Pharma giants and diagnostic testing leaders looking to expand in cancer detection should watch high-momentum liquid biopsy startups like Harbinger Health and Delfi Diagnostics.

As pharma companies invest in precision oncology, liquid biopsies — which enable real-time, non-invasive tumor profiling through simple blood draws — stand to improve patient adherence, which remains as low as 60% for some common tests like colorectal cancer screening.

Liquid biopsy tests also offer the ability to track treatment response, detect resistance early, and adjust therapy dynamically — advantages that could improve outcomes while reducing failed treatment costs.

As incumbents look to expand their footprint in oncology tech, there are several key shifts in the liquid biopsy landscape to watch:

- From single tests to integrated platforms: Leading liquid biopsy players are building comprehensive engines that combine multiple biomarker types and sophisticated AI. The bar for entry is rising, with leaders like Caris Life Sciences detecting 20+ cancer types through unified platforms. Standalone, single-disease solutions may struggle to compete.

- Data & IP moats are a gold mine: Novel approaches like genome-wide fragmentation analysis are creating defensible positions. Early leaders are building proprietary datasets that improve accuracy in early detection. The combination of unique tech and data suggests acquisition costs will only increase.

- The 5 targets below represent a fleeting window to gain capabilities in what’s becoming a fundamental tool for cancer care. The ongoing shift from theoretical promise to validated platforms, combined with emerging data moats, means the opportunity to shape this technology through acquisition won’t last long.

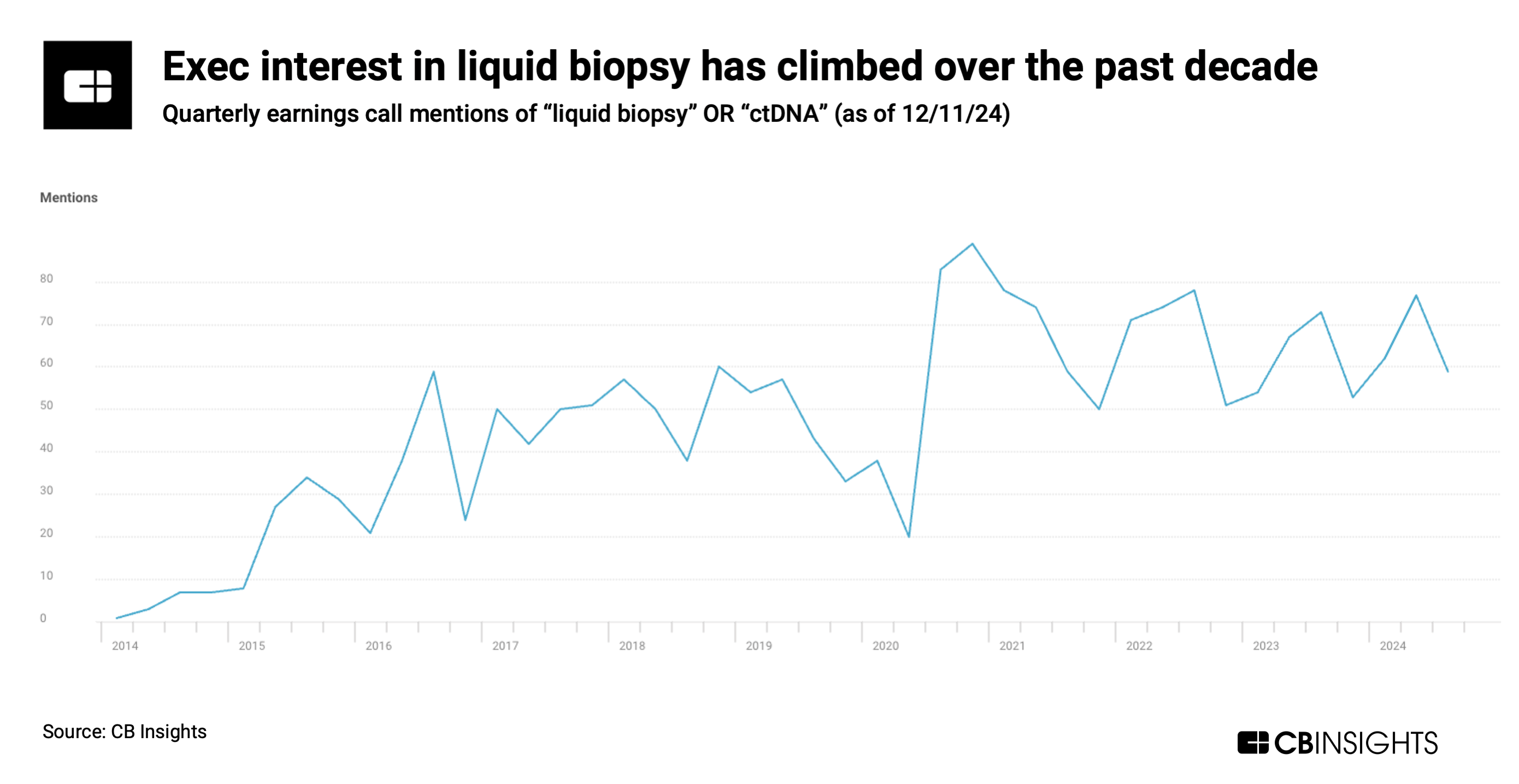

Source: CB Insights — Earnings transcript mentions of liquid biopsy and ctDNA (a type of liquid biopsy)

Advances in liquid biopsy tech have made it a consistent topic in healthcare industry earnings calls in recent years, and the market has seen a rebound in equity funding this year to $384M, up 62% vs. full-year 2023.

Incumbent activity points to a wave of consolidation

Diagnostics leaders have made recent strategic acquisitions in an effort to secure key capabilities before widespread adoption makes assets more expensive. For instance:

- Veracyte‘s January 2024 acquisition of C2i Genomics for $95M added whole-genome minimal residual disease (MRD) capabilities to its diagnostic platform

- Exact Sciences expanded its portfolio in September 2023 by acquiring Resolution Bioscience, venturing into next-gen sequencing-based liquid biopsies

- Quest Diagnostics bolstered its oncology offerings in April 2023 with its $450M Haystack Oncology acquisition, aiming to integrate sensitive MRD testing technology

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.