deepen its capabilities in data orchestration by offering its own customer data platform (CDP) or data clean room solution. We ranked the companies in the CDP market by their M&A probability and Mosaic score (600+) to isolate potential M&A targets for Shopify:

- Optimove leverages AI to orchestrate personalized multichannel campaigns for B2C companies.

- Simon specializes in personalization and customer journey orchestration for retail, travel, and subscription businesses.

- Hightouch is a composable customer data platform specializing in data activation and reverse ETL services.

Shopify is also building new demand channels for merchants. In 2024, it partnered with Mirakl to enable third-party marketplace creation and with Target to feature Shopify merchant products on the retailer’s digital shelves.

These moves suggest Shopify is building more than merchant tools — it’s assembling a vertically integrated commerce and media stack that could challenge the dominance of legacy ad platforms and redefine how brands connect with shoppers.

RELATED RESEARCH FROM CB INSIGHTS:

- The future of the customer journey: AI agents take control of the buying process

- How generative AI could supercharge retailers’ ad networks

- 7 tech M&A predictions for 2025

- Interviews with Shopify customers

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.