From a 7-year low in dealmaking to M&A gaining steam, we break down key changes in the fintech landscape using CB Insights data.

Fintech funding and dealmaking declined again year-over-year (YoY) in 2024, hitting their lowest levels in 7 years.

However, some positive signals are emerging, including growing deal sizes and a pickup in M&A, with a focus on cybersecurity capabilities.

Download the full report to access comprehensive data and charts on the evolving state of fintech across sectors, geographies, and more.

Key takeaways from the report include:

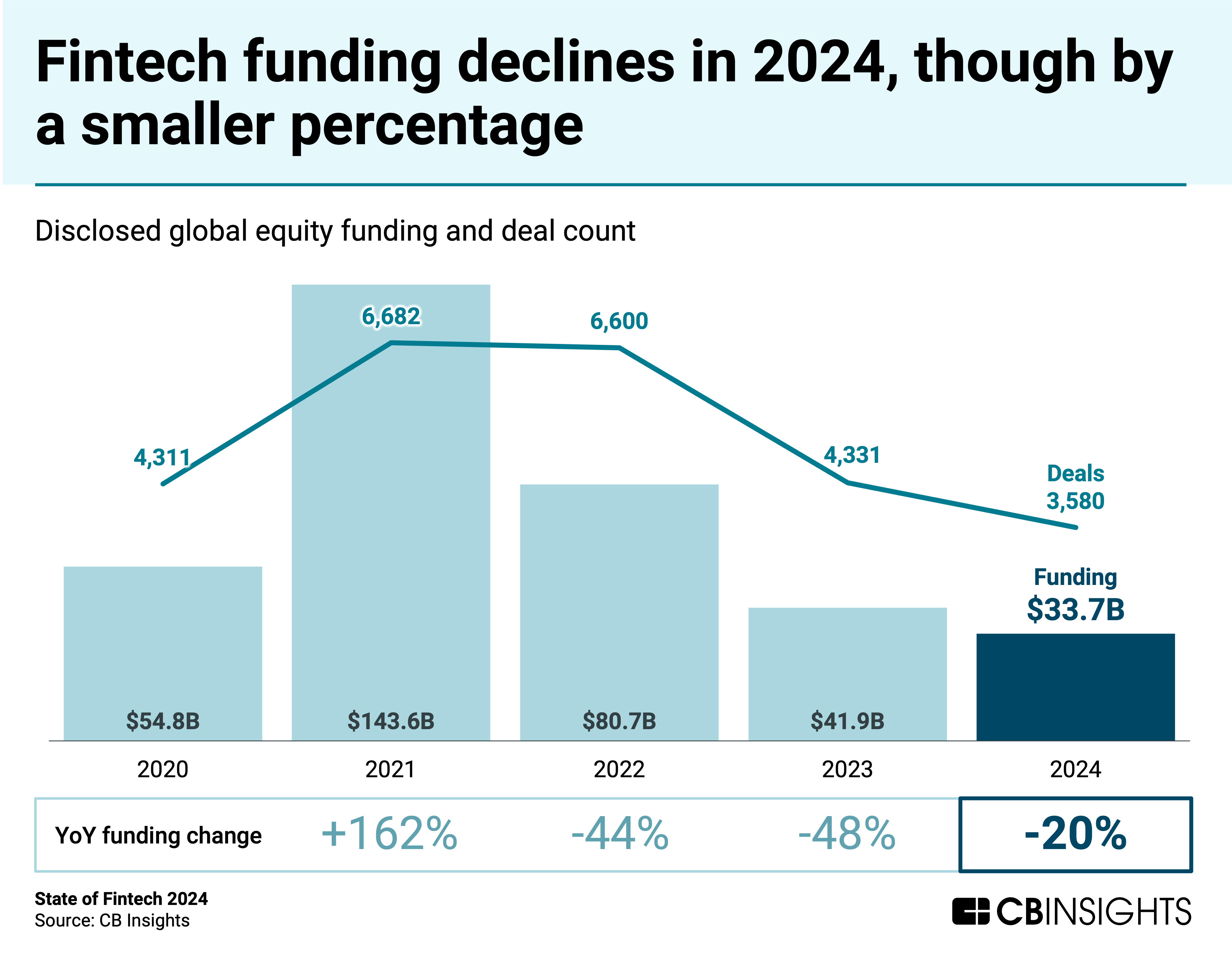

- Fintech dealmaking continues downward trend in 2024. Annual fintech deals and funding both dropped to 7-year lows in 2024. While deals dropped by 17% YoY to a total of 3,580, funding fell by 20% to $33.7B.

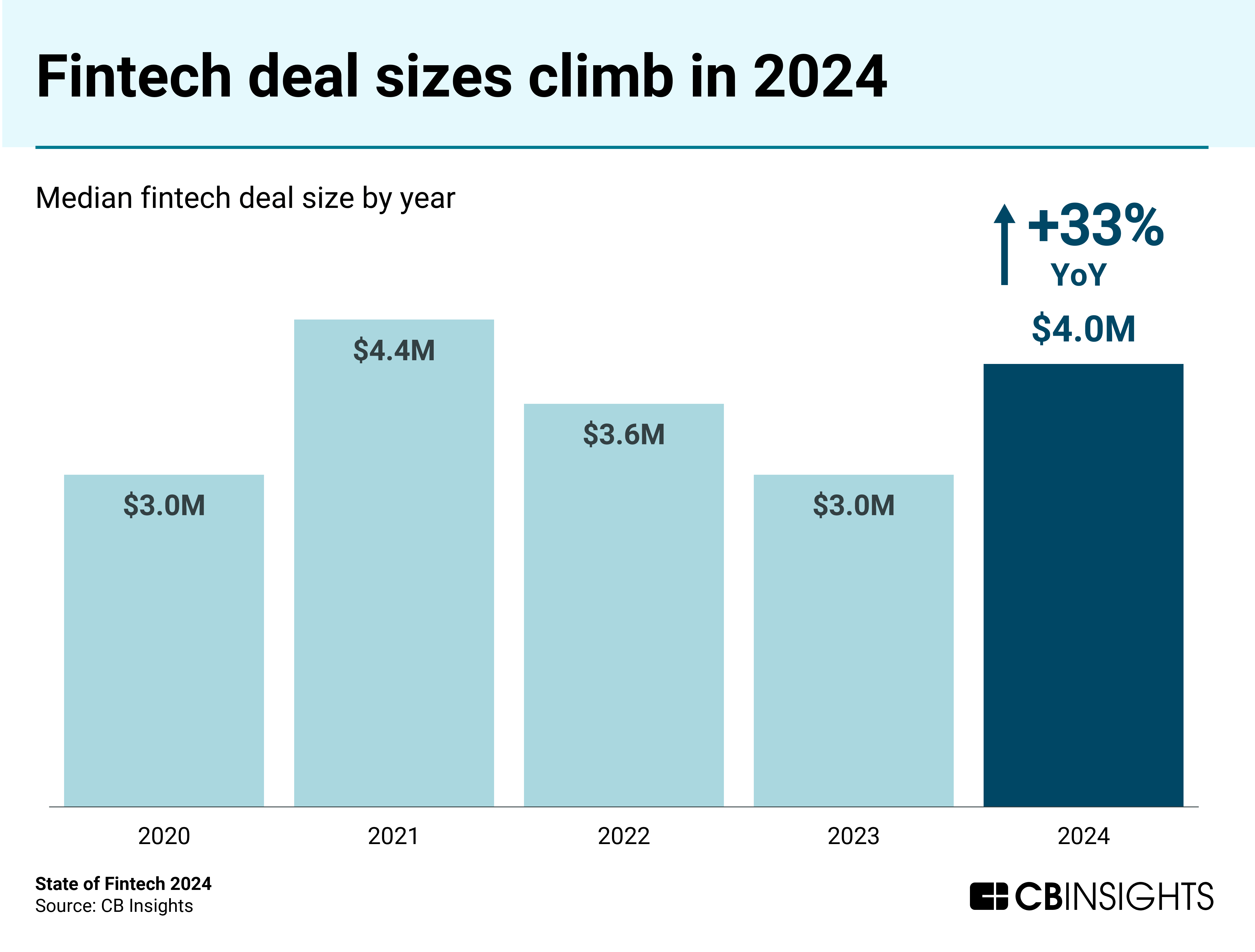

- One positive signal: bigger deals. The median fintech deal size increased to $4M in 2024 — marking a 33% jump YoY — with deal sizes rising across every major global region. Across fintech sectors, the biggest jump occurred in banking, where the median deal size rose by 70% YoY to reach $8.5M. Though fintech saw fewer deals overall in 2024, the increase in deal sizes suggests that investors are writing bigger checks for companies with compelling growth potential.

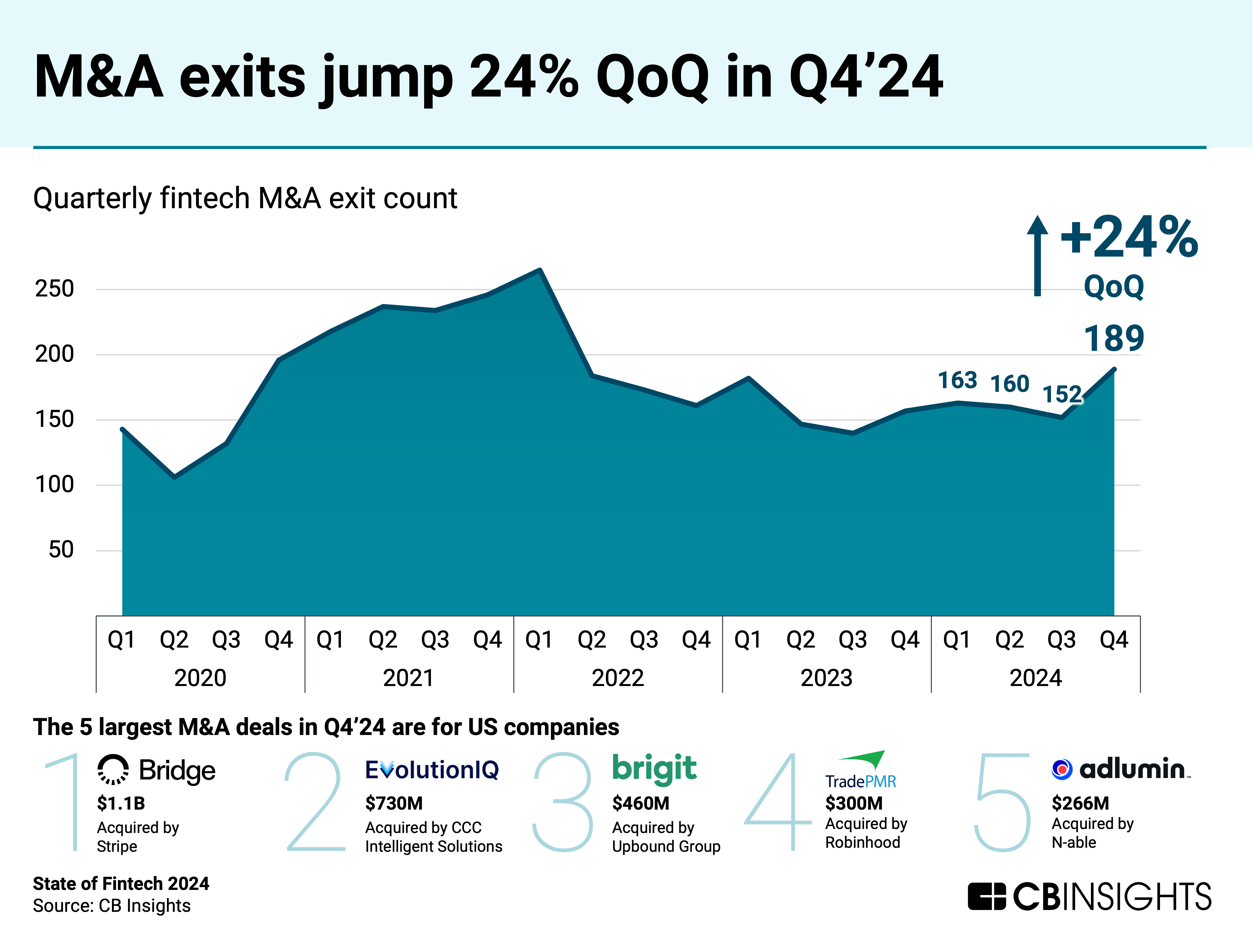

- M&A activity is also picking up. Fintech M&A exits jumped 24% quarter-over-quarter (QoQ) to 189 in Q4’24, with Stripe’s $1.1B purchase of stablecoin platform Bridge marking the quarter’s largest deal. Overall, fintech saw a total of 664 M&A exits in 2024 (up 6% YoY) as financial services companies sought to diversify their capabilities and build full-service platforms.

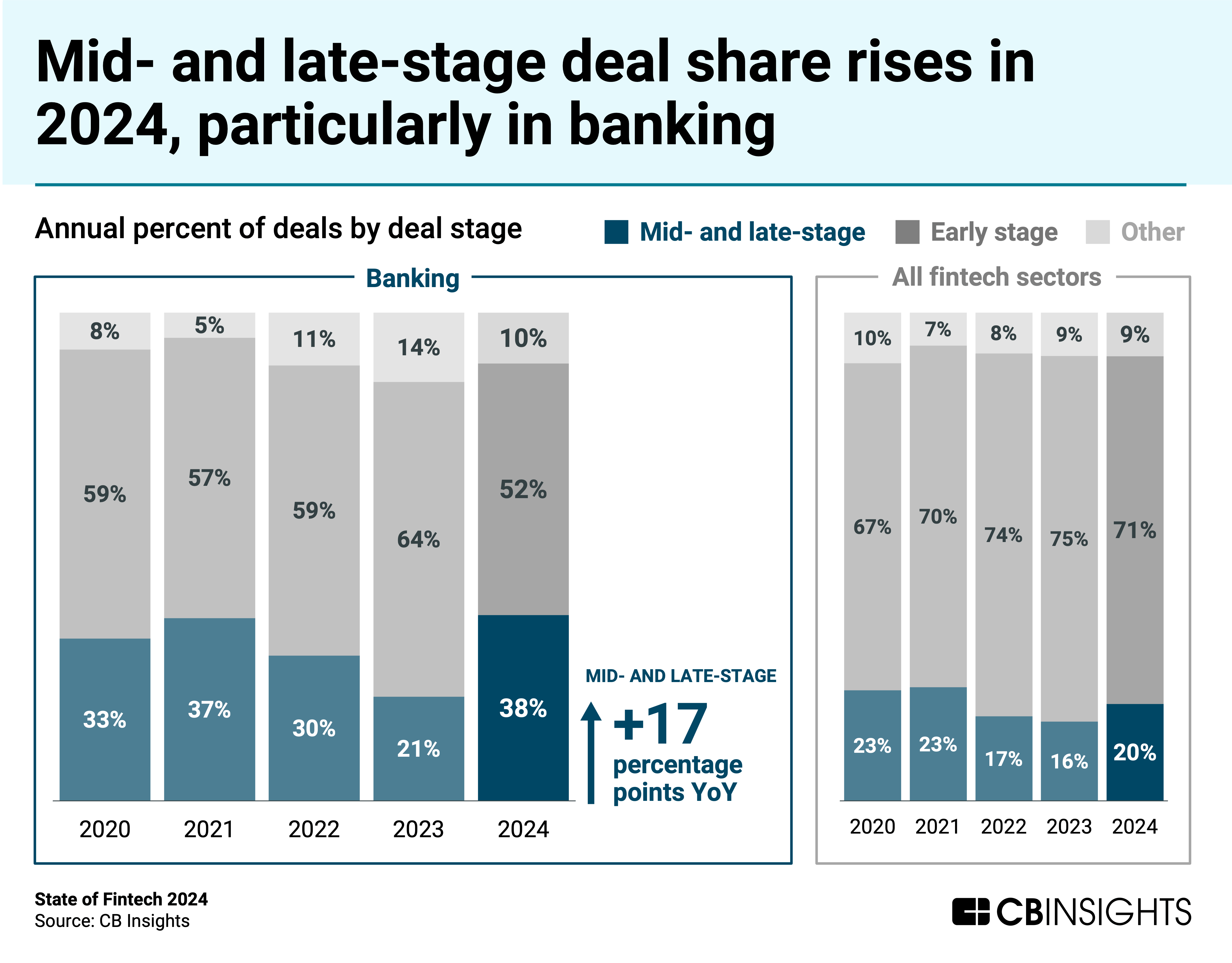

- Mature banking companies are catching the eyes of investors. Banking saw mid- and late-stage deals rise to 38% of its total deal volume in 2024 (vs. 21% in 2023), outpacing the 4 percentage point increase in fintech more broadly. Uncertainty about new banking technology and regulatory volatility — particularly among banking-as-a-service players — is likely driving investors to more proven solutions.

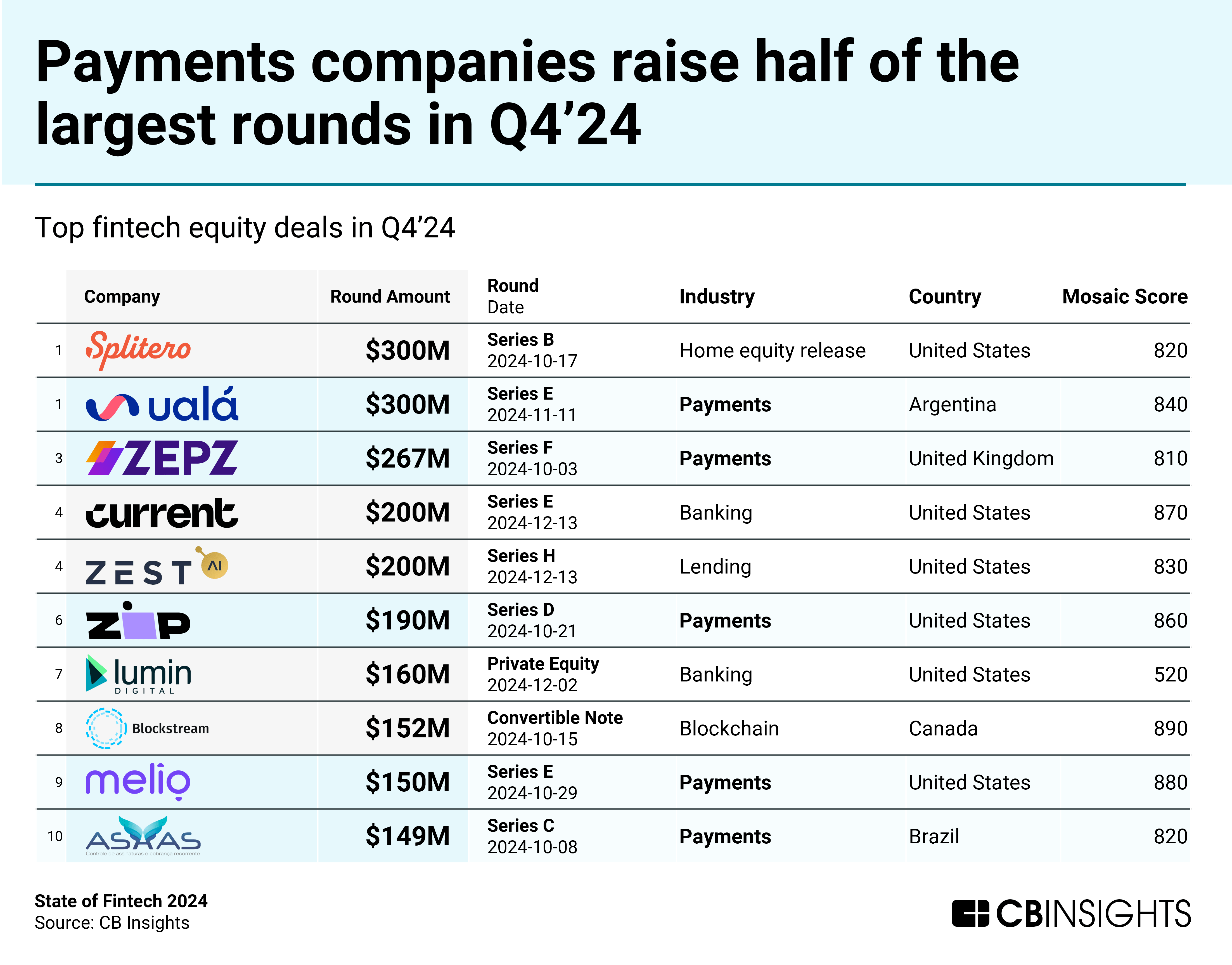

- Payments tech ends 2024 as a bright spot. Five of the top 10 equity deals in Q4’24 went to companies building payments solutions, from mobile payments apps to cross-border payments enablement tools to platforms digitizing B2B payments. This concentration of large deals within payments tech reflects the ongoing push to digitize commerce and business exchanges.

We dive into the trends below.

Fintech dealmaking continues downward trend in 2024

In 2024, annual fintech funding and dealmaking both decreased YoY, hitting 7-year lows.

However, there are signs that the fintech market is steadying. The annual decline in funding was fintech’s smallest in 3 years. Meanwhile, at the quarterly level, funding rebounded to close the year strong, increasing 11% QoQ to reach $8.5B in Q4’24.

One positive signal: bigger deals

While there are fewer fintech deals overall, deal sizes are climbing.

Following 2 consecutive years of decline, the median deal size in fintech jumped 33% YoY in 2024.

Across fintech sectors, banking saw the biggest jump in median deal size in 2024 — a 70% YoY increase to $8.5M.

This shift reflects increased investor selectivity in the current market. Companies that pass more rigorous due diligence are attracting larger investments, even as overall deal volume remains constrained.

M&A activity is also picking up

Fintech M&A deals jumped 24% QoQ in Q4’24.

US-based companies captured 8 of the largest 10 deals, including the top 5. Stripe’s $1.1B acquisition of Bridge was the largest of the quarter.

The quarterly increase points to broader stirrings of an M&A resurgence: for the year, fintech M&A exits rose by 6% YoY to 664 deals in 2024.

Acquirers are boosting capabilities across functions. For instance, Stripe’s purchase of stablecoin platform Bridge gives the company a stronger standing in the reinvigorated market for digital assets and boosts its cross-border payment capabilities. The deal also emphasizes stablecoins’ growing role in driving accessibility and stability within crypto’s current wave.

Bolstering cybersecurity was also a focus for acquirers in Q4’24, pointing to financial services companies’ push to integrate fraud detection in their product offerings. For example, in November 2024, IT company N-able bought Adlumin, which deploys its solutions to financial firms, to enhance its cybersecurity capabilities. In October, Socure — specializing in digital identity verification — acquired Effectiv to enhance its AI-driven fraud detection capabilities.

Mature banking companies are catching the eyes of investors

Early-stage deals made up a larger share of fintech investment activity in 2022-23, suggesting that investors shifted their focus toward nascent innovation requiring smaller capital commitments during the market slowdown.

The trend shifted in 2024, particularly in the banking sector. While mid- and late-stage deal share rose by 4 percentage points YoY across fintech broadly, it jumped 17 percentage points in banking.

Recent volatility in banking-as-a-service — such as Synapse’s bankruptcy in April — and intensified regulatory scrutiny are likely driving investors to more proven solutions.

Payments tech ends 2024 as a bright spot

Five of the 10 biggest fintech deals in Q4’24 went to payments companies, capping a relatively strong quarter for the sector. Despite a YoY decline, funding to payments companies rose by 20% QoQ to $1.8B in Q4’24.

Argentina-based mobile payments company Ualá secured a $300M Series E in Q4’24, tying home equity release firm Splitero for the largest round of the quarter.

Of the top payments deals, two went to companies automating accounts payable and other aspects of B2B payments (Melio and ASAAS). The opportunity to digitize B2B payments continues to expand, especially since businesses in many geographies still rely on manual processes.

Related resources from CB Insights:

- State of Venture 2024 Report

- 15 tech trends to watch closely in 2025

- Fintech 100: The most promising fintech startups of 2024

- The generative AI in financial services market map

- Prioritizing B2B payments tech: How 9 tech-driven markets stack up across maturity and momentum

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.