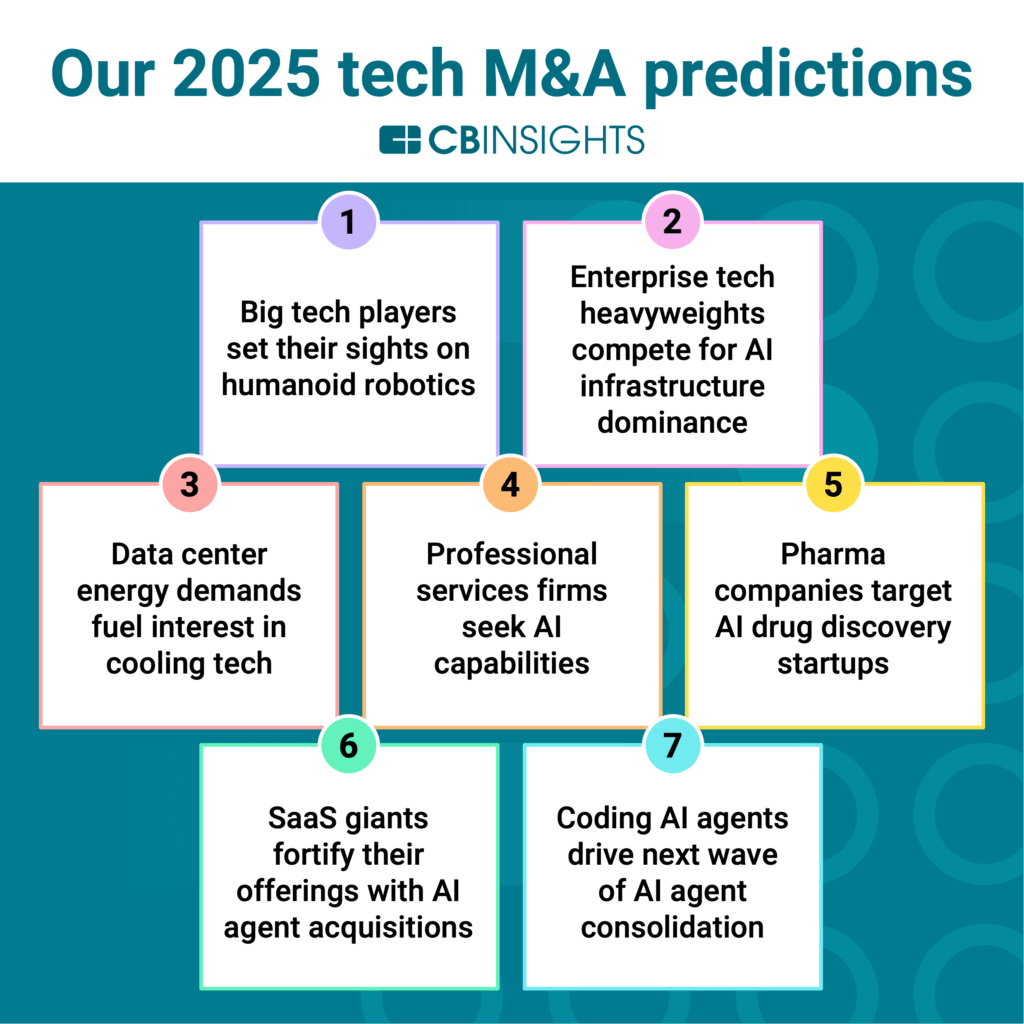

AI will be the driving force behind tech M&A deals in 2025. From AI agent consolidation to big tech’s next battlefield, we highlight 7 areas where we expect to see deals this year.

Watch a live briefing on these tech M&A predictions here.

The AI boom has set the stage for a wave of tech M&A this year.

After 2 consecutive years of decline, tech M&A deals were up in 2024, with some of the largest deals centering on AI. AI companies have also bucked the general downward trend in exit valuations, instead seeing nearly double the median acquisition price from 2023 to 2024.

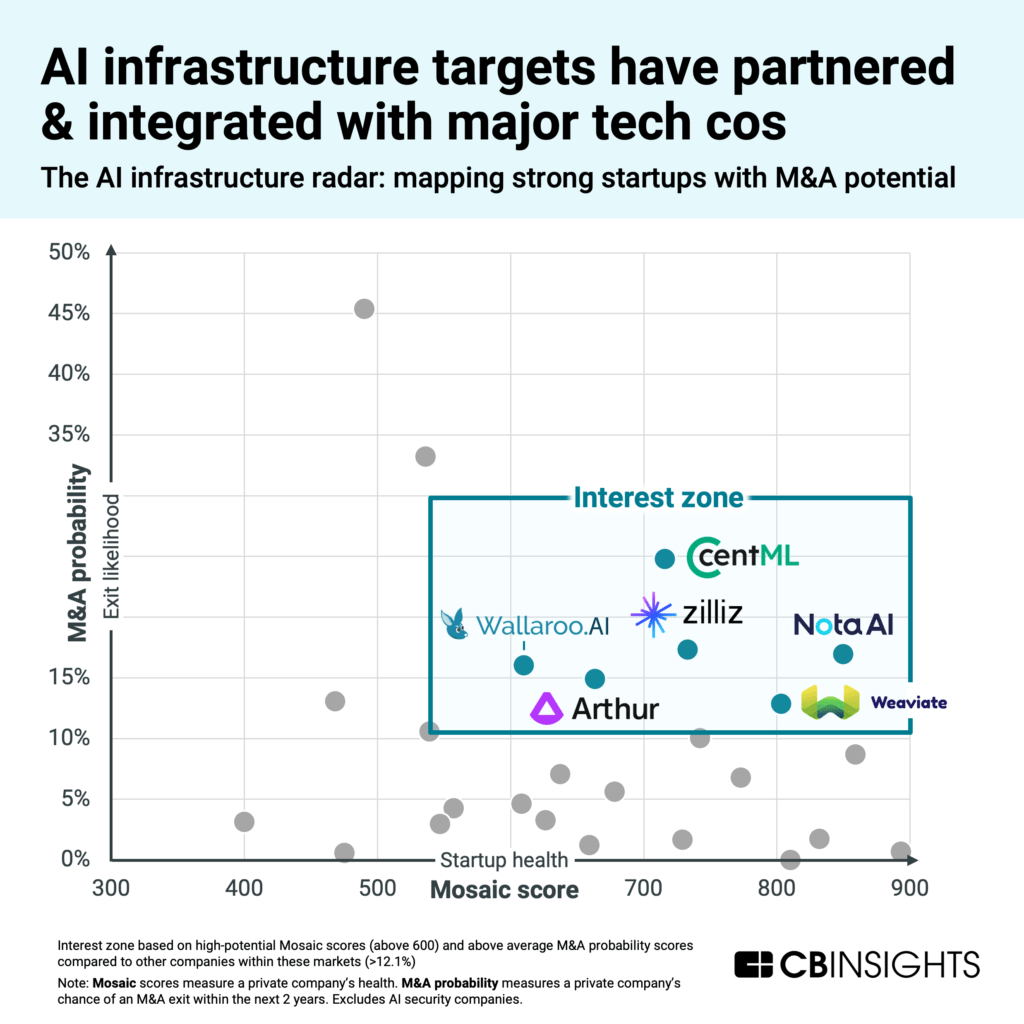

Using CB Insights’ predictive signals, such as Mosaic and M&A Probability, we’ve identified 7 AI-related areas where we expect to see M&A activity this year, as well as high-potential acquisition targets for each.

See highlights below, and download the full report for the rationale behind each prediction, as well as M&A target shortlists.

Tech M&A prediction highlights

- Big tech players set their sights on humanoid robotic: As physical AI takes off thanks to the rise of LLMs, humanoid robotics is becoming big tech’s next battlefield. Among high-potential acquisition targets, 1x stands out for its dual focus on industrial and consumer humanoids (just in January, it acquired Kind Humanoid to accelerate household robot development). This makes it a prime target for Meta, which recently announced plans to enter the consumer humanoid market.

- Enterprise tech heavyweights compete for AI infrastructure dominance: We’re already seeing strong signals from cash-rich companies such as Cisco and IBM, which are future-proofing their business models with AI investments. Hardware-aware AI optimization players CentML and Nota AI — which help accelerate AI model deployment while reducing compute costs — appear in our AI infrastructure acquisition target list. These companies have already shown quantifiable efficiency improvements as well as validation from Nvidia as a partner or investor.

Source: CB Insights advanced search. Data is dynamic (as of 2/27/2025).

- Data center energy demands fuel interest in cooling tech: Companies offering immersion and liquid cooling solutions enjoyed a funding rebound last year, attracting a combined $120M in fresh funding. Hypertec and Submer are high-potential acquisition targets in this space.

- Professional services firms seek AI capabilities: GenAI is coming for knowledge jobs — and leading professional services firms are buying AI capabilities to get ahead of it. One area where we see high M&A potential for professional services firms is to cater to clients’ responsible AI needs, with potential acquisition targets such as Lasso Security and HydroX AI.

- Pharma companies target AI drug discovery startups: AI drug discovery M&A is surging, with 12 deals in the sector since 2023. That M&A deal volume reflects both a maturing technology and growing urgency among pharma players to bring AI tech in-house.

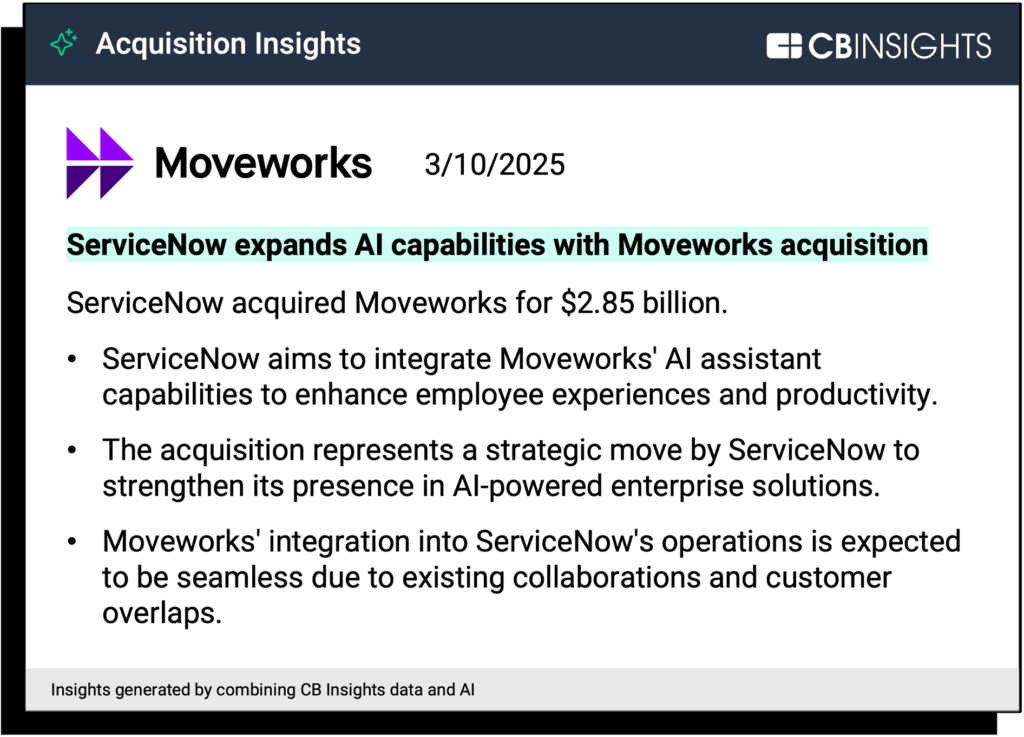

- SaaS giants fortify their offerings with AI agent acquisitions: While some believe AI agents signal the death of SaaS companies, we anticipate SaaS leaders will acquire AI agent companies to avoid disruption. We’re already starting to see this happen with ServiceNow acquiring Moveworks for close to $3B in March 2025.

Source: CB Insights — ServiceNow Acquisition Insights

Source: CB Insights — ServiceNow Acquisition Insights

- Coding AI agents drive next wave of AI agent consolidation: Explosive growth, soaring valuations, a fractured AI agent landscape, and rising doubts about revenue defensibility make the coding AI agents market ripe for consolidation. While some players like Cursor look too expensive for an acquisition, we’ve identified Warp, Vidoc, and Bito as likely targets with high Mosaic scores and higher-than-average M&A Probabilities.

What is Mosaic?

Mosaic is CB Insights’ proprietary metric that measures the overall health and growth potential of private companies using non-traditional signals. Mosaic is widely used as a target company and market screener to identify high-potential emerging tech companies, typically defined as those with a score of 510 or higher.

What is M&A Probability?

M&A Probability is CB Insights’ proprietary signal that measures a private company’s chance of an M&A exit within the next 2 years. It is used to quickly screen and triangulate companies based on exit likelihood.

Combining both Mosaic Score and M&A Probability makes it easy to shortlist acquisition targets.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.