CVCs plunge headfirst into AI, prioritize early-stage deals, and downshift on Asia. We break down the trends reshaping corporate venture capital using CB Insights data.

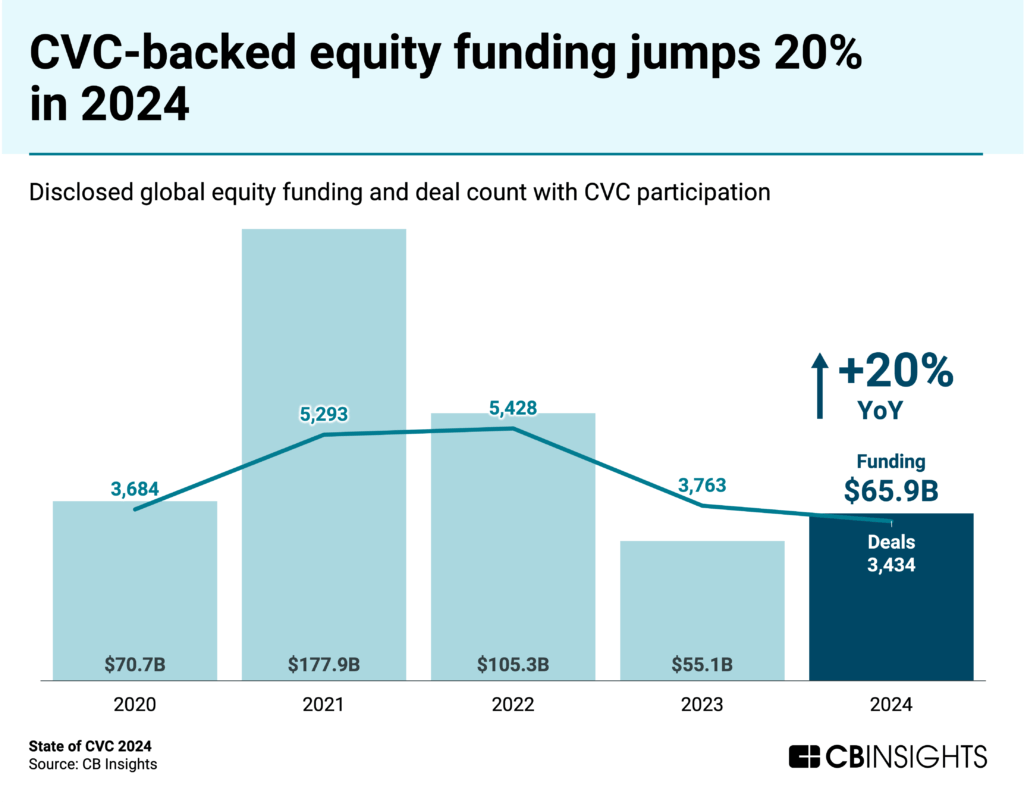

Global CVC-backed funding rebounded 20% YoY to $65.9B in 2024, fueled by increased attention to US startups — especially AI companies, which drew record-high shares of both CVC-backed deals and funding.

However, global CVC deal count dropped to its lowest level since 2018 as CVCs become more selective.

Download the full report to access comprehensive data and charts on the evolving state of CVC across sectors, geographies, and more.

Key takeaways from the report include:

- CVC-backed funding grows, deal activity slows. Global CVC-backed funding increased 20% YoY to $65.9B, but deal count fell to 3,434, the lowest level since 2018. All major regions saw deal volume declines, with Europe dropping the most at 10% YoY.

- CVCs are all in on AI. AI startups captured 37% of CVC-backed funding and 21% of deals in 2024 — both record highs. Counter to the broader decline in deals, CVCs ratcheted up AI dealmaking by 13% YoY as they race to secure footholds in the space before competitors gain an insurmountable edge.

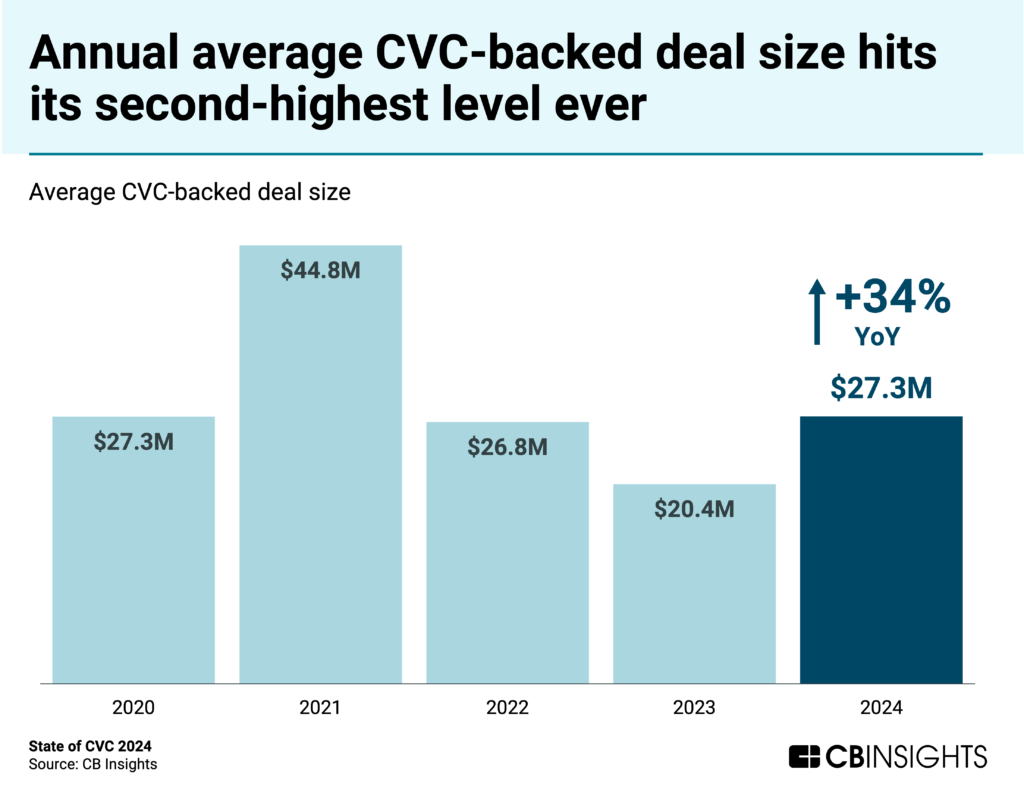

- The flight to quality continues. Among deals with CVC participation, the annual average deal size hit $27.3M in 2024, tied for the second highest ever. Amid fewer deals, CVCs are increasingly aggressive when they do decide to invest.

- Early-stage deals dominate. Early-stage rounds comprised 65% of 2024 CVC-backed deals, tied for the highest share in over a decade. Biotech startups made up half of the top 20 early-stage deals.

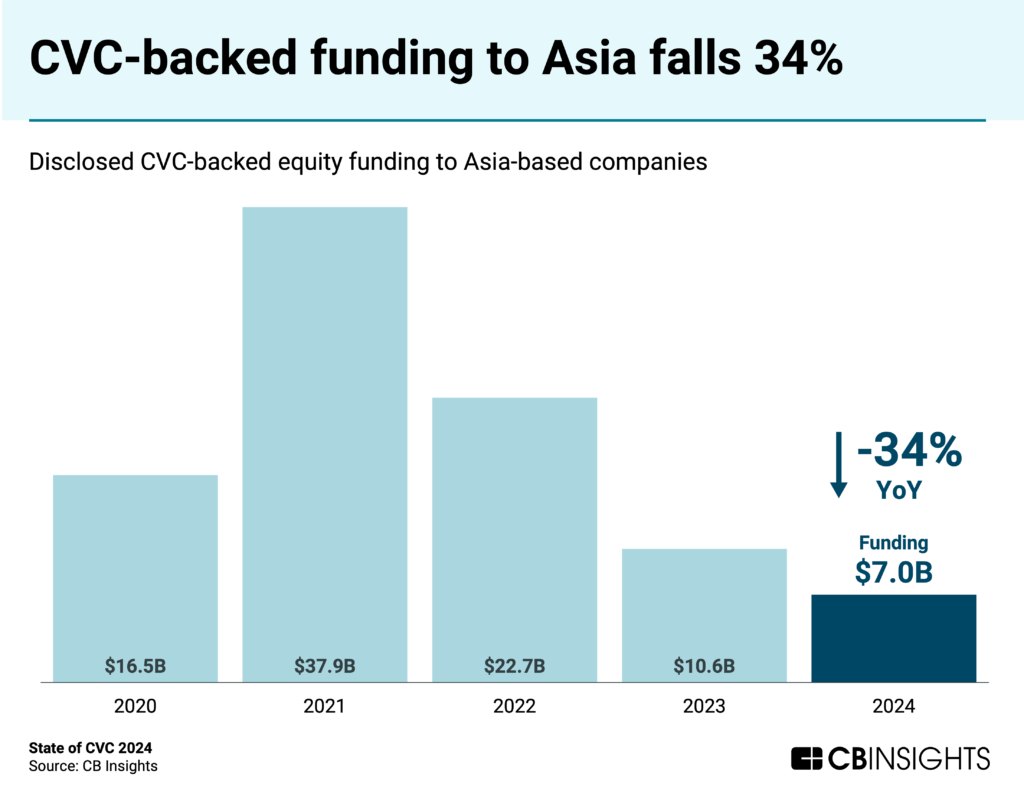

- CVC-backed funding plummets in Asia. In 2024, Asia’s CVC-backed funding dropped 34% YoY to $7B — the lowest level since 2016. China is leading the decline, with no quarter in 2024 exceeding $0.5B in funding. CVCs remain wary of investing in the country’s private sector.

We dive into the trends below.

CVC-backed funding grows, deal activity slows

Global CVC-backed funding reached $65.9B, a 20% YoY increase. The US was the main driver, increasing 39% YoY to $42.8B. Europe also saw CVC-backed funding grow 18% to $12.3B, while Asia declined 34% to $7B.

$100M+ mega-rounds also contributed to the rise, ticking up 21% YoY to 141 deals worth over $32B in funding.

Meanwhile, deal count continued its decline, as both annual (3,434 in 2024) and quarterly (806 in Q4’24) totals reached their lowest levels in 6 years.

Annual deal volume fell by at least 6% YoY across each major region — the US, Asia, and Europe — with Europe experiencing the largest decline at 10%.

However, Japan-based CVC deal volume remains near peak levels, suggesting a more resilient CVC culture compared to other nations. Two of the three most active CVCs in Q4’24 are based in Japan: Mitsubishi UFJ Capital (21 company investments) and SMBC Venture Capital (15).

CVCs are all in on AI

AI is driving CVC investment activity, much like the broader venture landscape. In 2024, AI startups captured 37% of CVC-backed funding and 21% of deals, both record highs.

In Q4’24, the biggest CVC-backed rounds went primarily to AI companies. These include:

- AI search startup Perplexity’s $500M Series C, backed by Nvidia’s NVentures

- Coding AI copilot Poolside’s $500M Series B, backed by the venture arms for Citigroup, HSBC, Capital One, LG, eBay, and Nvidia

- AI computing processor developer Lightmatter’s $400M Series D, backed by GV

CVCs are also investing in the energy companies powering the AI boom, such as Intersect Power, which raised the largest round at $800M (backed by GV).

Expect the trend to continue into 2025, as emerging AI markets mature further, such as AI agents & copilots for enterprise and industrial use cases; AI solutions for e-commerce, finance, and defense; and the computing hardware necessary to power these technologies.

The flight to quality continues

In 2024, the annual average deal size with CVC participation reached $27.3M, a 34% YoY increase and tied for the second highest level on record, exceeded only by the low-interest-rate environment of 2021.

Median deal size also increased, though only by 8% to $8.6M.

Even though the number of CVC-backed deals declined in 2024, the increase in average annual deal size reflects a focus on companies with strong growth prospects. CVCs are prioritizing quality and committing more funds to a select group of high-potential investments.

Early-stage deals dominate

Early-stage rounds (seed/angel and Series A) made up 65% of CVC-backed deals in 2024, tied for the highest recorded level in more than a decade.

In Q4’24, biotech companies were the early-stage fundraising leaders, accounting for 10 of the 20 largest early-stage deals. Biotech players City Therapeutics, Axonis, and Trace Neuroscience all raised $100M+ Series A rounds, with City Therapeutics and Axonis notably receiving investment from the venture arms of Regeneron and Merck, respectively.

Among all early-stage CVC-backed companies, the largest round went to Physical Intelligence, a startup focused on using AI to improve robots and other devices. Physical Intelligence raised a $400M Series A with investment from OpenAI Startup Fund.

CVC-backed funding plummets in Asia

Asia’s CVC-backed funding continued its downward trend in 2024, decreasing 34% YoY to $7B.

China was the main driver, with CVC-backed funding coming in at $0.5B or less every quarter in 2024. CVCs remain wary of investing in startups in the nation, which faces a variety of economic challenges, including a prolonged real estate slump, cautious consumer spending, strained government finances, and weakened private sector activity amid policy crackdowns.

In Japan, on the other hand, CVC activity remains robust. In 2024, funding with CVC participation ($1.7B) remained on par with the year prior, while deals (502) actually increased by 11%.