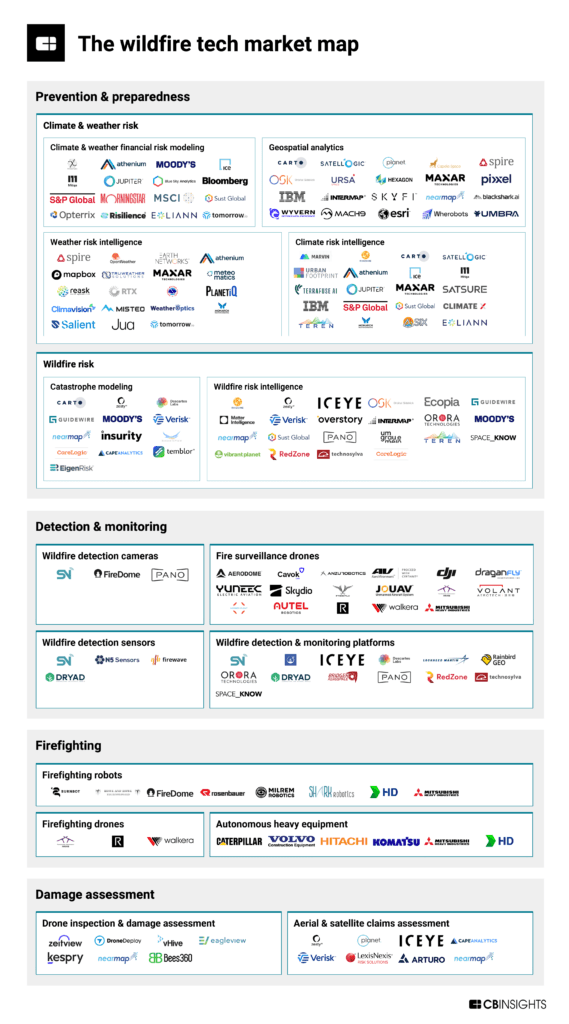

We map out 130 companies developing wildfire technologies for applications such as prevention & preparedness, detection & monitoring, firefighting, and damage assessment.

Wildfires have caused over $100B in economic losses since 2014, according to Swiss Re. The recent fires in Los Angeles are expected to add tens or hundreds of billions to that total, foreshadowing increasingly severe wildfire risk in the years ahead.

Companies are responding by developing solutions like fire surveillance drones to better monitor wildfires, as well as firefighting robots to minimize the severity when they occur. In fact, over 500 US fire departments have already deployed surveillance drones.

To help companies and governments understand the current wildfire tech landscape, we mapped 130 companies across 15 markets. We then organized tech markets by the wildfire lifecycle:

- Prevention & preparedness: Solutions in this category help forecast extreme weather events — including wildfires — and assess their damage potential. We break this category down into: 1) broader climate & weather risk; and 2) wildfire risk, which includes solutions specifically designed for wildfires.

- Detection & monitoring: These solutions use cameras, sensors, and analytics platforms to detect outbreaks early and track their progression to aid firefighting strategies.

- Firefighting: These technologies — such as drones and robots — support the suppression of wildfires or help create firebreaks to limit their spread.

- Damage assessment: This includes solutions to evaluate the destruction caused by wildfires after they occur.

Please click to enlarge.

To identify players for this market map, we included startups with a Mosaic score of 400 or greater and leading corporations developing wildfire tech. Categories are not mutually exclusive and are not intended to be exhaustive.

Market descriptions

Click the market links below for info on the leading companies, funding, and more.

Prevention & preparedness: Climate & weather risk

Climate & weather financial risk modeling focuses on quantifying the financial impacts of climate change and severe weather events, helping businesses forecast and mitigate monetary losses. Leading companies like Bloomberg and Morningstar serve many industries, from agriculture to insurance to government.

Featured companies:

Geospatial analytics analyzes and interprets geographic data (e.g., satellite imagery, GIS) for various industries, providing spatial insights and risk assessments. Startups in this market have raised a combined $508M since 2023 — the most funding of any market in this map.

Featured companies:

Weather risk intelligence emphasizes real-time weather monitoring and predictive modeling to reduce operational disruptions and manage day-to-day weather-related risks.

Featured companies:

Climate risk intelligence provides deeper analysis of long-term climate change hazards, guiding strategic decision-making and resilience planning for businesses and governments.

Featured companies:

Prevention & preparedness: Wildfire risk

Catastrophe modeling simulates large-scale natural disasters (e.g., hurricanes, earthquakes) to estimate potential losses, primarily for insurance and reinsurance purposes.

Featured companies:

Wildfire risk intelligence zeroes in on wildfire hazards with analytics and forecasting tools, helping organizations anticipate fire spread and prioritize mitigation. This market has the highest average company Mosaic health score (662 out of 1,000) among wildfire-specific tech markets.

Featured companies:

Detection & monitoring

Wildfire detection cameras use specialized imaging (thermal, infrared) to spot fire signatures early and relay alerts from fixed vantage points.

Wildfire detection sensors are ground-based devices that monitor environmental conditions (e.g., temperature, smoke) to detect potential fires in real time.

Fire surveillance drones provide aerial monitoring of wildfires using sensors like thermal imaging, enhancing situational awareness and firefighter safety. Companies in this market typically offer drones for a wider set of applications beyond wildfires. For example, Skydio, which has raised $400M since 2023, serves industries such as industrial inspection and defense, in addition to fire surveillance.

Featured companies:

Wildfire detection & monitoring platforms integrate satellite/aerial data, IoT sensors, and AI in a software platform to track and predict wildfire behavior at scale. ICEYE and Pano AI rank as leading startups here, offering solutions for enterprises and governments through platforms that use advanced imaging systems and AI models to predict potential wildfire locations and facilitate real-time detection and monitoring.

Featured companies:

Firefighting

Firefighting drones actively suppress fires by delivering water or fire-retardant agents, often equipped with thermal imaging to pinpoint hotspots. This is among the most nascent markets in the map, with 89% of deals since 2023 going to early-stage companies.

Firefighting robots are ground units equipped with sensors and suppression tools (e.g., water cannons), enabling safer and more efficient fire combat in hazardous areas.

Featured companies:

Autonomous heavy equipment encompasses self-operating machinery (e.g., bulldozers, loaders) used in construction, mining, or creating firebreaks, reducing human risk.

Featured companies:

Damage assessment

Drone inspection & damage assessment uses drones to capture high-resolution imagery of properties for quicker, more accurate insurance claims evaluations.

Aerial & satellite claims assessment leverages imagery from planes or satellites to evaluate property damage — often focused on large-scale or remote loss scenarios.

Featured companies:

RELATED RESOURCES FROM CB INSIGHTS:

- Weather risk intelligence funding surges as extreme weather events pile up

- Wildfires are causing insurers to leave markets. Can wildfire risk analytics reverse this trend?

- The Aerospace & Space Tech expert collection

- The Insurtech expert collection

- The satellite & geospatial tech market map

- The AI in defense tech market map

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.