From the drought in dealmaking to a new record for early-stage companies, we break down the trends reshaping insurtech using CB Insights data.

In 2024, investors continued to retreat from insurtech.

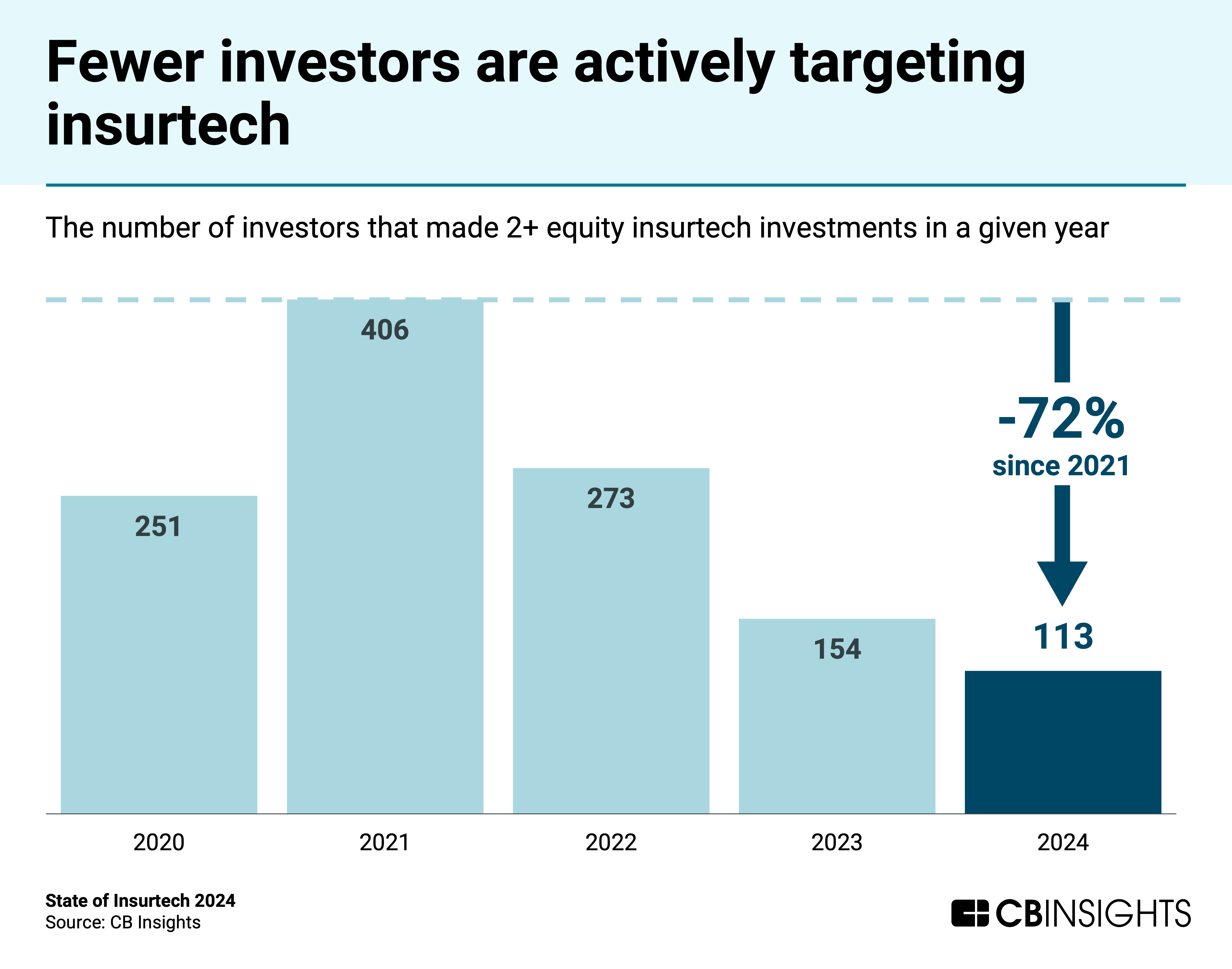

Just 113 investors made at least 2 equity insurtech investments during the year — a 72% drop from the high of 406 investors in 2021. As a result, insurtech dealmaking dropped to 362 deals, the lowest annual total since 2016.

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

Key takeaways from the report include:

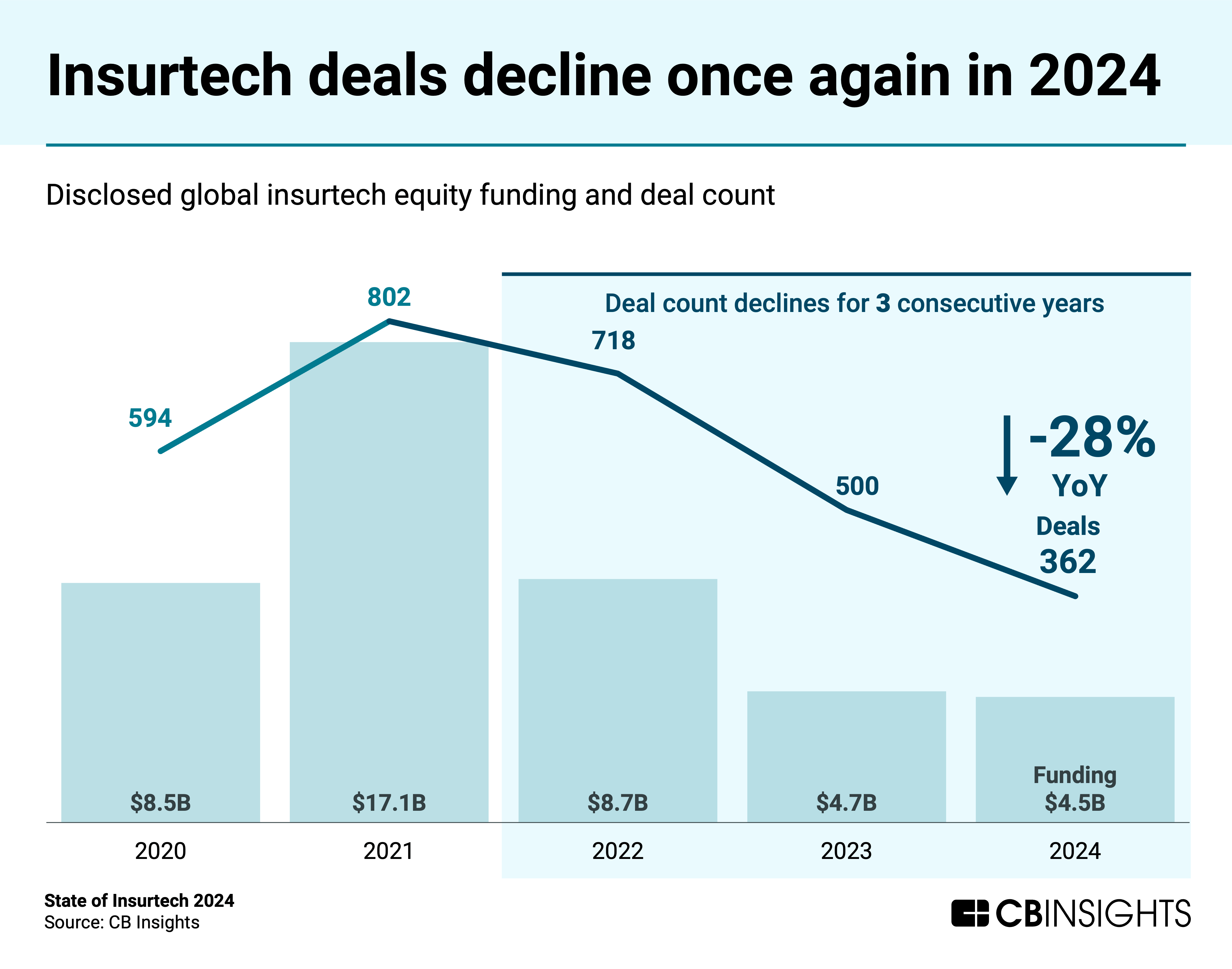

- Insurtech dealmaking and funding continue to decline. Deal count fell 28% year-over-year (YoY) to 362 deals in 2024, while funding dropped 4% to $4.5B. Insurtech deals and funding are both at recent lows.

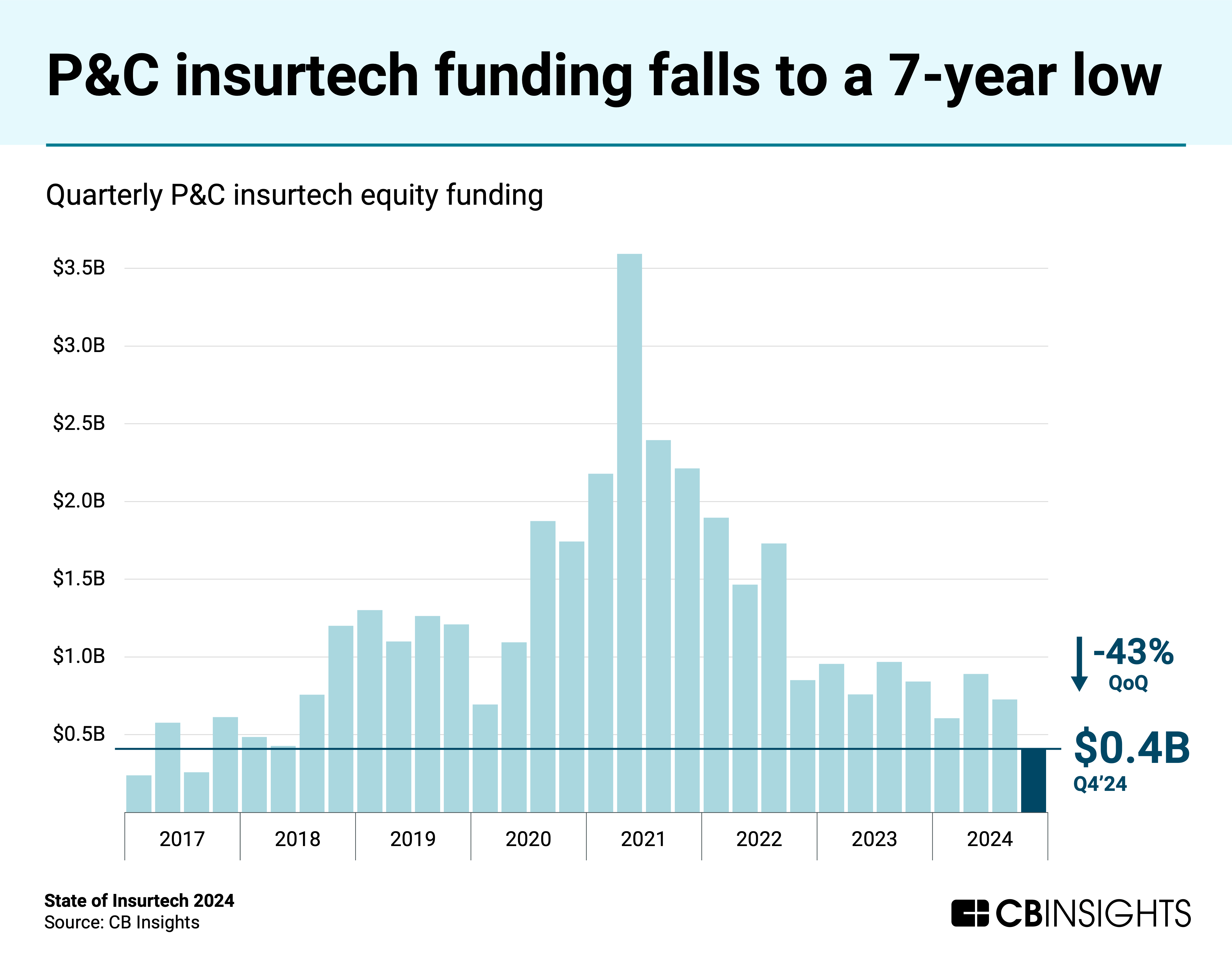

- Quarterly funding to P&C insurtechs is in the gutter. P&C funding dropped 43% quarter-over-quarter (QoQ) to $0.4B in Q4’24 — a 7-year low — with annual funding also declining to $2.6B. The year’s 2 largest deals in P&C went to AI-focused startups Altana AI and Akur8, highlighting investors’ appetite for specialized AI opportunities.

- Silicon Valley is dethroned as insurtech’s funding capital. Silicon Valley’s share of global insurtech funding dropped dramatically from 20% in 2023 to 10% in 2024, surpassed by New York at 15%. This was the first time since 2018 that Silicon Valley wasn’t No. 1.

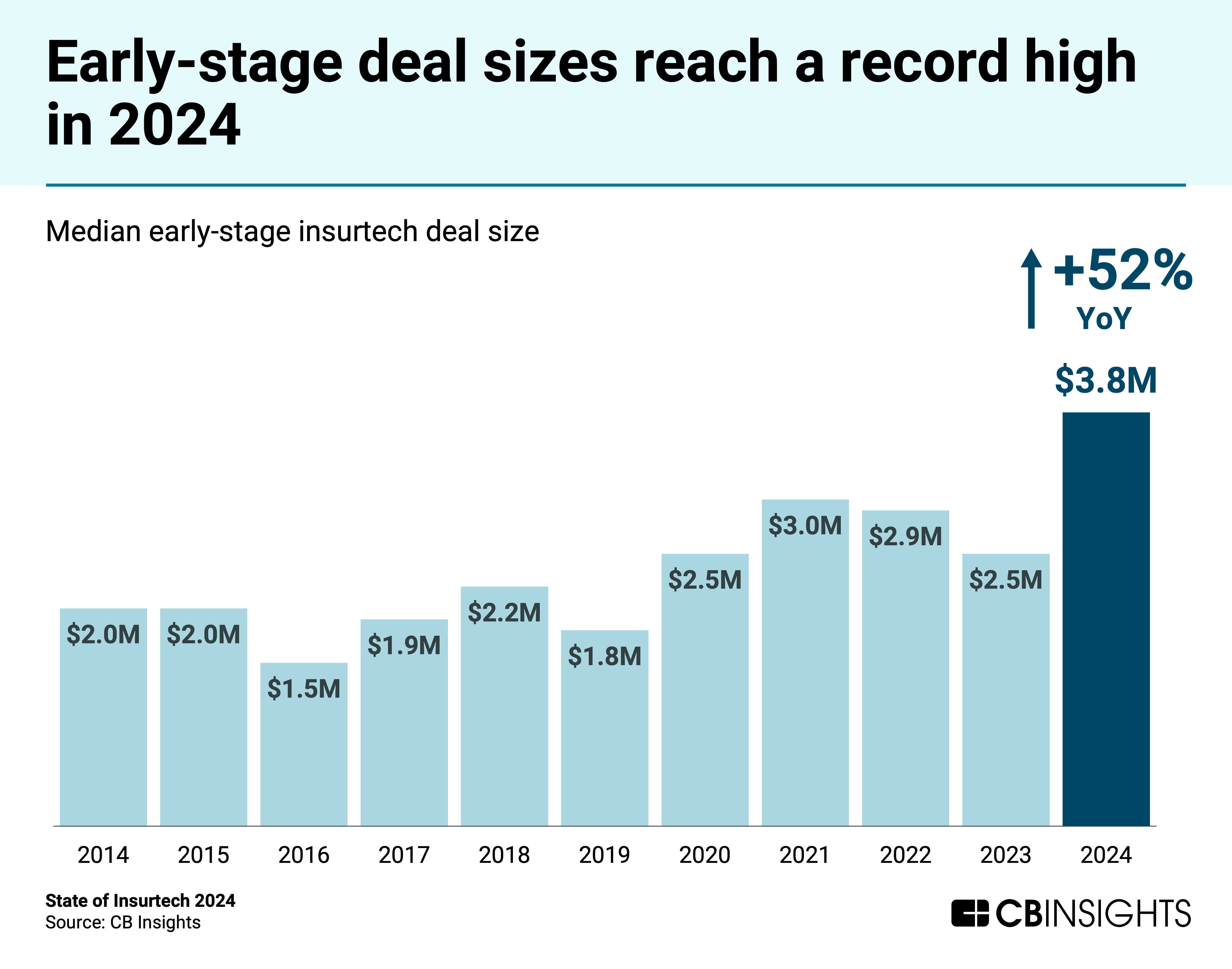

- Early-stage insurtechs raise record-high deal sizes. The median early-stage insurtech deal size surged 52% YoY to $3.8M in 2024 — outpacing the broader venture landscape — as investors concentrate on a more selective group of innovators.

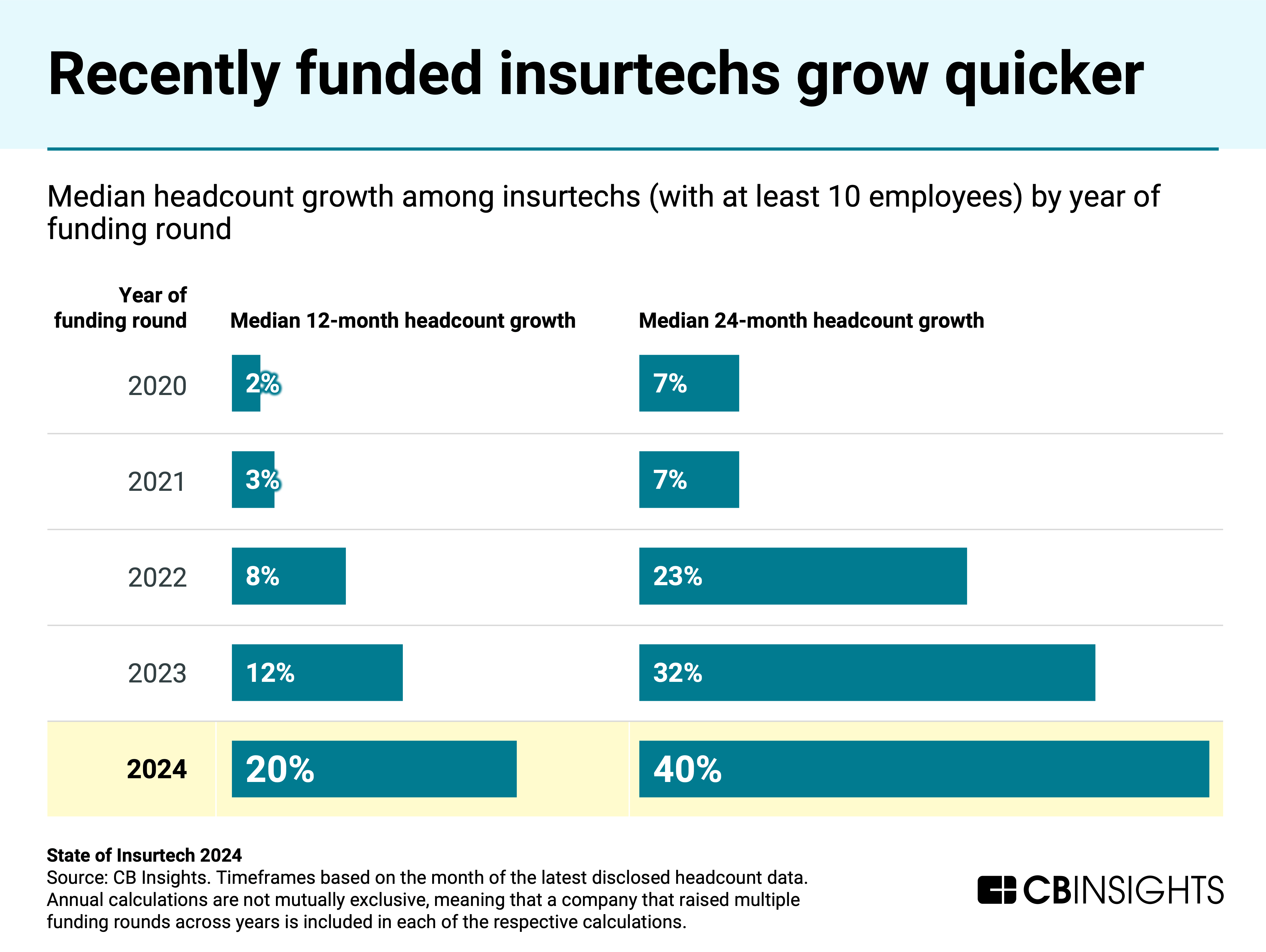

- Recently funded insurtechs show stronger business fundamentals and more efficient growth trajectories. Insurtechs that raised funding in 2024 have grown employee headcounts by a median of 20% over the last 12 months, far surpassing the 3% growth among those that raised during the funding boom of 2021.

Insurtech dealmaking and funding continue to decline

Insurtech deal count fell 28% YoY, from 500 deals in 2023 to 362 in 2024. The decline outpaced the broader venture environment, which saw deal count fall 19% YoY. 2024 was the worst year for insurtech dealmaking since 2016 (328 deals).

Deal volume among leading investors has also decreased. The number of investors that made 5 or more equity insurtech investments has fallen from 57 in 2021 to just 7 in 2024. Those that remain active now operate in a more favorable environment due to reduced competition across the marketplace.

Insurtech funding declined in 2024 as well, though by only 4% YoY.

Quarterly funding to P&C insurtechs is in the gutter

Q4’24 marked a 7-year low for P&C insurtech funding, which fell 43% QoQ to $0.4B. The decline caused broader insurtech funding to halve QoQ, from $1.4B in Q3’24 to $0.7B in Q4’24.

P&C deal count also fell 10% QoQ to 45 in Q4’24, the lowest level since Q2’16.

Annual P&C insurtech funding declined to $2.6B in 2024, a 7-year low, underscored by just 2 P&C insurtech startups raising $100M+ mega-round deals: Altana AI, which offers an AI-powered supply chain risk platform, and Akur8, an AI-powered pricing platform. Those deals signal appetite for specialized AI products for the insurance industry, coinciding with a global surge in AI funding to over $100B last year.

Comparatively, life & health insurtech saw an increase in annual funding and dealmaking. Funding increased 64% YoY to $1.8B in 2024, while deals ticked up from 126 in 2023 to 128 in 2024.

Silicon Valley is dethroned as insurtech’s funding capital

The share of global insurtech funding to Silicon Valley-based startups halved YoY, falling from 20% in 2023 to 10% in 2024. Comparatively, New York led the way with 15% of global insurtech funding share in 2024, more than doubling from 7% the year prior.

Silicon Valley is the world’s leading tech ecosystem, and venture-wide funding to the region’s startups soared last year amid a boom in AI investment. Given the ecosystem’s prominence, diminished insurtech activity in Silicon Valley could lead to missed opportunities for insurance-focused AI advancements.

Early-stage insurtechs raise record-high deal sizes

The median insurtech deal size increased from $4.1M in 2023 to $5.2M in 2024.

The increase was fueled by early-stage insurtechs, which saw median deal size surge 52% YoY, from $2.5M in 2023 to $3.8M in 2024. The size and growth rate both beat out the broader venture environment, where early-stage deal size increased 17% YoY to $2.1M.

Combined with the broader decline in dealmaking, larger check sizes indicate that investors are concentrating their investments on fewer bets. For the insurance industry, this dynamic points to a slimmer insurtech landscape with fewer high-growth participants moving forward.

On the other hand, late-stage insurtech deal sizes declined 19% YoY from $40M in 2023 to $32.5M in 2024.

The decline coincides with a restricted exit environment: Insurtech M&A exits fell from 57 in 2023 to 35 in 2024.

Nevertheless, notable exits include CCC Intelligent Solutions’s acquisition of EvolutionIQ in December at a valuation of $730M, as well as Applied’s purchase of Planck in July. Both acquisitions targeted genAI-enabled startups, signaling a broader appetite for genAI insurance offerings.

Recently funded insurtechs show stronger business fundamentals

Insurtechs that raised funding in 2024 are growing headcounts faster than other insurtechs, by a median of 20% over the last 12 months and 40% over the last 24 months.

Comparatively, median headcount growth among insurtechs that raised a funding round at the height of the funding boom in 2021 is marginal — just 3% over the last 12 months.

The higher growth rates of recently funded insurtechs suggest a new breed of companies with stronger fundamentals — they’re not only able to raise capital in a selective market but are also demonstrating more efficient growth than their 2021-funded counterparts.

By the same logic, investors and partners (like established brokers and carriers) should monitor the landscape for outliers that represent organic growth opportunities — such as insurtechs that haven’t raised funding in several years but continue to grow headcount at a steady clip.

MORE INSURTECH RESEARCH FROM CB INSIGHTS

- How genAI is reshaping the insurance value chain

- Insurtech 50: The most promising insurtech startups of 2024

- ITC Vegas 2024: Insurance is facing an AI inflection point

- Tech Transforming the World: The Game Changers Roundtable

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.