From AI’s ascendance to cautious dealmaking, we break down the trends reshaping digital health in 2024 using CB Insights data.

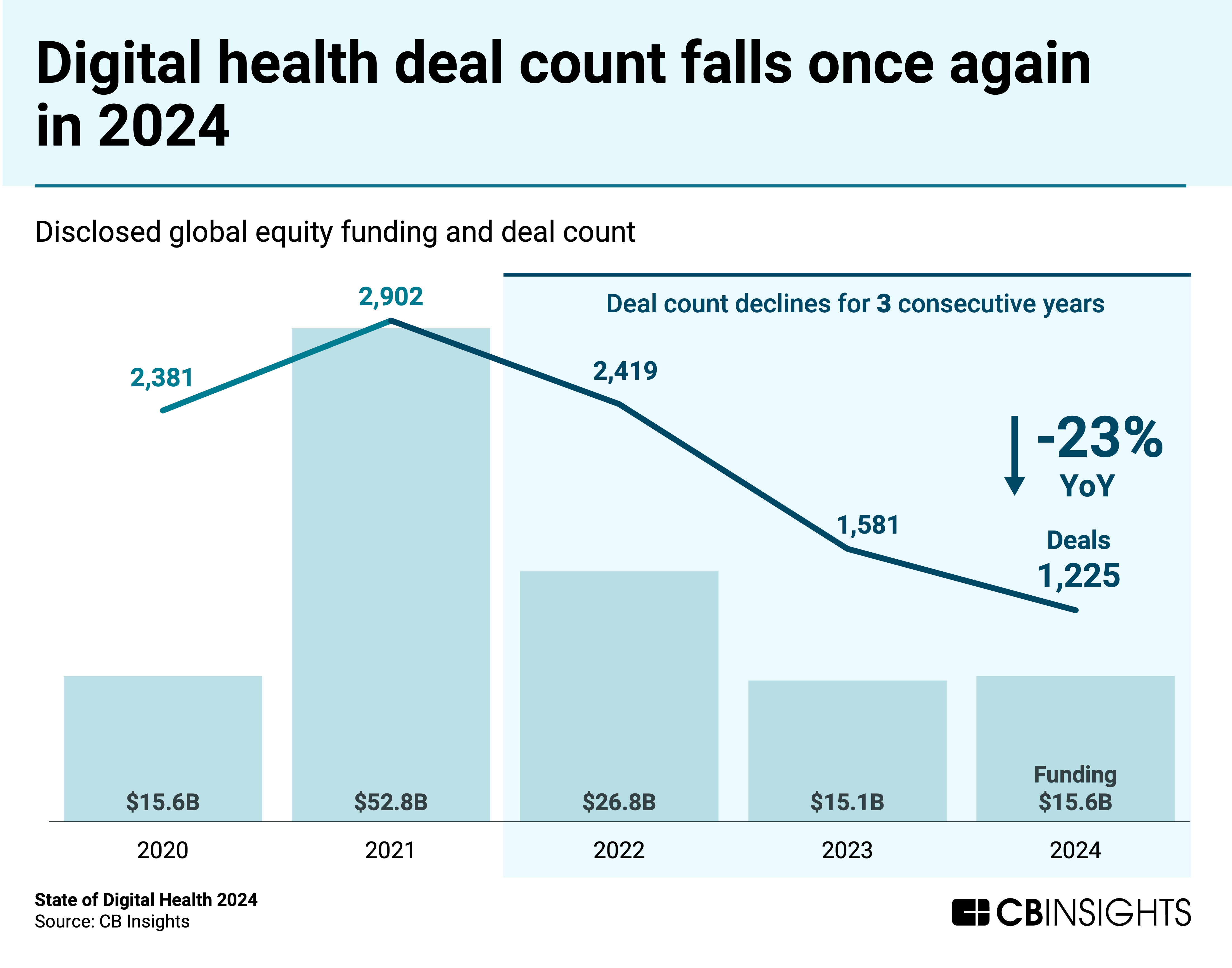

Despite a small bump in funding, global digital health dealmaking continued to decline year-over-year (YoY) in 2024. In fact, digital health deal count dropped to its lowest annual total since 2014, reflecting a more cautious investment environment.

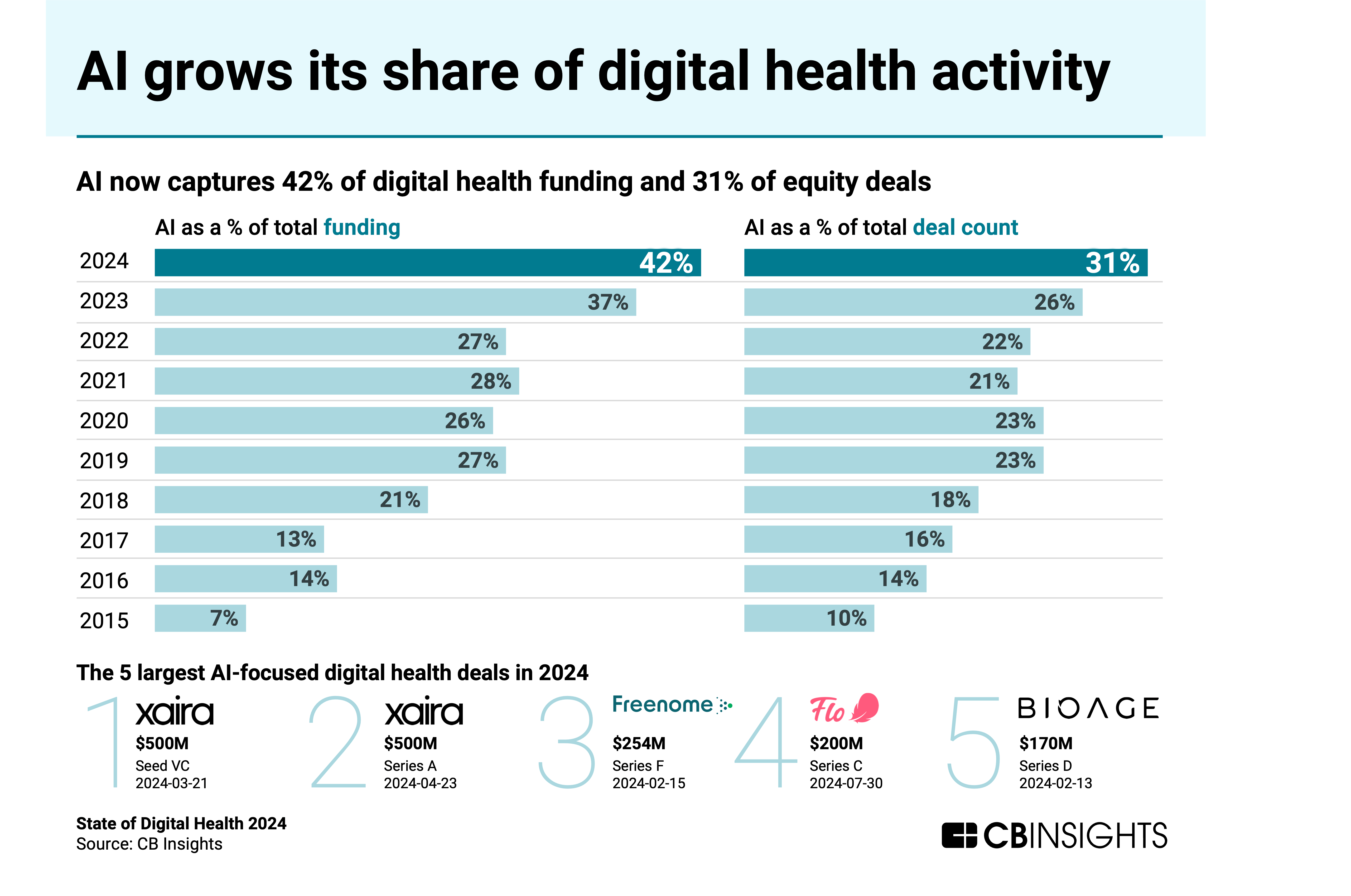

Mirroring trends in the broader venture market, AI proved to be a bright spot amid the downturn in digital health deals. In 2024, AI-focused companies secured 42% of digital health funding and accounted for 31% of deals — both record highs.

Download the full report to access comprehensive data and charts on the evolving state of digital health.

Key takeaways from the report include:

- Digital health dealmaking continues to decline. Despite a slight increase in funding YoY, digital health deal count dropped again in 2024, hitting its lowest annual total (1,225) since 2014. Regionally, Europe saw the sharpest drop in deals, with a 29% YoY decline.

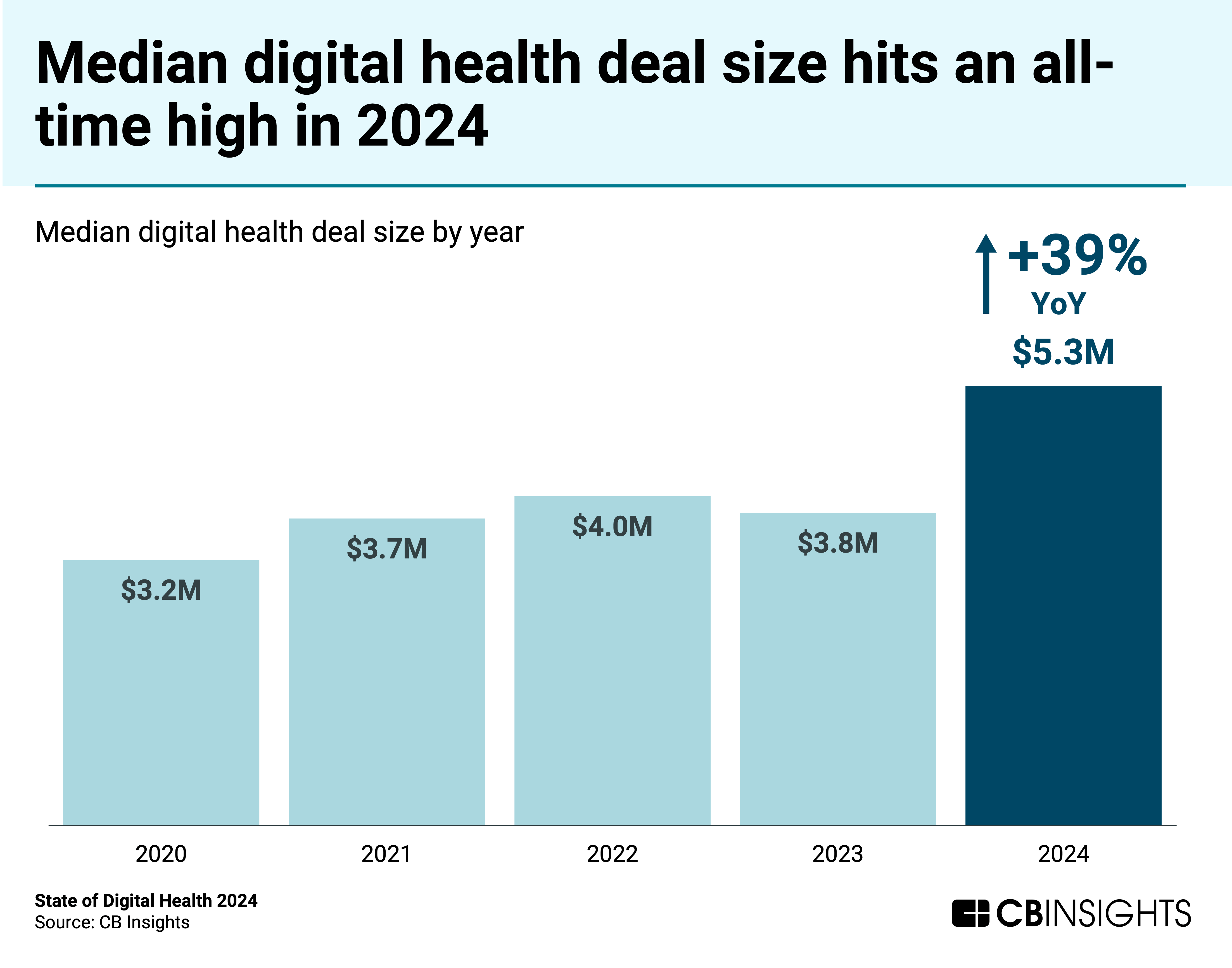

- Fewer deals, bigger checks. The median digital health deal size jumped 39% YoY to hit a record high of $5.3M in 2024. The combination of declining deal volume and larger deal sizes suggests that selective investors are concentrating their resources on companies that meet heightened benchmarks in areas like clinical validation, commercial traction, and regulatory readiness.

- AI takes center stage in digital health. In 2024, AI-focused companies captured 42% of digital health funding and 31% of deals — both record highs. The 5 largest AI-focused digital health deals were spread across diagnostics, drug development, and women’s health.

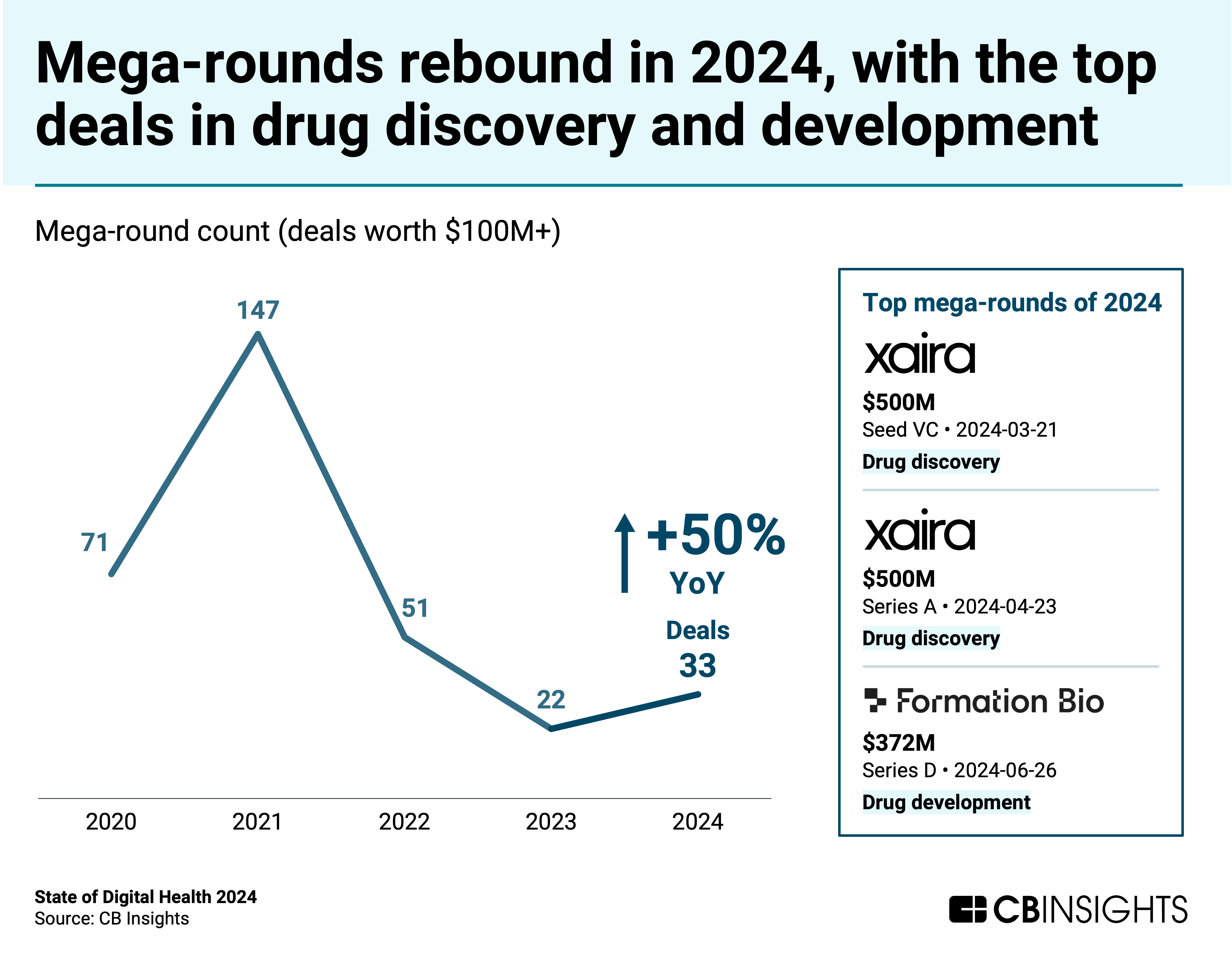

- Digital health mega-rounds rebound in 2024. Mega-rounds ($100M+ deals) increased in 2024 after 2 years of decline, with the top 3 deals focused on drug discovery and development. Most top deals (7 out of 10) went to US-based companies, pointing to the region’s position as a hub for high-value digital health investment.

We dive into the trends below.

Digital health dealmaking continues to decline

Following 2 years of decline, digital health funding increased slightly in 2024, rising by 3% YoY.

However, digital health deal count fell for the third year straight in 2024. It dropped by 23% YoY to reach just 1,225 — its lowest level since 2014 — highlighting that investors remain cautious.

Regionally, Europe saw the steepest drop, with deal count shrinking 29% YoY to 258, despite a modest funding increase to $2.8B. Asia also experienced a decline, with deal count falling 19% YoY to 218, alongside a funding drop to $0.8B. While still the most active market, the US recorded a 19% YoY decline in deal count to 683, even as funding climbed to $11.7B.

Fewer deals, bigger checks

While the overall deal count fell, the median digital health deal size surged in 2024.

It climbed by 39% YoY to reach $5.3M — a record high.

This combination of factors suggests that selective investors are prioritizing companies that meet heightened benchmarks in areas like clinical validation, commercial traction, and regulatory readiness.

AI takes center stage in digital health

AI is commanding a growing share of digital health investment activity.

AI-focused companies captured 42% of total digital health funding and 31% of deal volume in 2024 — both record highs.

This surge reflects heightened investor confidence in AI’s ability to accelerate drug discovery, improve early disease detection, deliver personalized care, and more.

The top 2 AI-focused digital health deals in 2024 went to drug development platform Xaira Therapeutics. Freenome followed with a $254M Series F to expand its AI-driven early cancer detection tools, while Flo Health secured a $200M Series C to scale its personalized women’s health platform. BioAge Labs rounded out the top 5 with a $170M Series D to advance its AI-powered aging-related treatments.

As AI adoption grows across healthcare operations — from clinical and administrative workflows to drug development — healthcare providers and pharmaceutical giants will likely pursue strategic partnerships and acquisitions to maintain their competitive edge.

Digital health mega-rounds rebound in 2024

Digital health mega-round activity rebounded in 2024 after 2 consecutive years of decline, with deal count rising by 50% YoY to 33.

The top 3 mega-rounds of 2024 all went to drug discovery and development companies.

Xaira Therapeutics led the pack with two $500M rounds for its AI-driven drug discovery and development platform, followed by Formation Bio with a $372M Series D to advance its drug development efforts.

At the regional level, the US accounted for 7 of the top 10 mega-rounds in 2024, reflecting its position as a hub for high-value digital health investments.

MORE DIGITAL HEALTH RESEARCH FROM CB INSIGHTS

- State of Digital Health Q3’24 Report

- AI’s moment in preclinical drug development arrives: Why formulation tech is the next frontier

- Inside the AI drug discovery arms race: Record M&A activity, a biologics funding spree, and more

- Digital Health 50: The most promising digital health startups of 2024

- The $4.6B opportunity in healthcare: Ambient AI to target clinician burnout

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.