From the growth potential of grid tech/nuclear to a dramatic pullback in funding, we break down key changes in the climate tech landscape using CB Insights data.

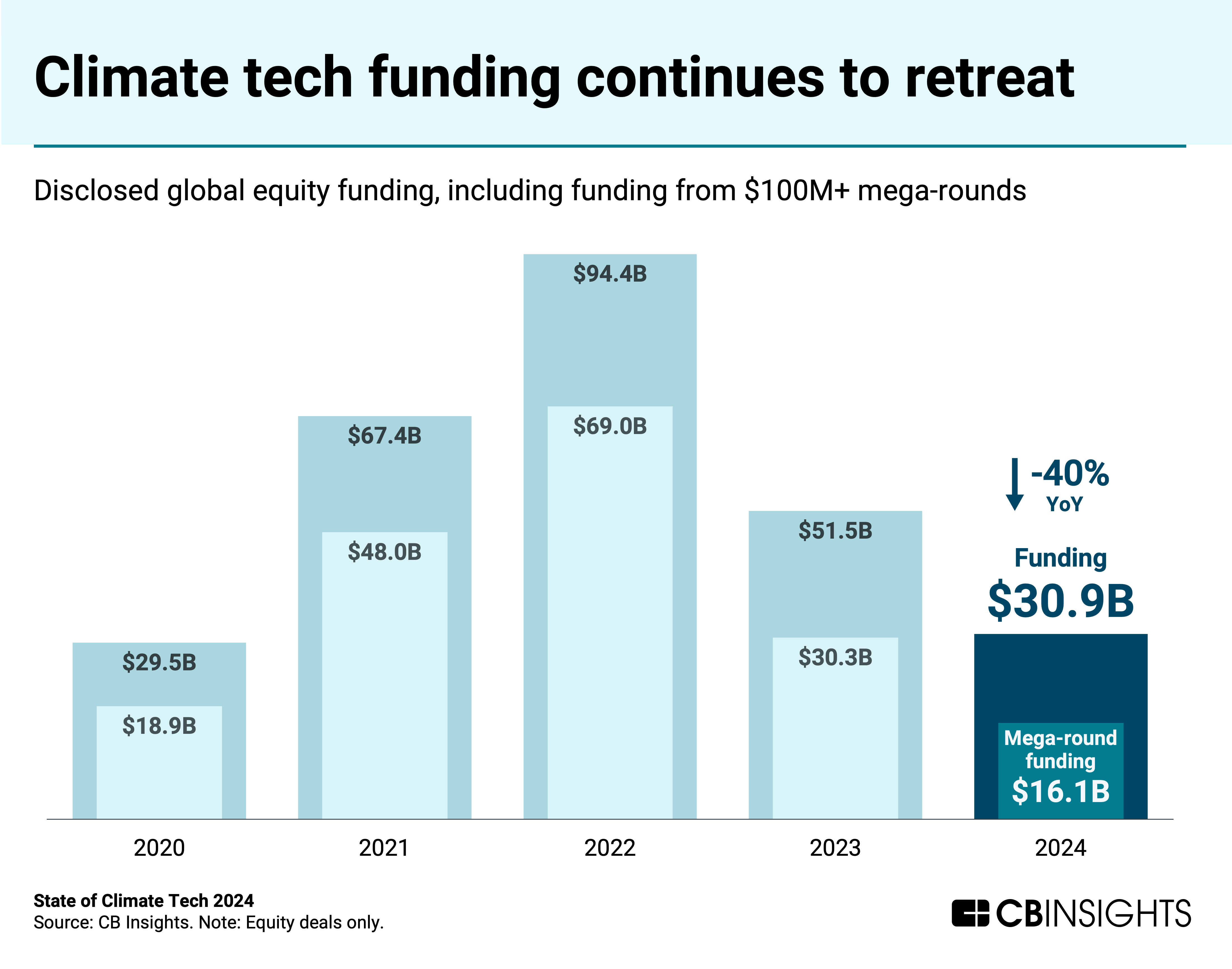

Climate tech investment activity dropped significantly in 2024, with both funding and deals falling to their lowest levels since 2020.

A key factor in the slowdown was a sharp drop in funding from mega-rounds ($100M+ deals), which dropped 47% year-over-year (YoY) in 2024. This coincided with high-profile bankruptcies of established climate tech startups like battery manufacturer Northvolt.

However, this turbulence wasn’t limited to the private markets — public players like Lilium and Arrival also filed for insolvency/bankruptcy over the period, highlighting the commercialization challenges facing capital-intensive industries like climate tech.

Download the full report to access comprehensive data and charts on the evolving state of climate tech across sectors, geographies, and more.

Key takeaways from the report include:

- Climate tech investment activity continues to contract. Global climate tech funding fell for the second year straight in 2024, dropping by 40% YoY, with mega-round funding falling by 47%. However, the space still saw notable mega-rounds. This included deals to players modernizing the power grid, drawing participation from tech giants racing to secure clean energy for computing infrastructure.

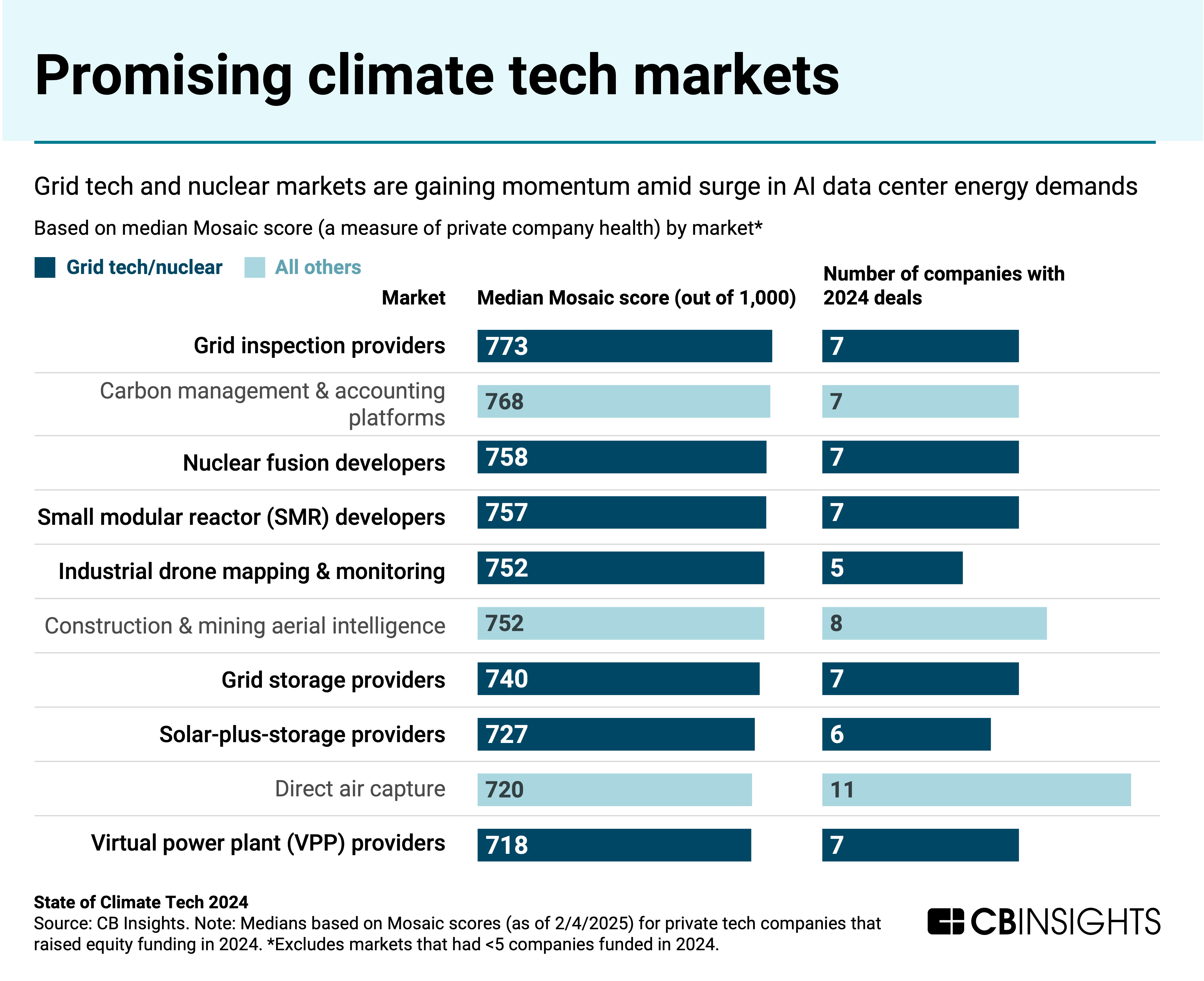

- Grid tech and nuclear are gaining momentum to meet AI’s energy needs. Within climate tech, markets targeting the grid and power generation show the strongest growth potential, according to CB Insights Mosaic startup health scores. This momentum is driven in part by the massive energy demands (and expected continued demand) of AI data centers.

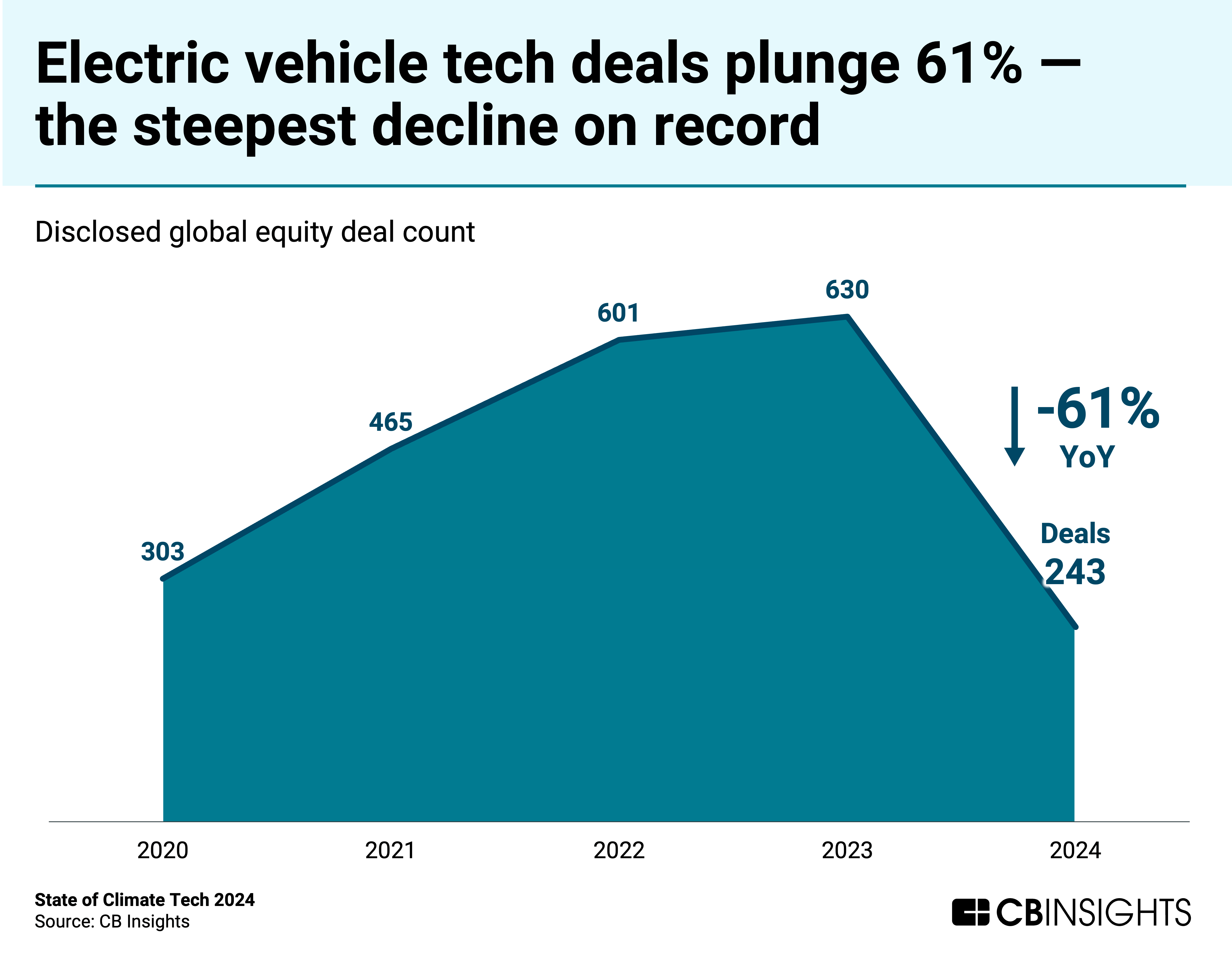

- Electric vehicle technology sees record pullback in deals. After years of steady growth, electric vehicle (EV) tech deal activity plunged 61% YoY in 2024 — its steepest decline on record. This points to broader challenges in the sector, like lower consumer demand for EVs and increased capital costs for scaling manufacturing operations.

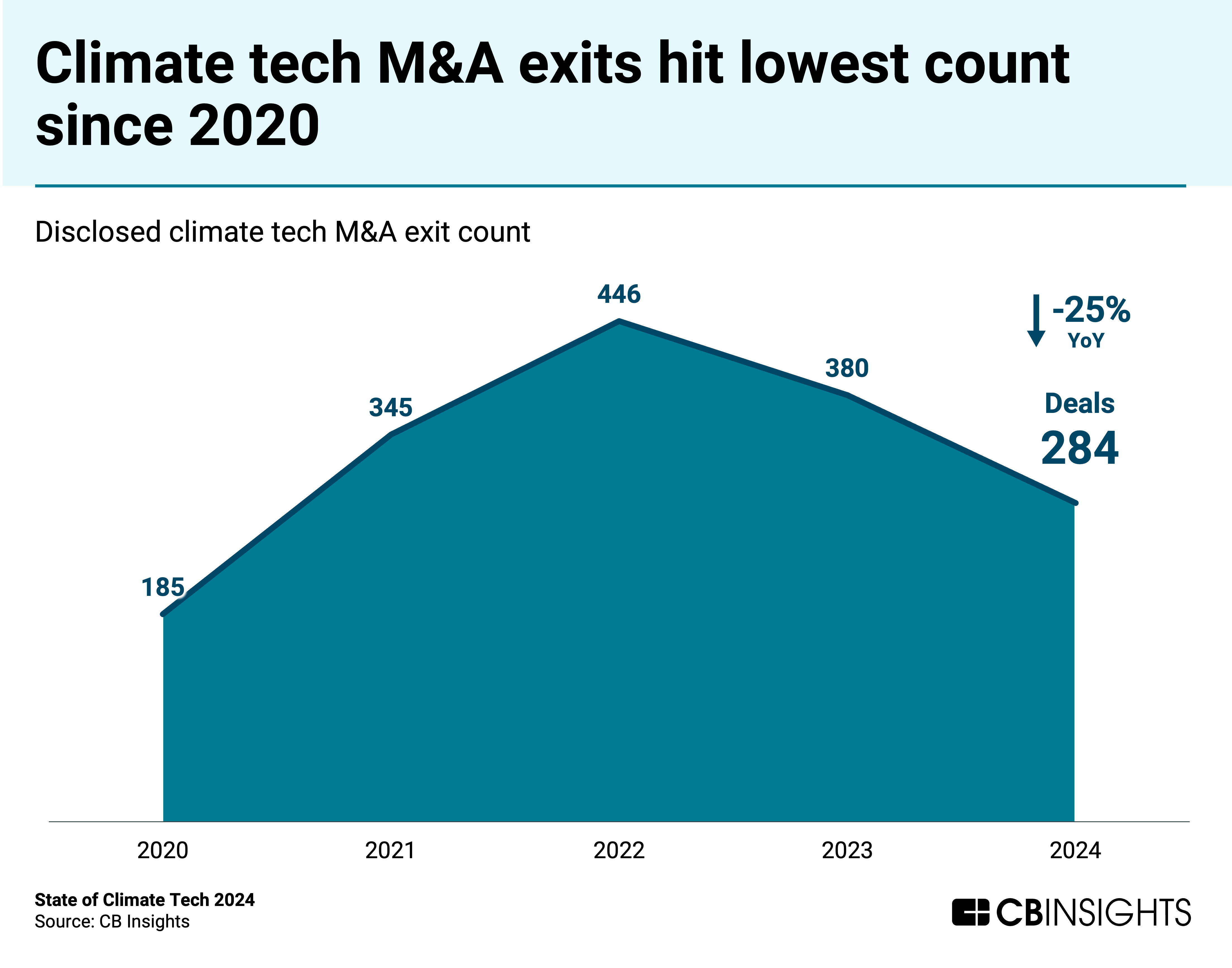

- Climate tech M&A exits decline once again. Climate tech M&A exits dropped by 25% YoY to hit 284, the lowest count since 2020. At the quarterly level, M&A exits steadily declined over the course of 2024, falling from 104 in Q1’24 to 39 in Q4’24. Growing skepticism around environmental, social, and governance (ESG) initiatives could be a contributing factor.

We dive into the trends below.

Climate tech investment activity continues to contract

Global climate tech funding dropped for a second consecutive year in 2024. It fell by 40% YoY, with mega-round funding falling by 47% over the same period.

The funding slowdown played out differently across the globe. US climate tech showed resilience YoY with relatively steady funding despite fewer deals. Meanwhile, other countries saw steep declines in climate tech dollars, with China experiencing the sharpest drop (-66% YoY).

Amid the overall funding decline, climate tech still saw several notable mega-rounds. This included deals in Q4’24 for companies modernizing the power grid:

- Crusoe secured $600M at a $2.8B valuation to support its efforts to use waste natural gas to power large-scale data centers

- X-energy received $500M as it works to build small modular reactors (SMRs) capable of generating more than 5 gigawatts of electricity by 2039

- Form Energy secured $405M to accelerate production of its iron-air batteries capable of 100-hour energy storage

Notably, some of these deals drew participation from big tech companies racing to secure clean energy for computing infrastructure. For example, Amazon (via the Climate Pledge Fund) invested in X-energy’s nuclear development, and Nvidia invested in Crusoe’s sustainable computing infrastructure, reflecting big tech’s interest in solutions that can help meet rising AI data center demands.

Grid tech and nuclear are gaining momentum to meet AI’s energy needs

Comparing median CB Insights Mosaic scores (a measure of private tech company health and growth potential on a 0–1,000 scale) for climate tech companies that raised equity funding in 2024 reveals the most promising markets in climate tech.

Grid tech and nuclear markets — covering technologies directly integrated into and operated by utilities to enhance power system reliability, flexibility, and clean energy integration — dominate the top 10 climate tech markets by median Mosaic score, highlighting their growth potential.

Surging energy demand from AI data centers is in part responsible for these markets’ momentum. For example, nuclear fusion and small modular reactors could provide continuous clean power generation, grid storage enables reliable renewable energy delivery, and virtual power plants help optimize massive power loads.

Electric vehicle technology sees record pullback in deals

Electric vehicle tech deals experienced their steepest decline on record in 2024, with deal count plunging 61% YoY to 243.

High-profile bankruptcies underscored the sector’s capital-intensive manufacturing challenges in 2024. Battery manufacturer Northvolt filed for bankruptcy a year after raising $1.2B, as it struggled to scale production efficiently. Electric van maker Arrival — which went public in 2021 at a $13B valuation — also filed for bankruptcy last year amid mounting production costs and the inability to raise funding.

Even the auto industry’s most prominent EV champions scaled back their electric ambitions throughout the year:

- GM delayed its Orion Assembly EV truck plant by 6 months and cut 2024 EV targets by 17%

- Toyota postponed US EV production to 2026

- Ford canceled plans to produce an all-electric three-row SUV, pivoting to a hybrid approach instead

- Volvo dropped its 2030 all-electric goal

Climate tech M&A exits decline once again

In 2024, climate tech M&A exits fell by 25% YoY to hit 284 — the lowest count since 2020.

At the quarterly level, M&A exits steadily declined over the course of 2024, falling from 104 in Q1’24 to 39 in Q4’24.

The decline in M&A activity coincided with key changes in market conditions, including the rise of economic headwinds, political uncertainty, and growing skepticism around environmental, social, and governance (ESG) initiatives.

For example, ESG tech markets collectively saw equity funding decline 54% YoY in 2024. On the corporate side, mentions of ESG in earnings calls have trended down since peaking in Q1’22.

As skepticism toward ESG initiatives grows, some companies appear to be placing lower priority on climate tech acquisitions that were previously considered strategic imperatives.

MORE CLIMATE TECH RESEARCH FROM CB INSIGHTS

- Data centers are reshaping nuclear development, driving billions in new power infrastructure investment

- Why fleet management leaders are racing to acquire next-gen telematics capabilities — and which M&A targets could be next

- The AI data center value chain: 12 high-momentum technologies powering the future of AI

- The top 25 utility companies by AI readiness

- Big Tech in Energy: How Amazon, Google, Microsoft, & Nvidia are advancing the global energy transition

- Sodium-ion batteries are poised for a breakout moment — energy players should prepare

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.